Another Triumph for The Money Party

Michael Collins

The average price for a gallon of gas rose 30% from $2.69 in July 2010 to $3.49 as of March 6. Most of that 30% has come in just the last few days.

We're about to embark on another period of let the markets take care of it. The Money Party manipulators are again jerking citizens around in the old bottom-up wealth redistribution program. Their imagineers are writing the storyline right now.

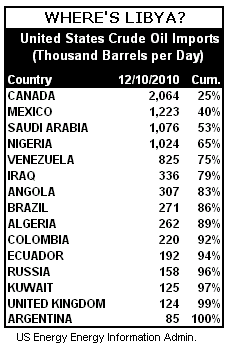

The conflict in Libya is causing the spike in oil prices over the past ten days or so according to the media script. Take a look at the chart to the right. Can you find Libya among the top fifteen nations supplying the United States with crude oil?

Why the Current Panic Over Gas Prices?

The general explanation points to the crisis in Libya as the proximate cause. The anti Gaddafi revolution began in earnest on February 17. But if the Libyan revolution were the cause, we'd have to attribute a 50% drop in a 2% share of the world's oil supply as the cause of the panic. We would also have to attribute the increase in US gas prices to a nation that doesn't impact the US crude oil supply and, as a result, should not impact the price of gas here.

Recent comments