US oil data from the US Energy Information Administration for the week ending July 22nd indicated that despite another large oil withdrawal from the SPR, increased production from our wells, and a refinery slowdown, we still needed to withdraw oil from our stored commercial crude supplies for the 4th time in 6 weeks, and for the 21st time over the past 35 weeks, mostly because of another big increase in our oil exports. Our imports of crude oil fell by an average of 355,000 barrels per day to an average of 6,164,000 barrels per day, after falling by an average of 156,000 barrels per day during the prior week, while our exports of crude oil rose by 789,000 barrels per day to a record high of 4,548,000 barrels per day, which meant that our trade in oil worked out to a net import average of 1,616,000 barrels of oil per day during the week ending July 22nd, 1,144,000 fewer barrels per day than the net of our imports minus our exports during the prior week Over the same period, production of crude from US wells was reportedly 200,000 barrels per day lower at 12,100,000 barrels per day, and hence our daily supply of oil from the net of our international trade in oil and from domestic well production appears to have totaled an average of 13,716,000 barrels per day during the July 22nd reporting week…

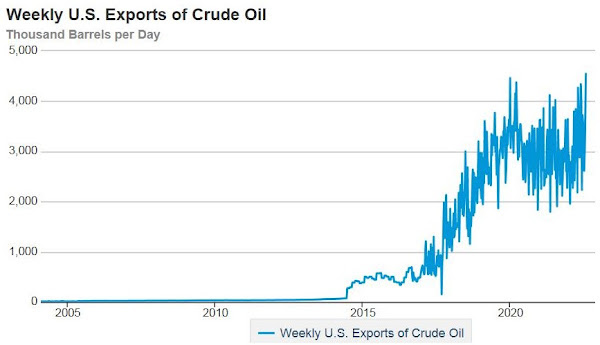

With our oil exports at a record high, we'll include a historical graph of them below, where you can see that prior to the end of 2014, US oil exports, except for those allowed under NAFTA, had been negligible because they had been banned 40 years earlier, in the wake of the Arab oil embargo. The ban on US oil exports was lifted in a spending bill that Congress passed during the last week of 2015, part of a compromise that Obama agreed to in order to avoid a government shutdown...

Meanwhile, US oil refineries reported they were processing an average of 16,027,000 barrels of crude per day during the week ending July 22nd, an average of 292,000 fewer barrels per day than the amount of oil than our refineries processed during the prior week, while over the same period the EIA’s surveys indicated that a net average of 1,447,000 barrels of oil per day were being pulled out of the supplies of oil stored in the US. So, based on that reported & estimated data, the crude oil figures from the EIA for the week ending July 22nd appear to indicate that our total working supply of oil from net imports, from oilfield production, and from storage was 864,000 barrels per day less than what our oil refineries reported they used during the week. To account for that disparity between the apparent supply of oil and the apparent disposition of it, the EIA just inserted a (+864,000) barrel per day figure onto line 13 of the weekly U.S. Petroleum Balance Sheet in order to make the reported data for the daily supply of oil and for the consumption of it balance out, a fudge factor that they label in their footnotes as “unaccounted for crude oil”, thus suggesting there must have been an omission or error of that magnitude in this week’s oil supply & demand figures that we have just transcribed... however, since most everyone treats these weekly EIA reports as gospel, and since these figures often drive oil pricing, and hence decisions to drill or complete oil wells, we’ll continue to report this data just as it's published, and just as it's watched & believed to be reasonably accurate by most everyone in the industry...(for more on how this weekly oil data is gathered, and the possible reasons for that “unaccounted for” oil, see this EIA explainer)….

This week's 1,447,000 barrel per day decrease in our overall crude oil inventories left our oil supplies at 896,631,000 barrels at the end of the week, which is our lowest total oil inventory level since February 6th, 2004, and therefore at a new 18 year low (see graph below)….our oil inventories decreased this week as 646,000 barrels per day were being pulled out of our commercially available stocks of crude oil and 801,000 barrels per day of oil were being pulled out of our Strategic Petroleum Reserve. The draw on the SPR was part of the emergency withdrawal under Biden's "Plan to Respond to Putin’s Price Hike at the Pump" (sic), that was expected to supply 1,000,000 barrels of oil per day to commercial interests over a six month period up to the midterm elections in November, in the hope of keeping gasoline and diesel fuel prices from rising further at least up until that time. The administration's previous 30,000,000 million barrel release from the SPR to address Russian supply related shortfalls wrapped up in June, and his earlier release of 50 million barrels from the SPR to incentivize US gasoline consumption was completed in May. Including those, and other withdrawals from the Strategic Petroleum Reserve under recent release programs, a total of 181,602,000 barrels of oil have now been removed from the Strategic Petroleum Reserve over the past 24 months, and as a result the 474,545,000 barrels of oil still remaining in our Strategic Petroleum Reserve is now the lowest since June 14th, 1985, or at a new 37 year low, as repeated tapping of our emergency supplies for non-emergencies or to pay for other programs had already drained those supplies considerably over the past dozen years, even before the Biden administration's SPR releases. Now the total 180,000,000 barrel drawdown expected over the current six month release program to November will remove almost a third of what remained in the SPR when the program started, and leave us with what would be less than a 20 day supply of oil at today's consumption rate...

Further details from the weekly Petroleum Status Report (pdf) indicate that the 4 week average of our oil imports rose to an average of 6,550,000 barrels per day last week, which was 1.9% more than the 6,425,000 barrel per day average that we were importing over the same four-week period last year. This week’s crude oil production was reported to be 200,000 barrels per day higher at 12,100,000 barrels per day because the EIA's rounded estimate of the output from wells in the lower 48 states was 200,000 barrels per day higher at 11,700,000 barrels per day, while Alaska’s oil production was 2,000 barrels per day lower at 435,000 barrels per day but had no impact on the final rounded national total. US crude oil production had reached a pre-pandemic high of 13,100,000 barrels per day during the week ending March 13th 2020, so this week’s reported oil production figure was 7.6% below that of our pre-pandemic production peak, but was 24.7% above the pandemic low of 9,700,000 barrels per day that US oil production had fallen to during the third week of February of 2021...

US oil refineries were operating at 92.2% of their capacity while using those 16,027,000 barrels of crude per day during the week ending July 22nd, down from their 93.7% utilization rate during the prior week, and a refinery utilization rate that's below normal for mid summer. The 16,027,000 barrels per day of oil that were refined this week were 1.0% more than the 15,875,000 barrels of crude that were being processed daily during week ending July 23rd of 2021, but 5.7% less than the 16,991,000 barrels that were being refined during the prepandemic week ending July 26th, 2019, when our refinery utilization was at 93.0%, a rate also slightly below normal for mid-July...

Even with the decrease in the amount of oil being refined this week, gasoline output from our refineries was still higher, increasing by 290,000 barrels per day to 9,658,000 barrels per day during the week ending July 22nd, after our gasoline output had increased by 447,000 barrels per day during the prior week. However, this week’s gasoline production was still 1.2% less than the 9,779,000 barrels of gasoline that were being produced daily over the same week of last year, while 7.3% less than our gasoline production of 10,416,000 barrels per day during the week ending July 26th, 2019, ie, a comparable week during the year before the pandemic impacted US gasoline output. Meanwhile, our refineries’ production of distillate fuels (diesel fuel and heat oil) decreased by 22,000 barrels per day to 5,009,000 barrels per day, after our distillates output had decreased by 102,000 barrels per day during the prior week. But even after those decreases, our distillates output was still 5.7% more than the 4,739,000 barrels of distillates that were being produced daily during the week ending July 23rd of 2021, while 3.0% less than the 5,164,000 barrels of distillates that were being produced daily during the week ending July 26th, 2019...

Even with the increase in our gasoline production, our supplies of gasoline in storage at the end of the week fell for the 2nd time in six weeks; but for 20th time out of the past twenty-five weeks, decreasing by 3,304,000 barrels to 225,131,000 barrels during the week ending July 22nd, after our gasoline inventories had increased by 3,489,000 barrels during the prior week. Our gasoline supplies decreased this week because the amount of gasoline supplied to US users increased by 724,000 barrels per day to 9,245,000 barrels per day, and because our imports of gasoline fell by 266,000 barrels per day to 599,000 barrels per day, while our exports of gasoline fell by 38,000 barrels per day to 768,000 barrels per day. After 20 inventory drawdowns over the past 25 weeks, our gasoline supplies were 3.9% lower than last July 23rd's gasoline inventories of 234,161,000 barrels, and about 4% below the five year average of our gasoline supplies for this time of the year…

Following the recent decreases in our distillates production, our supplies of distillate fuels decreased for the 4th time in eleven weeks and for the 29th time in forty-seven weeks, falling by 784,000 barrels to 111,724,000 barrels during the week ending July 22nd, after our distillates supplies had decreased by 1,295,000 barrels during the prior week. Our distillates supplies fell again this week as the amount of distillates supplied to US markets, an indicator of our domestic demand, increased by 53,000 barrels per day to 3,750,000 barrels per day, and even though our exports of distillates fell by 147,000 barrels per day to 1,495,000 barrels per day, while our imports of distillates rose by 2,000 barrels per day to 124,000 barrels per day.. But after forty-five inventory withdrawals over the past sixty-seven weeks, our distillate supplies at the end of the week were 19.0% below the 137,912,000 barrels of distillates that we had in storage on July 23rd of 2021, and about 23% below the five year average of distillates inventories for this time of the year…

Meanwhile, with this week's increase in our oil exports and decrease in our imports, our commercial supplies of crude oil in storage fell for the 7th time in 11 weeks and for the 31st time in the past year, decreasing by 4,523,000 barrels over the week, from 426,609,000 barrels on July 15th to 422,086,000 barrels on July 22nd, after our commercial crude supplies had decreased by 445,000 barrels over the prior week. After that decrease, our commercial crude oil inventories were 9.1% below the most recent five-year average of crude oil supplies for this time of year, but 24.8% above the average of our crude oil stocks as of the fourth weekend of July over the 5 years at the beginning of the past decade, with the disparity between those comparisons arising because it wasn’t until early 2015 that our oil inventories first topped 400 million barrels. Since our commercial crude oil inventories had jumped to record highs during the Covid lockdowns of the Spring of 2020, and then jumped again after last year's winter storm Uri froze off US Gulf Coast refining, our commercial crude supplies as of this July 22nd were still 3.1% less than the 435,598,000 barrels of oil we had in commercial storage on July 23rd of 2021, and were 19.7% less than the 525,969,000 barrels of oil that we had in storage on July 24th of 2020, and 3.3% less than the 436,545,000 barrels of oil we had in commercial storage on July 26th of 2019…

Finally, with our inventories of crude oil and our supplies of all products made from oil near multi year lows in recent months, we are continuing to keep track of the total of all U.S. Stocks of Crude Oil and Petroleum Products, including those in the SPR. The EIA's data shows that the total of our oil and oil product inventories, including those in the Strategic Petroleum Reserve and those held by the oil industry, and thus including everything from gasoline and jet fuel to propane/propylene and residual fuel oil, fell by 8,857,000 barrels this week, from 1,688,796,000 barrels on July 15th to 1,679,939,000 barrels on July 22nd, after our total inventories had fallen by 3,862,000 barrels during the prior week. That left our total liquids inventories down by 108,494,000 barrels over the first 28 weeks of this year, and only 2.1 million barrels from hitting a new 13 1/2 year low...

note: the above was excerpted from my weekly blog post at Focus on Fracking

Comments

thanks for oil updates

I think oil is so tied to overall inflation and the CPI keeps gas prices separate when energy costs percolate through everything else.