(hat tip to taonow: I've stolen your analogy)

A while ago, in a diary entitled Are Hard Times near? The Great Decline in interest rates is ending I pointed out that the great decline in interest rates that began in 1981 looked like it was coming to an end, and with it American consumers' ability to refinance debt at lower rates. I noted that if consumers could no longer refinance at better terms, and if their wages weren't growing, the engine of the American economy would stall, not just for a short time, but for a very long period -- What I have called "The Slow Motion Bust."

With oil prices at $126 a barrel, and $4 a gallon gasoline, the boa constrictor of higher prices has tightened around the average American's budgetary breathing space some more. A look at how much and how consumers are coping, below.

As I have noted previously, the starting point for my analysis is pretty simple: suppose you wanted to undertake a significant new purchase. If you didn't have enough money now, you could still purchase it soon if you got a pay increase. If you didn't get a pay increase, you could cash in an asset or borrow against it. If you couldn't do that, you could take out a new loan, or else refinance an old loan at a lower interest rate. If you couldn't do any of those, you might have to cut back in other areas, or else forego the purchase.

The same applies to American consumers as a whole. Only twice before in the last 28 years have American households had both no wage increases, and no ability to refinance their spending. When those conditions obtain, consumer spending ccontracted, and the economy entered a recession in 1982 and 1990.

Something a little different has been happening this time. American consumers have been reacting to higher energy and food prices by re-allocating rather than cutting back their total spending. Thus the anticipated recession caused by a decline in consumer spending has been more shallow so far than many have expected.

First of all, let's review. This is a graph of a parabolic curve:

in this case, the price of a barrel of oil over the last 11 years. And the graph ends only a month ago, missing the last $10 surge in price: oil closed today at over $126 a barrel! That is a parabolic curve, and like a fever, it will break dramatically, but nobody is sure when, and in the meantime the fever may kill the patient -- in this case the economy.

Consumer budgets have been severely impacted by the increases in energy and food in the last 10 years. Here is a chart of consmer spending on essentials. Notice how it too has climbed dramatically since 2000:

The average American household has had to devote 7-8% more of its total income to essential expenses (some $2000 a year for every family, every year). And this graph too is probably already slightly out of date, with the most recent increases in gas prices.

Note also that the graph is the average change. Some consumers have noticed less of an increase, but lower wage earners undoubtedly have suffered much more.

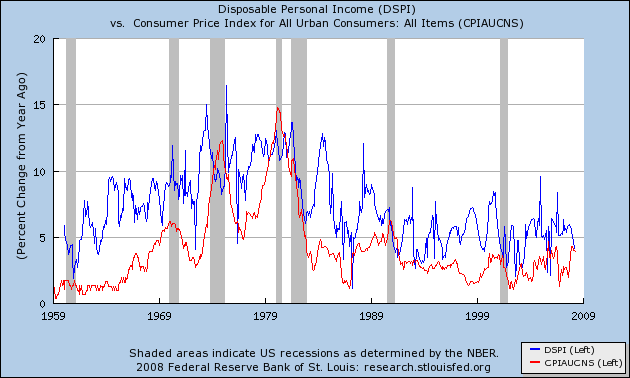

Note that the above graph measures spending on essentials as a percent of "disposable personal income? (basically, income after taxes). Typically, in the past, as shown in the graph below, when disposable personal income (blue) has failed to increase more than the rate of inflation (red), a recession has begun. Note that this situation has just occurred again.

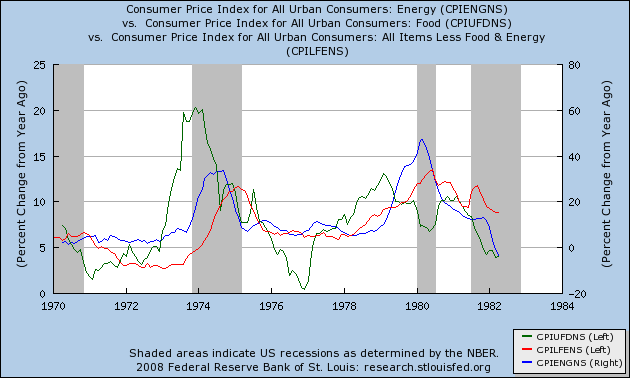

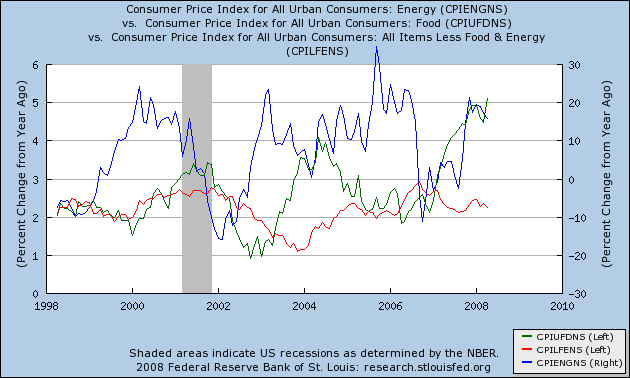

So, what's a little different this time? Let's look at the 1970s, the last time an oil price shock caused recessions. As I have pointed out before, in both cases inflation started first in food (green) (causing the world food crisis of 1972-74), then in energy (blue), and only then with a lag did price increases filter through to the rest of the economy, what economists call "core inflation" or inflation minus food and energy (red):

What's different this time is, in the 1970s there was a "wage-price spiral" as unionized workers in particular, with lots of bargaining power, caused wage increases to increase as overall inflation did. Nowadays, with labor almost totally powerless, the "wage" part of the spiral is missing: median wages simply aren't keeping up with the inflation rate. And so when we look at prices, so while food prices (green) and energy prices (blue) are spiking, look at what has happened to "core" inflation -- the price of everything else. In both 2002-2004 and again from 2006-present, as food and energy inflation picked up, core inflation went down! It wasn't just lagging food and energy inflation, it has moved in the contrary direction!

In other words, lacking the ability to demand higher wages, as Americans have had to pay more for food and energy, they have had to cut back their budgets for other items, meaning that sellers have been unable to pass on increased costs to consumers. How have Americans done this? First of all, by borrowing against 401k balances:

At the end of last year, 18% of workers had loans outstanding from their plans, up from 11% in 2006

And also, by borrowing against credit cards:

U.S. consumer borrowing jumped more than double the amount economists forecast in March, indicating a slowing economy is forcing Americans to accumulate credit-card and other forms of debt.

....

Consumers are turning to credit cards after banks tightened standards for home-equity loans and other borrowing. The March figures brought U.S. consumer borrowing in the first quarter to $34 billion, the most since the first three months of 2001, when the economy entered its last official recession.

"Consumers are strapped as incomes are not keeping up with inflation and this is leading them to rely increasingly on credit to see them through the worst housing downturn since the Great Depression,'' said Chris Rupkey, chief financial economist at Bank of Tokyo-Mitsubishi in New York. ``The days of extracting cash from one's home to spend on goods and services are long gone.''

....

Household spending grew at the slowest pace since the 2001 recession in the first quarter, according to Commerce Department statistics. Consumer spending accounts for about two-thirds of economic growth.

In addition to tapping their 401k balances (the financial equivalent of eating one's seed corn) and going deeper into credit card debt to finance day-to-day purchases, it appears that $3 rapidly turning into $4 a gallon gas is finally having an impact on commuters' lover affairs with their cars. Newspapers report increased mass transit ridership:

Mass transit systems around the country are seeing standing-room-only crowds on bus lines where seats were once easy to come by. Parking lots at many bus and light rail stations are suddenly overflowing, with commuters in some towns risking a ticket or tow by parking on nearby grassy areas and in vacant lots.

“In almost every transit system I talk to, we’re seeing very high rates of growth the last few months,” said William W. Millar, president of the American Public Transportation Association.

And where mass transit hasn't been feasible, there has also been an increase in carpooling:

Phil Gutierrez is used to traveling to work the way nearly three-quarters of all New Jersey commuters do -- in his car by himself....

[But] There are signs that the recent spike in the cost of gasoline has prompted a growing number of New Jersey commuters to do as Gutierrez has done and seek out a different way to travel back and forth to work.

Participation in the two-year-old "Carpooling Makes Sense" program run by the state Department of Transportation is up sharply in recent months.

Empty parking spots are becoming scarce at some of the free park-and-ride lots along the Garden State Parkway. And the non-profit transportation management associations around the state report growing numbers of inquiries about carpools and vanpools.

Anecdotally, I can report that my sibling unit just last week started a carpool with 2 other coworkers who live nearby, one of several carpools that have sprung up just in the last few weeks at that office.

In other words, instead of reacting to higher prices by cutting back their total spending, and saving more (which would deepen the recession), American consumers have instead re-allocated their total spending -- spending more on food and energy, and a roughly equivalent amount less on other discretionary items, returning to practices of riding mass transit and carpooling last popular in the 1970s, and finally by raiding the only cookie jars still available to them: their 401k's and credit cards. Result: a shallower recession -- so far.

Comments

so far

I agree with you that this is a slow motion collision for many people have been maintaining paying their bills by using the home equity and credit cards. I was unaware of borrowing against 401ks on top of it but I sure don't see wages rising anytime soon. One thing really missing on the campaign trail is global labor arbitrage. Sure Dems are talking about tax incentives but when one is competing against a 10:1 or 100:1 wage ratio, changing the corporate tax code is just not going to cut it in terms of increasing wages. Add to that all three Dems will not address the domestic labor supply really (Clinton on the campaign trail at least has been recently acknowledging it but I am unaware of any policy shift to deal with this), which also means wages won't rise due to stabilizing the domestic labor supply.

I think it should be "US workers first for jobs in the US"

as an overall policy to help that out (it's not that at all currently).