Back in August 2007 when I was first formulating my idea of a "Slow Motion Bust" that would recreate the Panics of the 19th and early 20th centuries, but in multi-year s l o w m o t i o n, I wrote on the Big Orange Political Blog that business cycle research seemed to be making a resurgeance. In that blog post, I discussed the compelling data set forth by UCLA economist Edward Leamer in a paper presented at Jackson Hole earlier in August 2007 (warning: pdf).

To summarize that blog entry, according to Prof. Leamer, the 10 recessions that have occurred since World War II have followed a typical pattern. Housing declines first, well before the recession; then durable goods especially cars (which fall most precipitously during the recession); then consumer nondurables (generally retail sales); and finally at the end, consumer services:

We have experienced 8 recessions preceded by substantial problems in housing and consumer durables....

....

Residential investment consistently and substantially contribute[d] to weakness [in GDP growth] before [ these 8 ] recessions....

....

After residential investment as a contributor to prior weakness come consumer durables, consumer services, and then consumer nondurables. Those are all consumer spending items -- it's weakness in consumer spending that is a symptom of an oncoming recession.... The timing is: homes, durables, nondurables, and services. Housing is the biggest problem in the year before a recession... durables is the biggest problem during the recession [although consumer durables declined even more than housing before 2 of the 10 post World War II recessions]

In terms of timing, housing typically begins to decline 5 quarters before recession, with durables and nondurables hitting their peak 4 quarters before the recession, and gently declining until the recession hits.

After a housing slump, the next part of the economy to turn negative before a recession is consumer durables, meaning big-ticket items that consumers purchase to last a long time. The biggest example of that is cars.

Previous production of new homes and cars create a stock of existing assets that compete with current production....

The asset prices of both homes and new cars suffer from downward price rigidities

In other words, the economy can only sustain X amount of cars and houses in any given period. Overbuilding in one period (a boom) means that in the next period, there will be underproduction (a bust). It is this absolute decline in activity that forms the basis for the recession.

____________

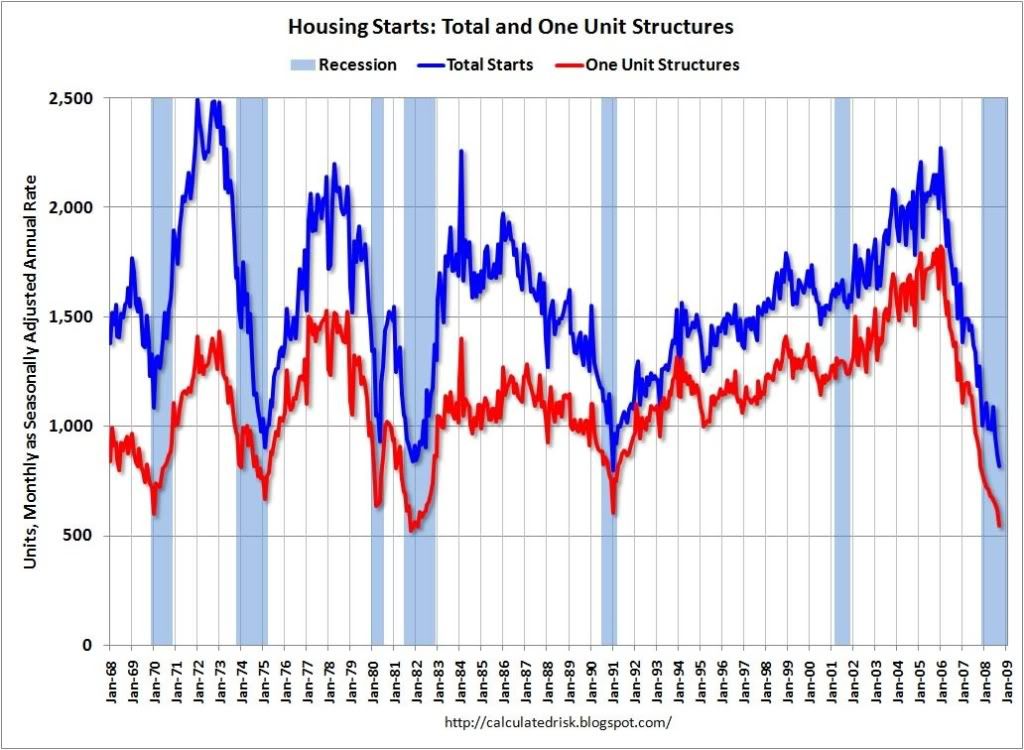

Judging by Prof. Leamer's research, unless we are in the midst of a 1929-32 style economic Armageddon, then we are probably right in the trough of the recession now. As we all know, the housing market has been collapsing since early 2006. Durable goods held up well, but auto sales - the biggest coincident indicator of a recession - have been collapsing for the last several months:

Sales at the nation's top automakers fell sharply in September, as tighter credit for buyers and dealers combined with high fuel prices resulted in industrywide U.S. sales falling below the 1 million mark for the first time in more than 15 years.

The sales declines were broad based, with Japanese automakers reporting the same kind of double-digit declines that hit U.S. brands earlier this year when the record gasoline prices sent buyers scurrying from SUVs and pickups to more fuel efficient car models. Overall Asian brands saw a 31% drop in sales, more than the 24% drop among traditional domestic brands.

Meanwhile, housing starts and permits are at levels not seen since the bottom of previous recessions:

and sales are actually picking up a little bit.

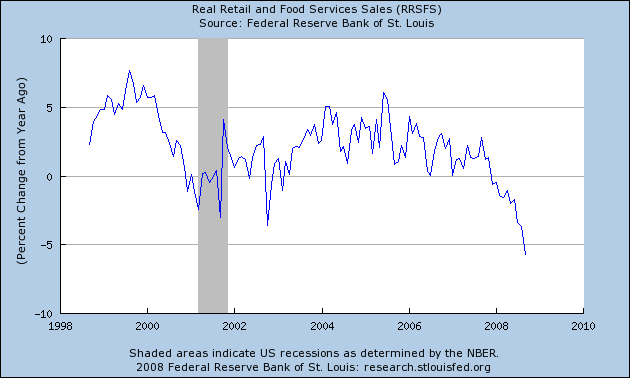

The next part of the economy to decline is consumer nondurables. As tracked by official retail sales, and independently by Shoppertrak, retail sales finally declined substantially with the onse of $4 gas in summer, and then declined drastically in September:

recovering somewhat by the latter part of October.

According to Prof. Leamer's research, services decline last, sometimes at the very end of recessions. The most recent ISM services report supports that view, as the services portion of the economy is only now on the cusp of decline:

(readings over 50 indicate expansion; readings under 50 indicate contraction).

(readings over 50 indicate expansion; readings under 50 indicate contraction).

In conclusion, if the historical business cycle pattern described by Prof. Leamer is being followed during our current recession, then his research supports my speculation that at some point in the next few months we may begin a period of tepid recovery or respite. If my notion of a "slow motion bust" remains valid, that respite (much like the period between the 1979 and 1981 recessions) will be brief, lasting less than a year before the contraction resumes.

Comments

Actually, there is a range between ...

... a "normal recession" and a 1929 style start of a Great Depression.

For one thing, this is the first business cycle of more than a few years since WWII where there has not been any growth in median income. That in and of itself may result in a longer recession. And for another thing, recession duration is also affected by whether it is a US recession or a global downturn, since when it is largely limited to the US, exports can accelerate the recovery.

And consumer spending declined in Q3, before the financial crisis hit, so the Christmas season may well see many firms that normally use Christmas to push from break even into profit facing the need for a good Christmas to push from collapse toward break-even ... and not getting it.

Given the Panic of 2008, which will delay recovery in the housing and auto markets, the ongoing hollowing out of the middle class, and the lack of strong export markets, and the recent news of the decline in there's no reason to bank on a recovery in Q1 2009.

It is possible ... after all, this is an economy we are talking about, not a mechanism ... but it seems more likely that the recovery will be delayed until government stimulus has a chance to have an impact, which would mean more like Q3 2009.

neo-liberals

In terms of income decline, from what I can tell so far, the Obama administration looks like neo-liberal DLC ver. 2.0 and since 1.0 already gave that temporary bump through bubbles, but started the race to the bottom... plus the neo-liberals first up are going to give multinationals what they want, which is unlimited de facto migration, that means the U.S. is going to have massive wage repression, labor arbitrage through the immigration system, worse than what has been already happening...i.e. wages will decrease.

Supposedly this is first up on their agenda versus rebuilding US manufacturing, investing in infrastructure and most importantly modifying trade policy to represent workers.

It's so bad they want to turn our entire educational system into a green card machine. Go to school here, get a green card, which will also squeeze out US citizens further from opportunity. The rejection rates for college are already sky high, that's going to be a complete disaster forcing US citizens to compete on a global scale for opportunities in US schools and there already are simply not enough seats available.

So, until jobs, wages, careers start being stable and increasing, we might get some respite by the numbers but in terms of the real economy, the working class, this does not look good.

Then.....the deficit. I am not a deficit hawk and need to understand (if someone knows these interactions would be a great diary!) how this massive deficit plus the increase to foreign loan originators is going to do.

There are two deficits ...

... there is the government budget deficit, and there is the current account deficit.

Suppose the current account was in balance. Then, except for official transactions, the capital accounts would also be in balance. So if the government was running a deficit, all the debt would end up as part of the savings accumulated within the US.

In that case, the ability to service the debt depends on its size versus the size of GDP. Government debt in infrastructure that supports improved productivity in the US ... that is certainly less of a worry, and if the infrastructure is sorely needed is likely to end up with a reduction in debt burden as a share of national income. On the other hand, government debt to engage in a military adventures overseas is unlikely to lead to sustained economic growth.

Now, flip it over. Suppose there is a massive current account deficit, with not government deficit. That means that there will be a massive accumulation of external obligations in the form of private US debt held overseas. That represents an accumulation of income flows out, tending to push the current account deficit further into the red, in a classic debt spiral.

Now, combine an external deficit with a government deficit. Again, the question is what the government is spending money on. If the money is spent on infrastructure that tends to reduce the current account deficit, than that can reverse the foreign debt spiral and help the economy pull out of the blown out current account deficit ... spending on overseas military adventures, of course, directly increase the current account deficit while doing nothing to reduce our structural import dependency.

reasonable explanation

and also shows the differences between FDR/Keynesian policies and how those helped vs. what is going on right now.

It would be awesome if you wrote up a blog post, fleshed out some of these comments, very insightful, glad you're here.

durable goods increased, last report

wasn't expected. durable goods up 0.8%

It was aircraft orders.

CIO Reports

is now saying that IT spending won't recover until at least Q1'10- if then. I think this might be the end of the beginning- but by no means is it the beginning of the end.

-------------------------------------

Maximum jobs, not maximum profits.

Edward Leamer has been totally wrong....

Edward Leamer stated in Dec of 2007 that we would avoid a recession. Regardless of his PHD, he is more of a trend observer, not an expert. Peter Schiff has been much more accurate and understands the REAL world economics better.

""Leamer, however, insisted the housing woes alone won't hobble the economy enough to cause two consecutive quarters of negative economic growth in the nation's gross domestic product _ the standard used to define a recession.""

http://www.msnbc.msn.com/id/22116055/#storyContinued

Leamer's data was good, he failed to follow it!

When Leamer gave his speech on business cycles to the Jackson Hole conference in 2007, he cited reams of data, which I summarized in my original post (follow the link). Problem is, he didn't follow his own data to its natural conclusion -- instead he said, in effect, "It's different this time." He thought that because the Bush expansion hadn't created many new manufacturing jobs, the decline of housing wouldn't lead to a decline in manufacturing/durable goods purchases.

So I disagree. Leamer's research is invaluable, and in fact this recession is following the pattern his data predicts.

The facts show Leamer was wrong

What good is Leamer when 4 months later, he predicts that we would avoid a recession? Anyone can gather data. Even a person with a high school education can do that. Great...Leamer gathers good info, then does not know how to put it to practical use. What good is that?

Leamer is a book-smart person who obviously makes the same mistakes that a rookie would make by missing and misunderstanding that we would be in a recession.

BTW, we are not even close to being "probably right in the trough of the recession now" as you stated above. We already have $7 trillion invested in this economic system that is laced with toxic debt. Every month, that figure continues to rise. This will take YEARS, not months to get out of. Housing prices continue to fall. Until stabilization begins to occur, we can't even begin to think of a bottom.

We are all entitled to our opinion, but the leading indicators do not even remotely suggest an economic rebound anytime soon.

More news regarding this "recession" we are in

Well, if we want to call this a "recession", ok but we are more than likely entering into at least a mild depression or worse.

As I mentioned before, there is no stabilization in sight. It's a snow-ball effect. Loss of jobs means no spending. No spending means no need for services and goods...which means more loss of jobs and less spending. IF anyone here thinks differently, let's see your reasoning and facts to back up the reasoning. The evidence overwhelmingly points to further deterioration of the economy.

Hank Paulson said that this economic hardship will be deep and long lasting. So much for the over optimists.

If it looks like a depression, walks like a depression, and quacks like a depression...well...you know the story.

http://biz.yahoo.com/ap/081205/financial_meltdown.html

AP

Half-million jobs vanish as economy deteriorates

Friday December 5, 6:27 pm ET

By Jeannine Aversa, AP Economics Writer

Half-million jobs disappear, worst in 34 years, as economy deteriorates ever more rapidly

WASHINGTON (AP) -- An alarming half-million American jobs vanished virtually in a flash last month, the worst mass layoffs in over a third of a century, as economic carnage spread ever faster and the nation hurtled toward what could be the hardest hard times since the Great Depression.

sure is, outsourcing

I think the reality of squeezing the middle class bone dry is coming home to roost.

Will, why not just register (upper right hand column) and log in? I notice you are posting a lot of comments and all of those letters you have to type and so on go away when you're logged in.

re: sure is, outsourcing

No doubt! The middle class is up the creek without a paddle. The majority of the middle class has the bulk of their wealth in 401K (stocks) and in their home equity. Both have gone down substantially for most. The outsourcing is way out of control. Unfortunately, those job will be gone forever, unless legislation is pass to curb this destructive practice. The fact is...greed will keep such legislation from happening.

Here is a little fact on outsourcing. Yes, my blood boils over this. A few company execs get rich, while the average guy trying to feed his family gets laid off.

<<>>

http://encarta.msn.com/encyclopedia_701702628_2/Outsourcing.html

Robert...

BTW...Yes, I might register. I just don't know how much I will post in the future. I am just angry and sounding off. I am not a pessimist by nature, but false optimism will only hurt the unaware even more, if the truth is ignored.

One of the major reasons why this "recession" is totally different than 2001 is because:

1- We can't lower interest rates to spur on housing. There are very few qualified buyers. Many have ruined credit due to walking away from their old home.

2- The housing market is already saturated with vacant homes. There is no reason that homebuilders will substantial increase housing starts with the glut we currently have.

3- Even for the lucky ones who have good credit and didn't walk away from their home, the lending is very tight. Many qualified people are being turned away.

4- Loss of retirement and stock money will restrict spending.

5- Personal debt and debt to equity ratio are the worse since the 1940. People are strapped for cash.

6- As you said, outsourcing has destroyed all chances of a healthy job market.

7- We don't produce anything like we used to. That is done in Japan, China, Mexico, etc.

We are in deep poop. No recovery for years to come.

deep do do

I agree but you would be surprised who reads this blog, very surprised. Just yesterday CBS News referenced the site and frankly people need to sound off, we're all about sounding off and trying to turn this economic insanity around.

Robert...2

To be honest, no matter who reads this, I don't see any changes. Paulson only sees ONE solution to ending this crisis, and that is by pumping the banks with good money and acquiring their toxic debt. Peter Schiff says that is not the answer. I agree. The banks aren't lending out the money anyway because they are loaded with debt and also have to pay their CEO high exec salaries and bonuses. Not only that, but the banks are scared to loan out money on assets such as houses that are falling in value. The banks are stupid idiots who are not doing their job and managing their money, so why would anyone in their right mind give them more money? Why reward bad behavior?

The FEDS need to think creatively, such as setting up their own fresh lending channel DIRECTLY to the public. The fed rate is around 1% if I am not mistaken. What's wrong with the gov't loaning that money directly to the public for say...2-3% for a home? I'm sure that there are many other ideas out there. This is just one.

Imagine...the feds already have pumped in $7 trillion, with virtually no results. That could finance 35 million home mortgages @ $200K loan values. 35 MILLION! The US housing market only needs about needs about 3.5 % of that money to supply about 1.35 million housing starts which is average for a given year. I think there are many people who can qualify for a 2-3% fixed loan, and wouldn't be in a hurry to bailout even IF prices dropped, because the mortgage at those rates are still less than rent.

I'm sure there are better ideas than this one. I don't have a PHD in economics, but I can say with certainty that bailout out the banks is not the best way to stimulate the economy.

I hate to be negative because even Robert Schiller (professor at Yale) says that negative public sentiment can hurt the economy. But the reality is that no matter how much we try to hide the truth, it will come out. This is not like past recessions where all we needed to do is just keep a positive sentiment. This is the real deal...the mother of all recessions. No positive spin can conceal what is happening.

You are proposing solutions vs. fatalism

They may or may not work, but the point is, even though you express the fatalistic attitude that "there is not going to be a recovery for years", at the very same time you are proposing solutions that can ameliorate or change that scenario.

Elections have consequences. The election of a laissez-faire, klepto-plutocrat free market fundamentalist Administration in 2000 and 2004 had real consequences. State actions to clamp down on predatory loans were pre-empted. A do-nothing SEC allowed Wall Street banks to lever up at levels of 30 or 40 to 1. Just for example.

Changes in these policies can also have consequences, and those consequences can be for the better. Even a belief that things are going to get better can have real economic consequences.

You are commenting on a blog post that is nearly two months old, and obviously the question of whether that was the bottom of a (regular, shallow) recession has been answered with a resounding "NO". I've written subsequent diaries indicating we are in a full fledged deflationary bust since then. I'll have more to say about Leamer's work shortly.

There is still reason to believe that a new Administration, populated by Economic Adults, can produce at least a tepid recovery in 2009, if proper solutions are put in place.

Cheers.

re: You are proposing solutions vs. fatalism

New Deal...I appreciate your level headed response, however I must admit that I have lost faith in the gov't and feds. Many in congress are against the bailout. I personally think that the feds have a personal vested interest in bailing out the banks which is why they are doing it.

I do not like either the republicans or democrats. I think many in both parties are corrupt. Obama and his administration will NOT forsake their buddies in the banking industry.

One of the top economist in this nation was on CNBC about 6 months ago and pretty much said that the way the fed was going about this is totally wrong. Yet, not only are they going down the wrong path, they are going down the path with greater force. The critics are correct. This has nothing to do with what's best for the economy. It has more to do with bailing out wall street. Look for Obama to continue to protect his buddies in the banking industry while the rest of us lose.

Read Obama's lips...NO REAL CHANGES.

Have a great day. I really mean that. Might as well while you can.

Will

Create an account and log on

Come on Will, you're posting every day and that will stop your comments from going into the moderation queue where they sit waiting for me to check the queue and approve it.

You better hope you are wrong...

...or we can kiss any recovery good-bye.

Now, I agree with you about the state of the Congress and our 'business establishment'.

Yet we have Obama. And do not forget what Mr. Franklin so aptly said:

'We must hang together or we will most certainly hang separately.'

I don't think even the levels of corruption we see in Congress will be able to resist the screams for change from the polity more than a second or two when it really hits home just how fucked up Bush has left us.

Nor do I think Obama will hesitate for a split-second in throwing Goldman Sachs et. al. under the fuckin' bus if they try to stand in his way. The guy has demonstrated, and I was no fan of his at the beginning, that he is one cold-blooded dude when it gets down to you or him. It's gonna be you, the financial looters, not him that's gonna go under the bus.

He is smart enough to know that if he cannot pull our chestnuts, holiday metaphor for ya Robert, our of the fire right frikin' now that he won't need Wall Street for his next run.

'Cause there will not be one.

Time will tell which of us has the right of it. I'm betting on human nature.

Obama's not going under the bus for anyone.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Re: You better hope you are wrong...

Citizen...I hope I am wrong, but the fact of the matter is that Obama raised twice as much money as McCain. The big boys put who they want in the white house.

I have no idea if Ron Paul would have been the best Pres, but the fact that he wanted to abolish the federal reserve would have made a lot sense. Remember who the were the REAL culprits in this downturn...the FED RESERVE. They artificially kept the interest rates low for FAR too long and caused the overheating of the economy. Not only that, but they failed to monitor where the money was going.

Was it Bush's fault? Yes. Was it congress's fault? Yes. Was it Greenspan's fault? Yes and a triple YES. It's far more the fed reserve's problem than all of those dirty crooks combined. And now the fed reserve is giving our money to those dirty greedy banks...again. With Obama's approval may I add. Meanwhile the economy continues it's downward spiral. My friend just tried to get a home loan and has good credit. They turned him away saying that his loan amount was too high, but they could lend him a lower amount. He qualified for twice that amount 3 years ago.

-----

Thomas Jefferson once said:

"I believe that banking institutions are more dangerous to our liberties than standing armies . . . If the American people ever allow private banks to control the issue of their currency, first by inflation, then by deflation, the banks and corporations that will grow up around [the banks] . . . will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered . . . The issuing power should be taken from the banks and restored to the people, to whom it properly belongs." -- Thomas Jefferson -- The Debate Over The Recharter Of The Bank Bill,

http://www.barefootsworld.net/prophesy.html

---------

http://biz.yahoo.com/ap/081207/obama.html

AP

Obama: Economy to get worse before it improves

Sunday December 7, 3:04 pm ET

By David Espo, AP Special Correspondent

Barack Obama says economy to get worse before it gets better; priority is on recovery plan

WASHINGTON (AP) -- President-elect Barack Obama said Sunday the economy will get worse before it gets better, pledged a recovery plan "equal to the task" and warned lawmakers that the days of pork barrel spending are ove