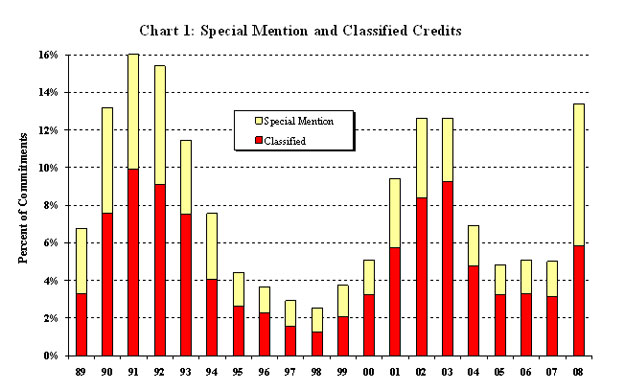

The percentage of large syndicated US loans rated as problematic has nearly tripled in the last year, highlighting the damage done by the lax underwriting standards of the private equity boom, a report by US regulators showed on Wednesday

From Comptroller of the Currency:

The portion of SNC credit commitments held by U.S. domiciled banking organizations declined slightly to 41.1 percent from 42.7 percent, the fourth consecutive year of decline. Holdings by foreign banking organizations declined as well to 39 percent from 41.4 percent. Holdings by non-bank organizations, such as securitization pools, hedge funds, insurance companies, and pension funds, increased to 19.9 percent from 15.9 percent

Classified credits rose to $163.1 billion from $71.6 billion and represent 5.8 percent of the SNC portfolio compared with 3.1 percent in 2007. Credits classified substandard rose to $154.9 billion from the 2007 review. The severity of the classifications increased this year with doubtful and loss credits totaling $8.1 billion compared with $2.0 billion in 2007. Nonaccrual4 classified credits increased to $22.3 billion from $3.9 billion, but represent a relatively low 0.80 percent of the total portfolio

Recent comments