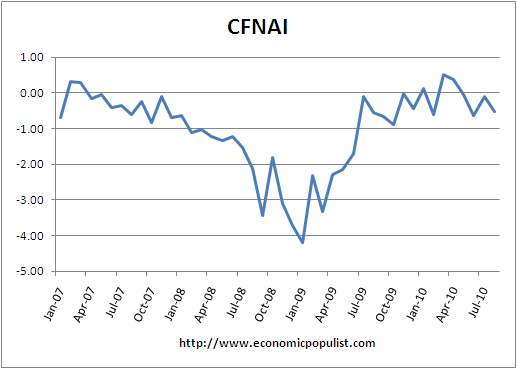

The Chicago Federal Reserve released their activity index for August 2010 today. The monthly index declined to -0.53.

Led by declines in production- and employment-related indicators, the Chicago Fed National Activity Index decreased to –0.53 in August from –0.11 in July. None of the four broad categories of indicators that make up the index made a positive contribution in August.

What is interesting is how the 3 month moving average of the CFNAI, the CFNAI-MA3, correlates to recession cycles. When the CFNAI-MA3 goes below -0.7, there is a strong correlation to the start of a recession. The 3 month moving average dropped to -0.42.

The 3 month moving average graph below, we added the current indicator level, in red, and a line, in purple, when the activity index would suggest a recession is probable. While we are not below -0.7, there is a clear slow down of business activity in the Midwest.

When the CFNAI-MA3 value moves below –0.70 following a period of economic expansion, there is an increasing likelihood that a recession has begun. Conversely, when the CFNAI-MA3 value moves above –0.70 following a period of economic contraction, there is an increasing likelihood that a recession has ended.

The elements dragging down the index are employment and consumption, housing. How long can one claim a recovery when the American middle class is left in the dust?

Recent comments