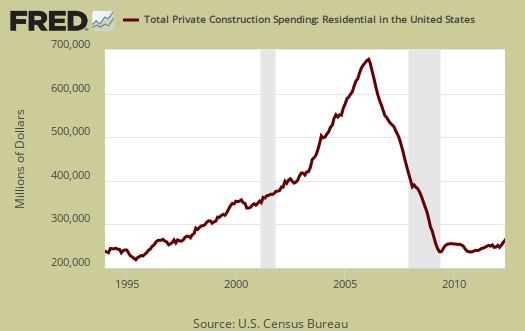

The Census, part of the Commerce Department, today released the monthly construction spending report. This is a monthly tally, reported seasonally adjusted, annualized, of how much money was spent on construction. Spending was $830.0 billion in May, up +0.9% from April and an increase of +7.0% from May of last year. The survey has been done since 1960 and one would never guess from the press punditry that construction was actually only 3.4% of 2011 GDP by industry sector output. The below graph shows just how badly construction spending imploded since 2008, never to recover. Dollars are not adjusted for inflation either.

Private construction spending increased +1.6% overall, and is up +13.1% from May 2011. Residential construction was up +3.0% from April and is up +7.5% from May 2011. Most of that is apartments. Multi-family residential construction increased +6.3% from April and from May 2011 has increased an astounding 50.3%. Below is the graph for residential construction spending. One can track the entire housing bubble rise and burst by this graph.

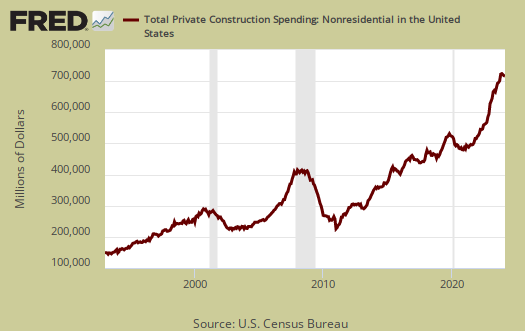

Private, non-residential construction Increased +0.4% from April 2012. Manufacturing was the bring spot, up 2.8% but from the ISM report, it seems improbable that would last going forward.

No surprise, considering our government slash and burn cutbacks, public construction spending overall is down -0.4% from April. Below is the report breakdown.

Educational construction was at a seasonally adjusted annual rate of $65.0 billion, 3.0 percent (±3.8%)* below the revisedApril estimate of $67.0 billion. Highway construction was at

a seasonally adjusted annual rate of $78.0 billion, 0.5 percent (±6.3%)* below the revised April estimate of $78.4 billion.

We here at The Economic Populist love graphs, especially the Saint Louis Federal Reserve FRED tools. FRED has a host of construction spending graphs by individual sectors. Covered is spending on highways, sewers, commercial, manufacturing, water supply, power and so on.

For example, below are the details of all manufacturing construction spending, both public and private. This month manufacturing construction was up +3.4% from April and has increased +27.4% from May 2011 at annualized rates. In the below graph we can see manufacturing construction was also decimated from the Great Recession.

Total Power construction is another welcome piece of positive news. Power construction increased +0.7% from April and is up +30.7% from May 2011.

As an economic report, this data is considered minor by analysts and economists, yet when one really looks at the series over time, it shows how investment, construction, especially residential real estate, imply future growth. So, while it doesn't add that much to the economy by itself, construction spending is almost a forward looking economic indicator.

Recent comments