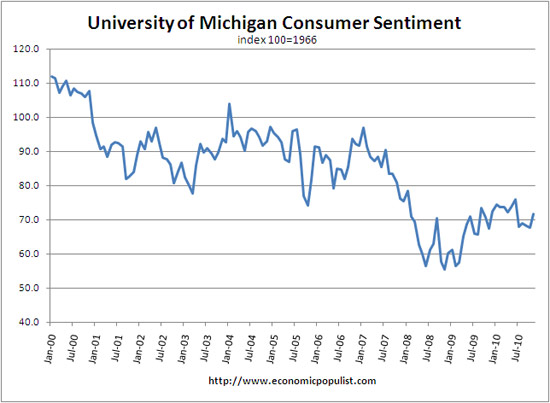

The University of Michigan Consumer Sentiment Index rose to 71.6, a 5.8% monthly increase. The press proclaims this is the highest since June 2009. That's true, but from the graph below, that's nothing to get all excited about.

The economic news heard by consumers grew significantly more favorable in November. Net references to job gains improved by 17 percentage points in November, rising to its highest level since June," the survey's director Richard Curtin said in a statement.

The survey's barometer of current economic conditions was 82.1 in November, up from 76.6 in October and above the preliminary reading of 79.7. Expectations were for a reading of 79.9.

The survey's gauge of consumer expectations also rose and ended November at 64.8, compared with 61.9 in October and 62.7 in early November. Expectations were for a reading of 63.0.

Inflation expectations increased 3.0%, so what people expect versus what the data shows are clearly two different things.

Seems I'm not alone in thinking the cheer leading from our losing team was too good to be true. Below is a quote from the survey of consumers index chief economist warning that thinking all is better is wishful, a potential Lucy football:

It is clearly too early to declare the November uptick in consumer confidence a turning point. It marks the third time that the Sentiment Index has reached this level since the cyclical low was recorded two years ago. In each of the prior rebounds, the gains as well as subsequent losses were mostly based on changing prospects for the economy. Unfortunately, there has been no improvement in consumers' financial prospect in the past two years. While consumers clearly believe that the recovery has gained some traction, most still think that the economic gains will be too small to improve their own job and income position anytime soon."

From the press release, reality checks in, people are broke.

The personal finances of consumers remained quite bleak in November. Nearly twice as many consumers reported that their finances had worsened rather than improved during the past year, with one-in-three reporting declines in household income. There has been some small improvement since the cyclical low point. Income

gains were reported twice as frequently this November compared with a year ago, although the frequency of income gains have remained unchanged for the past 4 months. The larger problem was that just 25% of all households expected their finances to improve during the year ahead, down from 29% last November. The majority of households expected no income increase during the year ahead in November, for the 23rd consecutive month, an all-time record. Households with incomes above $75,000 held the same dismal outlook for their finances, show-ing no improvement in their financial expectations for the year ahead. Holiday sales will be based, more than

ever, on the availability of discounts as consumers continue to cope with their dismal financial circumstances.

Recent comments