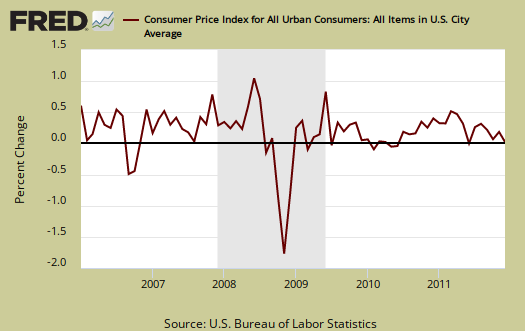

The January Consumer Price Index, which measures inflation, increased 0.2%. From a year ago, CPI has risen 2.9%. Below is the graph for CPI's monthly percentage change.

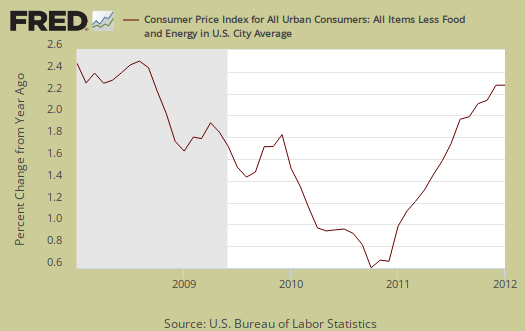

Core inflation, or CPI minus food and energy also increased 0.2% for January. Core inflation has risen 2.3% for the year. This is the highest yearly increase in core inflation since 2008. Core CPI is a Federal Reserve inflation watch number. Below is the graph for the year core inflation change.

Components of core inflation are kind of strange. New vehicles had no price increase, used cars & trucks dropped another -1.0% from last month. This is the 5th month in a row buying a used auto has become cheaper. Airfare dropped, -0.9% from last month. Shelter, all types, increased 0.2% from December. Apparel shot up 0.9% in cost from December. Recreation increased 0.6% from last month and everyone's favorite, educational books and supplies jumped 0.8% in price from December. Smoking just increased another 0.5% in a month. If nicotine addiction doesn't kill ya, the taxes will.

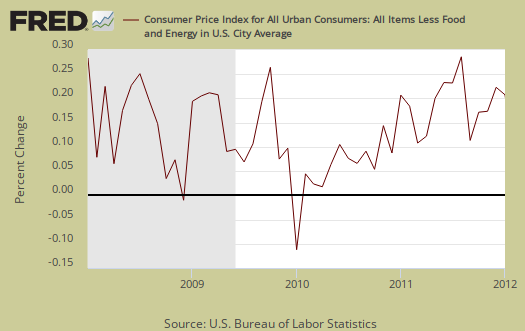

Core CPI's monthly percentage change is graphed below. As we can see, overall, without energy and food, inflation is hitting that magic Federal Reserve target number of 2% per year.

Food and beverages overall increased, 0.2%. The food at home index (think groceries), while unchanged from last month, is up 5.3% for the year. For the year, meats are up 7.2%, fats and oils (really?) have increased 12.7%. This month, fruits & veggies dropped, -1.3%, dairy increased 0.9%, both sugars and fats increased 1.4% and getting drunk (alcohol) just increased 0.8% from December.

Eating out, or food away from home increased 0.4% from December and is up 3.1% from January 2011.

Food getting way too expensive is not in your imagination. $9 bucks for a bad tasting frozen meal? Are you kidding me?

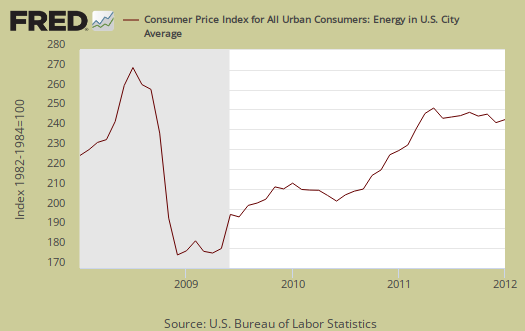

Energy overall increased 0.2%, after plunging for the last 3 previous months. The energy index separates out all energy costs and puts them together. Energy is also mixed in with other indexes, such as heating oil for the housing index and gas for the transportation index. The energy index is still up 6.1% for the year.

Gas alone increased 0.9% for January and is up 9.7% from this time last year. What's interesting is seasonally unadjusted, gas prices jumped 3.6% in January. The transportation index overall increased 0.3%. Gas is part of this index.

Below are gas prices, last updated February 13th. Notice the oil bubble in early 2008 and notice how close gas prices are now to that previous oil bubble. This CPI report is for January 2012 but watching gas prices can gives good indicator on future inflation to come.

Heating your house with gas just got a whole lot cheaper. Utility gas plummeted another -2.9%, the 4th month in a row and is down -5.5% from this time last year. Household energy overall decreased -0.6% this month, but is up 1.2% for the year. Fuel oils for households increased 1.4% and are up 12.1% for the year. Electricity costs were unchanged from December. Seems one great subsidy would be to let people retrofit their homes from heating oil to gas at this point. Below is the CPI-U Energy Index.

The CPI energy index, capturing the last oil bubble below, is all energy, gas, natural gas, fuel oil and so on. Notice it's dip and return versus the food index as well as how it's not as high as the CPI energy index was during the oil commodities bubble of 2008.

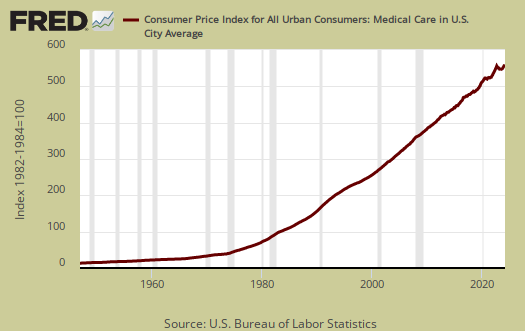

The overall Medical index increased 0.3% for the month, and is up 3.6% for the year. Medical care services increased 0.3% and is up 3.7% for the year. Professional services, or Doctors decreased, -0.2% and is up 2.0% from this time last year.

Medical commodities are things like your prescription drugs and it increased 0.6% from last month and is up 3.2% for the year. Advertising costs baby. Medical costs are part of core inflation.

Strange isn't it, that Medical care is never mentioned when referring to costs and inflation. It's only as important as food, yet health care is treated almost like it's an extra for daily living. The reason is the importance ranking in CPI. This is because no everyone gets a serious illness at once (but lord help you if you do), so the average medical expenses spread out of the population are diluted in overall cost of living figures.

There has been much criticism as of late that the Federal Reserve only focuses in on core CPI, instead of food and energy. According to the BLS, Food and beverages, which includes food at home, makes up 14.8% of the index. Housing is 41.5% and transportation, including gas for the car, is 17.3%. Medical care is only 6.6%, they claim. All items minus food and energy are considered 77.2% of the total price expenditures for consumers.....according to them.

The DOL/BLS does take yearly surveys on where the money goes in the monthly budget, but as one can see, food and energy are significant amounts of the monthly finances. Run away costs in these two areas can break the bank, so can food. Additionally CPI uses substitution, so if steak goes through the roof, somehow we're all just fine with hamburger and prices didn't really overall increase much.

CPI-W for the month, unadjusted was 223.216, a 3.1% for the year. CPI-W is used to calculate government transfer payments, such as social security increases.

Last month's CPI report overview, unrevised, although most graphs are updated, is here.

If you're wondering why the graphs look weird, the graph calculates percentages from the index and doesn't round. The actual data from the BLS report does round to one decimal place. In other words, 0.05% is rounded to 0.1%.

headlines claiming gas pushed up inflation are wrong

After just reviewing MSM via the Internets, the blazing headlines that gas prices drove this month's inflation increase are clearly, very obviously wrong. This is why we do these overviews, because the MSM seems to echo chamber some original buzz headline and if that buzz headline is incorrect, the entire media reporting sphere is incorrect.

Anyway, we can see, from the above, food by itself, increased 0.2%, core, which doesn't include gas increased 0.2% and we see other parts of core inflation drop. They also ignore housing, the largest part of people's budget and it, across the board, homeowner, renter or hotel guest stayer, increased 0.2%.

Sure gas increased the overall energy index, but inflation was across the board, it wasn't gas driving the all items CPI-U increase. See the index breakdown at the bottom, proof positive gang.

Gez, someone pay me for this or at least go to the top link and read the CPI report yourself. They speak English at the BLS ya know (abet cryptic English).

why it matters to look at statistics objectively

I switched on FAUX and they are spinning gas price statistics to somehow blame Obama for price increases. This is ridiculous. First, during the Bush administration, there was a speculative bubble on oil that collapsed. We also had a global recession which dramatically collapsed demand.

What we have here is increased global demand, a lack of refineries, some commodities inflation overall, and a huge threat traders are banking on, Iran.

Anyway, political spin and the desire to blame Obama for rising gas prices as the new strategy for election 2012 seems to be driving this month's media CPI headline buzz.

So glad reporters are objective and people just look at the statistics and try to get an understanding behind the real reasons for rising gas prices.

Down Recently in the US From What I Have Read

I believe the Iran situation is keeping prices where they are.

http://articles.latimes.com/2012/jan/17/business/la-fi-mo-gas-prices-201...

If Obama had the right financial people in his cabinet (other than Volker who is a real US Hero) they probably would have rescinded all those trader exceptions and got the speculators out of the oil market.

You are right about the refineries. No one wants to build them. The big money now wants to build LNG plants turning cheap NG into expensive LNG that can be shipped overseas. The US has a 3000 year supply maybe a 100 years less if we went to CNG cars or CNG hybrids even better.

The 2013 Ford Fusion 47mpg highway, 43mpg city. Think about those numbers and that's sort of a mid size.

I haven't been here for some time. I just wanted to see how the forum was doing and say hello.

Refineries - What Happens if XL Pipeline Goes to the Gulf?

Nobody rational wants a refinery nearby. But as we now learn corporations are people and those people are going to build more gulf refineries if the XL pipeline goes to the Gulf. Big Oil's spin is that Alberta Tar sands will give the U.S. driver more gasoline. So why ship the oil from Alberta to the Gulf? Only one reason, the refined product goes the same place the Alaska Pipeline goes: Asia through the expanded Panama Canal.

If they build the XL Pipeline, there has to be more local Louisiana refinery capacity used, a whole lot more. That extra refining either crowds out crude from the Gulf, or you build more refining capacity. So now we have a perfect segue into adding more refining capacity. More refineries,we know, is something those 'people' want to build. The U.S. driver will not see any more gasoline from the XL Pipeline. It is the same fraud as the Alaska Pipeline.In 1970, we were told that all the Alaska crude from the Pipeline would go to the West Coast.

In the 1830s a famous French author Stendahl wrote an historical novel called the 'Red and the Black' about the return of the French Monarchy.

The punch line of the novel was that the Retrogrades who returned to power:

"They acted as if they had forgotten nothing and they acted as if they had learned nothing".

Burton Leed

Iran, oil vs. CPI

Iran just moved some warship into the gulf. My comments are not meant to deny the impact of oil on the U.S. economy or inflation. More we saw buzz headlines trying to claim that January's CPI numbers were all about gas and not so.

Well, welcome back! We seem to go through comment spurts on EP, although actual reads, references and links are still about the same.

If there is something I can set up here to help people discuss, let me know for it's you guys who really add to the site.