The Japanese made an unusual suggestion the other day that was largely ignored in the American press.

Japanese economists, increasingly concerned that the United States might seek to pay its enormous and growing debt obligations in a weakened US dollar, are looking to the possibility of US Treasuries being issued in yen.

...

As the yen strengthens, the effective value of debt held in dollars will decline, a fate that yen-denominated Treasuries would escape.

This idea isn't new. President Carter issued bonds denominated in German Marks and Swiss Francs when the dollar's value was in doubt during the high inflation of the late 70's. Now there are new questions being raised about the dollar, but this time the concern isn't inflation - its default.

In the past few months, the US dollar has strengthened against other major currencies, with the notable exception of the yen, even as the country has been at the epicenter of the deepening financial crisis. That dollar strength is not expected to last.

"There is no wonder the dollar will weaken," said Eisuke Sakakibara, Japan's former top currency official and now a professor at Waseda University. "The dollar now looks strong for a technical reason. The money the US financial firms had invested in the world is being repatriated into the homeland, causing dollar-buying. But once this conversion into the dollars is done, the currency will head south," Sakakibara said at a forum in Tokyo on Sunday.

...

"The US will be forced to issue foreign currency-denominated US Treasures in its hour of need," said Mizuno. "The US cannot finance its deficit by itself. The US financial system cannot survive without foreign investors. We will see 'Obama Bonds' in the future."

To see how this works, check out this chart. Notice how the bankruptcies of major financial institutions have actually strengthened the dollar, rather than weakened it.

While this may seem incongruent at face value, it actually makes some sense. The defaults are forcing borrowers to raise cash to cover their over-exposed positions. That means selling their winning bets to pay the margin on their losing bets.

Their winning bets were often commodities (such as the falling oil price) and investments in developing nations. Their losing bets were Wall Street financial institutions and American real estate.

However, this is a temporary phenomena that is already beginning to end. According to Bank of America, repatriation of dollars has slowed from $6.4 Billion a day to $200 Million a day. Once the repatriation of dollars ends BofA expects a significant fall in the dollar's value.

A strict reading of interest rate differentials would imply the potential for a further 10% fall in the USD Index during the weeks ahead, about three times the 3.5% correction in place from the October 28 recovery high.

With that in mind it should not come as a surprise that global demand for gold is at an all-time high. Foreign investors have to put their savings somewhere, because they certainly aren't buying dollar-assets. Look at this chart of foreign buying of dollar-based securities below.

Uncle Sam's Credit Line Running Out

America's economy is dominated by consumer spending, which is approximately 70% of he GDP. Compare that to China, where consumer spending is less than 40% of GDP. China makes things. We consume things. China saves. We spend.

It's the ant versus the grasshopper all over again, and winter is coming.

The budget deficit for just October was $237.2 Billion. That's more than half of last year's record budget deficit in just one month. Since America's savings rate is about zero, we simply cannot fund this deficit spending ourselves.

Meanwhile, the Federal Reserve has cut interest rates to just 1%, with more cuts coming. If you were a foreign investor how eager would you be to buy our debt that produces almost no yield?

Which brings up the big problem - how are we going to fund our ostentatious lifestyles with a banana republic economy?

It's this problem that has caused economists to speak the unspeakable - a government default.

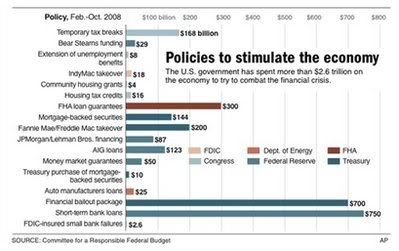

How much more can the US taxpayer take? It sounds insane, but the liabilities being taken on by the Fed and the US Treasury are now so enormous that the government itself could default. No?Check out the chart showing the recent spikes in the US 10-year credit default swap. In other words, the market is now pricing-in the genuine possibility that the US will struggle to pay-back some of its long-term T-bills.

If the government can't borrow the money from foreigners to pay for its massive deficit spending (estimated at $1.5-$2 Trillion or the coming year) then it will have no choice but to monetize the debt. That means the Fed will create money out of thin air in order to purchase the treasuries. It costs nothing to do this, but it also means setting up a hyperinflationary scenario as foreigner investors will flee the dollar.

The attraction of investors to the short end of the Treasury market is "juxtaposed with the massive oversupply and inflationary expectations of the longer end," he writes.Backshall is not alone in this dire assessment. Scott Minerd, the chief investment officer for fixed income at Guggenheim Partners, a Los Angeles money manager, estimates that total Treasury borrowing for fiscal 2009 will total $1.5 trillion-$2 trillion. That was based on $700 billion for TARP, a $500 billion-$750 billion "cyclical deficit," an additional $500 billion stimulus program and some uncertain amount for the Federal Deposit Insurance Corp.

Minerd doubts that private savings in the U.S. and foreign purchases of Treasury debt will be sufficient to meet those government cash requirements. That leaves the Fed to take up the slack; that is, monetization of the debt.

The idea that the American government will lose its AAA-rating has been mentioned for a couple years now. Of course if the world's reserve currency is no longer trustworthy then is any debt trustworthy? A loss of the AA-rating would be like setting off a neutron bomb on Wall Street. The buildings would remain standing, but everything else would be destroyed.

If you look at currency reserves around the world, it looks like the reserve currency is losing its attraction.

The end of dollar hegemony is approaching and everyone knows it. They just aren't sure what will replace it.

Just before flying to America this weekend, French President Nicolas Sarkozy announced his position: “‘The dollar, which at the end of World War II was the only world currency, can no longer claim to be the sole world currency ... What was true in 1945 can no longer be true today.’” Stating this fact was not a matter of ‘courage,’ but ‘good sense.’”

This day has been coming since America went off the gold standard in 1971 and dared the rest of the world to do something about it. The rest of the world blinked.

Now, 37 years later, the rest of the world still doesn't know what to do about it. Thus you can bet that there won't be a replacement for the dollar-standard until the entire dysfunctional economic system collapses. That's why betting on other currencies might not be the best solution to survive the end of the dollar empire.

Comments

timing

I agree with everything in your post but the timing of all of this is key. I was very surprised to see the dollar strengthen at all.

Maybe this is all going to hit in 2009, Q2 or Q3, not sure but it doesn't seem to be the immediate reaction at all.

Great post!

We're in a dollar bubble.

It'll pop quicker than the commodity bubble.

Commodities...

were never in a bubble.

A bubble can only exist with increasing supply to meet increasing demand. Commodities (oil, PM's, etc.) never had the huge stockpiles to create the bubble.

The bubble only existed in Tech stocks, and housing recently.

I do believe you are correct about the dollar bubble

umm....

Don't be too sure about that. ;)

A non-believer?

Try buying physical gold and silver bullion lately? Without several weeks delay?

FX markets really have no idea

I trade forex, mainly the futures, and I have to tell you, these traders have no fucking clue either as to what's going on. Half think the US Dollar is a safe haven because Europe and Asia are going to face the brunt of our economic downfall. The other half think the Dollar will fall because all this debt and well...economic downfall. Traders don't know, otherwise they wouldn't be bidding up the 30 year.

Dollar and inflation

I wonder how much of the current negative inflation rate can be attributed to the rise of the dollar?

It occurred to me that gold is off nearly 30% from its highs in dollars, but hit new all-time highs in October in most other currencies (such as Euros and Pounds).

Gartner is saying trading in Gold is almost dead

And this guy has been a big player in Gold. The fact is, like he says in his newsletter and on television, all the ingredients for $1000+ Gold is there, yet it isn't moving. No one can figure out why.

correction

I meant to say Dennis Gartman and the Gartman Letter. Anyone who googles Gartner will get a technology industry letter. My apologies.

I believe the problem in the gold market

Is that "paper" gold has gotten divorced from "metal" gold- and that due to industrial use, "metal" gold is really trading at about 1.5x the spot price, with a severe lack of supply. Gold certificates are still trading at spot price- but more people are insisting on the real thing.

-------------------------------------

Maximum jobs, not maximum profits.

maybe the Japanese are reading this too

This research group predicted the current crisis years ago, to the month. Their latest analysis is extremely worrying.

http://www.leap2020.eu/GEAB-N-28-is-available!-Global-systemic-crisis-Al...

Summer 2009: The US government defaults on its debt

Our researchers anticipate that, before next summer 2009, the US government will default and be prevented to pay back its creditors (holders of US Treasury Bonds, of Fanny May and Freddy Mac shares, etc.). Of course such a bankruptcy will provoke some very negative outcome for all USD-denominated asset holders.

All I can say is, it won't

All I can say is, it won't be a good scenario when the US government starts creating money out of thin of air.

Hasn't been for about 40 years now

Which, as you say, is only a little bit longer than the US Government has been creating money out of thin air.

-------------------------------------

Maximum jobs, not maximum profits.