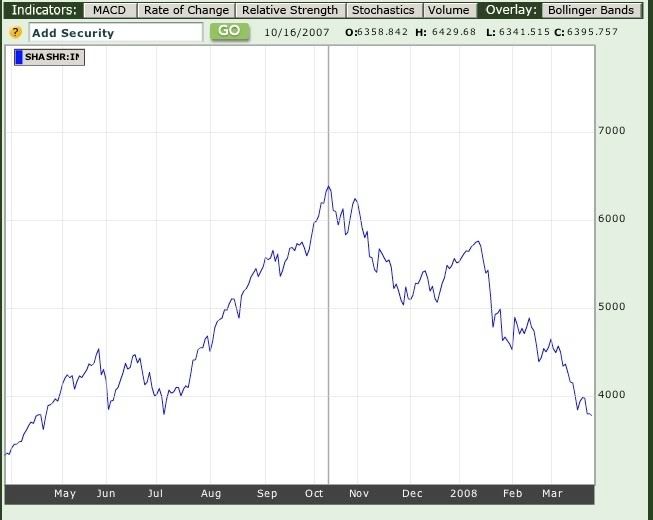

For those who claim that China, India, et al. will bail out the US slowdown by picking up the slack, I bring you this chart of China's Shanghai A shares:

The index reached a high of 6430 back in October 2007. This morning it finished at ~3590. That's a 45% decline in 5 months! If it reminds you of the Nasdaq in 2000, it should. This is the chart of a bubble popping. Large numbers of Chinese "investors" opened brokerage accounts in the last year. Just how many? This is from the February 19 edition of USA Today:

China's new investors, swelling to perhaps 30 million people, "have gotten used to a one-way bet, a simple ride up, as there's a lot of confidence about the economy and the Olympics," says Fraser Howie, a Briton living in Singapore and co-author of the 2006 book Privatizing China: Inside China's Stock Markets.

The story goes on to note how working class Chinese have already lost multiples of their monthly salaries in the slump. You don't suppose any of them were gambling, and perhaps had taken out loans to do so, do you?

The Hang Seng (Hong Kong) and Nikkei (Japan) indeces are also off over 33%. That's a worse performance than our domestic stock markets over the same time.

Stock market performance is generally thought to be a leading indicator of the real world economy. And in the real world, there was this little surprise as reported by the South China Morning Post:

Baosteel slumps after surprise profit decline

Reuters in Shanghai

1:10pm, Mar 27, 2008

Shares in Baoshan Iron and Steel fell their 10 per cent daily limit at one stage on Thursday morning after the mainland’s biggest steelmaker reported an unexpected fall last year net profit - its first annual fall since 2001....

China's manufacturing/infrastructure boom now is similar to the US's boom 100 years ago. Anyone want to guess what an unexpected slowdown in US Steel meant back in our industrial heyday?

Make no mistake, this is a global slump, and foolish debtors and creditors alike will slowly be crushed.

Comments

I can see the US affecting

China but overall it looks like China will exceed the United States economically in a few years.

Bank of China has been affected by the subprime, how much? It mentions $80 Billion and yesterday they dumped some of it.

But overall they are sitting pretty.

Did you see McMillion's China report in the studies section?

It's dated (3COM deal was blocked) but overall accurate and in depth.