Seasonally adjusted retail sales rose more than expected in July, and revisions to May and June sales added another 0.4% to the running total. The Advance Retail Sales Report for July (pdf) from the Census Bureau estimated that our seasonally adjusted retail and food services sales totaled $446.5 billion, which was an increase of 0.6 percent (±0.5%) from June's revised sales of $443.9 billion and 2.4 percent (±0.7%) above the sales of July of last year. June's seasonally adjusted sales were revised from the $442.0 billion first reported to $443.9 billion, while May's sales, which were revised down to $443.3 billion from the originally reported $444.9 billion last month, were revised back up to $443.9 billion with this report. Annualized, those revisions would add $10.6 billion to the previously reported second quarter personal consumption expenditures, and assuming no change in the price indices for May and June, 0.14 percentage points to real 2nd quarter growth. Estimated unadjusted sales in July, extrapolated from surveys of a small sampling of retailers, indicated unadjusted sales rose 1.8%, from $447,712 million in June to $455,846 million in July, while they were up 2.0% from the $443,153 million of sales in July a year ago...

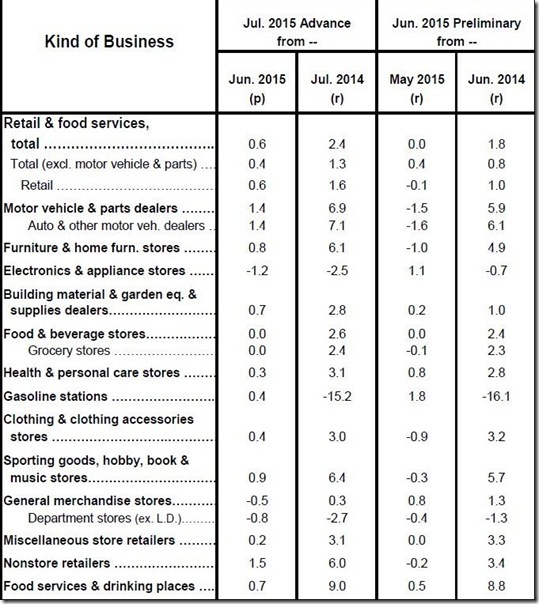

As usual, we'll include the table of monthly and yearly percentage changes in sales by business type taken from the Census pdf, as you should all be familiar with this view. The first double column below gives us the seasonally adjusted percentage change in sales for each type of retail business type from June to July in the first sub-column, and then the year over year percentage change for those businesses since last July in the 2nd column. The second pair of columns gives us the revision of last month’s June advance monthly estimates (now called "preliminary") as revised in this report, likewise for each business type, with the May to June change under "May 2015 revised" and the revised June 2014 to June 2015 percentage change in the last column shown. For your reference, the table of last month’s advance June estimates before this month's revision is here.

As you can see from the above, the 1.4% increase to $92,753 million in sales at vehicle and parts dealers gave a major boost to July sales, but even excluding automotive sales from the total, other retail sales were still up 0.4% to $353,724 million. Other types of retailers that saw major sales increases in July included non-store and online retailers, who saw sales increase 1.5% to $40,493 million, specialty stores, such as sporting goods, book and music stores, where sales rose 0.9% to $7,404 million, and furniture stores, where sales rose 0.8% to $8,666 million. On the other hand, electronics and appliance store sales saw sales fall 1.2% to $8,610 million, while department store sales fell 0.8% to $13,769 million. For the past year, the 9.0% increase in sales at restaurants and bars was the largest of any group, while the 15.2% drop in gasoline stations sales was the worst result, and obviously due to lower gasoline prices.

There were also major changes to June sales, shown in the 2nd pair of columns above. Comparing that data to our copy of sales as originally reported last month, we first find that sales at car dealers, which were originally reported as down 1.0%, have been revised to show a worse June sales decline of 1.6%. Offsetting that, we find that several types of retailers saw their June sales revised up by more than a half a percent. The change in June sales at building material and garden supply stores saw a 1.5% improvement, as they were revised from a decrease of 1.3% to an increase of 0.2%; gasoline station sales were revised from an increase of 0.8% to an increase of 1.8%; furniture store sales were revised from a decrease of 1.6% to a decrease of 1.0%; clothing store sales were revised from a decrease of 1.5% to a decrease of 0.9%, and sales at drug stores in June are now shown to have increased 0.8%, rather than the 0.2% increase reported in the advance estimate..

gas and autos

IP just saw an auto surge so I wouldn't be thinking that if sales forecasts were low...

but notice how gasoline stations are back on the rise....bummer.

refineries down

gasoline prices are spiking in a few areas of the country, crashing in others...California's gas prices have been high since the explosion at the Exxon Torrance refinery, and just this past week the distilling unit at BP's Whiting Indiana refinery went down, and is expected to be out for a month...so Ohio gas prices spiked to $3, while other parts of the country are paying $2 a gallon...

US refineries had been running at a record 96.1% of capacity, soaking up that excess oil supply...with Whiting, BP's largest, down, there's no place for that heavy crude to go...

rjs

refining

There currently is not issue with supply. clearly refining capacity is stretched to its limits. Why isn't anyone pushing for more refining capacity, instead of increased supply thru more drilling and pipelines?

Also, if this were a true market - only BP supplies should be affected, not all brands - and they say there is no collusion in gas prices yet they always rise and fall in unison and within pennies of each other.

lots of questions in this current spike, not many answers

traders

the markets have been moving the prices...the day the refinery went down, the spot price of gasoline in Chicago rose 60 cents...clearly there was no more shortage of gasoline in the afternoon than there was in the morning...

you also have to remember that most of the oil companies are commodity houses, too...BP moves 10 times more paper oil than they move the physical variety...

rjs