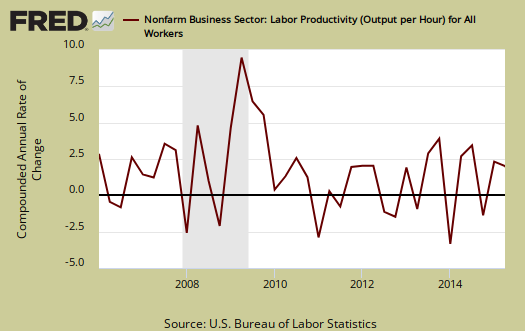

The BLS Productivity & Costs report for Q2 2015 shows labor productivity increased 1.3% annualized. Output increased 2.8% and hours worked increased 1.5%. Unit Labor costs increased only 0.5% in Q2 2015. The reason labor productivity rose was because economic output grew more than worker hours. Both Q4 2014 and Q1 2015 showed decreases in labor productivity. The result means productivity is below the long term 2.2% average and implies businesses will have to hire more people to expand. Below is a graph of the quarterly change in labor productivity.

The basic equation for labor productivity is: , where

is the total output of industry and

stands for labor.

Output can be thought of what is produced from the fruits of labor. Examples would be the cars which come off the assembly line and burgers & fries being served up at McDonald's. Here is the BLS labor productivity formula:

Labor productivity is calculated by dividing an index of real output by an index of the combined hours worked of all persons, including employees, proprietors, and unpaid family workers.

, or Labor, is measured in hours only. Nonfarm Business Output directly correlates to real GDP, minus the government, farms,all of those nonprofits and our infamous, often illegal nannies and gardeners, and equivalent rent of owner occupied properties. The output, or

is about 74% of real GDP reported. Farms, if you can believe this, only represent about 1% of output. Labor productivity is reported as annualized figures and both indexes are normalized to the year 2009. The main productivity numbers above are all business, no farms, where labor costs have a high ratio, about 60%, to output. These productivity statistics are referred to as nonfarm business.

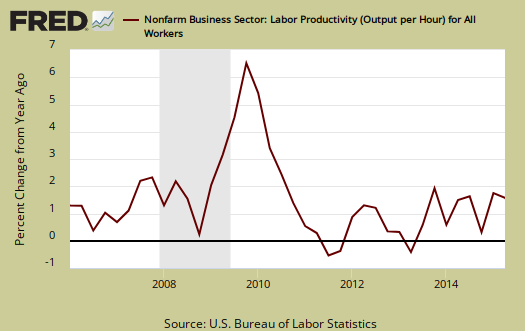

From Q2 2014, a year ago, annual productivity increased 0.3%, output increased 2.8%, and hours worked rose by 2.6%. That is very sluggish productivity growth, yet due to the soaring productivity post Great recession, odds are workers are being treated better and not worked to death for the same pay. Labor productivity changes from a year ago is shown in the below graph.

BLS defines unit labor costs as the ratio of hourly compensation, to labor productivity, where is compensation

represents hours worked as above, or:

For more formula definitions see the BLS handbook. One can also view unit labor costs as the ratio of total worker financial compensation to economic output, adjusted for inflation. Below is the report description of the ratio relationship:

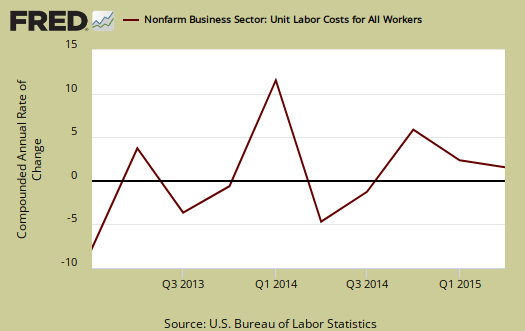

BLS defines unit labor costs as the ratio of hourly compensation to labor productivity; increases in hourly compensation tend to increase unit labor costs and increases in output per hour tend to reduce them. Real hourly compensation is equal to hourly compensation divided by the consumer price series.

Graphed below are unit labor costs, compounded annual rate, percent change. Nonfarm business unit labor costs increased by 0.5% for Q2 2015. From a year ago, Q2 2014, labor costs are up 2.1%. Increases in unit labor costs imply compensation is keeping up with economic output. Increased productivity, or output per hour, for the same $$ paid to workers would lower unit labor costs.

Graphed below are unit labor costs, indexed to 2005. We can see the decline correlating to the Great Recession. One can also see the recovery in more recent years.

Real hourly compensation is wages adjusted for inflation. Real hourly compensation is equal to hourly compensation, defined above, divided by a special inflation series called the consumer price series*, , or:

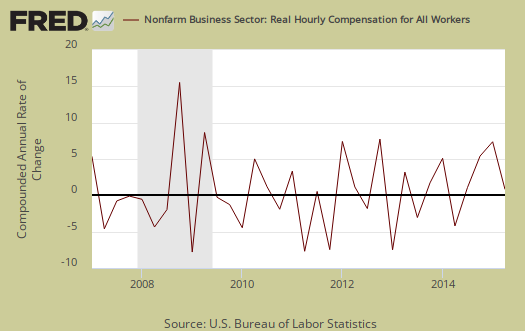

In terms of real dollars, adjusted for inflation, we have a -1.1% decrease in real hourly compensation for Q2 2015, non-farm businesses. This is actually some worse news as wages have not kept up with inflation. In comparison to Q2 2014, real hourly compensation increased 2.3%. This means wages from a year ago have kept up with inflation. Below are quarterly changes to hourly compensation, adjusted for consumer prices.

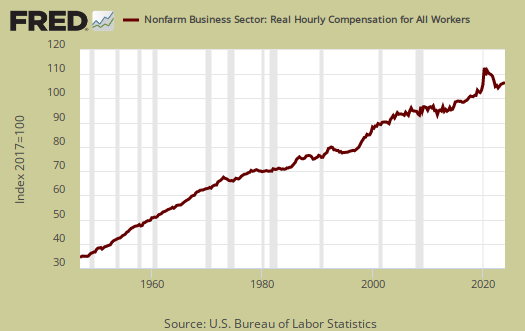

Below is a historical graph of real hourly compensation for nonfarm business. What this shows is worker squeeze extensively from 2007 to 2013. We see a steady increase up until 1980 and then starting with year 2007, we see a complete flat line and latest compensation is slightly improving.

The BLS also reports separately on manufacturing productivity, but uses a different calculation method than the one for business productivity. One cannot subtract manufacturing from business and get services productivity, the two are not the same. Manufacturing is sales, removing duplicates, adjusting for prices and output () is correlated to shipments and the industrial production. indexes. Hours are hours like above. The report has the manufacturing productivity measurement details.

Manufacturing productivity increased 2.5%, for Q2 2015. Manufacturing output grew by 1.5%, while hours worked decreased b -1.%. Since Q1 2014, manufacturing productivity increased 1.1% as output increased by 2.3% and hours worked showed a 1.2% increase. Manufacturing has shown employment growth, so the above correlates to payrolls and the manufacturing ISM indicators.

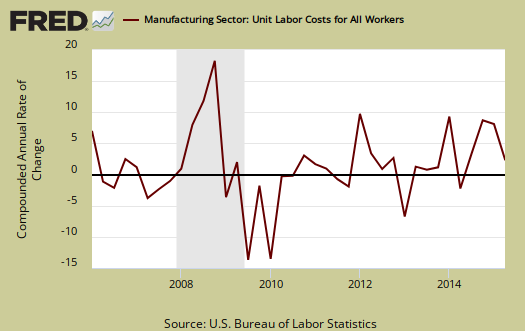

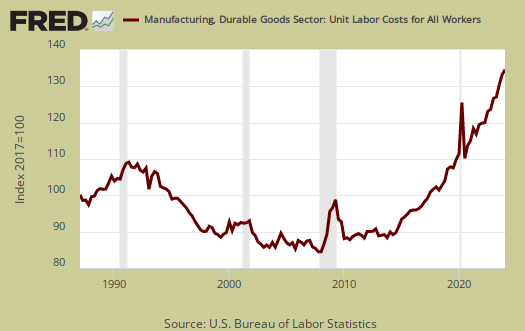

Manufacturing unit labor costs decreased by -2.3% for Q2 2015. From Q2 2014, manufacturing unit labor costs have increased by 0.2%.

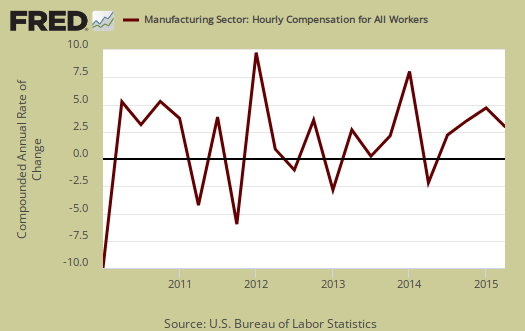

Compensation for manufacturing workers increased 0.2% for the quarter and from a year ago has increased 1.3%. Clearly Q2 manufacturing wages are not keeping up with inflation.

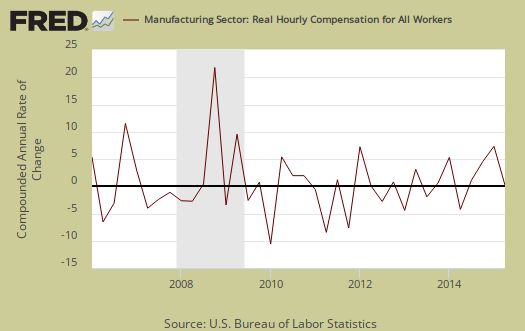

Q2 2015 real compensation (wages) in manufacturing declined by -2.7%. From Q4 2014, real hourly compensation for manufacturing workers at least has increased by 1.3%. Manufacturing wages for Q1 are clearly under attack.

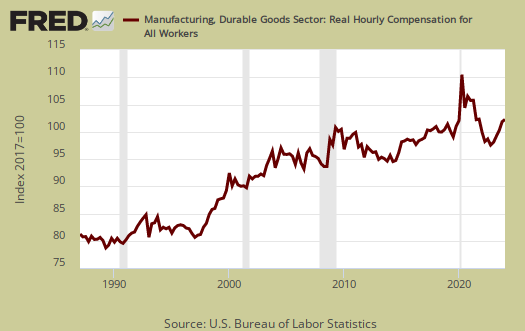

For Q2 2015, durable good manufacturing productivity grew by 3.4%, output increased 1.7% and hours worked declined by -1.6%. Durable goods labor unit costs dramatically dropped by -3.3%, compensation had no change. Real compensation decreased by -2.9%. Graphed below is the durable goods manufacturing real hourly compensation index and marvel at the decline over time.

Unit labor costs in durable goods shows the decline of the American worker for they are returning to their lows. Unit labor costs show real output per hour. Durable goods workers are producing more and more and U.S. workers are getting less reward.

Nondurable manufacturing productivity increased by 1.2% on an output increase of 1.3%. Hours barely budged, a 0.1% increase. Nondurable manufacturing unit labor costs decreased by -0.6%, hourly compensation increased by 0.5% and real hourly compensation decreased by -2.4%. Q2 reads like wage slave for nondurable manufacturing.

What you see these days in productivity is not what it appears. The press will claim increased productivity is a great thing, and maybe that's true for corporate profits, but it's clearly not translating into wages and jobs for workers. Labor share is a measure of how much of the economic pie goes to workers. If labor share increases, this implies labor is benefiting from increased economic growth. When the compensation to productivity gap widens, labor share falls and that means workers are not reaping the economic rewards of their sweat and toil.

Below is labor market share for nonfarm business which shows workers overall are getting less and less of the productivity pie.

Overall, the labor productivity statistics for Q1 2015 look like the soaring productivity figures of post recession have passed. While the American worker is not getting more of the pie per capita, the figures do imply businesses have to at least hire more people and that is a good thing.

* The BLS productivity statisticians use CPI-U-RS, an unpublished inflation research metric, for the consumer price series. This consumer price series seems to flatten inflation, thus make the decline in U.S. wages less, although when normalized to a base year of 2009 the two series are the same for all practical purposes. The implicit price deflator, applied to nonfarm business output (productivity), is from the BEA. The CPS and the price deflator are all to remove inflation effects from the productivity statistics.

Recent comments