By Numerian

How the banks could inflict such damage on the country’s home title and mortgage registry system would take another investigation by Congress to determine – assuming Congress was interested.

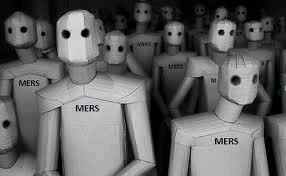

The Mortgage Electronic Registration Systems company (known as MERS), which has been at the center of legal problems affecting the securitization of home mortgages and foreclosures, has given up one of its principal corporate objectives. It is now instructing its members to cease foreclosing on residential properties in the name of MERS, and to begin immediately to register all assignments of mortgages with local county recorders of deeds. (Image)

The whole purpose of MERS when it was established in 1996 was to by-pass the county recording process, and the billions of dollars of fees that banks and mortgage companies would have had to pay to comply with state and local real estate laws. MERS operated on a legal assumption that it could have its cake and eat it too, by acting as an agent for its member banks in their real estate transactions, but also acting if necessary as a principal in its own name when it came to assigning mortgages and foreclosing on properties.

This legal principle took a devastating blow last week when US Bankruptcy Judge Robert Grossman of New York issued a ruling stating that MERS cannot operate as a principal when it came to assignments and foreclosures. The company only maintained a parallel data base of mortgage assignments that gave it no legal rights to interfere in real estate legal processes. By making changes to its rules today that will abandon any pretense that MERS is a principal to real estate transactions, the company is bowing to Judge Grossman’s ruling. By also instructing its members to begin filing mortgage assignments with county clerks, MERS is defeating one of the basic purposes of its establishment: the avoidance of real estate fees.

Fee avoidance was essential if the home mortgage was ever going to be securitized, since securities require multiple assignments of the same mortgage which eventually finds itself in the hands of a trustee for the security. It is now open to question whether mortgage backed securities can remain profitable with fees having to be paid multiple times for as many as 1,000 mortgages in a security. This is going to have serious implications for Fannie Mae and Freddie Mac, which are the only parties left in the US which issue and securitize home mortgages. Fannie and Freddie were founding partners in the establishment of MERS, so this is as much a blow to their business model as it is to MERS, which the two government agencies can ill afford when Congress is debating their future.

Judge Grossman was fully aware of the implications of his ruling.

The Court recognizes that an adverse ruling regarding MERS’s authority to assign mortgages or act on behalf of its member/lenders could have a significant impact on MERS and upon the lenders which do business with MERS throughout the United States. However, the Court must resolve the instant matter by applying the laws as they exist today. It is up to the legislative branch, if it chooses, to amend the current statutes to confer upon MERS the requisite authority to assign mortgages under its current business practices. MERS and its partners made the decision to create and operate under a business model that was designed in large part to avoid the requirements of the traditional mortgage recording process. This Court does not accept the argument that because MERS may be involved with 50% of all residential mortgages in the country, that is reason enough for this Court to turn a blind eye to the fact that this process does not comply with the law. Link

MERS claims that over 50 million mortgages in the US have been registered on its system. Given the action MERS took today, it will be much harder now for lawyers to argue in court that assignments made only on the MERS registry are legally valid. Unfortunately, for any of these 50 million mortgages that were securitized, chances are the various assignments along the way to the trustee were not recorded on local government records. This now means the chain of title is “clouded”, and such uncertainty affecting tens of millions of mortgages is the last thing the housing market needs. Sellers and buyers don’t know if the title will be clear of any other claims should they engage in a transaction, and homeowners might not even know if they are making monthly payments to the right bank.

Similarly, trillions of dollars of mortgage backed securities are now clouded too, because they aren’t backed by mortgages. MERS is effectively admitting that these securities are uncollateralized, which means investors now have a sound legal claim that the banks issuing the securities should buy them back at 100% of face value. There are, in fact, reasonable claims already being made by some investors against, for example, Wells Fargo and JP Morgan Chase, that these banks perpetrated a fraud by selling so-called “mortgage backed securities” which they should have known were uncollateralized.

It is questionable if MERS can even survive this capitulation to legal reality, but MERS only has 50 employees. Whether Fannie Mae and Freddie Mac can survive is now also open to question, especially if the housing market is going to revert to the old model where mortgages are kept forever by the bank originating the transaction, since securitization will be defunct. Even if Congress intervenes and passes a national law that recognizes the principal rights of some entity that replaces MERS, this will still probably require that each assignment in a securitization be registered locally and fees paid.

How the banks could inflict such damage on the country’s home title and mortgage registry system would take another investigation by Congress to determine – assuming Congress was interested. One thing is for certain: if the CEOs of all the major banks don’t resign because of this scandal, if there isn’t a thorough house cleaning of the boards and executive ranks of the major banks behind the mortgage securitization process, if in fact no one takes any responsibility for placing tens of millions of American homes in legal limbo, than we can conclude malfeasance and corruption have taken firm root on Wall Street.

First published at The Agonist

Comments

MERS destroyed AMERICA

To see the picketing in Wisconsin is just the beginning. Every State is bankrupt because MERS never paid the filing fees, resulting in every County Recorder being without funds which pay for teachers,police, firefighters and county workers.

And No News is covering the question..."WHY" ....WHY are all the States out of money? Why isn't the news asking that question??? Because the MEDIA is owned by the banks and the banks are what started MERS....

The illusion of knowing the truth is like finding out SANTA Clause wasn't real!!

I pray for some hot shot investigative reporter to dig and report!!

God Help America....

The news doesn't like to upset us

MERS is the creation of the big banks and Wall Street to suit their needs. It had nothing to do with anything but selling Mortgage Backed Securities. You can be sure that they knew it was illegal. But they didn't care. And now a huge percent of the mortgages can be challenged. That could work out quite well with come creative leadership (oops, we have no leadership).

I hope the people of Wisconsin realize what a creep this Walker is. We can't recall members of Congress but we can governors and state officials. Time for Walker to pack his bags.

Michael Collins

It is beyond the pale...

"...than we can conclude malfeasance and corruption have taken firm root on Wall Street."

That is very much a foregone conclusion, and it appears that within this current political climate or moment, no one in government leadership (except the usual handful of ineffectual reformers) have any plans to rock anyones boat. Although, the little people will be allowed to suffer the inevitable consequences...nothing new about this story.