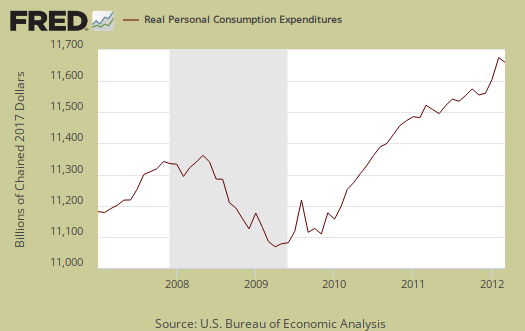

Consumer spending increased 0.3% from last month, but after taking price increases into account, showed only a 0.1% increase. Personal consumption expenditures are often called consumer spending. Real Personal Consumption Expenditures, or PCE, are about 71% of GDP. Real means chained to 2005 dollars, thus adjusted for inflation. Below is a graph of real PCE.

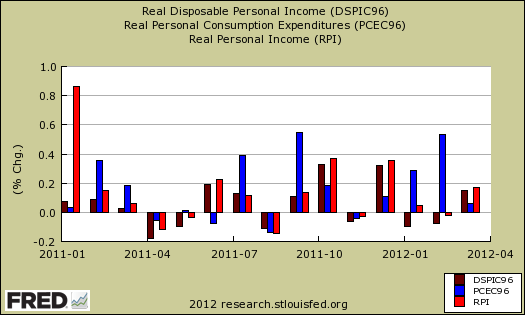

The Personal Income and Outlays report covers individual income, consumption and savings. While disposable income increased by 0.4%, when adjusted for inflation, disposable income was actually a 0.2% increase. Personal income increased 0.4%, but adjusted for inflation increased 0.2%. The personal income & outlays report is seasonally adjusted. Below is the monthly change for real personal income (bright red), real disposable income (maroon) and real consumer spending (blue).

February was a blow out in terms of consumer spending. Not adjusted for inflation, PCE increased 0.9% in February and in real dollars increased 0.5%. This is why Q1 GDP showed an increase in consumer spending. Below are the raw totals, in adjusted for inflation dollars.

Consumer spending is not just automobiles, smartphones, toys and Starbucks. Things like housing, healthcare, food and gas are the majority of consumer spending. In other words, PCE is about paying for basic living necessities. Graphed below is the overall real PCE monthly percentage change.

What people spent money on, adjusted for prices, or in real dollars, by monthly percentage change was:

- durable goods: -0.2%

- non-durable goods: +0.4%

- services: 0%

Health care, for example, is a service. Gasoline is a nondurable good. Cars are a durable good. From the report it appears autos had a bad month:

Real PCE -- PCE adjusted to remove price changes -- increased 0.1 percent in March, compared with an increase of 0.5 percent in February. Purchases of durable goods decreased 0.2 percent, in contrast to an increase of 2.1 percent. Purchases of motor vehicles and parts more than accounted for the decrease in March, and accounted for most of the increase in February. Purchases of nondurable goods increased 0.4 percent in Marc h, compared with an increase of 0.1 percent in February. Purchases of services decreased less than 0.1 percent, in contrast to an increase of 0.4 percent.

Price indexes are used as divisors to adjust for inflation and price changes. The indexes are used to compute spending and income for an apples to apples, real dollar comparison to previous months and years. Economic statisticians use real dollars so one does not erroneously assume economic growth when it's really inflation.

The PCE price index increased +0.2% for March and is up +2.1% from a year ago. Minus energy and food, the price index increased +0.2% and is also up +2.0% from this time last year. The energy index for personal consumption has increased 3.7% from one year ago and the food index is up 3.1% from March 2011. While the PCE price index represents inflation, it is different from CPI.

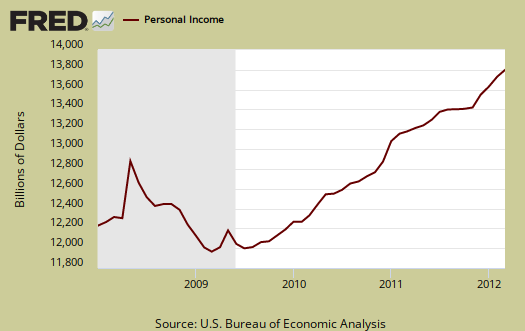

Personal income increased +0.4% in March and these numbers are the total for everybody in the United States who is reported and not part of the underground economy. Below is personal income, not adjusted for inflation, or price changes.

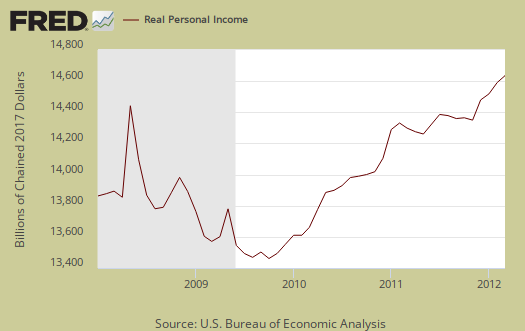

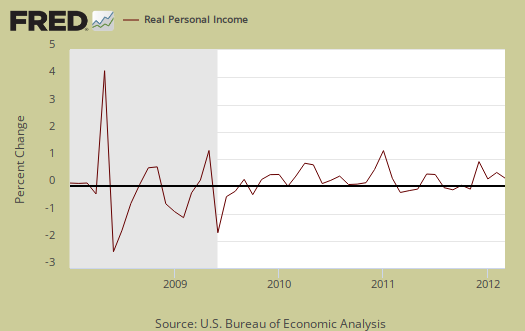

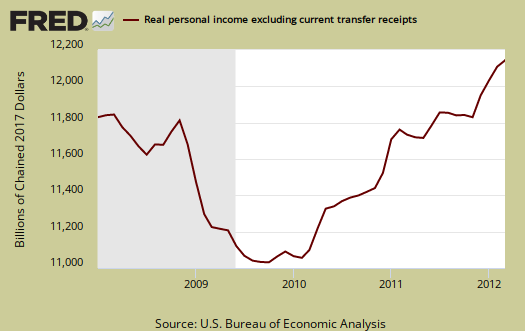

Real personal income, or personal income adjusted for inflation, via the PCE price index, and also government payments, such as social security, are removed, was up +0.1% for March. Below is the graph of real personal income. While personal income is everybody, all income in the U.S., we can see, when adjusted for inflation, personal income is just catching up with levels, on aggregate, from 3 years ago.

Why the BEA report doesn't give real personal income monthly changes including transfer receipts, I do not know. Below is the monthly percentage change in personal income, adjusted for inflation, including payments from the government. For March real personal income increased 0.17% from February, not rounded.

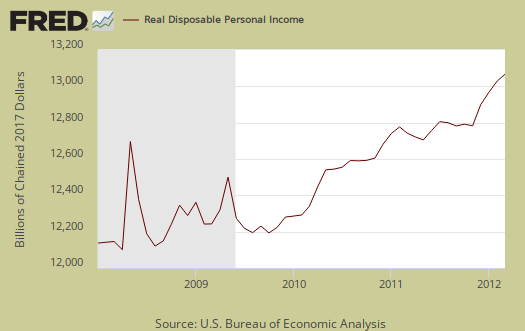

Disposable income is what is left over after taxes. DPI (disposable income), increased 0.4% from last month. That's not because people made way more money, it's because taxes were less.

Personal current taxes increased $7.8 billion in March, compared with an increase of $10.2 billion in February. Disposable personal income (DPI) -- personal income less personal current taxes -- increased $42.5 billion, or 0.4 percent, in March, compared with an increase of $29.4 billion, or 0.2 percent, in February.

DPI adjusted for inflation (see the price indexes above), increased 0.2%, from the previous month. These numbers are aggregates, which includes income of the uber-rich, or the 1% of the population, as they are now called.

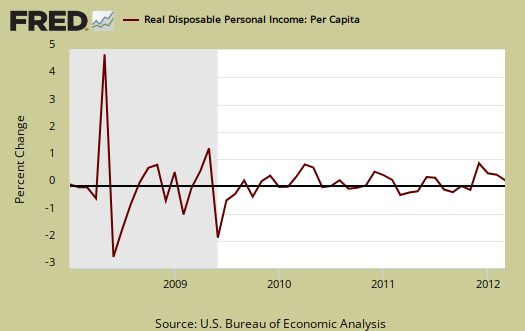

Below is real disposable income per capita. Per capita means evenly distributed per person and population increases every month. March mid-month the U.S. population was 313,612,000. In other words, while on aggregate personal income has increased, so has population to earn that income. When taking increased population into account, we basically have no growth in real personal income.

Interesting reality check huh? It seems politically, any mention of the effects of population on aggregate data is a no no and dismissed. Disposable income, when spread across increased population growth and adjusted for inflation shows it's often worse news, which makes declines even more miserable. The numbers reported in the press headlines are aggregates, or the total, regardless of how many more people are in the country.

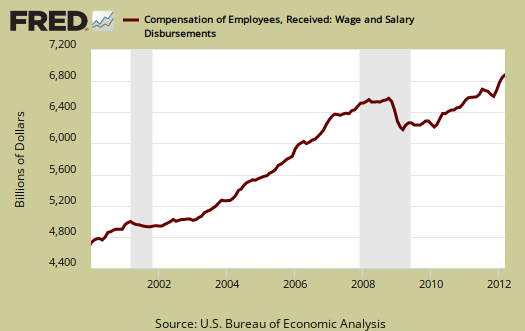

The monthly percentage change for wages and salaries was 0.3%, with total employee compensation, which includes wages, salaries, benefits, also increasing 0.3%. Landlords made out like bandits, rental income increased 0.9% in a month and proprietor's total income increased 0.6%. Personal receipts, income on assets, increased by 0.5%. This is income from non-incorporated businesses, such as the self-employed. Dividend income increased 0.7%.

Private wage and salary disbursements increased $17.3 billion in March, compared with an increase of $24.1 billion in February. Goods-producing industries' payrolls decreased $1.3 billion, in contrast to an increase of $1.8 billion; manufacturing payrolls increased $0.1 billion, compared with an increase of $1.6 billion. Services-producing industries' payrolls increased $18.6 billion, compared with an increase of $22.3 billion. Government wage and salary disbursements increased $1.4 billion, compared with an increase of $0.7 billion.

Below are wages and salaries for the past decade. Notice the dip and the more flat line than earlier in the decade. Bear in mind these are aggregate, or all wages and salaries, and not adjusted for inflation.

Below is personal income minus personal current transfer receipts. This graph shows how much personal income increased that wasn't funded by the government and is used as a recession indicator. Transfer receipts are payments from the government to individuals where no actual services (work) was performed. This includes social security, unemployment insurance, welfare, veterans benefits, Medicaid, Medicare and so on. Transfer receipts monthly change was +0.5%, not adjusted for inflation. In chained 2005 dollars, real personal income minus transfer receipts increased +0.1% from last month. Notice real personal income minus transfer receipts is fairly flat line for 2012 so far. Real income, has not recovered from this recession (or maybe 2001 as well), and this should be no surprise from the unemployment rate alone.

Transfer receipts really jumped in nominal dollars.

Personal current transfer receipts increased $11.6 billion in March, compared with an increase of $0.3 billion in February. Within current transfer receipts, government social benefits to persons for social security increased $6.8 billion, compared with an increase of $2.6 billion.

Now recall how social security is projected to run out of money to the contributions to social security for this month from paychecks:

Contributions for government social insurance -- a subtraction in calculating personal income -- increased $2.5 billion in March, compared with an increase of $3.3 billion in February.

People need jobs, in order to pay into social security. Below is a graph of just transfer receipts.

Personal savings is disposable income minus outlays, or consumption and not adjusted for inflation. The Personal Savings Rate was 3.8% in March.

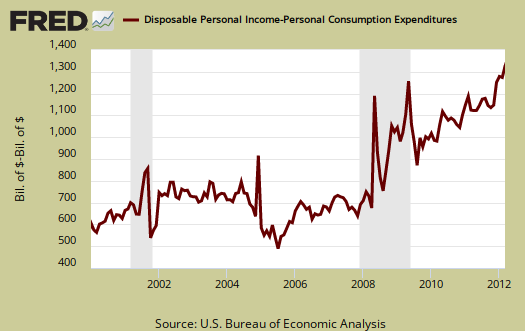

Below is disposable personal income minus personal consumption expenditures monthly raw total changes.

Personal Outlays are PCE, personal interest payments, and personal current transfer payments. PCE is defined above by percentages is almost all of personal outlays. Personal interest payments are things like the interest you pay on your credit card. Personal transfer payments are defined as:

Payments consisting of transfer payments by persons to government and to the rest of the world. Payments to government include donations, fees, and fines paid to Federal, state, and local governments, formerly classified as "personal nontax payments."

In other words, personal transfer payments are nothing more than that speeding ticket you just got or how you just donated to this site. People often confuse transfer payments with transfer receipts, not the same thing.

To visualize more data from this report, consider playing around with more of the St. Louis Federal Reserve Fred graphs.

Here is last month's report overview, not revised.

Recent comments