On June 24, 1982, four bank examiners from the Federal Reserve Bank of Kansas City walked into the rear of a small shopping mall in Oklahoma City.

This unlikely location marks the start of a series of events that have brought us to the brink of a global economic collapse and a second Great Depression.

In order to reform the broken financial system you must first come to terms with the fundamental reasons for the current dysfunction. To do that we must go all the way back to the first instance that this dysfunction manifested itself, in the same way that a medical researcher must trace a mutating virus back to its origin in order to find a vaccine.

Many popular reform proposals revolve around the idea of reversing the Gramm-Leach-Bliley Act, which was passed in 1999. Other people point towards the Commodity Futures Modernization Act which passed in December 2000, that allowed the exponential growth of derivatives - a condition that now threatens to undermine any bailout effort.

While there is merit to the idea of reversing these deregulation measures, both of these laws were passed after the failure of Long-Term Capital Management in 1998. Both of these laws were passed after the Savings and Loan Crisis, which spanned the 1986 to 1991 era.

The only real difference between those crisis and today's crisis is size.

It's safe to say that whatever the fundamental problem with banking system is it is at the very least 35 years old, if not older. Which brings us back to Oklahoma City.

Getting to the root of the problem

Penn Square Bank was founded in 1960. It operated a single, drive-up retail outlet in a local shopping mall.

In 1975 the bank was purchased with borrowed money, and the following year Penn Square formed a loan department for oil and gas leases. Penn Square's asset sheet became concentrated in these commercial loans as early as 1977.

During the 1979 oil crisis, Penn Square began selling participation in these commercial gas and oil loans to Wall Street banks such as Seattle First National Bank (Seafirst), Northern Trust Company, Chase Manhattan Bank, and Michigan National Bank. About $2.1 Billion worth in all.

But most of all, Penn Square sold loan participation to Citibank and Continental Illinois National Bank and Trust. Continental, the 7th largest bank in America, held $1 Billion of these loans.

This system was different from today's world of collateralized-debt obligations (CDO), where all the risk was passed along to buyers elsewhere. The markets weren't as sophisticated in 1982. Penn Square retained these loans on their books. When Penn Square reached the end of their loan capacity it simply offered a share of the action to larger banks in exchange for a finder's fee.

However, the concept is still the same. Risk was spread out among many parties, and Wall Street proved themselves to be unable to detect toxic debt from bubble assets when it sees it.

The Penn Square debacle was caused by a gross dereliction of duty on the part of the bank’s board of directors and management. They were able to perpetrate their abusive practices by obtaining funds—normally through money brokers from banks, credit unions and S&Ls around the nation. These financial institutions, which held 80 percent of the uninsured funds at Penn Square, were motivated solely by a desire to make a fast buck.

- FDIC report on Penn Square

When the Federal Reserve raised interest rates to usury levels in 1980 in order to crush inflation, credit dried up everywhere. The economy collapsed into recession and the oil and gas bull market ended.

In May 1982, rumors spread that Penn Square was over-extended, which caused deposits to flee. Penn Square had about $470.4 million in deposits, of which only about $207.5 million were insured. Penn Square was unable to raise enough capital, and by the end of June it was obvious that Penn Square would fail.

On July 5, 1982, Penn Square was declared insolvent and went into FDIC receivership; the largest in FDIC history at the time.

“I’ll never forget . . . [they were] lined up as far as you could see in

a hot July sun out in the parking lot of this little . . . shopping center . . . lined up all the way out in the parking lot forever, waiting to get their deposits."

- FDIC attorney, Donald McKinley

The first casualty from the Penn Square debacle was Seattle First National Bank, the largest bank in the northwest. The losses from Penn Square forced Seafirst to merge with Bank of America, creating the largest bank in the nation.

But this was merely the start.

The Origin of "Too Big To Fail" (TBTF)

Continental-Illinois was the product of a bank merger in 1910. During the Great Depression Continental-Illinois received a $50 million loan from Reconstruction Finance Corp. in order to stay afloat, thus becoming one of the first recipients of a federal bailout.

Through a continuous series of mergers, Continental-Illinois expanded. By the early 1970's Continental had 60 branches and employed 8,200 people in the Chicago area alone. By 1981 Continental-Illinois was the largest commercial and industrial lender in America. It's assets had increased 110% in five years and eventually totaled $33 Billion at the time the government stepped in.

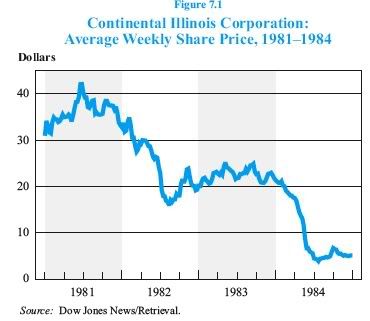

Roger A. Anderson, the Chairman of Continental-Illinois became the highest paid banker in the United States in 1981, with a whopping salary for the day of $710,440. Business magazine Dun's Review declared his bank one of the five best-managed corporations in the country. The Wall Street Journal said Continental-Illinois was "the bank to beat". The company's stock went from $25 to $40 in two years.

However, there was indications of problems even before Penn Square failed. Continental's loans-to-assets ratio increased dramatically from 57.9 percent in 1977 to 68.8 percent by year-end 1981, when it was the highest of the ten banks.

"We hear that Continental is willing to do just about anything to make a deal."

- banker quoted from the FDIC report.

When Penn Square imploded both Chase and Continental-Illinois approached the FDIC and urged it to keep it open. They developed schemes to off-load their toxic debts from Penn Square onto the public balance sheets, but the FDIC didn't bite.

"If we bail out this one, bad as it is, if we take Continental Illinois and the rest of them off the hook and they don't have to pay a thing, then the markets will know that, no matter what risks they take, the government will bail them out. Eventually, it's going to lead down the road to the nationalization of the banking system."

- William M. Isaac, Chairman of FDIC, 1982

"Goddammit, I don't care what it costs! If it costs $1 Billion, you've got to bail it out. If you don't, Continental Illinois is going to fail and who knows where it stops."

- Paul Homan, Federal Reserve Comptroller's supervisor of regulation

The major banks refused to take part in any bailout. They wanted the federal government to take the losses. In so doing Isaac won the debate over Penn Square, but that was merely the first round.

Continental had a very small retail branch. Thus core deposits made up only 20% of total deposits. The bank relied on fed funds and large CDs.

As Continental's CDs came due, money managers simply declined to renew them and took their funds elsewhere. Money began to rush out of the bank, and what new money could be found required higher interest rates.

Continental-Illinois was in trouble.

Continental-Illinois had lent more than $60 million to Braniff Airlines, AM International and Wickes, three of the largest corporate bankruptcies of 1982. They had also lent large sums to GHR Companies and International Harvester, two companies on the brink of bankruptcy.

Another problem was that Continental-Illinois also had significant exposure to Latin American, which, starting with Mexico, imploded during the summer of 1982. The bank was in even worse shape than the markets realized.

"Continental Illinois continued to make serious mistakes after Penn Square. What should have been done right away was the board of directors should have fired the management, brought in strong management from outside, taken a huge loan write-off and eliminated its dividend to stock holders."

- William Isaac, Chaiman of FDIC

However, Isaac wasn't the one making the decisions for Continental Illinois. The Federal Reserve was, and the Fed simply lacked the nerve to invoke its full authority as a bank regulator. It didn't threaten to issue a cease-and-desist order to stop dividends or change management. It didn't even hint of denying Continental Discount privileges. This episode demonstrated how the Federal Reserve could be cowed by a major commercial bank.

Paul Volcker met with Continental's top executives several times. All of the Federal Reserve's suggestions, echoed by Isaac above, were rebuffed.

To put an exclamation point to the Fed's impotence in regards to commercial banks, Roger Anderson would join the Federal Advisory Council in 1983. This select group of 12 commercial bankers that met with the Federal Reserve Board every quarter was extremely influential on Federal Reserve decisions.

The man that Paul Volcker tried to get fired would now be giving Volcker economic advice.

At the end of August, 1982, CEO Anderson announced that the bank had dealt with the difficulties and could now go forward, business as usual. The Fed knew better but did nothing about it.

Meanwhile, Moody's allowed Continental-Illinois to retain its AAA rating.

"[The only] difference between Continental and the Titanic is that the Titanic had a band."

- financial reporter quoted in FDIC report

Continental increasingly had to turn to international funds (with higher interest rates). Domestic institutions slowly sold their exposure to Continental during 1983.

By the start of May, 1984, even Reuters had caught onto Continental's troubles. Foreign investors began shifting their deposits elsewhere. On May 11, Continental had to borrow $3.6 Billion from the Fed's Discount window. Also, a group of 16 Wall Street banks arranged another $2 Billion loan.

"The banks tried to get together without government and it didn't work. Then they fell on their knees with hands outspread and said, 'Save us!'"

- a Treasury official, 1984

Now is when the government bailouts started.

Nothing new under the sun

To prevent a systemic event in the financial system, the FDIC provided a $1.5 Billion loan and participated in a $500 million loan from a group of commercial banks. All this was done to recapitalize the bank. (Hmmm. Does this sound familiar?)

In exchange the government received interest-bearing subordinate notes 100 points above one-year treasury bills.

In a controversial measure, the FDIC promised to protect all deposits at Continental, regardless of the $100,000 limit.

Two months were spent looking for a buyer for Continental, but none could be found. Meanwhile depositors continued to withdraw funds from the bank.

In July the FDIC made the most controversial move of all - they agreed to buy $4.5 Billion of toxic debt from Continental.

"[It's] a bailout for the powerful."

- Rep. Fernand St. Germain

If that sounds like a starkly familiar echo to today's situation, it gets worse.

In exchange for the federal government purchasing $4.5 Billion in worthless loans, the government received non-voting preferred stock which amounted to 79.9% of an ownership stake.

You might recognize this arrangement, because it is exactly the same deal that was done when the Federal Reserve bailed out AIG in 2008.

In contrast, the FDIC closed down 43 small banks in the first half of 1984. In almost every case only the insured deposits were paid off.

This double-standard would forever put small banks at a disadvantage. Depositors of more than $100,000 would always chose a larger bank because it was safer. This made smaller banks more vulnerable to a liquidity squeeze.

However, at this point there was a slight difference. In exchange for this bailout plan the government demanded that the banks executives be fired. The old management and board of directors was let go.

In their place was put John Swearingen and William Ogden as executive officers of CIC and CINB, respectively.

These two new executives replaced the board of directors, but the government could veto any replacement.

On August 31, 1984, Bank of America bought Continental-Illinois for $1.9 Billion. The government began selling its shares of Continental in 1986, and completed the process by 1991.

Of the $4.5 billion the FDIC loaned Continental, $1.1 Billion was lost. Or to put it another way, 24% of the taxpayer money was thrown away.

Aftermath

On July 1, 1988, John R. Lytle, a former vice president of Continental, and William G. Patterson, former head of energy lending at Penn Square, both pleaded guilty in Federal District Court.

Lytle guilty to misapplication of bank funds, and Patterson pleaded guilty to aiding and abetting Mr. Lytle.

In 1991 the country saw another TBTF situation when the Bank of New England Corporation (BNEC), with $21.9 Billion in assets, went under. Fed Chairman Alan Greenspan noted that depositors at some large banks would need to be protected. Thus the TBTF policy became the default policy of federal regulators.

Lessons from TBTF

as one regulator observed, the banking agencies were reluctant to tolerate the sudden and uncontrolled failure of large institutions and therefore generally opt[ed] for managed shrinkage, merger, or recapitalization. There were several reasons for adopting such an attitude, the most important of which was "systemic risk". This rubric covered potential spillover effects leading to widespread depositor runs, impairment of public confidence in the broader financial system, or serious disruptions in domestic and international payment and settlement systems. In addition to systemic risk, the logistical

difficulties and potential expense of liquidating a large bank also contributed to regulatory reluctance to close such a bank and pay off insured depositors. Moreover, liquidation would mean tying up uninsured depositors funds during the lengthy proceedings, a situation that could have a very disruptive effect on a bank's community. For all these reasons

combined, the larger the bank, the more likely it was that bank regulators would look for alternatives to closing the bank and paying off the insured depositors.

Regulators had another concern besides inequity and local economic disruption. They and industry observers worried that the perception of de facto 100 percent deposit insurance for many banks led depositors to believe they needed to devote little if any attention to where they placed their money, a situation that could induce some banks to take excessive

risks.

- from the FDIC report

These are very good reasons why the TBTF policy exists, but it doesn't provide a solution. As Mr. Isaac predicted back in 1982, if the government is there to backstop each and every bank risk-taking then it creates a huge moral hazard in which profits are privatized and losses are socialized in the form of taxpayer bailouts.

Nothing was learned from 1982-84. Nothing at all. The federal regulators kept applying the same solutions over and over again which created a larger and larger moral hazard that now threatens the entire world's financial system.

If we keep going down this road our options will grow smaller and smaller, while the losses will continue to pile up until the currencies of the world themselves collapse (if it isn't already too late).

I don't know how to fix the current situation, but I do know how to prevent it from happening again in the future.

There are two possible solutions:

1) Make the federal regulators more proactive in stopping these asset bubbles from forming in the first place.

I don't know exactly how this can be done, and I'm not sure if it is even possible. I'm not a federal regulator so I don't claim to have access to all the information. Therefore I can't rule out that this can be done.

However, if I'm correct and it can't be done, there is another simple solution:

2) Break up the banks before they become TBTF.

We have anti-trust laws on the books. The federal government has not been using them much since Reagan became president in 1981. It's time to strengthen them.

By making sure that no bank is TBTF, then we can be certain that we will never get into this situation again. The bankers can continue their risk-taking all they want, but they will have to suffer the consequences for it.

On top of that, there is the added advantage of reducing the overwhelming power that Wall Street holds on Washington politicians today. Breaking up the large banks wouldn't just be good for our financial system, it would be good for our democracy.

Comments

everyone hit the sharing buttons this post is a must read

located next to the arrow.

This piece is a must read

I agree that TBTF needs to be an immediate criteria to break up a bank.

I know one thing, structured financial "products" need to be approved before every being allowed on the market. Take

CDOs for example. In the mathematics itself, the base model are some very obvious assumption flaws. It's so bad I am now wondering about the entire financial mathematical field and what they are even reviewing in Academic research.

Then, to me it's obvious to throw off any system which allowed unlimited CDSes on one underlying contract. So far in my own reading this implies if I see a potential asset I believe is going "down" regardless of the fact I own none of that assets, I can buy a CDS and collect when that asset defaults.

Another reason I think to stop TBTF is it seems once these institutions are big enough, they can buy off any politician and as you note, even get their own guys onto the Federal Reserve...

which is another can of worms, beyond only one appointment by the President, it seems the Federal Reserve just doesn't have that much accountability or is interwoven into the power sharing government structure.

It's been a while since I put this much work into a post

I got the idea for this article from the book I'm reading, Secrets of the Temple (I'm almost done with it).

It's a history of the Federal Reserve from late 1979 to about 1985. It was moderately interesting until I came to the part about Penn Square and Continental Illinois.

Then suddenly I was "Deja Vu! I've seen this movie before."

After that it was pretty easy finding the FDIC reports on these banks and drawing some common sense conclusions.

It's amazing how a little historical knowledge can put things into perspective.

reminds me

on the "books" reads page is the list of some books but it's gotten "no love" as of recent. There are certain texts, which are "must reads" that we can help promote.

I read Secrets of the Temple and I wish some PBS grant would turn it into a documentary.

Right now we have the "illuminati" type of documentaries around on the Federal reserve which destroys any valid credibility they have in criticism.

Well, damn good job and I can see from the web stats a host of other financial sites are picking up on your work, so it's being read (which to me is the most important thing, nothing worse than busting your butt to not get any readers!)

Also, if you have any "must read" books I can add them to that page and we could also put together a "book review" of blog posts that are reviews section.

Derivatives and the TBTF concept

Steve Pizzo's article Follow The Numbers shows us that derivatives numbers are overwhelming the world's banking system

"Here's the breakdown, according to the International Bank of Settlements, which acts as banker for the world's central banks:

1) Listed credit derivatives stood at USD 548 trillion;

2. The Over-The-Counter (OTC) derivatives stood in notional or face value at USD 596 trillion"

http://www.opednews.com/articles/Follow-The-Numbers-by-Stephen-Pizzo-090...

World derivatives, therefore total $1.14 Quadrillion USD. In a prior article, Pizzo shows us that US banks have too much exposure to derivative 'gambling debt' speculation, showing that total commercial banks and trust companies with derivatives had total assets of $10.5 trillion vs. total derivatives at $175.8 trillion

see page 22 of 33 at

http://www.occ.treas.gov/ftp/release/2008-152a.pdf

The jig is up folks.

At the April 2nd G20 meeting world leaders should write off this toxic speculative derivative 'debt'.

Put in further perspective, the entire world's GDP, according to the CIA's world book, is $71 trillion USD annually. Compare that with that $1.14 quadillion and you now understand that a huge transfer of wealth is taking place, crowding out legitimate recovery efforts.

EVDebs

Hello, long time no see! I'll have check those numbers, on face, that seem not possible (and yes I know derivatives, the shadow banking system is the real problem).

You might consider joining up, creating an account for I know you are on a lot of the EP topics being written on/discussed.

The numbers are legit

You'll find those numbers are for real.

I forgot I had an account here Robert ! I can't keep my multiple personas straight.

Pizzo's blog is at newsforreal.com and his latest is on Inflation, The Miracle Cure.

I read through them briefly

and it's including things like forex futures, gold futures, commodities futures, i.e. investment vehicles which are fine, based on relatively stable models, been around for 200 years in some cases.

So, I think separating out those "tried and true" options, which go under the title "derivatives" versus all of these "things" created in the last decade and especially in 2004-2007 time frame, which are not based on even valid models....

But it all points to the massive need for strong regulation on all derivatives.

Also I am noticing a pattern where banks, institutions seem to get themselves into constant trouble by being over leveraged. They need to require a very conservative leveraging structure, across the board.

Yeah, on the ID thing I try to keep all of my online ids

where there isn't a security issue the same so I can keep my sanity. There is openid but I guess it has some serious security issues.

Awesome post

Incredibly important, thanks

Quip Pro Quo Must End Also

Political Contributions are nothing but BRIBE MONEY, QUIP PRO QUO. Companies being BAILED OUT make large contributions to Congressional/Senatorial members of the federal government and to State politicians. This must end to preserve our republic

Terrific Post....thanks for

Terrific Post....thanks for all your hard work.

I'd forgotten about Penn Square/Continental Illinois precedent...my outrage meter had kinda stopped at the S&L debacle.

Too bad this kind of analysis never makes it to the political blogorama- dome where all we get is full time Kabuki theater from both the left and the right. The lefties spend all their time re-crucifying Bill Clinton, with an occasional snarl at Phil and Wendy Gramm and the righties have the vapours over impending socialism.