In the last couple a days a lengthy brief by Aaron Krowne, famous for the "Mortgage Broker Implode-O-Meter", titled Debate Over: It's Hyperinflation (and US Economic Collapse) has gotten extensive attention. The title is pretty self-explanatory. Krowne claims that the Fed's recent negative interest rate policy is going to provoke hyperinflation:

the one thing that is different this time; the only thing on the planet that could truly be the cause of the EXTREME price action in oil, are the actions of the Fed. In specific I mean holding interest rates at the ungodly low rate of 2% -- below even their own doctored inflation reading (which is around 4%); and hell, below even their core inflation reading, which is a percent lower or so.

So the US Fed has deeply NEGATIVE real interest rates for the first time since... well, since they LAST blew a horrible, stupid, gargantuan bubble (in housing).

But they've never been this deep, this negative, or coincided with this late stage of the dollar's waning role as a global reserve currency -- or with total dollar-based financial market collapse.

Well, there's plenty of reason to be critical of many of the Fed's recent actions. Heck, I've also suggested that the Fed's recent negative interest rate policy has created Global Inflation and US Stagnation.

But I am always on the lookout for contrary information, and while I knew that "easy Al" Greenspan had a hand in igniting the housing bubble, and interest rates haven't been this easy in decades, I wanted to be sure that the Fed hadn't been this easy previously in its history. And there, dear reader, I was in for a surprise....

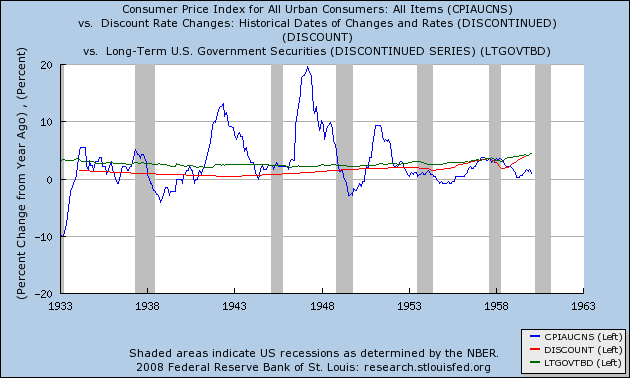

Here's a graph of long and short term interest rates from 1933 through 1958. The CPI is in blue, long term government rates are in green, and short term government rates in red:

Oh, my! For half of the entire 25 year period, Fed interest rates were negative, just as they are now. And while some of those times they coincided with increasingly high inflation, at other times they coincided with declining inflation. And during the post Great Depression 1930s and the later 1950s, they coincided with totally somnolent inflation. (BTW, there was also a brief period in the mid 1920s too but the graph doesn't go back that far).

Now it's true that Aaron Krowne has added lots of qualifiers to his statement. But based on the experience of 1/4 of the entire 20th century, the idea that negative interest rates (i.e., government rates less than the inflation rate) leads to hyperinflation, has to be regarded as busted.

Comments

nice catch

I would have thought hyperinflation would be caused by our massive trade deficit, increasing the money supply generally and the US currency no longer being used as a reserve currency and other nations decoupling from the US.

There are a lot of doomsday sayers out there right now it seems. I mean it sucks and what they have been doing is outrageous, but I sure don't see Germany at the end of WWI here.