A little story passed by the radar of most folks this past week. A piece of news that really shows the US reaching a watershed moment. What is this oh so awesome thing? Well it isn't awesome, in fact, it isn't good at all. Investors are starting to reject government securities.

Treasury Inflation Protected Securities (TIPS) has been a staple investment for a long time, finding a home in portfolios big and small. So what are TIPS, and why should I care?

So what's the deal on TIPS?

First issued in 1997, these are bonds you can invest in either through a broker or straight from Uncle Sam. What made these things special over other Treasury products was that TIPS served as a hedge against inflation. This was tied to the rate of inflation, or more specifically, the Consumer Price Index (CPI). If the CPI went up, you got more cash, if it didn't, well..you get the idea. But allow me to show you with an example done by the folks the bond giant, PIMCO (hey, we're all about education here at Daily Kos!).

For example, consider a $1,000 ten-year TIPS note with a 2.5% coupon in an environment of 4% annual inflation. Initially, the interest paid would be 2.5% of $1,000, or $25.00. But the principal on the TIPS note will adjust upward on a daily basis to match the inflation rate, reaching $1,480 (4% per year, compounded annually) at the end of 10 years. Although the coupon rate on the TIPS note will remain fixed at 2.5%, the actual interest payments will also rise as the value of the principal increases; in the tenth year, the annualized interest payment will be 2.5% of the inflation-adjusted principal, or 2.5% of $1,480, which is $37.00. At maturity, the investor who purchased the TIPS note when it was issued for $1,000 will receive the inflation-adjusted principal of $1,480.

The inflation protection built into TIPS is designed to provide investors with predictable real returns and an explicit hedge against inflation. As the table below shows, monthly returns on TIPS, as defined by the Lehman Brothers U.S. TIPS Index, have had a positive correlation to monthly changes in inflation, while other major asset classes have had a negative correlation to inflation.

- excerpt from "TIPS Basics", from PIMCO

Treasury Inflation Protected Securities' protection racket

Many of you have noted that inflation, despite what the CPI has stated, seems to be more than that. And do you know what? So do the major investors in TIPS now think so. Analysts from Wall Street to across the nation are coming out and saying that the government's inflation numbers don't add up to what they've been monitoring.

One particular fallout has been that many are taking another look at how TIPS are being valued. For them, the risk and rate are not sufficiently quantified as they are currently being priced. As a recent Bloomberg article noted, the major players are not participating as they used to or pulling out entirely.

Morgan Stanley, the second-biggest securities firm, and FTN Financial, a unit of Tennessee's largest bank, are telling clients to pare holdings of TIPS, whose principal amount rises with the Labor Department's consumer price index. Morgan Stanley says derivatives tied to inflation expectations are a better bet, while FTN recommends corporate and agency bonds because the index doesn't reflect the actual rate of U.S. inflation.

The $500 billion TIPS market's 5 percent returns this year have beat a 2.2 percent gain for Treasuries, according to Merrill Lynch & Co. indexes. TIPS should pay more, because the consumer price index downplays the 39 percent increase in gasoline and a 133 percent rise in corn in the past year, investors say. Yields on TIPS relative to Treasury debt, a gauge of traders' inflation bets, barely changed over the past 18 months even as consumer expectations for prices climbed to 3.4 percent, the highest since 1995.

``The consumer price index underestimates inflation,'' said Jeremy Wolfson, who oversees $8.5 billion as chief investment officer at the City of Los Angeles Department of Water and Power Pension Fund. ``Whether TIPS are adding a true inflation hedge, that's arguable based on the CPI component of it.''

- excerpt from "TIPS Flunk Inflation Test as Fuel, Food Overtake CPI", Bloomberg.com

You have to understand, TIPS were supposed to be one of the top shelf treasury products. Outside of US Savings Bonds and other AAA government debentures, these were on virtually every pension fund's buy list. Now things have changed. Investors, and by that, I mean the "institutionals", are saying that what Uncle Sam is selling ain't what they promise to be.

What we have here is a loss of confidence, not so much in the ability to pay but in the quality of the product. When it comes to government debt, that is a critical blow. Governments simply cannot afford to have their financial products questioned. Yet, here we are, and really it's the government's fault.

Last week we noted that the rate of inflation was higher than what was released. At the Shadow Government Stats, utilizing the CPI formula the way it was meant we really have an inflation rate nearing 14%! Now compare that to the CPI's official non-seasonal adjusted 4.5%, and you can see how major investors would find fault with how TIPS are priced.

Et Tu, US Savings Bond?

Now all this doesn't mean that investors are now going to stop buying US Savings Bonds or other treasuries. But the shock of questioning the validity of TIPS has opened some eyes to other possible prospects. Prospects, that in the past, would have been unheard of, are now being asked. One being, can the US government meet it's debt obligations?

At the rate of growth in government spending, the Federal Reserve will eventually start raising interest rates. The benchmark 10-Year Note has seen, what could be, a bottoming in rates. With the Fed making cuts, we saw a low of 3.28 on the 10-Year back in 2003. But, as one can see, we've climbed almost 100 basis points from that low.

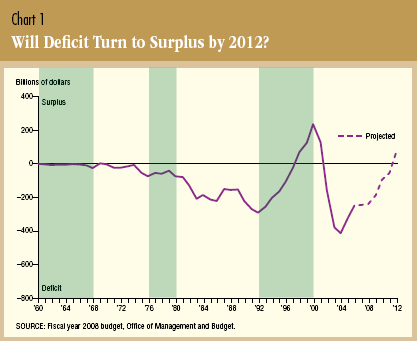

Since George W. Bush took office, the government has been running a budget deficit of historic proportions. And all you Republicans really ought to be a shamed of yourselves. Looking a chart put out by the Federal Reserve Bank of Dallas, we can see when we really sank into negative territory. Please note that the green areas are when this nation's had a Democratic President.

Virtually every time we sank, in post-war history, has been under a GOP Administration! Ok, I'm sure somewhere, LBJ also had a hand in this, but nothing like what Nixon and the other Republicans have done! Under Carter, we see flat growth in the deficit. Yet, under Reagan and then Papa Bush, we a long decline into negativeland. Almost unsurprising, the Clinton Administration managed to reverse this, and actually getting us into budget surpluses! Of course, America gets cheated again, with Bush Jr. slamming the breaks on the surpluses and reverse course in a big way. And now, today, we stand at a budget deficit that's even bigger than under the Gipper!

Don't kid yourself, bond investors see this, and they ask questions. How far will this go? Is it sustainable? Growth in government outlays have been financed with debt. How much can the government borrow, really, without reaching the point where we become like many other nations that have gone bankrupt. Many are beleiving that we long passed that Rubicon. International bond investors have to be wondering if the US will default on it's debt obligations.

So where's the connection to this and TIPS? The government's been pricing those inflation bonds under some bad math. Could we be pricing and setting up future treasury auctions under similar circumstances? You see the bankers, be it in New York or London or Hong Kong, they have analysts that are willing to project real economic data that the government is afraid to publish. We all know about the political tint on those figures like the jobs numbers and inflation. But to the money men, this isn't an issue, they want the truth. If what they see doesn't correlate to what the government is saying, and not only lose confidence in the bonds but the government's ability to meet it's obligations, will they purchase more bonds?

Many Americans say it can't happen here. That we won't be Argentina or Russia or well take your pick. That because America is a "super power" we're above the laws of finance. Well I got news for those folks, it can, and it could possibly happen in our lifetimes. It's never "different this time." Folks said that British Sterling could withstand anything, that is until a financial hurricane by the name of George Soros smashed the Pound. Mark my words, it will happen here, and the Fed will raise rates, and the average consumer will get squeezed.

Investors have other places to park their money. The popular thought was that US government bonds, with their Triple-A status, was the best in debt safety and value. You could almost say that US treasuries were the "reserve currency" of the debt world, almost infallible and second-to-none. People used to think that way about the US Dollar too.

Comments

scary stuff - Cramer

Today on Mad Money (which he has been very wrong...often), but still he did hit the subprime disaster....anyway he announced a banking/financial meltdown like to 0, bank failure.

He did say our lovely Presidential candidates could stop talking about tax cuts and address this and the Fed could come up with a plan which would alleviate it but he clearly said soon, as in very soon, we're going to see bank failures.

Ouch.