The Federal Reserve's consumer credit report for October 2011 shows a 3.7% increase in consumer credit. Revolving credit increased 0.6%, and nonrevolving credit increased 5.3%.

The report also gives percent changes in annualized rates. They are:

- Consumer credit: 3.75%

- Revolving credit: 0.5%

- Bonrevolving credit: 5.25%

Overall consumer credit increased $4.2 billion dollars to $2,468.8 billion. Revolving credit increased $0.8 billion while non-revolving increased $3.4 billion. Revolving credit are things like credit cards and non-revolving are things like auto loans and student loans.

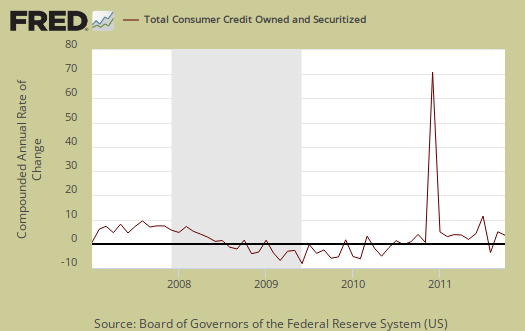

From the above graph we can see outstanding consumer credit drops correlate to recessions. This report does not include charge offs and delinquencies, which increased slightly for Q3. Below is total consumer credit.

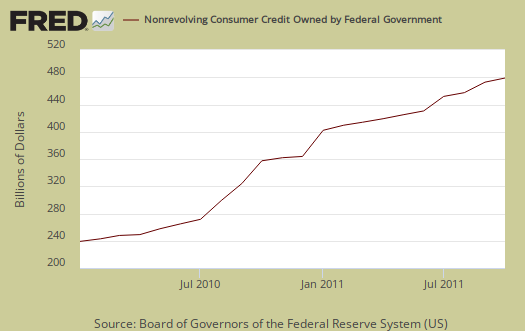

The increase was in large part due to student loans. Tuition has soared this fall, 8.3% at public colleges alone. The federal government started making 100% of guaranteed student loans in July 2010. Federal Government non-revolving credit, which includes these student loans, increased $3.8 billion from September to October. People went more into debt, clearly, to pay for the soaring, absurdly high, educational costs. These are aggregates, but it's doubtful that the U.S. population entering into college is directly proportional to these increases.

Below is non-revolving credit, seasonally adjusted, annualized percentage change.

Revolving credit, think credit cards, are also up for October. Folks, this is October, so while various articles claim the slight increase is due to Christmas, uh, at best, that's another month away for most people. We'll bet money they are paying their electric bill instead.

Below is revolving credit, raw totals. Charge offs are not included in this report. These numbers are seasonally adjusted.

Other press claimed the increase is due to a better economy. Sorry folks, people don't go into more debt unless they have to. What the report means is people took on more debt, simple as that.

Recent comments