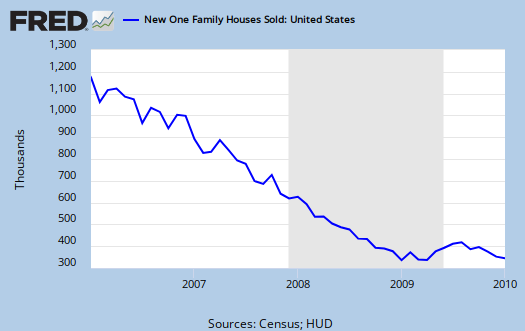

New Home Sales are at record lows.

Sales of new single-family houses in January 2010 were at a seasonally adjusted annual rate of 309,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

This is 11.2 percent (±14.0%)* below the revised December rate of 348,000 and is 6.1 percent (±15.1%)* below the January 2009 estimate of 329,000.

Supply is now 9.1 months. The average sales price, in my view is still out of alignment with wages in this country, especially now, more and more people are becoming retail sales clerks and burger flippers.

The median sales price of new houses sold in January 2010 was $203,500; the average sales price was $254,500. The seasonally adjusted estimate of new houses for sale at the end of January was 234,000. This represents a supply of 9.1 months at the current sales rate.

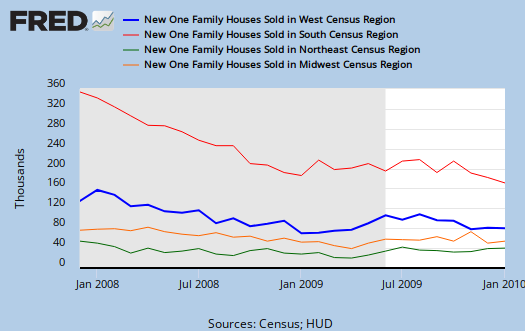

Breaking down by regions):

This is a bad news, but not unexpected if one has been reading this site, for housing data. As always, check out the additional graphs and comments from Calculated Risk.

One thing I'm wondering about is mobility. How mobile are certain regions of the country, how often must they move to find work? I just noticed the differences in the regional graphs and I was wondering how much of an input internal migration causes in these sales?

Not only that

There is another sign that the housing market is tanking: a 13-year low in mortgage applications.

36 months of a recession is a depression

This recession officially started on 12/07 as marked by NBER. Right now the recession graphs call it over (those are the gray blocks), but a lot of economists are questioning that call. We'll see because it takes months to really call an end date, but right now we're at 25 months.

What's really bad about this data is there are tax credits in place, 8k for 1st time homebuyers and 6500 for existing home buyers.

Housing sales data wasn't supposed to tank until those are over, starting around April 2010.

Good news at Freddie Mac

They only lost $6.47 Billion last quarter.

You see! No big deal! Only another 6 and a half billion dollars of losses in a quarter.

Dontcha' just love that spin?

You know, I read somewhere that if a company is losing money hand over fist that it shouldn't be giving out dividends. Must have been before this New Economy thing happened.

just reading the CR headline in the middle column

"Potential Large Wave of Foreclosures".

The Freddie/Fannie thing is one of the reasons a while ago I posted a warning about the housing market collapse as if it was 2006.

Freddie/Fannie is worth at least another Instapopulist, this entire thing, did I enter economic fantasy land, or did I enter a time warp because all I see is the gov. took on all of the housing private risk, now owns the housing market and it's imploding further still and now it's completely on the taxpayer....

AND....as RC has promoted, they won't do a "bottom up" housing market save, say reduce the principle on the loans.

More from Fannie

The bailouts of the GSE's continue.

The GSE's are a gushing wound on the economy and no one seems to care.

Truly!

I forget how many posts I've written about the GSE black bail out hole and on top of it, sure looks like they kicked the entire real estate market can down the road...

Yet these continual things get little "oh shit" press articles and then ...nothing happens.

I think my last tally is they are way bigger than TARP now in terms of risk and taxpayer liability.

I think it's because people just do not understand them...

might be time for one of those tutorial type overview posts?

I forgot to mention this part

$7.6 Billion in dividends while they borrow tens of billions from taxpayers. That is just straight out theft.

Modest Proposal

I hve an underwater mortgage I borrowed "from Suntrust," but it turns out that it was then actually owned by Fannie Mae. I could solve part of Fannie Mae's problem by buying this "underwater" mortgage at its present value. In fact, there are many of us who could provide relief for Fannie's cash-short problem -- they get rid of the toxic "default risk" and reduce their cost at the same time. Hey Fannie, who is the person to talk to about this financial innovation?

Frank T.

Frank T.

25% of all mortgages under water

11.3 million mortgages larger than home value.

And Calculated Risk is pointing out housing is a leading economic indicator....

that's all folks!

Both markets are broken

real estate market and the mortgage market are broken. The mortgage market, which is essential to real estate market, needs to be reconstructed (there's a proposal for that).

Jobs would also help.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.