We have repeatedly heard over the past decade how “things just happened.”

How “…nobody could have foreseen that.”

Or, how everything came about due to “..unintended consequences.”

Conscious actions have intended consequences.

While at the same time we have repeatedly witnessed how the major perpetrators, culprits and predators go unscathed, facing no consequences for the abominations against the public.

In fact, we have observed them to be unjustly rewarded again and again and again.

Then there are those of us who must hustle endlessly for the next month’s mortgage payment, or rent due, or the next meal, are constantly chided with the admonition that “…we must innovate our way out of this!”

We, Kimosabe????

“We” have innovated endlessly, only to find ourselves bereft of employment while the technology we developed has been transferred, along with our jobs, offshore!

We are scolded with the further mythology of “free trade” and that nebulous and ephemeral “free market” – which always translates to the relocation of factories, production facilities, research and development labs, network operations centers, call centers, etc., to cheaper labor markets, while importing their products and services back by the very same corporate offshorers, at considerably greater profits, and less or no taxation, to benefit them --- while destroying what remains of the tax base --- a perfect recipe for neofeudalism

A concerted design of predatory legislation and predatory jurisprudence (as in colossally corrupt US Supreme Court, and federal circuit court, decisions) over the past thirty to forty years allowed for our present circumstances; legislation which overturned the very laws protecting us from the uber predators.

That legislation and court decisions decriminalized fraud for those at the very uppermost echelon of the economic ladder, while criminalizing virtually everything for the rest of us.

Some of that predatory legislation:

1994: Riegle-Neal Interstate Banking and Branching Act

1995: Private Securities Litigation Reform Act

2000: Commodity Futures Modernization Act

2005: Bankruptcy Abuse Prevention and Consumer Protection Act

As might be expected, many of our legislators are mighty pleased with the legislation they passed, and frequently crow about it whenever they speak before the U.S. Chamber of Commerce, as witnessed several years ago by Senator Dodd’s remarks:

I am proud to have had [USCC’s president and CEO Thomas Donohue]’s and the Chamber’s support on some of the most important pieces of legislation with which I have been associated. Laws like the Private Securities Litigation Reform Act; the Y2K litigation reform act; the Class Action Fairness Act; the Gramm-Leach-Bliley Act, which has helped bring our financial services sector into the 21st century; and the Terrorism Risk Insurance Act, which in the aftermath of 9/11 has played a crucial role in keeping our economy strong.[1]

Along with the predatory legislation went a host of Supreme Court decisions --- predatory jurisprudence --- acting to destroy the existing socioeconomic fabric: the decision in 1978 to allow the dumping of the mentally ill onto the streets by the Renquist court, the privatizing of eminent domain around 2004 or 2005, the recent decision in favor of Citizens United, allow even more super-rights for the corporations and a host of other decisions

(Of course the very first predatory jurisprudence in favor the corporations’ super-rights occurred with the 1886 decision favoring Southern Pacific Railroad.)

Those who cannot remember the past…..

As the philosopher Santayana reminded us, it is best to familiarize ourselves with history. Or in this case, the recent history in the rush to deregulate, which was lucidly described in the last several years of the Carter Administration, and early years of the Reagan Administration in the book, Dismantling America, by Susan J. Tolchin and Martin Tolchin.

Mrs. Tolchin is presently University Professor in the School of Public Policy at George Mason University. Mr. Tolchin was an award-winning congressional correspondent for The New York times for many years, and a founding member of the Politico web site.

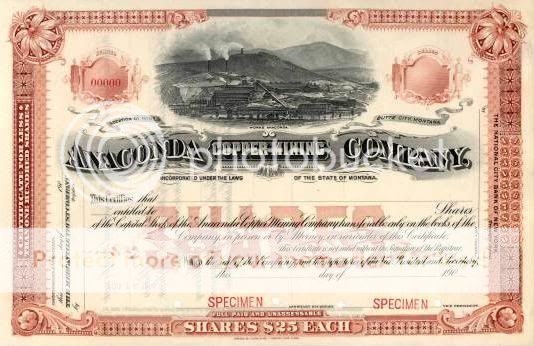

In their most excellent book, published in 1983, the Tolchins begin with the closing of the Anaconda Copper Company smelter and refinery in Montana, resulting in the offshoring of those jobs to Japan – this happened just after ARCO Oil had acquired Anaconda. [2]

(Predictably, ARCO was later acquired by a multinational much in the news recently, BP, British Petroleum.)

Prior to ARCO’s acquisition (or “merger”) with Anaconda, during a hearing before the Federal Trade Commission (FTC) in 1976, ARCO promised to invest up to $1 billion in Anaconda.

Of course, they never specified whether that investment would be in Montana or Japan. [3]

In their book, the Tolchins also mention the establishment of the Regulatory Action Network by the U.S. Chamber of Commerce to facilitate the deregulation of everything! [4]

Naturally, the problem with regulations; they interfere with corporate profits.

But the problem with deregulation; it interferes with life (i.e., hastening death, murder, destruction, etc., etc., etc.).

Further mentioned was Reagan’s Executive Order 12291 – “..granting OMB superagency status over regulations and mandating economic analysis from the agencies…,” dramatically altering the regulatory environment; effectively putting the brakes on further government regulations. [4]

(And don’t forget Reagan’s other executive order, #12615, which established the Office of Privatization --- by themselves these two executive orders would exact extreme changes.)

During Carter’s administration (1978), the Regulatory Analysis Review Group (RARG) was established. Unfortunately, this group would pave the way for what was to follow in the Reagan Administration’s assault on regulations protecting the public welfare.

This committee created by President Carter was the first action by a U.S. president to effect intervention in the day-to-day operations of regulatory agencies. [5]

While the Tolchins’ exhaustively researched book covers a gamut of material, from laxness in nuclear regulations to a host of other pertinent subjects, they also amaze with some recondite history on the first example of the carbon offset concept: first proposed by the Environmental Protection Agency (EPA) during the Reagan Administration (EPA Emissions Trading Policy Statement, 47 Fed. Reg. 15,076 [1982]).

So, interestingly enough, hedge fund manager, Al Gore (Generation Asset Management) wasn’t the first inventor of carbon offsets. [6]

In the last paragraph of the last chapter (There’s No Such Thing as a Free Market), the authors have written the most eloquent of statements:

For regulation is the connective tissue of a civilized society.[7]

Postscript

Quite recently, Ari Fleischer appeared in the corporate news, calling for the resignation of career journalist, Helen Thomas. This should be particularly galling to the vast majority of Americans, especially given Fleischer’s background of perfidy.

As far as “official Washington” is concerned, it was Richard Armitage who “outed” C.I.A. covert agent, Valerie Plame (and given the number of highest-level security clearances accorded to Armitage, he was well-versed in what constituted acts of treason), it was Ari Fleischer who testified under oath, and after being granted immunity, that he willfully and knowingly revealed Ms. Plame’s covert status to reporters.

Not only did this compromise Valerie Plame’s status, but as an operational supervisor with the C.I.A.’s WMD counterproliferation operation, Brewster Jennings, Fleischer’s treasonous behavior compromised the C.I.A.’s entire counterproliferation operation.

This conveniently occurred after Ms. Plame and the Brewster Jennings’ operation – as reliably rumored within the U.S. intelligence establishment – had successfully intercepted a deadly shipment of VX gas during a smuggling attempt across the Turkish border into Iraq around 2003.

Evidently, this VX gas was later to be claimed as a “found” weapon of mass destruction in Iraq!

The Brewster Jennings operation was reputed to have tracked the originating point of this VX gas back to America, but the investigation was conveniently derailed by Fleischer’s compromising actions.

The FBI’s investigation in this matter went nowhere as one would expect. There were multiple FBI investigations of both Paul Wolfowitz and Richard Perle regarding their passing the most sensitive classified documents to the government of Israel which were also fruitless --- to be expected given that Robert Mueller was and is the director of the FBI.

I would refer the reader to Janine Wedel’s recent book, The Shadow Elite as a reference to Wolfowitz and Perle’s activities.

This follows a distinct pattern, as the investigation of the Bank of Credit and Commerce International (BCCI), happened to stop at the Criminal Division of the U.S. Department of Justice before it could be traced further, possibly as high as the Vice President (George H.W. Bush), who had most conveniently appointed the very same Robert Mueller (later to be appointed to director of the FBI by then President George W. Bush) to head the D.O.J.’s Criminal Division.

For a light and easy reference to the notorious BCCI scandal, I would recommend the recent excellent film – on DVD – called The International, starring Clive Owens and Naomi Watts.

And for a true synergy of learning (or a deja vu experience), please first view this movie, then read Ms. Plame's memoirs of her harrowing experience, Fair Game: My Life as a Spy,My Betrayal by the White House.

Just as there is no longer an economy in America, so too is there no media. What America is in dire need of are thousands of Helen Thomases, instead this country is plagued with an endless number of traitors, and those who yearn to commit treason.

And in a world of stenographers posing as faux newsies and pseudo-reporters, the one real journalist will be sorely missed!

Notes

- Senator Dodd’s remarks before the U.S. Chamber of Commerce

http://dodd.senate.gov/?q=node/3779 - pp. 1-2, Tolchin, Susan J. and Martin. Dismantling America. 1983. Houghton Mifflin. ISBN 9780195035773

- Ibid., p.30

- Ibid., pp.6, 41

- Ibid., p. 45

- Ibid., p. 260

- Ibed., p. 276

References

Tolchin, Susan J. and Martin. Dismantling America. 1983. Houghton Mifflin. ISBN 9780195035773

Truell, Peter and Gurwin, Larry. False profits: the inside story of BCCI, the world’s most corrupt financial empire. 1992. Houghton Mifflin. ISBN 0395623391

Wedel, Janine. Shadow Elite. 2009. Basic Books. ISBN 0-465-09106-7

Wilson, Valerie Plame. Fair Game. 2008. Thorndike Press. ISBN 9781410405425.

Meta:

- politico

- deregulation

- regulation

- BP

- Anaconda Copper Company

- ARCO

- Ari Fleischer

- BCCI

- British Petroleum

- Clive Owens

- Department of Justice

- Dismantling America

- FBI

- George Mason University

- Helen Thomas

- Janine Wedel

- Martin Tolchin

- Naomi Watts

- Paul Wolfowitz

- predatory capitalism

- Richard Perle

- Robert Mueller

- Santayana

- Shadow Elite

- Supreme Court

- Susan J. Tolchin

- The International

Comments

anyone else feel helpless & hopeless?

We got beat on health care, beat (obviously) on bail outs, beat on jobs, beat on financial reform, beat on corporate governance, beat on Chinese currency float, beat on trade, and esp., esp. beat on jobs including "Stimulus"...

EP has taken a hit lately and I think it's because people are just exasperated that we get absolutely nowhere in terms of the government doing anything on almost anything.

Plus, for myself, I see such bullshit and frankly it is bullshit, coming from the right and the left in terms of their claims on what policies and legislation will do and how it's "popular with the people". Uh, no, that's their agenda and a lot of it, frankly yes heavily on the right but also on the left, makes zero economic sense. Instead it seems they are more interested in further power plays instead of getting very specific policy and legislation crafted to tackle, reforms and those policies based in economic realities.

Perhaps there's still hope

Well, people with any analytical thinking talent who are still sane most likely realize by this time that America is a completely corrupt criminal enterprise, sad to say.

Still, there is at least one bright spot, Phil Angelides of the FCIC is an honest man full of integrity who has a pristine rep (can't be bought off).

And to date he's refused to meet with Goldman Sachs' types who have repeatedly tried, in vain, to get him to meet with them so they can buy him off.

And although Madam Born is no boat rocker, she has demonstrated her honesty and integrity previously while head of the CFTC, and she now enjoys an independent position for the first time.

well, blog your brains out

The point of EP is to get to specifics and analyze as well as general rants to get the focus on economic, all things $$ reforms that actually work and make sense for most of Americans, middle class, working stiff.

Tonto

Tonto always used to warn the Lone Ranger,

"White Man speak with forked tongue." I could never forget that line.

Burton Leed

Three Uplifting Stories from Darkest of Times

The first everyone knows, "It's a Wonderful Life". Jimmy Stewart does not jump of the bridge and the curmudgeon who owns the Bank loses. and good-guys at the S&L prevail. Quaint. Well at least until the 80's.

Then there's "Grapes of Wrath". The poor Oakies make it to California only to get shit on like us. But they get by in the end because Henry Fonda gives his famous solidarity speech, "where ever some guy is gettin' beat up by a cop.. I'll be there..."

But the best is "Treasure of Sierra Madre", a story of not only self-destructive greed, but a world where cops and criminals are indistinguishable. In the end, Walter Houston who saves the drowned boy, finds redemption by renouncing greed and and becoming a beloved healer. This is an ancient story going back to Chaucer and Boccaccio in the 1350's time of the Black Death. Even darker times.

If you are still not buying the spin, there's Edgar Cayce. Never wrong yet. He had a prediction for 2012.

He says that the Money Syndicates "will be brought under control"

A comment on our Regulators:

http://www.youtube.com/watch?v=VqomZQMZQCQ

Burton Leed

Awesome Post!!!

Great blog James.

AIG can bring the world economy to its knees, be insolvent except for nearly $200 billion in Government bailouts and give out bonuses to the people who did it after the bailout.

Yet stealing something three times in California can yield a life sentence.

Nothing in my opinion clarifies the difference between us and them more than the laws themselves which are supposedly written for everyone.

The Tolchins are excellent reporters

They represent what the NYT should be. More years back than I care to remember, I attended a small dinner party with them. They were fascinating.

Excellent history, bookmarked! And this, "predatory jurisprudence" - a phrase I expect to use. Worth a hundred words at least.

Michael Collins

thanks, Michael, thanks Jim

Thank you. It was really just an excuse to post Mrs. Valerie Plame Wilson's photo.

One thing is for sure, whichever actress they select to play her in the movie of her book, can't be as attractive as she is!

(Semi-kidding about the reason for this post, of course.)

Destruction of the Middle Class - More Empirical

generation.

Burton Leed

what is the graph key?

What does each line graph represent?

Analysis of Graph on Middle Class Job Destruction

Burton Leed