The S&P Case Shiller home price index shows a -3.9% decline from a year ago over 20 metropolitan housing markets and a -3.3% decline for the top 10 housing markets from September 2010. Home prices are back to Q1 2003 levels.

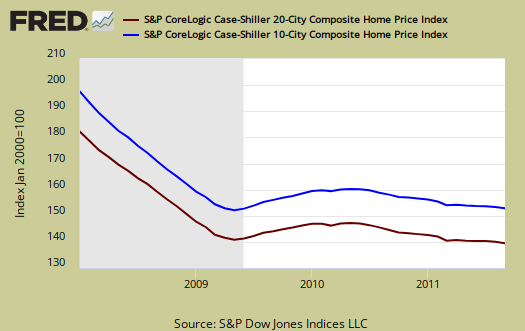

Below is the yearly percent change in the composite-10 and composite-20 Case-Shiller Indices. These are not seasonally adjusted, but comparing from September 2010.

Wondering why we have conflicting news headlines on the S&P Case-Shiller Housing Index? Because some in the press use the seasonally adjusted data and others do not. To make matters worse, some compare the not seasonally adjusted monthly results and others the housing price index in comparison to one year ago.

The seasonally adjusted change in home prices was -1.2% from Q2 to Q3, yet S&P is reporting the not seasonally adjusted change, which was +0.1% between quarters.

This month the not seasonally adjusted August to September change for the composite-20, -0.6%, was the same as the seasonally adjusted rate. The same is true for the composite-10, both the seasonally adjusted and not seasonally adjusted monthly change was -0.4%. Intuitively, the convergence of the seasonal adjustments in September makes sense, it's the winding down of the housing season.

The above graph shows the composite-10 and composite-20 city home prices indexes, seasonally adjusted. Prices are normalized to the year 2000. The index value of 150 means single family housing prices have appreciated, or increased 50% since 2000 in that particular region. These indices are not adjusted for inflation. The composite-20 index, seasonally adjusted is 139.49 and comparable to April 2003 levels (ignoring 2009). Not seasonally adjusted the composite-20 index is 141.97, equal to June 2003 levels. This quote from the report about sums up the situation:

Over the last year home prices in most cities drifted lower. The plunging collapse of prices seen in 2007-2009 seems to be behind us. Any chance for a sustained recovery will probably need a stronger economy.

The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average and published with a two month lag. Their seasonal adjustment calculation is the standard used for all seasonal adjustments, the X-12 ARIMA, maintained by the Census.

So, why would S&P report the not seasonally adjusted data? According to their paper on seasonal adjustments, they claim the not seasonally adjusted indices are more accurate. Why? It appears the housing bubble and bust has screwed up the cyclical seasonal pattern. What a surprise.

The turmoil in the housing market in the last few years has generated unusual movements that are easily mistaken for shifts in the normal seasonal patterns, resulting in larger seasonal adjustments and misleading results.

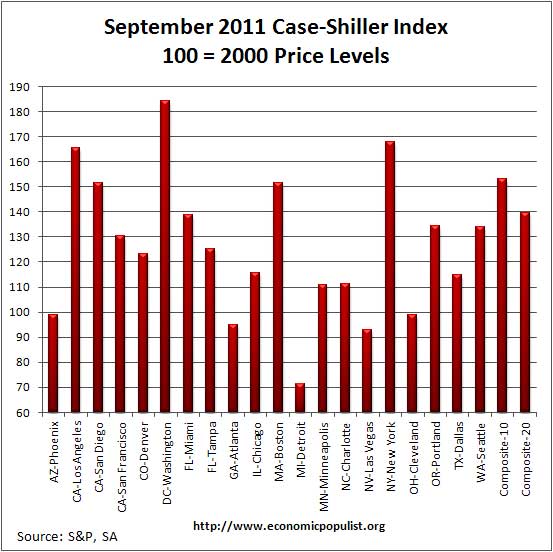

Not seasonally adjusted data creates more headline buzz on a month by month basis. S&P does make it clear that data should be compared to a year ago, to remove seasonal patterns, yet claims monthly percentage changes should use not seasonally adjusted indices and data. This seems invalid for housing markets are highly seasonal. Below are the seasonally adjusted indices for September 2011.

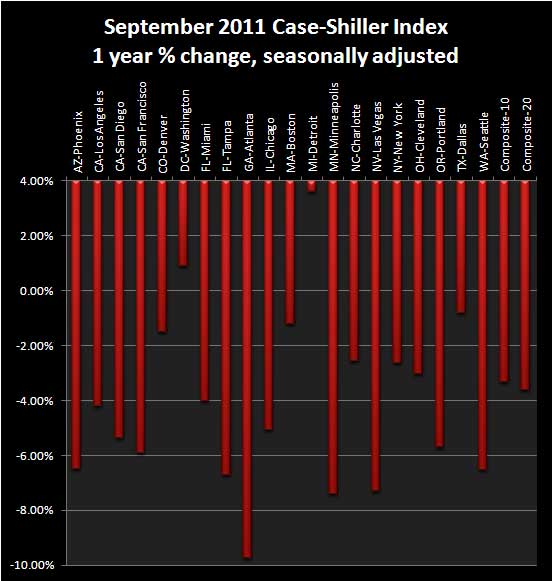

For September 2011, the S&P/Case-Shiller Home Price indexes shows 18 of the 20 cities tracked are down for the year. Detroit, had the best yearly increase, 3.61%, but bear in mind they have been hammered. Atlanta is down -9.75% from a year ago.

Below are all of the composite-20 index cities yearly price percentage change, using the seasonally adjusted data.

Calculated Risk, has additional custom graphs and data analysis and is the uber site for residential housing, with valid statistical analysis.

In a separate report on shadow inventory or houses being kept of the market, S&P says it will take 45 months to clear it all off the market. Shadow inventory is $384 billion. One of the wildest numbers from the shadow inventory report is the New York metro area. NYC has 155 months worth of shadow inventory being kept off the books.

Foreclosures increased 1% in Q3:

Foreclosure filings — default notices, scheduled auctions and bank repossessions — were reported on 610,337 properties in the third quarter, an increase of less than 1 percent from the previous quarter and a decrease of 34 percent from the third quarter of 2010. The report shows one in every 213 U.S. housing units with a foreclosure filing during the quarter.

Corelogic reported reported 22.1% of all homes have negative equity.

Negative equity data shows 10.7 million, or 22.1 percent, of all residential properties with a mortgage were in negative equity at the end of the third quarter of 2011. This is down slightly from 10.9 million properties, or 22.5 percent, in the second quarter. An additional 2.4 million borrowers had less than 5 percent equity, referred to as near-negative equity, in the third quarter.

S&P does a great job of making the Case-Shiller data and details available for further information and analysis on their website.

QE3 in January?

A current ZeroHedge article by Tyler Durden reports research by ConvergEx (Nick Colas' team) that is cited by ZeroHedge to make out an arguable case for QE3 to come as soon as January. Durden's article, How President Obama Is Rapidly Becoming A Gold Bug's Best Friend, opines that we can "expect to see massive monetary easing resume as soon as January when Obama realizes he needs something to go right or else he can kiss that second term good bye."

This prediction, as developed by Durden, is based on analysis of views about and quotes of Ben Bernanke, as developed by ConvergEx, which indicate that the Fed may be totally sold on the theory that rising home prices, and only rising home prices, stand in a causative relation to economic recovery in 2012. ZeroHedge quotes ConvergEx --

The home price increase numbers are then considered as predictably manipulable by means of a QE3 action by the Fed (and beyond that QE4, etc.).

In summary, ConvergEx is quoted as follows --

Underlying assumptions as to causality are contributed by ZeroHedge, and amount to (A) that President Obama will do anything to get reelected in 2012, and, (B) that Obama practically controls the Fed. Or, the assumption may be that a majority of the FOMC desperately want to see Obama re-elected, and, believe they can attain that goal through massive QE3. As with everything 'Gold Bug', there's CT premises woven into the fabric of the narrative tapestry. (And, what do I know? - the CT may all be true!)

ZeroHedge presents the entire note from ConvergEx, complete with a pretty good report on the regression analysis methodology. IMHO, we would do well to put some emphasis on the final sentence in the ConvergEx note --

Yes, members of the FOMC have been seriously considering a QE3 move that would focus on MBS (mortgage-backed securities). This may or may not be something that Obama personally supports, but even if it is, it's doubtful that the FOMC is anxious or in any way willing to do Obama's bidding. I think that what is much more important to the Fed is preserving their institution, which is currently subject to popular and political attacks beyond anything seen for at least 75 years. At least, there's a lot of evidence out there for the idea that institutions like the Fed strive mightily at all times for self-preservation above all other goals.

Here's the thing -- to do a QE3 focusing on MBS, the Fed would have to consider likely serious political blowback, in an election year, from a public that is almost certain to see the action as another bank bailout. (And isn't that what the QE3 would actually amount to?) The risk to the Fed's "world as we know it" would be substantial. IMO, the least of the worries of members of the FOMC is the re-election, or not, of President Obama!

According to Durden, "if rising home prices means diluting a few hundred billion more dollars, so be it."

I would respectfully suggest another way of seeing this issue: "If the price of preserving the USD's pre-eminence as the world's reserve currency means the defeat of Obama next November, so be it."

But what do I know?

Maybe the Fed really does believe that any problem can be solved by throwing money at it.

Maybe Ben Bernanke has never seen a regression analysis he didn't like.

Maybe the Fed is determined to turn the tide rather than trust the tide to turn when it's ready -- which may be some time in 2012, with or without Fed action.

See, Robert Oak's blog from last May, Zillow Says Housing Market Won't Bottom Until 2012

Also, recent comment there by 'Johnny Brooks' -- Housing market bottom in 2012

Zerohedge

I've seen the rumors flying on QE3, but housing data and such is not a QE3 annoucment. I have a tendency to read Zerohedge but not cite them that much. The reason is he often gets it wrong. They kind of fly on rumor, often they will be on the only ones finding a story before it officially breaks, but on the other hand, they also get it wrong too.

Seems so far the FED can buy up all of the MBS they want and few blink an eye. QE involves Treasuries though.

Total Immigration, Visas , LPR and Illegals

LPR + Visas + Illegal Immigration is immigration. The point about LPR is the Honorable Guttierez has proposed allowing 700K Visas holders to become citizens and proposal is backed by usual suspects.

NYT:

In a rare show of bipartisan comity on the angrily contested issue of immigration, the House of Representatives on Tuesday passed a bill that tweaks the visa system to allow more highly skilled immigrants from India and China to become legal permanent residents.

J. Scott Applewhite/Associated Press

Representative Jason Chaffetz, Republican of Utah, helped introduce an immigration bill.

Related

The bill, originally offered by Representatives Jason Chaffetz, a conservative Republican from Utah, and Lamar Smith, a Texas Republican and chairman of the House Judiciary Committee, sailed through by a vote of 389 to 15. Joining as sponsors were several Democrats who are outspoken liberals on immigration, including Representatives Luis V. Gutierrez of Illinois and Zoe Lofgren of California.

Burton Leed

Stimulus and Inflation

Economists since Adam Smith, classical and neo-classical, have understood that credit stimulus,or money aggregate expansion is inflationary when there is no offset in the services, goods of GDP.

Famously, Adam Smith analyzed the Sieglo de Oro (1700 Spain) to show how importation of gold, yes gold caused inflation, The reason was that Spain was importing vast amounts of gold from the New World without expanding the productive base of the economy, goods and services. The result was inflation. The reason so many have pleaded for manufacturing expansion has core of stimulus is the fear of inflation.

If QE3 is just a an expansion of money without production, it will create inflation.

Burton Leed

Oooops! Maybe QE is the wrong term

"I've seen the rumors flying on QE3, but housing data and such is not a QE3 annoucment. ... Seems so far the FED can buy up all of the MBS they want and few blink an eye. QE involves Treasuries though." -- Robert Oak

Oooops! Maybe 'QE' isn't the right term, and maybe it's all outside the province of the FOMC. Whatever it is, it's often referred to as 'QE'. Here's an example, from article by Charlie Zhou as published at seekingalpha.com (23 October 2011), 3 REITs Which Should Benefit From The Next QE ... Note use of phrase 'The Next QE' in Zhou's headline!

In pursuing this line of thought, I've been working off news reports back in October about published views of Daniel Tarullo (Obama-appointed public member of the Board of Governors).

It's difficult to make sense of this whole RMBS argument for QE3, whether it's coming from Charlie Zhou, Tyler Durden, ConvergEx or Governor Tarullo himself. ConvergEx makes an explicit comparison with the 1930s, pointing out that the tools that were put into place by the New Deal back then do not now exist. Charlie Zhou notes that the problem isn't the interest rate, it's that almost no buyers are eligible for it.

As for the connection to the Euro and to gold, my point is that anything like QE by the Fed seems to be immediately reflected in increasing effective rates on long-term Treasuries and rising gold prices. So how does this stuff add up? How would or could any Fed action result in making more funds available to home buyers, absent a major act of Congress?

I can't give an exact account of my reasoning, and maybe it's more my prejudice, but I'm sticking with my story until I am proven wrong --

IMHO, there's no QE in the cards during the next 12 months. Of course, I could be wrong about that. My prediction back at the beginning of the last week of November when it looked like a long march had not yet begun -- before the € was rescued by the $ -- was that gold could still end the year securely in the $1900s range ... and it now looks more like goldbugs will be lucky if gold ends the year above $1800. So much for predictions! (Oh well, gold did regain $1750, probably.)

QE is FOMC

They are the ones who vote on it. But it's basically buying up treasuries, at least QE1, QE2.

They did swaps recently, operation twist.

Many blame the rise in commodities on the Fed. It raises inflation but deflation is also a problem and also a method to "lower" interest rates than "zero".

I think the Wikipedia article is a good explanation.

Quan., qual., credit easing, 'printing' and 'twist'

"I think the Wikipedia article is a good explanation." -- Robert Oak

EP is an educational experience, at least for me. (Never too old to learn!)

Thanks to Robert Oak for the link to Wiki's Quantitative_easing, particularly at the heading '5.1 Qualitative easing' (and entire section '5. Comparison with other instruments').

I think that most commentators confuse the five instruments -- quantitative easing, qualitative easing, credit easing, monetizing government debt ("printing") and altering debt maturity structure ("the twist"). It appears that there is no universally accepted taxonomy, and many lump them together and call it all "QE."

To most gold bugs, all of it is "printing" or monetization. For example, most gold bugs see euro bonds as a form of "printing." However, the euro bond proposal could be to shift shorter-term national debt over to long-term euro bonds. In other words, although complex in details, euro bonds could be largely a kind of twist, rather than a form of monetization. (I don't think that it necessarily comes down simplistically to shifting debt from the PIGS to Germany and ultimately monetizing that debt.)

When Fed purchases MBS (as with QE2), that could be seen as 'qualitative easing' or as 'credit easing'. It appears that QE2 purchase of MBS was seen by Bernanke as 'credit easing', although QE2 was seen internationally as 'competitive devaluation'. (See, Global Post article by David Case, November 2010.)

Here's from Wiki --

I like approach of Willen Buiter (formerly at London School of Economics, now economist for CitiGroup in London). See, Willem Buiter (2008-12-09), "Quantitative easing and qualitative easing: a terminological and taxonomic proposal". (Archived at Financial Times, blog.ft.com, although Buiter's FT blog has been discontinued.)

Given experience since 2010, it doesn't appear that Fed monetary actions are capable of accomplishing credit easing in the current structural context -- so to 'target' credit easing is almost fraudulent. Of course, in defense of Bernanke, if I had a dollar for every time he has indicated or been quoted as saying that solutions lie with Congress, I'd be rich.

BTW: On fundamentals, I agree that nationalizing failed banks would make sense in Europe. For the USA, I stick with systemic solution proposed by American Monetary Institute, which avoids nationalization of banks as a policy while proposing an end to fractional reserve banking.