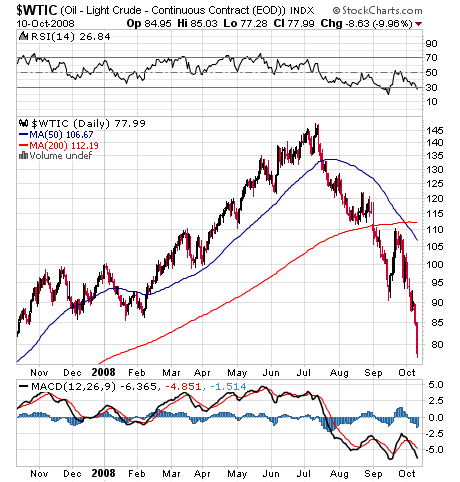

Lost in this past week's dismal news for 401k retirement reports (can we call them 201k's now?) is a silver lining for the consumer: this recession, like every 20th century recession before it, has created enough demand destruction to break the back of inflation. Been to your local gasoline station this past week? Odd are, you are seeing prices you haven't seen in a long time. In fact, the price of Oil per barrel is now lower than it was a year ago. Here's the graph demonstrating that truth:

In my neck of the woods, we are paying $2.80+ a gallon for gasoline. And since oil price declines take a few weeks to be reflected in prices at the pump, I full expect to be paying close to $2.25 a gallon as soon as election day.

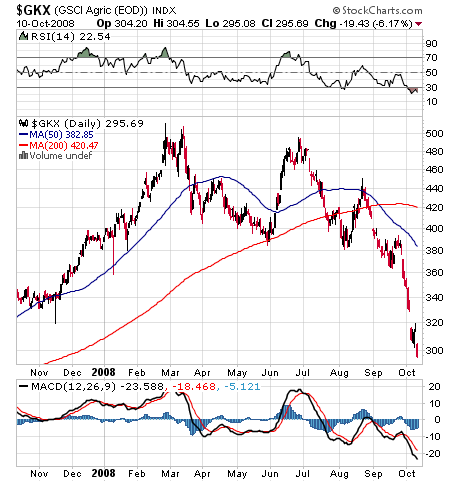

Not only have gasoline prices declined to less than they were a year ago, so have the agricultural commodity prices (wheat, rice, corn, other grains)

Earlier this year, gasoline and food price increase were killing consumers. Now you can expect continuing price declines for the near term in both of those consumer staples.

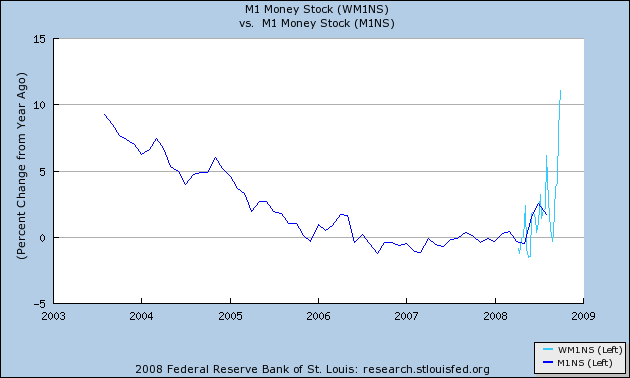

Not only is inflationary pressure nearly collapsing at the commodity level, but the Fed has primed the pump mightily via its actions to try to keep the banking system afloat. Below is a chart of basic money supply, M1. The dark blue line is the year over year percentage change in M1 monthly through August 1; the light blue line is the weekly value through the end of September:

This is an important economic indicator because, at or near the end of recessions, money supply increases and outpaces consumer prices. The weekly numbers above show an average year over year increase in M1 of ~5.5% . August's year over year consumer inflation was 5.4%. If as I expect, declining oil and food prices lead to a significant decline in September's number on a par with August's -.4%, then year over year consumer price inflation will stand at ~4.7% -- less than the growth in money supply,

With more cash staying in their wallets, and rapidly decreasing inflation, this may be the long-awaited consumer "respite" I have predicted for the end of this year.

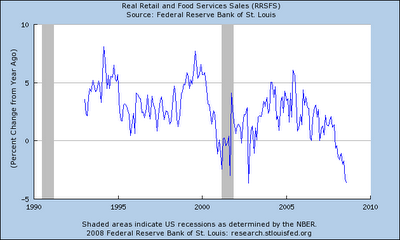

And a good thing, too, because the fallout from the explosion of the neutron bomb over Wall Street looks like it is hitting Main Street suddenly and wrenchingly. In the last 45 days, we have seen year over year retail sales numbers suddenly decline:

As I have previously noted, Shoppertrak reported that by the end of September, traffic in the retail shops in tracks was down over 10% from the previous year, a precipitous decline.

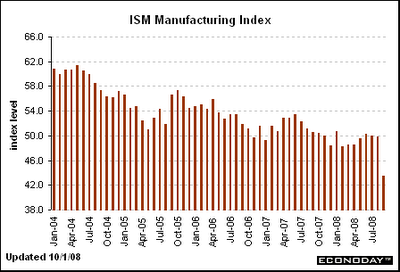

Manufacturing, which had also been holding steady all year, in August suddenly declined:

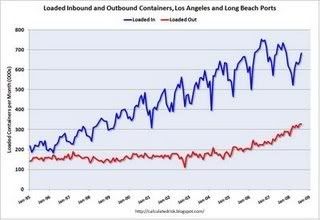

Container shipping traffic also declined significantly in August, presaging a poor holiday season (and this doesn't even include what are likely to be just terrible numbers from September):

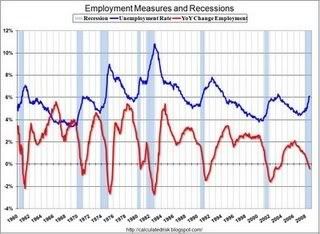

Finally, layoffs and unemployment are also spreading out into the general consumer economy:

(courtesy Calculated Risk)

Right now, the respite of declining prices in Oil and food are in a desperate race against the spreading economic decline. If the "real" economy collapses faster than consumers regain confidence to spend, the decrease in inflation could turn into an outright vicious deflation. At the moment, each of those outcomes appears almost equally likely.

Comments

wouldn't that be inflation?

You lost me. My understanding of sudden increases in the money supply cause inflation by in essence devaluing the dollar since an increase in supply with steady demand.

They do.

Just not yet.

The pattern in Latin American collapses from the 1980s was, (1) real estate collapses, (2) deflation, (3) increased inflation due to printing to get out of (2).

ah, ok, you're describing short term

The reprieve before the Holocaust.

What I find astounding generally on oil/commodities is the fluctuation. No way that equates with physical supply/demand

with those levels of swings.

We never did figure out where that physical supply was hiding (pirates off of Somalia?) on the last go around and all I know is while I saw this coming, I screwed up on my window trying to put my 2 cents (literally) on DUG in time to catch the ride. ;)

Check out Jim Rogers video clip (and I really don't know who this is, I just found his commentary brazen and interesting) in the FMN.

I'm finding this entire situation, the big picture becoming more and more despairing....it's like they are insisting on propping up an entire system that frankly should collapse and they plain start over. It seems all that is really going on, in spite of this new equity stakes for fictional cash plan....is they are going to dump all of this toxic bad debt onto citizens instead of these private financial institutions when the reality is ...people are plain tapped out. They can't get more debt because they are already overloaded on debt and all the focus is about seemingly is keeping the debt machine going instead of real goods, real production, real economic growth.

If I was a manufacturing lobbyist, domestic...I think I would gather up my gang and go lobby Congress and try for a power grab away from the financial institutions to get some money for a production economy.

These are my random thoughts at the moment but what I see going on is simply a delay.