Other than the employment report and the GDP report itself, the monthly report on Personal Income and Outlays from the Bureau of Economic Analysis is probably the most important economic release we see monthly. It gives us the monthly data on our personal consumption expenditures (PCE), which accounts for more than 2/3rds of GDP, and the PCE price index, the inflation gauge the Fed targets. The price index is used to adjust that personal spending data for inflation to give us the relative change in the output of goods and services that our spending indicated. This report also gives us monthly personal income data, disposable personal income, which is income after taxes, and our monthly savings rate. However, because this report feeds in to GDP and other national accounts data, the change reported for each of those are not the current monthly change; rather, they're seasonally adjusted amounts at an annual rate, ie, they tell us how much income and spending would increase for a year if November's adjusted income and spending were extrapolated over an entire year. However, the percentage changes are computed monthly, from one month's annualized figure to the next, and in this case of this month's report they give us the percentage change in each annualized metric from October to November..

Thus, when the opening line of the press release for this report tell us "Personal income increased $44.4 billion, or 0.3 percent, and disposable personal income (DPI) increased $34.5 billion, or 0.3 percent, in November", they mean that the annualized figure for seasonally adjusted personal income in November, $15,617.6 billion, was $44.4 billion, or a bit less than 0.3% greater than the annualized personal income figure of $15,573.2 billion extrapolated for October; the actual, unadjusted change in personal income from October to November is not given. Similarly, annualized disposable personal income, which is income after taxes, rose by less than 0.3%, from an annual rate of an annual rate of $13,596.4 billion in October to an annual rate of $13,630.9 billion in November. Likewise, all the contributors to the increase in personal income, listed under "Compensation" in the press release, are also annualized amounts, all of which can be more clearly seen in the Full Release & Tables (PDF) for this release. So when the press release says, "Wages and salaries increased $37.1 billion in November, compared with an increase of $47.2 billion in October", that really means wages and salaries would rise by $37.1 billion over an entire year if November's seasonally adjusted increase in wages and salaries were extrapolated over that year, just as rental income of individuals rose at a $5.7 billion annual rate and interest and dividend income, sometimes the largest contributor to the monthly personal income increase, fell at a $9.7 billion annual rate in November. So you can see what's written in the press release is misleading, and often leads to media reports that parrot those lines the same way the BEA wrote them, and why we favor referencing the pdf in reviewing this report.

For the personal consumption expenditures (PCE) that we're most interested in today, BEA reports that they increased at a $40.1 billion rate, or a bit more than 0.3 percent, as the annual rate of PCE rose from $12,390.5 billion in October to $12,430.7 in November; that happened as the October PCE figure was revised down from the originally reported $12,393.5 billion annually, and prior months were slightly revised as well. Components of the current dollar increase in November spending were a $24.2 billion annualized increase to an annualized $4,029.7 billion in spending for goods and a $16.0 billion increase to $8,400.9 billion annualized in spending for services. Total personal outlays for November, which includes interest payments, and personal transfer payments in addition to PCE, rose by an annualized $44.0 billion to $12,883.4 billion annually, which left total personal savings, which is disposable personal income less total outlays, at a $747.6 billion annual rate in November, down a bit from the revised $757.0 billion in annualized personal savings in October. As a result, the personal saving rate, which is personal savings as a percentage of disposable personal income, fell to 5.5% in November from October's savings rate of 5.6%.

As you know, before personal consumption expenditures are used in the GDP computation, they must first be adjusted for inflation to give us the real change in consumption, and hence the real change in goods and services that were produced for that consumption. That adjustment is accomplished with the price index for personal consumption expenditures, which is a chained price index based on 2009 prices = 100, also included in this report. Looking at Table 9 in the pdf, we see that that index rose from 109.751 in October to 109.769 in November, a month over month inflation rate that's statistically 0.028%, which BEA reports as an increase of “less than 0.1 percent”, following the PCE price index increase of ~0.1% in October. Since the inflation adjustment to PCE is so small, that left real PCE still statistically up 0.3% in November, after October's increase was revised to statistically unchanged from the previously reported 0.1% increase. Note that when those price indexes are applied to a given month's annualized PCE in current dollars, it yields that month's annualized real PCE in our familiar chained 2009 dollars, which are the means that the BEA uses to compare one month's or one quarter's real goods and services produced to another. That result is shown in table 7 of the PDF, where we see that November's chained dollar consumption total works out to 11,323.4 billion annually, ~0.3% more than October's 11,290.0 billion.

However, in estimating the impact of the change in PCE on the change in GDP, the month over month change doesn't buy us much, since GDP is reported quarterly. Therefore we have to compare real PCE from October and November to the the real PCE of the 3 months of the third quarter. While this report shows PCE for those amounts monthly, the BEA also provides the annualized chained dollar PCE for those three months in the GDP report which we reviewed earlier. In table 3 of the pdf for the GDP report, we see that the annualized real PCE for the 3rd quarter was represented by 11,262.4 million in chained 2009 dollars. By averaging the annualized chained 2009 dollar figures for October and November, 11,290.0 billion and 11,323.4 billion, we get an equivalent annualized PCE for the two months of the 4th quarter that we have data for so far. When we compare that average to the 2nd quarter real PCE, we find that 4th quarter real PCE has grown at a 1.6% annual rate for the two months we do have (note the math to get that annual rate: (((11,290.0 + 11,323.4) /2 ) / 11,262.4) ^ 4 = 1.0158268. This means that even if December real PCE does not improve from the average of October and November, growth in PCE would still add 1.08 percentage points to the growth rate of the 4th quarter...

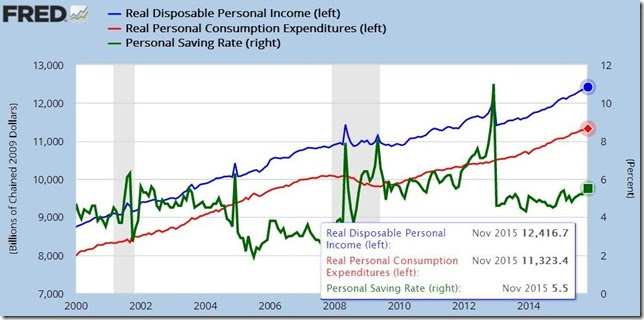

Real disposable personal income, or the purchasing power of disposable income, is arrived at in the same manner as we found real PCE; disposable personal income figures are adjusted for inflation using the PCE price index. Even though that index was only up 0.028% in November, disposable personal income was only shown as up 0.3% for the month by virtue of upward rounding from a 0.2567% increase. Hence, when that 0.028% increase in the PCE index was applied to that, it reduced real disposable personal income to the rounded increase of 0.2% reported by the BEA, following the 0.3% increase in October. Our FRED graph below shows annualized real disposable personal income in blue and real personal consumption expenditures in red monthly since January 2000, with the annualized scale in chained 2009 dollars for both shown in the current data box and on the lower left; also shown on this same graph in green is the monthly personal savings rate over the same period, with the scale of savings as a percentage of disposable income on the right. The spike in income and savings at the end of 2012 was mostly the result of income manipulation before the year end "fiscal cliff" of that year, while the earlier spikes were as a result of the tax rebates enacted as a fiscal stimulus under George Bush.

The median annual household

Over the past 8 years, the median annual household rose $32 a year.

The median annual household income in November 2015 was $56,746 -- which is 1.1 percent lower than January 2000.

The median annual household income in December 2007 was $56,714 -- when the Great Recession began.

http://www.sentierresearch.com/reports/Sentier_Household_Income_Trends_R...

the fed uses interest rates to prevent wage growth

My sloppy chart. Pairs recessions with a graph of the fed funds rate. Americans are just too dumb to realize that when the Fed talks about "inflation", they really mean "wage inflation". They have been deliberately keeping wages down for generations. Add in outsourcing, insourcing, cheap illegal labor. It doesn't take a rocket scientist.

http://www.charthub.com/charts/2016/01/01/fed_rates_vs_recessions

Jared Bernstein makes note...

The former chief economist to Vice President Biden at the Washington Post says very low inflation [because of very cheap oil], meant that stagnant nominal wage growth translated into real wage growth ...

If so, then barely. And what if oil had not fallen so much? As always, the cost of housing and food went up.

He also notes: "This year marks the 13th out of 16 years since 2000 that forecasters have been too optimistic re growth expectations. Cumulatively, the downside misses on the level of real GDP sum to almost 15 percent since 2000. That tells you a few things. One, the models are missing something important that’s holding back growth; and two, researchers are insufficiently self-correcting. The economy is Lucy and the forecasters are Charlie Brown, or, more formally, what researchers are considering temporary factors are, in fact, more persistent."

https://www.washingtonpost.com/posteverything/wp/2015/12/28/unfinished-e...

calvinball

Inflation metrics have their own controversy. Anyone who runs a household plus knows statistics knows there is no way inflation is just 2% per year in reality. Rents, case in point are very geographically dependent and those on the West coast are getting 50% increases since 2008.

rent inflation

rent has been the primary driver of CPI inflation, and why PCE inflation, where housing has a smaller influence, is less than CPI...CPI less shelter is down 0.8% year-over-year...

rjs

Inflation

The Boskin Commission removed inflation from the CPI calculations. This was done to cheat working Americans and retired Americans from what was due them by the Government and/or their employers. It's actually quite simple if you work or have worked you lose.