Towards the end of last year, I wrote a number of posts about 2 possible scenarios for 2009: recession vs. recovery (although I noted that there could be a recession first, then a recovery). I used at least 4 different indicators to discuss what might happen.

Now that we are through with the first quarter of 2009, let's see what those indicators are showing.

First of all, in the typical, inflationary post WW2 era, a recession would begin with a spike of inflation, and then higher interest rates would engender demand destruction, bringing inflation down, following which a recovery would ensue. Two criteria perfectly forecast those recessions and recoveries: (1) M1 money supply greater than the inflation rate, and (2) a positively sloped yield curve 12 months previously, where long-term interest rates were longer than short term interest rates.

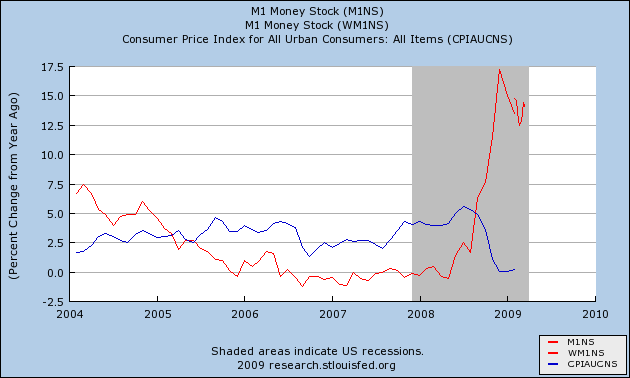

Since about last September, both conditions have obtained. Here is CPI vs. M1, showing that M1 has been well in excess of CPI for nearly 6 months:

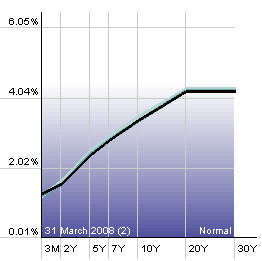

Since that time, the comparison to the bond yield curve a year prior has only gotten more positive as well:

Of course, the economy got worse rather than improving at the end of last year. Among other reasons, that led me to look at economic indicators during the deflationary periods of the Roaring Twenties and Great Depression, with the result that in such times recessions tended to end when YoY CPI bottomed out, at or near a time when M1 exceeded CPI. During such deflationary times, the yield curve was of limited significance -- a positive yield curve was a necessary but not sufficient indicator of growth. The above graph shows M1 exceeding CPI, but is CPI bottoming?

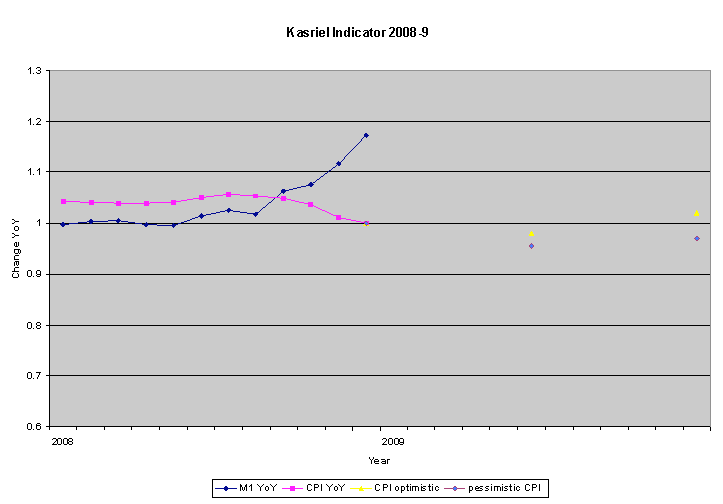

At the end of my series on the Roaring Twenties and Great Depression, I laid out optimistic and pessimistic scenarios for 2009. The optimistic scenario featured inflation readings that were at least close to the readings of 2008:

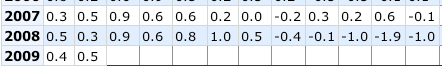

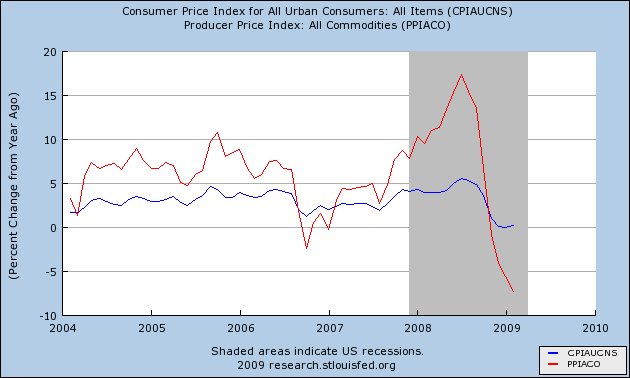

So far, that has not only happened, but Oil prices have rebounded so robustly that 2009 inflation is equalling early 2008 inflation. For that, let's look at the monthly CPI for the last several years:

It still seems likely that 2009 inflation will be more tame than 2008, but if the early pattern holds, YoY CPI will indeed hit a bottom shortly.

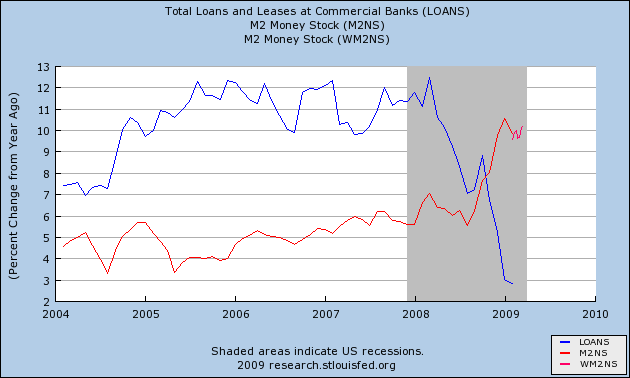

Another indicator I looked at was bank loans vs. M2, which reliably crossed paths at or near the end of a recession since the 1950s. The graph below shows that has occurred and remains the case since late last year:

Yet another indicator is to compare CPI with commodity price PPI. In general, for both inflationary and deflationary times, PPI for commodities bottoms at or before the end of a recession. While commodity PPI has not turned up:

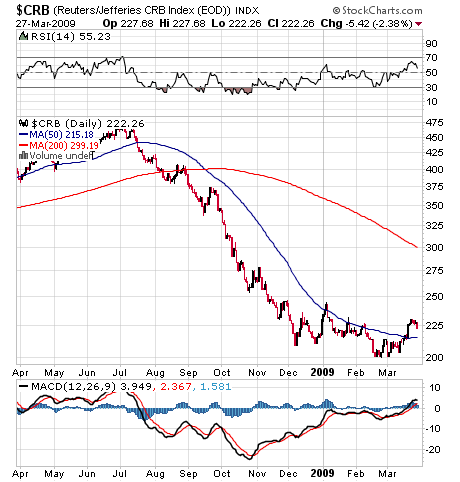

there is plenty of evidence from the commodity index that it will do so shortly, perhaps as soon as the next report:

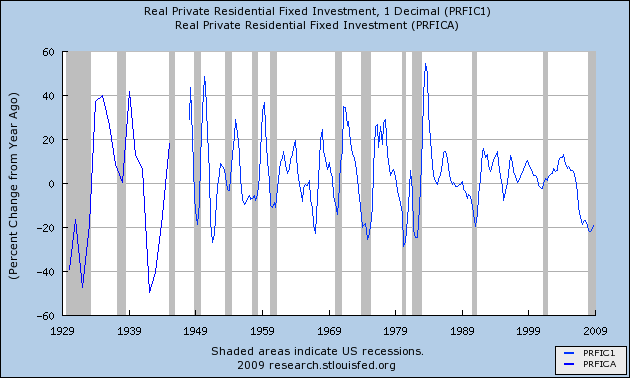

Finally, in all prior recessions, real residential investment has declined at a much lower rate before or by the end of a recession than at its recession bottom. While that number meandered through most of 2008:

we will have to wait until the end of April to find out how it fared during the first quarter of this year. The earliest indication, the Census Bureau's monthly report of residential construction is not encouraging, continuing to decline at an annual rate as of February.

But if all of the above indicators hold up, and if the rate of change of real residential investment does improve substantially, we may very well be close to the end of this recession (i.e., GDP decline will hit bottom), and about to start a (probably very anemic and fragile) recovery.

Comments

Consumer confidence, unemployment and

consumer credit outstanding will also determine recovery. Particularly interesting is consumer credit outstanding because if consumers are feeling tapped out they may be less likely to spend more. The level is has been around $2.56 to $2.57 trillion for the past year (G-19 Release)

RebelCapitalist.com - Financial Information for the Rest of Us.

That's why Oil is important

I think recent data indicates where the wallet hits the checkout line, that consumer confidence is improving - not by much, but improving.

Unemployment is a lagging indicator, it won't determine economic recovery or not, but it certainly is what is important to many if not most consumers.

Oil has a direct impact on Joe/Jane Sixpack's ability to spend. When prices fell from ~$4 to ~$1.50 late last year, lower income consumers in particular got a substantial subsidy. If Oil prices climb back towards ~$3, consumers will start feeling tapped out again.

tiny bubbles

It seems they are hell bent on trying to restore the fictional money and bubble cycle. I suspect that next bubble is somehow tied in with government spending too.

I honestly do not think the economy, in reality, recovered from 2001-2002, instead was masked by the housing bubble.

I also strongly suspect the real problem is offshore outsourcing, bringing in foreign guest workers, illegal labor and bad trade deals...

In other words, the smashing, flattening of the U.S. middle class is so severe, without bubbles it would show up in the national EIs and the above policy areas are what is doing that (and less so things like health care, tax reveneues/corporate avoidance).

i.e. another jobless "recovery".

So, here's the big picture question, while all of these economic indicators point to your analysis....

has anyone looked at the real "main street" recovery and looked at the de-correlation to the EI's over time?

In other words, because even GDP has phantom components now that are not real, they count offshore outsourcing into domestic GDP when it should not be....

so we have divergence in traditional economic indicators from what is really happening with main street?

My hypothesis is 1. yes and 2. the divergence is increasing.

this is taking into account that unemployment is a major lagging indicator.

Agree

Just when you thought they would run out of bubbles, they go for the direct one -- a bubble in creating currency out of thin air.

I suspect any recovery will also be "jobless" as you say.

oops, the money money bubble

oh yes that is right, slipped my brain and the crash and burn of this one is quite the tsunami.