The New York Fed has just published a study on the predictive power of the yield curve in 3 months vs. 10 year Treasury bonds. (warning: pdf. For an html friendly summary with graphs, see Prof. Mark J. Perrys' claims that the NY Fed research means the recovery has already begun!).

The study updates previous research dating from the 1980's onward to the effect that a negative spread between the 3 month and 10 year Treasury yields (negative means 3 month Treasuries pay more interest than 10 year Treasuries) is means economic contraction - a recession - 1 year later. Conversely, a positive spread means economic expansion 1 year later.

Based on that, the New York Fed says that the recession is over! I disagree.

It is true that in both inflationary and deflationary times a negative interest rate spread means contraction one year later. During inflationary times, a positive yield curve means economic expansion one year later. What isn't true is that in deflationary times a positive yield curve has any predictive power at all.

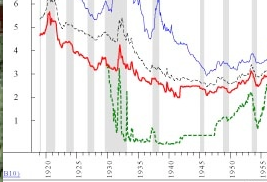

The problem with the New York Fed study is that it covers data beginning only with 1960. These include only inflationary post WW2 recessions. As this graph shows, there was a positive yield curve during the Great Depression of 1929-32, and prior to the deflationary Recessions of 1938 and 1949 (3 month rates are in green, 10 year rates in red).

I examined this in detail in my series on Economic Indicators during the Roaring Twenties and Great Depression.

First quarter 2009 GDP is going to be reported in about 3 weeks. I will state with confidence that it will be negative and the New York Fed will be proven wrong.

Comments

This method may predict recessions but predicting

recovery their last sentence says it all:

Thanks again.

RebelCapitalist.com - Financial Information for the Rest of Us.

If you want to control the

If you want to control the people, you manipulate what they read and hear.

The people hear the simple message that the economy is getting healthy and they are expected to open their wallets. The people are expected to again inflate the balloon. The problem is the balloon will not inflate this time and the Feds are worried about it.

So what we will be shown are statistics from the chart people showing the economy is on its way back. Their reasoning will be, "see the head and shoulders on the chart, it shows the economy is getting healthy." The fundamental people will say but there are still large unemployment figures, manufacturing is gone for good and people can't even get that Walmart job. The greeters job that was always the salesman's joke, if all of it fails I can at least be a greeter at Walmart.

So who has the control of the media? Who is the one that, for publication, puts out such figures as:

1. Core CPI and not main CPI number

2. U3 unemployment figures and not U6 figures

3. Bank asset testing is postponed to keep the markets from "over" reacting.

We live in a time that taxes are now redefined. No new taxes means they become fees or they become sin taxes. We are manipulated to look at that shiny object over there while they manipulate your financial affairs.

It benefits government and those well connected to get the

people to think the bubble is again inflated. To those in charge, it doesn't matter to them that we have hardly any have viable capital producing companies remaining in the USA. They only want the people to perceive that we have a healthy economy.

When will people wake up and realize that they are constantly manipulated by what is given to the media.

I'll place bets on New Deal Democrat

I read that original piece where you analyzed the yield curves. This is really getting frightening. Let's see, I believe Ben Bernanke missed the entire subprime implosion, the derivatives shadow economy and is claiming printing money, increasing the money supply at unprecedented levels isn't a problem....and now this.

What it reminds me of is derivatives themselves. CDOs, many of them are built from CDS data, which in turn is only a decade old.

I'm reading the Black Swan at the moment and while it's a huge "rant", he goes into this fictional bad math and one has to wonder if the Federal Reserve has a case of it also.

Thanks for the dose of reality

I actually found a link from Prof. Perry's blog to your diary. That guy is unbelievably optimistic and someone (in a diary on DailyKos) just quoted from one of his diaries from back in February to try to use it to show that we're all in "Happy, Happy, Joy Land". Sheesh! I also heard a VERY rosy scenario about the economy this morning on CNN radio and caught part of Ed Schulz's radio show this AM in which he was utterly ecstatic that "Wells Fargo made a THREE BILLION DOLLAR PROFIT in the first quarter." ACK! These people sound like I probably did about six years ago (or more). Such naivete! Again, thanks for the dose of reality---It's a shame there's so much obfuscation going on from Geithner as well as the Fed.

bank profits

Yeah, they fail to note precisely where those profits come from....how hard is it to make a profit if one received $25 billion dollars from the Treasury?

Also, they just relaxed mark-to-market which assuredly assisted.

Agree with both your points

First thing I said to Mr. 3G when the "great news" about WF came out was: "Uh, yup! They got billions from the Treasury and now they report a profit. Smart boyz in that bunch!"

And about the FASB rule----I can't believe they backed off and let these charlatans go with "Mark to Fantasy" again! Wasn't that supposed to have been changed once before and they backed off on it (last year I thought I read that). I read/heard somewhere that it was Congressional pressure that forced the FASB to back down. IF that's true, our good little bought and paid for Congresscritters are once again doing the bidding of their "owners" (lobbyists).

Hi 3G!

I'm glad to see you over here at EP.

If you haven't read my "Economic Indicators during the Roaring Twenties and Great Depression" series (very long and wonkish, and never crossposted at DK), I humbly bighly recommend it -- I think it gives a more realistic idea of what indicators to watch.

I actually do think there are some "green shoots", but I suspect this recession will end with a "SPLAT!" at the bottom of the cliff, rather than a bungee jump.

Hey backatcha, NDd!

I had to get out of DailyKos for at least a bit. There's some nimrod wandering through a diary (snarky one) about today's news re: the stress tests and it is clearly someone who either has ties to Wall Street or lives in fantasyland. Someone in that diary posted a link to Perry's blog so I followed it and then saw a link there to your diary---so I clicked on over here. I knew I'd get reality-based commentary. I will definitely check out your work mentioned in your comment----I still have a lot to learn and the idea of knowing which indicators to watch sounds like something that I'd definitely benefit from. Thanks, as always, for educating your readers and sharing your knowledge.

Hrmm

Good stuff, New Deal, I always love reading your posts. I have a question though, is there a correllary between increased government spending (like we saw with the New Deal on forward) and the time before when the government really didn't spend much unless it was a war (like the Civil War)? I am not sure you can get data from the 1860s, but we did have something of a "minimalist government" afterwards. See, I'm wondering if the "religion" being adhered to by the folks at the Fed is tainted because increased government spending (and thus increased demand for debt).

Addendum

I'm really curious to see data basically before the establishment of the Federal Reserve system and after wards.

oh JV, you're so "Ron Paul"

;) I have a tendency to blow off all of those who claim the Federal Reserve is a problem, a grand conspiracy and so forth....although William Greider's Secrets of the Temple is a must read.

But considering these latest actions, I'm taking another look at the Ron Pauludites of the world and am starting to believe they have a point.