The saying goes "a picture tells a thousand words". If that's true then these charts I'm about to show you tell a huge, scary novel.

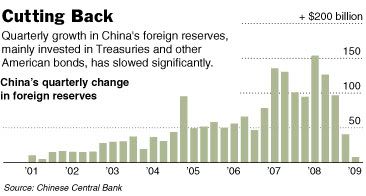

Let's start with this one.

Reversing its role as the world’s fastest-growing buyer of United States Treasuries and other foreign bonds, the Chinese government actually sold bonds heavily in January and February before resuming purchases in March, according to data released during the weekend by China’s central bank.

Mr. Wen voiced concern on March 13 about China’s dependence on the United States: “We have lent a huge amount of money to the U.S. Of course we are concerned about the safety of our assets. To be honest, I am definitely a little worried.”

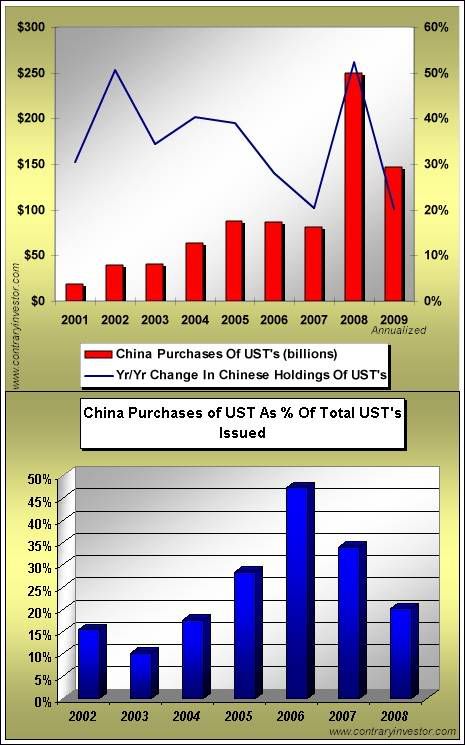

Increasingly China is becoming a less and less dominant creditor to America.

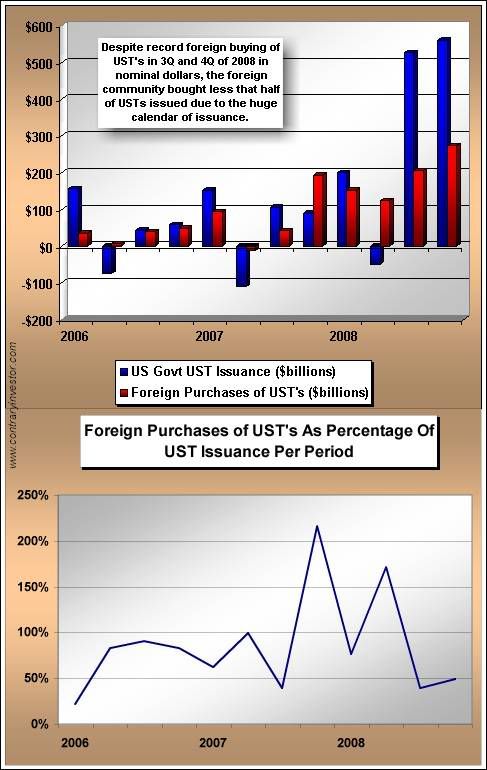

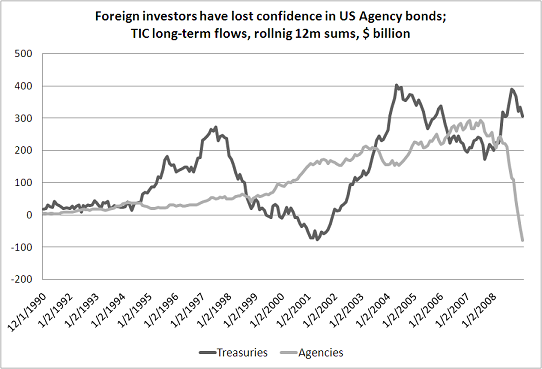

Other foreign creditors have taken China's place in buying our debt. In fact, foreign purchases of treasury debt has never been greater.

While that should be good news, it isn't for several reasons.

The first reason why this isn't good news is because of the sheer, overwhelming volume of treasury debt being issued. Despite a massive increase in foreign purchasing of treasury debt, the massive supply of new debt coming on line is swamping it.

On March 20, 2009, the bipartisan Congressional Budget Office (CBO) released its latest forecast in an effort to take into account the impact of the recently released Obama budget. The verdict? A whopping $1.8 trillion deficit for 2009, approximately four times larger than the all-time record established in 2008 ($455 billion).

...

The U.S. government needs to roll over $2,596 billion of outstanding Treasury bills and notes coming due in 2009 before it can add any new borrowing to finance the expected deficit. In previous years, foreign investors have invested most of their trade surpluses – to the tune of $200 billion to $500 billion per year – in Treasuries and agency debt. We cannot expect this trend to continue as we go forward, especially given that China, Japan, and the Middle East are experiencing a sharp decline in their exports and have indicated that they will have to support their own economies with massive stimulus packages.

This has forced the Federal Reserve to monetize that treasury debt (i.e. print money), $43.9 billion in just a couple weeks. Not to mention the monetization of tens of billions of dollar's worth of GSE debt.

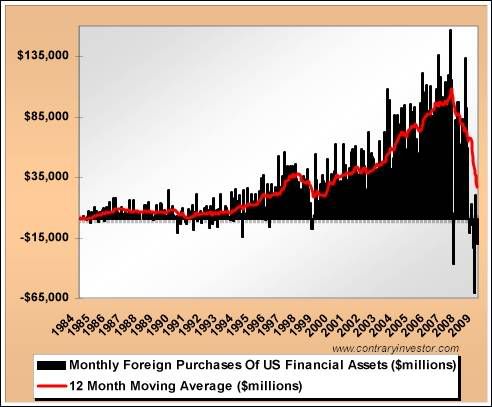

The second reason is that we are only talking about treasury debt. The entire rest of the world, especially the private sector, has stopped purchasing all other types of our debt.

Net foreign purchases of long-term securities were negative $43.0 billion.

...

Foreign holdings of Treasury bills decreased $15.4 billion.Monthly net TIC flows were negative $148.9 billion. Of this, net foreign private flows were negative $158.1 billion, and net foreign official flows were $9.2 billion.

There's no secret why that has happened - we've been selling them bad debt.

If the private investor won't buy our debt then we must rely on foreign countries recycling their dollars from their trade surpluses. Which brings us to reason number three.

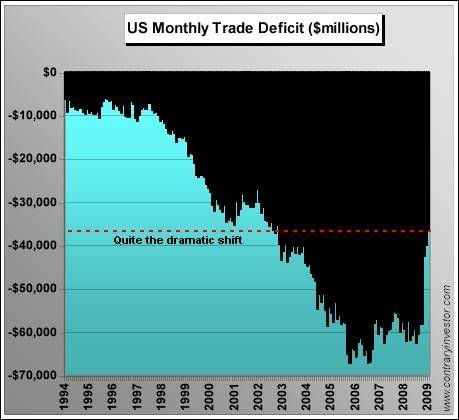

How Bretton Woods II has worked since 1971 is that America runs chronic trade deficits, and then foreigners use their trade surpluses to buy our debt. This enables foreign exporters to keep their currencies artificially low, thus undercutting American producers. It also keeps interest rates artificially low in America, thus enabling American consumers to borrow more than they can pay back.

To put it another way, Americans can buy things they don't need with money they don't have so that we can continue to be the mouth of the world. It's a totally dysfunctional, unsustainable, and unhealthy system, but it's been the global monetary and trade system for as long as most of us have been alive.

But now the long-term problems in this system have become short-term problems. The unsustainable has reached the end of its days.

It wasn't foreign creditors, tired of buying our bad debt, that finally gave up. It was the American consumer, unable to find good jobs at home, or take on more debt from yet another asset bubble, that finally gave up.

Our imports are falling off a cliff, thus the number of dollars available to be recycled into our debt is drying up.

Which brings us to problem number four.

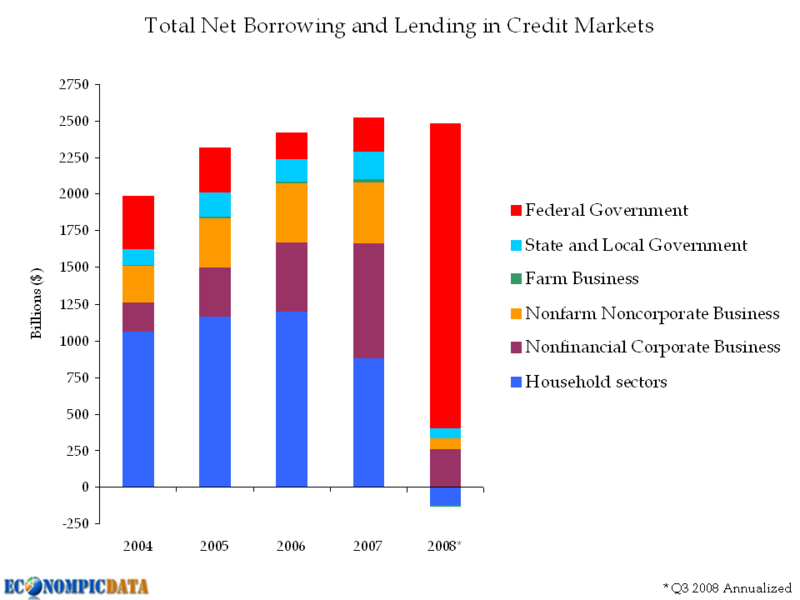

Notice how the government has stepped into the gap when the real economy stopped borrowing.

If it wasn't for the government borrowing the collapse in the trade deficit would not be a problem because our national borrowing needs would also be shrinking by a similar amount.

However, the federal government has been trying desperately to reinflate the credit markets. Much of that effort has been going into highly unproductive military spending.

The federal government right now is spending like there is no tomorrow.

(AP) -- The Treasury Department said Friday that the budget deficit soared to $192.3 billion in March, and is near $1 trillion just halfway through the budget year, as costs of the financial bailout and recession mount.The deficit already totals $956.8 billion for the first six months of the budget year, also a record for that period. The Obama administration projects the deficit for the entire year will hit $1.75 trillion.

A deficit at that level would nearly quadruple the previous annual record of $454.8 billion set last year.

This isn't a matter of politics - it's a matter of math. The money simply isn't there.

Foreigners, no matter how hard they try, can't lend us dollars that they don't have if they don't have the trade surpluses to begin with. What's more, why should they be lending us money when we've already proven that our financial system is full of crooks?

Without the foreign creditors, and without any real domestic savings, we have no choice to fund our federal borrowing by turning to the federal reserve's printing press.

This also has consequences.

(Reuters) - China and other emerging nations back Russia's call for a discussion on how to replace the dollar as the world's primary reserve currency, a senior Russian government source said on Thursday. Russia has proposed the creation of a new reserve currency, to be issued by international financial institutions, among other measures in the text of its proposals to the April G20 summit published last Monday.Calls for a rethink of the dollar's status as world's sole benchmark currency come amid concerns about its long-term value as the U.S. Federal Reserve moved to pump more than a trillion dollars of new cash into the ailing economy late Wednesday.

China, instead of buying up our debt, is starting to use those huge foreign currency reserves to boost their own domestic markets. You can hardly blame them.

"Foreign Central banks aren't going to finance much of the 2009 US fiscal deficit; Their reserves aren't growing anymore."

- Brad Setser, Council on Foreign Relations

Besides alienating our foreign creditors by cheapening our money through the printing press, there is also the question of whether all this federal deficit spending will do any good. Is it really a good allocation of resources to try and reinflate an unsustainable credit bubble?

"The prescription of massive debt, of money printing, of releveraging the economy, is exactly what engendered the depression of 2008, and all of the remedies are the same virus that killed us," says Michael Pento, chief economists at Delta Global Advisors in Huntington Beach, Calif. "You've exacerbated everything that went wrong in the beginning. You're increasing the money supply and you're releveraging the economy."

When it all boils down, paper money is a matter of credibility - will it be worth something when you go to purchase real goods.?

Behind that paper money lies credit, or put another way - debt. Is that debt any good? Is that debt backed by worthless, suburban houses and bankrupt consumers with credit cards? Are we paying for that debt by printing money out of thin air?

The answer to both of those questions is increasingly "yes". Our foreign creditors are way behind the curve in waking up to these facts, but they are waking up. Don't expect them to play the sucker forever.

Comments

Someone did their homework!

Great in depth post midtowng! I submitted this to reddit.com

Anybody else reading this, you can spread great posts via those "share" buttons to get it in blog post aggregators so more people read it.

I like reddit personally because they make it all very easy to find good posts and submit them.

Back to the post, this is really the ultimate tsunami coming our way in my view and without a strong U.S. manufacturing policy, to turn the U.S. into a production economy again, we're in deep shit. And that means confronting trade policy, moving investment into new ventures in advanced manufacturing and making sure they hire U.S. citizens (domestic workforce) which seems to be a topic also taboo in D.C.

Then, also services, this would be Research & Development, startups, STEM, advanced medical, needs to have massive incentives, again tied to the domestic labor force.

Excellent work. In problem

Excellent work. In problem #3 you say, "It was the American consumer, unable to find good jobs at home, or take on more debt from yet another asset bubble, that finally gave up." The next logical question is: since the jobless consumer is depleted of buying power (unable to take on any more debt), will deleveraging make it less necessary for the U.S. Treasury to seek foreign creditors? Basically we're totally insolvent relying on virtual credit (as money). Once again, methinks America is bankrupt.

If Crichton had been an economist

This is great and yes it is a scary novel indeed. It reminds me of the vibrating water glasses in Jurassic Park. (I'd like to see Hank Paulson as the "Newman" character hidding in the port-o-potty...)

Bookmarking now. See you for Tea?

politicians on that dinosaur island

I can think of at least 50 that should be on that damn island.

Fantastic post, couple things...

First and foremost, let me me say that this was one fantastic post. This is why I come here, good stuff like this. You know, what you posted doesn't surprise me in the least. This has been a long time coming, you simply cannot continue with an illogical policy long enough without consequences. Warren Buffet, several years ago, did a little infomercial or something about this very thing. It was about two islands that traded with each other, actually one sold goods the other just gave them cash. Eventually the island selling the goods ended up literally owning the buying island.

The fiscal situation with our government is completely insane. While I'm dubious about these tea protestors (I still think it's a put up job using some paid lobbyists and a whole lot of suckers), they do make one good claim...the government spends too much. Look, we need some sort of healthcare scheme, same with a K-Doctorates education system. But I fear the way we go about our fiscal duties, we'll have neither. Obligations are obligations, the sale of our treasuries really marks us as another company per say in the market for capital. If you thought a company would not meet its obligations entirely, would you invest in that company? Would you purchase bonds or stock? We, sad to say, live in a system where a country is no different than a company, just another mark in a ledger.

To be honest, I'm sorta glad this is happening. Relying on foreigners to buy our debt was financial heroine. You have to break the addiction some time. The longer you keep it up, the worse it will be when you go cold turkey. We are going to have to make some hard decisions and face a reality that will not be kind to your political persuasion.

If you're a progressive, guess what a lot of what you regard as the commons or duties government should take up will have to be limited or abandoned.

If you're a conservative, guess what your taxes most likely will increase, and your military adventures limited or abandoned.

If you're a libertarian, the days of unfettered free trade probably will end because the government will only go so far in raising taxes and go to new revenue streams like tariffs (though probably would call them something else to avoid WTO rulings).

Hope of lower taxes or universal health care may bear witness to more waiting. We need to get our financial house in order. The results of our extravagance like illegal wars in Iraq to entitlements are showing up. Please take a gander to the score of numbers below.

What you see here are the actual prices for Eurodollar futures, one of the most liquid and largest traded contract on the planet. For the new folks out there, Eurodollars or more precisely Eurodollar rates are what banks charge each other and is often one of the benchmarks used for interest rates; that is LIBOR that you've all heard about. I could go into the whole "why it's got the Euro" part, but trust me it's a benchmark rate thats really the important part, and no it has nothing to do with the Euro currency. Now what you need to know to figure out the rate is very simple. See the prices above, each one represents a contract for "delivery", take 100 and minus it with the number you see. For example, for December 09, the price is 98.75, so subtract that from 100 and traders are expecting 3-month LIBOR to be

Once more look at the roster of prices, what do you notice? The prices are dropping. Market participants are expecting a rise in interest rates as time goes on. The last contract shown, for March 2019, they're expecting right now that interest rates will go to 4.145%. This could change, the price of Eurodollars changes. But I suspect that rates will continue to rise as the government borrows more money. If Uncle Sam cannot find buyers for bonds at a given rate, then expect our dear old Uncle to raise the rate until he finds a buyer.

Also, in case your are wondering, Europe and Japan are facing the same situation regarding rates. Euroyen and Euribor contracts show rates rising as well. If anyone was alive or read up about recent history, one will know that interest rates were in the double digits two decades ago. We just may be seeing history repeated.

What about in the short term?

Those things are all true in the long term. I'm more concerned about the short term. What if the deleveraging isn't gradual? What if our foreign creditors suddenly rush towards the exits? It only takes one major foreign CB to decide that they need to get out while the getting is good.

In that case there will be a sudden and dramatic shortage of credit in America. It's a situation familiar in 3rd world nations.

My point is that I am afraid we will end up like Argentina in 2001, where the government, suddenly without any credit, decides that it will declare an emergency and seize all the retirement holdings of the entire working class.

"They can't do that. That's illegal, right?" Well, torturing people is illegal as well. Domestic spying is illegal as well.

Something being illegal isn't going to stop the government.

Which is why I'm sourcing as locally as possible

With little-to-no credit purchases. I'd much rather, say, spend $1250 on a subscription farm now, than try to convince my bank to give me a higher credit card limit this summer when out-of-state food starts going through the roof.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.