This is a joint article I wrote with Bonddad

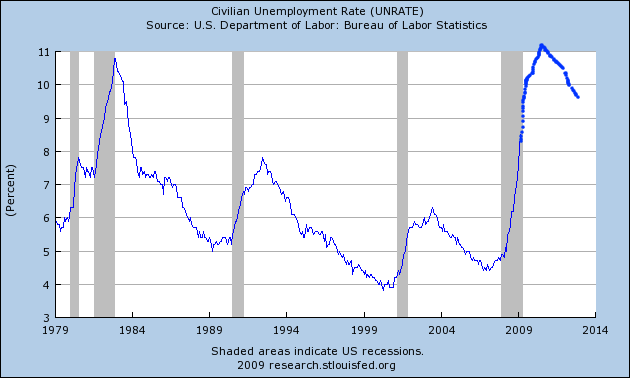

Regardless of when this recession ends, the malaise of working and middle class America will not be relieved until wages increase, and employment rates return to a robust level. Since unemployment is a lagging indicator, the news on that score is grim. Almost every analyst believes that there will be another "jobless recovery" such as those that followed the 1990 and 2001 recessions. Even after GDP bottomed and those recessions technically ended, there was an average 17 month increase in unemployment of .9% (or a 15% percent increase in the rate) followed by a 13.5 month decrease back to the rate at the "bottom" of the recession. If that pattern holds true again, then even if this recession bottoms shortly, unemployment will be 10.1% by July, rise to 11.3% by December 2010, and take until at least early 2012 to decrease back under 10%, looking like this graph:

Note this is U3 unemployment, so U6 unemployment will be correspondingly worse.

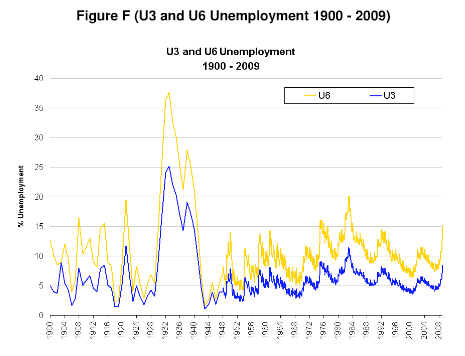

It is safe to say that there will be major social and political consequences from an unemployment rate over 10% for 2 1/2 or more years -- and that's under the optimistic scenario that in GDP terms, the recession bottoms shortly. As this graph of reconstructed U3 and U6 unemployment since 1900 shows, such a rate would surpass 1981-82 and be second only to unemployment during the Great Depression itself:

If ever there was a time to reinstitute the CCC and the WPA, the large scale public works employment programs which were the cornerstones of the "RELIEF" element of the New Deal, now is it! Even extended unemployment benefits will run out far too soon, leaving many able-bodied and -brained workers sitting unproductively and sullenly at home. Putting them to work on public sector projects would not just be important symbolically to society, and psychologically to the workers and their families, but would produce real and long-lating tangible benefits as well.

The Civilian Conservation Corps, a work relief program for young men ages 18-25 from unemployed families, was established in 1933. The CCC became one of the most popular New Deal programs among the general public and operated in every U.S. state and several territories in 2600 work camps. The young men were paid wages, but were expected to share their wages with their families. They built such things as fire trails, camp sites in parks, and also cleared swamps and planted trees.

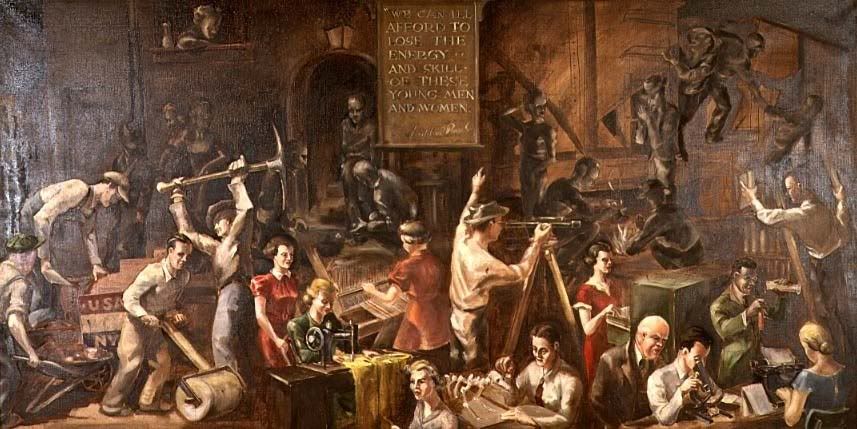

In a similar vein, the Works Progress Administration, so named in 1935, was the largest New Deal agency, employing millions of people and affecting most every locality in the United States, especially rural and western mountain populations. Between 1935 and 1943 the WPA provided almost 8 million jobs and income to the unemployed. As discussed in beautiful detail in photoessays by Land of Enchantment (Murals) and The Field (artwork), the programs built many public buildings, projects and roads and operated large arts, drama, media and literacy projects, employing actors, artists, musicians, and writer (nearly 4 million in 1936 alone). It fed children and redistributed food, clothing and housing. Almost every community in America has a park, bridge or school constructed by the agency, and most public buildings of a certain age will feature architecture or a mural created by one of its artisans:

Kossack Spud1 also provided an additional extensive discussion of some of the huge legacy of infrastructure created by these New Deal Programs.

Obama's $787 Billion stimulus program has a lot in common with FDR's:

An author, economist and historian who have all studied the Depression agree Obama's stimulus plan might do for a somewhat different crisis what FDR's public works programs did for even worse times.

Author Nick Taylor said both FDR and Obama made job creation through infrastructure improvements the "main thrusts" of national initiatives to solve economic crises each inherited from prior administrations. The author of "American-Made: The Enduring Legacy of the WPA," he said Obama's critics don't acknowledge that creation of the WPA and CCC helped lower unemployment from 25 to 14 percent between 1933 and 1937.

....

Associate Professor Harold Petersen, who teaches economics at Boston College, believes ... FDR and Obama both made sound decisions, based on the valid principle that spending drives economic growth, to create job programs that put money in peoples' hands.

....

Professor William Keylor, who teaches history at Boston University, said ...."It does indeed sound like what FDR was up to. Our infrastructure is in bad shape. If done efficiently, these projects could really improve our communities."

From Bonddad

So -- why do we need to look at the idea of creating another WPA? Because looking at the overall structure of the US economy there are no areas that appear to be ready to drive the economy into a recovery. Let me illustrate this point. Let's break down GDP into its four basic components -- personal consumption expenditures, gross domestic investment, exports and imports and government.

While I do think retail sales have bottomed I also don't think they will be the driver of an expansion. As I wrote previously:

Let me make clear: I don't think we're going to have a gangbusters, consumer led recovery. The US consumer still faces a weak job market, massive debt and a big destruction in his wealth over the last few years. This is not an environment where people will go out and spend. However, I do think that the overall trend of durable, non-durable and retail sales numbers indicates the decline is moderating and we will see a clear bottom over the next 4-6 month

Let's take the above points one at a time. As this graph demonstrate, the rate of unemployment claims is topping:

Yet the number of unemployed people remains at high levels as I noted in this article. These is no reason to see this situation ameliorating any time soon. In fact, I expect that we'll be hearing about a "jobless recovery" when things start picking up. In short, this is not an environment when people ramp up spending.

Combine that with a high level of household debt. Total household debt outstanding is almost as high as total US GDP. Simply put, people need to de-lever their financial position. Leading to that de-leveraging is the massive loss of household wealth that has occurred over the last two years. Total household wealth stood at $64.3 trillion in 2Q07 and currently stands at $51.4 trillion -- a decrease of 20%. All of these factors add up to a consumer who will not be driving the recovery.

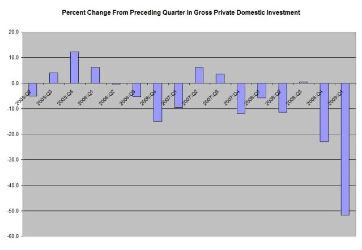

And overall investment won't help us either. Here is a chart of the percentage change in total gross investment:

It has dropped in 9 of the last 12 quarters -- and one of the quarters where we saw in incease was only an increase of .4%. In addition, last quarter saw a decrease of 51.8% from the preceding quarter. Simply put, that number is terrible.

Let's break this number down into its sub-parts -- residential investment, non-residential investment and equipment and software investment.

Residential

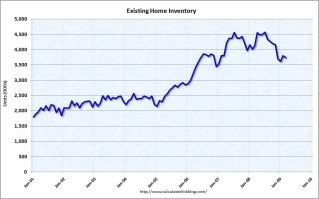

Do we really need any more houses? No. (Thanks to Calculated Risk for the graphs)

The existing home inventory is still at very high levels. And this number does not include the "shadow inventory" of houses in foreclosure that are still on bank's balance sheets.

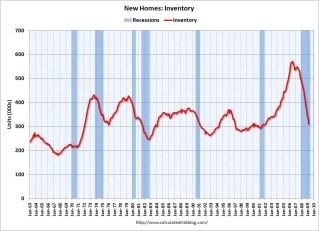

While the new home inventory is down to a more normal level

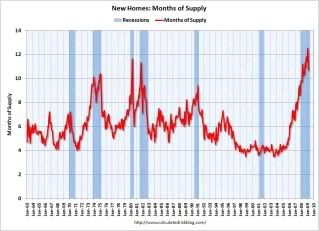

The months of available supply are current sales levels is still at sky high levels. In addition,

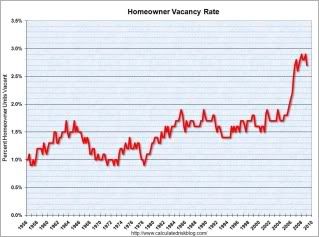

The vacancy rate is still at abnormally high levels, indicating we're not using all the houses we've built. As a result:

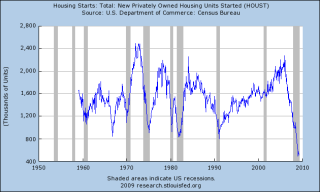

Housing starts are at multi-decade lows. In other words, we're not building our way out of this recession.

Non-residential

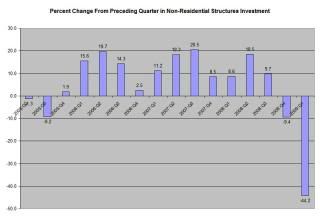

Here is a chart of the percentage change from the preceding quarter in non-residential structure investment.

Last quarter this number dropped by 44.2%. Also note this number continued to increase until the 4Q08. In other words, this area of the economy is just starting to contract. Considering the severity of last months drop and the continued tight credit conditions it's difficult to see this area of the economy picking up any time soon.

Software and equipment

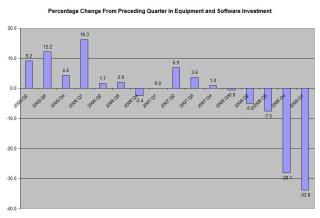

Here is a chart of the percentage change from the preceding quarter in software and equipment investment:

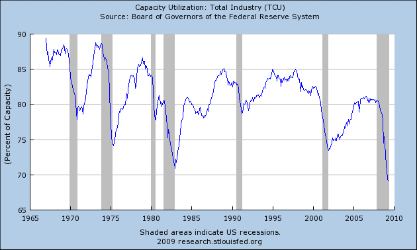

Finally, capacity utilization is at its lowest level in over 40 years:

There is no reason to invest when you've not using what you already have.

OUR CONCLUSION

While the overall trend of economic numbers is moderating that does not mean we have the driving force to get us out of the hole we're in. People don't just start spending money; businesses don't just start investing. Someone has to make the first move. And that's where Keynsean policies come into play. A WPA would accomplish several tasks. It would lower the overall long-term unemployment rate for a period of time. In addition, it would also increase domestic investment in areas we need like infra-structure. Finally, it would provide the force to get us out of the hole. While the economic numbers are getting better we need that "something" to get the numbers moving higher. And no other area of the economy appears ready to provide that push.

Obama's program works mainly through private employers, and is not focused on manual labor. If as it appears, we are about to undergo a sustained period of over 10% unemployment, there is a real and pressing need to get even the relatively unskilled into even manual labor cleaning, building, rebuilding and repairing our infrastructure and parks. Congress and the Obama Administration should not wait, and they should not just rely on the states and the private sector. Both for real, and important symbolic reasons connecting them to the FDR legacy, they should enact legislation now laying the foundation to re-establish the WPA and the CCC immediately and for the duration of double-digit unemployment.

Comments

folks submit this to the sharing sites, vote it up, reference it

Wow. This is a dramatic and great idea and even though it's from the New Deal, this is quite out of the box as a proposal!

I believe that the entire U.S. economy will never recover, we've gone past the edge on the middle class squeeze to the point it's bringing down the entire Macroeconomic economy.

What I see happening is the U.S. simply refuses to deal with what globalization is doing to the United States. There is no way American workers can compete with wages that are at 100:1, 10:1, even 3:1 ratios to U.S. wages and there is no way that will level until the United States PPP and standard of living goes to a 3rd world country.

Somehow I don't think that's what America is supposed to be about.

So, not only do they need a jobs program, tied to citizenship, to U.S. workers, to people of this nation, almost as a national union....but they need to modify a host of policies from corporate international tax codes to trade to employment law and put U.S. labor first.

FDR said work was a right and now that entire value is gone. Instead we have game shows as drama of who will be canned next.

The entire middle aged class is now double whammied. Through age discrimination, labor arbitrate their income is greatly reduced. Then they have no retirement. Old pensions were replaced with 401ks which have gotten wiped out through the stock market bubbles and busts and they also have had to raid them for health care costs, living expenses, being out of work.

So, we need a major paradigm shift in this nation and we need this age group especially to get their careers back.

This continual retraining, reeducation bullshit is just that. These people have college degrees, advanced degrees, years of experience, skills abounding and the reason they are in this boat is the obsession from multinational corporations to thrash their workforce and labor arbitrage people.

Folks, this really is a dramatic policy call and at minimum one that wakes up the brain and puts the focus squarely where it needs to happen, the U.S. labor force. So, please cite it on other sites in comments, rate it up on sharing sites, send it around to your friends. I think NDD and Bonddad are really onto something with this policy suggestion.

Yes, A Jobless Recovery Is No Recovery

Agreed wholeheartedly that our country will not recover until the "work for a living" is employed. We have left the Industrial Age and the Information Age. Remember when our country was transitioning to the Informational Age, we had high unemployment. Today, we are leaving the Information Age for an Unknown Age. Since the new Age is still TBA ( to be announced) the recovery will take a long long time to sprout. With no direction into a new Age for the near future, we are positioned for THE GREATEST DEPRESSION.

We need three prongs

1. We need health care workers. As the baby boomers age, they're going to need care. Medicare home health workers can be a huge chunk of the new WPA.

2. We need a massive transition to ambient energy. Note I didn't say *alternative* energy- in some areas of the country coal, gas, and oil still make economic, if not green house gas, sense. But it's time to stop shipping these items worldwide, and it's time to stop having all of our energy eggs in the fossil fuels basket. A massive conversion to electric transportation and fast battery chargers fed by a huge variety of energy sources is in order for the United States- and that will take a lot of work.

3. Our third prong, is reducing transportation needs overall- and that means fiber to every house, every building, in the United States. Every barn even. A networked farm can use less labor in the long run.

These are the three challenges that are equal to the national highway and parks system that the WPA and CCCs built.

-------------------------------------

Executive compensation is inversely proportional to morality and ethics.

-------------------------------------

Maximum jobs, not maximum profits.

Retrofitting

The only area of the construction economy that seems to be sustaining is the remodeling end. People won't build new houses, but they will fix up old ones.

There's already some of this in the "Green Jobs" part of the stimulus/budget (Van Jones, et al), but a big program to push retrofitting could be a big win. This would drive manual labor, as well as the manufacturing feed-streams for everything from windows to water heaters. Lots of wins there in the snow belt.

In the sun belt, we can work on the upgrades needed to handle micro-distribution of power generation (e.g. paying back the grid from local solar/wind, etc).

And there's also a big opportunity to push retraining. A non-trivial subset of the currently unemployed are experienced. They could be effectively put to work mentoring/training others. The service/servitude industry isn't a good answer for mainline employment. Learning real skills is a win for the coming decades.

Interesting that an auto

Interesting that an auto worker in the U.S. can no longer support a family of four on current wages. Yet, this is not the case in China. I find the BLS projections not credible inasmuch as they indicate a decline in 2010, while there's currently zero evidence to support this, given current trend.

PPP

Supposedly China is second as I recall in standard of living, but I have a hard time believing that because even with these (to us) beyond low wages, both India and China they have loads of disposable income and live pretty well.

The rest of the country....but the ones displacing U.S. workers are the ones I'm referring to.