Andy Bebut, a/k/a Theroxylandr, has this post at his blog describing an important relationship between stocks and bonds:

Back in 2007 I was writing that during the Kondratieff Spring, Summer and Autumn Treasury bonds and stocks are trading generally in the same direction, with bonds leading. During the Winter they are trading in opposite direction.

Andy's full blog is as always well worth reading, but I wanted to elaborate on the important difference in how stocks and bonds have behaved during the last 10+ years, vs. how they behaved during the great bull market of the 1980s and 1990s.

A little known fact is that, despite the attention given to the great stock market bull market that ended in 2000, the bond market bull was if anything, even more intense. For example, Paul Farrell has written:

Bonds beat stocks by factor of 11 times from 1981 to 2009

Yes, and you'd have been 11 times richer. Listen closely to [newletter writer Gary] Shilling's analysis of the past 28 years. In his Insight newsletter he compares the performance of the S&P 500 stock index to the bond market. First he focuses on his "all-time favorite graph" comparing "the results from investing $100 in a 25-year zero-coupon Treasury bond at its yield high (and price low) in October 1981, and rolling it into another 25-year Treasury annually to maintain that 25-year maturity."

His bottom line: "On March 31, 2009, that $100 was worth $16,656 with a compound annual return of 20.4%. In contrast, $100 invested in the S&P 500 at its low in July 1982 was worth $1,502 last month for a 10.7% annual return including dividend reinvestment. So Treasurys outperformed stocks by 11.1 times."

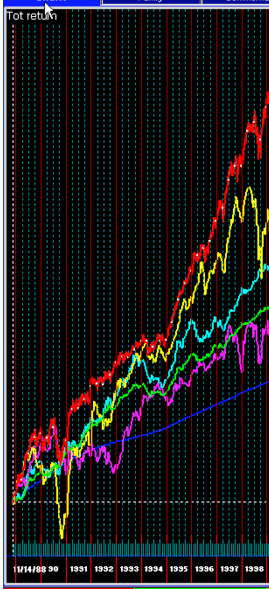

Unfortunately, graphs showing bond prices vs. stock prices during that time are hard to come by online. Here is the best I found after a lot of looking:

In the graph to the left, which covers the time 1990-1998, as for stocks, the red line is the S&P 500. The yellow line is the Russell 2000. As for bonds, the green line is the Vanguard total bond fund. The light blue line is the 30 year treasury price. (Ignore the purple and dark blue lines).

.

Not only do all four lines move in the same direction until mid-1998, but they zigzag up and down at roughly the same time with bonds leading slightly.

.

Put simply, during the Bull run from 1982-1998, when bond interest rates went lower, that was good for stocks; when they moved higher, it was bad for stocks. In other words, from the peak in interest rates in 1981 until the Asian currency crisis of 1998, stock prices and bond prices moved in the same direction.

.

.

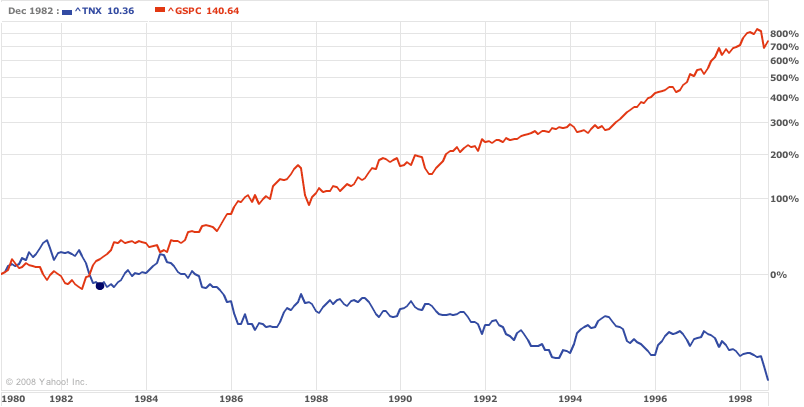

Because bond prices increase when bond yields decrease, another way stating the same phenomenon, is that bond yields and stock prices formed a mirror image of one another during that time. Here's a graph of bond yields (blue) vs. the S&P 500 (red) from 1980-1998:

It's pretty easy to see that the two lines continuously move away from one another. As bond yields decrease, stock prices increase.

Now let's look at a continuation of our first graph of bond yields (blue) vs. the S&P 500 (red), covering 1998-present:

Instead of explodiing away from one another, now the two lines move in tandem, ending virtually unchanged vs. one another after 11 years. Also, note that the scale of the bottom graph is much more expanded than the top graph: if the scale were the same as the top graph, the entire area of the second graph would be contained within about 1/4 of the vertical axis of the top graph, and the two lines would be atop one another for the entire period! For any period of time when stock and bond prices have temporarily separated (mildly, during the period of reasonable GDP growth between 2003-2006), there is always a compensating move back together. Since the beginning of this year, the lines have almost fully converged.

Why the difference in behavior during the two periods, 1981-98 vs. 1998-present? During the first period, declining interest rates meant refinancing of debt on easier terms, offering more chances for consumption and expansion. In the second period, declining interest rates indicated increased fear of a debt-deflationary meltdown.

Kondratieff winter should last about 15 years, and normally continues until the debt/deleveraging issues are overcome, so we are nowhere near the end of this part of the cycle. This has implications for the relative moves of stocks vs. bonds. There are some who think that stocks will crash again, while interest rates explode to the upside. In Kondratieff winter, that isn't going to happen. If stocks retreat, bond yields will decline too (just as they did in the late 2008 crisis). If interest rates move up, so will the nominal value of stocks.

For those who think that the threat of deflation is decreasing, while Fed and Treasury pumping of $Trillions into the system threatens future inflation, the second scenario -- increasing bond yields together with increasing nominal value of stocks -- is the most logical outcome.

Comments

Some interesting dynamics forming

Fed and Treasury cannot afford to have mortgage rates to increase. It threatens their plans. But mortgage demand (I believe) is off.

Another potential issue is if interest rates go up what does that mean for adjustable rate mortgages still out there - it could be a good amount.

RebelCapitalist.com - Financial Information for the Rest of Us.

From Calculated Risk Updated Reset Schedule:

Link.

Looks like there could be another problem if interest rates go up.

RebelCapitalist.com - Financial Information for the Rest of Us.

What that suggests is

If interest rates continue to increase, the stock market will continue to rally - in nominal, but not necessarily real, terms.

I have a sense that the mortgage resets/recasts may be less of an issue for the overall economy than most people think, although they will certainly continue to drive house prices lower.

I am more concerned about the rebound in gasoline prices. We have surging prices again, perhaps - again - driven by speculation, while EIA statistics show continuing lower gasoline demand.

oil

We also had a flurry of hearings and discussion on the possibility of speculators manipulating the market and the minute oil dropped, all of that activity disappeared.

Now it seems....they are back with more prices divorced from demand reality.

Why is it we only pay attention to certain things when there is a crisis?

I love your posts

I remember reading Kondratieff almost 20 years ago and being blown away. NDD, you are really the only guy I know that truly utilizes his stuff in the writings. Question, do you believe we are also heading into a new 40-year cycle?

--------------------------------------------

www.venomopolis.com

40 year cycle

I'm not so familiar with the 400 year cycle. The appeal of the K-wave is that it has already been tested in real time, twice, after publication of the book, and it has worked both times.

About 40-year cycle

I'm think about K-wave for years already and my strong individual opinion is that there is no fixed length of the K-wave.

Each season has a length of maybe 10 to 25 years, so the sum of the 4 seasons may fluctuate.

There is one argument though is that the cycle is somehow related to the human life duration, which is extending.