The shear amount of information uncovered is staggering. Hopefully it will keep your interest.

Let me warm up here with a couple of interesting quotes.

"Gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium."

Murray N. Rothbard

Why Gold and Why Now?

"If you don't trust gold, do you trust the logic of taking a beautiful pine tree, worth about $4,000 - $5,000, cutting it up, turning it into pulp and then paper, putting some ink on it and then calling it one billion dollars?"

Kenneth J. Gerbino

Ever wonder why banks and governments like a paper currency system? Why they fully embraced the Keynesian theory of deficit spending?

"Deficit spending is simply a scheme for the 'hidden' confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights."

Alan Greenspan

That one is a classic considering the source.

The contrivance of paper currency keeps a death grip on the wage slaves by secretly confiscating their wealth through a hidden taxation system that is difficult to detect. Gold or gold standard did not allow this to happen because it is impossible to inflate gold. For most of the 19th century the US experienced a slight deflation due to the industrial revolution and greater technological advances.

Let me say up front the gold standard is not coming back. So why then am I writing this?

GOLD stands as a sentinel over the world’s currencies. It keeps a check on governments and exposes their manipulations. The bankers fear it so they must control it. First Paulson and now Geithner have repeated the mantra of a “strong dollar policy”. In fact when our Treasury Secretary uttered these words last week in China he was nearly laughed off the stage. But …

What does it mean to have a strong dollar policy? In government new speak it means something else must look weak … that something is gold.

Remember the words of former Fed Chairman Paul Volker from the 1970’s, “the one mistake that I made was in not capping the gold price.”

Alan Greenspan's comment before Congress in July of 1998, "Central banks stand ready to lease gold in increasing quantities should the price rise.

In April of this year an event took place that almost went unnoticed by many.

[..]March 30, 2009 came and passed, and so many people stood for delivery, refusing to part with their long gold futures positions.

On Tuesday, March 31st, Deutsche Bank (DB) amazed everyone even more, by delivering a massive 850,000 ounces, or 8500 contracts worth of the yellow metal. By the close of business, even after this massive delivery, about 15,050 April contracts, or 1.5 million ounces, still remained to be delivered. Most of these, of course, are unlikely to be the obligations of Deutsche Bank. But, the fact that this particular bank turned out to be one of the biggest short sellers of gold, is a surprise. Most people presumed that the big COMEX gold short sellers are HSBC (HBC) and/or JP Morgan Chase (JPM). That may be true. However, it is abundantly clear that they are not the only game in town.

Mysteriously, on the very same day that gold was due to be delivered to COMEX long buyers, at almost the very same moment that Deutsche Bank was giving notice of its deliveries, the ECB happened to have “sold” 35.5 tons, or a total of 1,141,351 ounces of gold, on March 31, 2009. Convenient, isn’t it? Deutsche Bank had to deliver 850,000 ounces of physical gold on that day, and miraculously, the gold appeared out of nowhere.

The buyer of such an enormous amount of gold was not named but the timing was convenient that the ECB probably saved the bank and COMEX from a huge problem. The size and timing of the delivery of Deutsche Bank’s COMEX obligation is suspicious, to say the least, when taken in conjunction with the size and timing of the ECB’s gold sale.

When it comes to commodities there exists a rule going back to the 19th century known as the 90% rule. Simply stated, a seller must posses 90% of said commodity in order to sell futures. The Deutsche Bank entering into short contracts while not possessing the physical metal would be in violation of these rules.

Since then the German Central Bank and Dubai have requested that their gold, held abroad, be returned from the U.S. and U.K. respectively.

Rob Kirby has uncovered probably the most revealing information about the US gold hoard. Or at least what is left of it. The Mineral Industry Surveys is published by the United States Geological Survey (USGS) in which it provides a macro look at import/exports of US precious metals (gold). Keep in mind the USGovt reports gold holdings of 8,100 metric tonnes of gold. Yet in 2007 the US exported over 2000 tonnes of gold.

In 2008 nearly 3000 tonnes of gold were exported.

Rob Kirby points out

U.S. mine production of gold is roughly 228 metric tonnes. This figure of 2,920 metric tonnes is equal to 36 % of all alleged sovereign U.S. gold stocks or more than 14 times annual U.S. gold mine production. So, I was left wondering, “just what is/are ‘gold compounds’?I contacted the USGS and queried a qualified individual [who had working knowledge of this data stream] about the definition of “Gold Compounds”. I was told that, according to the U.S. Census Bureau – who supplies not only the definition but the actual reported numbers, gold compounds were typified by industrial type products containing low percentages/amounts of actual gold content – like gold paint.

I then reasoned with the USGS person, if such were the case, why would U.S. exports have increased in 2008 to nearly 3,000 metric tonnes [when the Global Economy was slowing and the U.S. Dollar was strong] from 2007, when U.S. exports totaled approximately 2,000 metric tonnes [when the U.S. Dollar was weaker and the Global Economy was booming]? I noted that this was counter-intuitive and made no fundamental economic sense:

Kirby went on to question the USGS about whether gross weight or gross value was assigned to “Gold Compounds” and was told it was gross value the US Census Bureau attached to the exports.

I responded rhetorically, “being an issue of gross value – then let me guess that the U.S. Census Bureau is assigning an astronomically high value to these goods. Such a high value would be COMPLETELY INCONSISTENT with what the U.S. Census Bureau claims these items are- namely, industrial goods. The values being reported would be more in line with these goods being gold bullion or equivalents”.

The individual from the USGS confirmed my reasoning when he responded, “that would be CORRECT”.

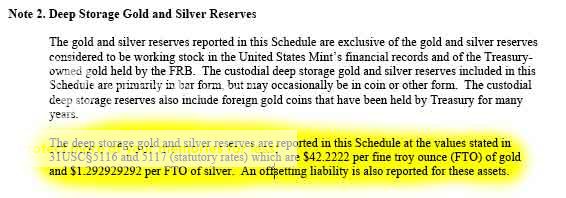

What Kirby is talking about is the US Treasurys’ official reporting of the value of the US gold hoard…. now known as “Deep Storage Gold”.

At $42.22 a troy ounce they would have completely wiped out the entire US gold holdings in the first year.

5000 metric tonnes = 160 753 733 troy ounces [$128 billion+ at today’s prices] Exported from the US in the last two years.

Notice that in 2007 gold had a huge run up in price. A price that the central banking powers had to extinguish.

The US Gold reserves confiscated in 1933 was made up of gold melt. The US Gov't did not waste time separating the metals so most of the gold held is 90% bars. What has been confirmed is the US has been exporting gold melt or "gold compound" for the last two years.

Over the course of 2007 / 2008 – more than 5,000 metric tonnes of “Gold Compounds” have been exported from the United States of America representing more than 62 % of reported sovereign U.S. gold reserves or about 24 times annual U.S. mine production.

Industry funded trade groups like the World Gold Council and GFMS Metals Consultancy, have not reported any of these movements in monetary metals. These facts shine light on their credibility and exposes them as being part of the misinformation stream coming from various governments and central banks around the world.

Organizations like GATA have sought to expose the manipulation and suppression schemes of the worlds central banks for years. Their research has done much to expose the truth.

The Reserve Bank of Australia confessed to the gold price suppression

scheme in its annual report for 2003. "Foreign currency reserve assets and gold," the RBA's report said, "are held primarily to support intervention in the foreign exchange market."The head of the monetary and economic department of the Bank for International Settlements, William S. White, in a speech to a BIS conference in Basel, Switzerland, in June 2005:

"There are five main purposes of central bank cooperation, White announced, and one of them is "the provision of international credits and joint efforts to influence asset prices (especially gold and foreign exchange) in circumstances where this might be thought useful."

Nearly two years ago, the US Treasury quietly made a subtle change to its weekly reports of the US International Reserve Position, which includes the US Gold Reserve.

In stating the US Gold Reserve is 261.499 million ounces, the gold is now reported 'including gold deposits and, if appropriate, gold swapped.'

This description provides clear evidence that the US Gold Reserve is in play. Gold has been removed from US Treasury vaults and placed on deposit, presumably in the couple of bullion banks the Treasury has selected to assist with its gold price-capping efforts.

The U.S. government has not had a genuine audit of its gold holdings in decades. In recent years, it has changed the description of gold holdings in reports so that now it is only described as "custodial gold" rather than gold reserves.

Cross posted at the Economic Populist

Comments

"There is no Gold in Fort Knox"

I'm not a Gold bug and when I first saw your post I thought it was CT, i.e. "there is no Gold in Fort Knox" stuff, but taking a second look, your citations are credible.

That Greenspan quote is pretty amusing.

Eisenhower Administration

Was the last time an independent audit was done to Fort Knox.

I don't know if its there or not.... in 50 years how could anyone? ... it is the most guarded secret of the FED & Treasury. They talk it down constantly, calling it a barborous relic yet central banks of the world still list it as an asset on their books. The question is ... do they still hold as much as they say they do?

They operated leasing programs in which the gold does not come back, they count leased gold as a holding, talk about double booking.

Sir Alan Stanford

Not sure if anyone has been following the Standford Case, essentially another possible Madoff scheme. Tonight CNBC played one of their investigative reporting pieces specifically about this guy and Stanford Financial. Anyways, there's a part in there that reminded me about the first half of this article. In it, Sir Alan Stanford was looking to build up his real estate assets. He borrowed money from other investors (unwittingly) to literally buy a small island that was part of the island nation of Antigua (he has dual citizenship there, though originally from Texas). He had purchased the tiny island, which was to be converted into a private resort for high net worth customers (with a membership fee of $15 million), for tens of millions of dollars. When it was time to do the books, he ordered his bean counters to put the value of the island into the billions (this while the deal for the island was going through just weeks prior). So right there, out of thin air, an asset's value was ballooned without the market.

--------------------------------------------

www.venomopolis.com

cooking the books

otherwise known as accounting magic tricks.

When we get into this realm of asset evaluation and accounting methods, etc. it's one dense forest and for the layperson they cannot see the trees to save their souls, much less experts.

Some of the more common methods to create Ponzi schemes, asset inflation, profits when there are losses, etc.

Maybe a "cookbook" of recipes on how the methods operate.

A cookbook on cooking the books.

You can't inflate gold--close but no cigar

You can inflate gold. It's just *really hard to*. The majority of the gold in our economic system is probably only 1-2% of the gold on the planet earth; 19th and early 20th century mining systems were horridly inefficient and during that boom time of American gold production (1849-1954) many mines ended up shutting down because they were unprofitable- inflation had pushed the price of gold too low to mine.

With Gold now back up to ~$1000/oz, some of those old mines in my state have discovered a whole new business model- gold mining tourism, in which the vacation might cost you $500, but you'll earn $1500 over that for a week's work.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Gold discoveries

if large enough could push the price down for a short period. This happened with the Comstock silver boom.

However your assessment of gold price is wrong. Gold price was artificially fixed until at just over $20 oz. until 1933. After the FDR gold confiscation he revauled gold (devalued the currency) to a fixed $35 oz. The price remained there until 1971.

If finding gold is that profitable why am I not reading about new gold millionaires coming out of Oregon?

DEQ

"If finding gold is that profitable why am I not reading about new gold millionaires coming out of Oregon?"

It's profitable, *BUT* thanks to 40 years of land-use laws and environmental sensitivity, it's no longer legal or politically correct to do this large scale. The Sumpter Dredge will never run again.

Your question led me to find out that Cracker Creek Mine has suddenly closed- sometime in the last couple of days their website, which previously offered Highbankers at $120/4 hours rental, has been taken down. Looks like they might be a victim of a government decision to limit public access to the entire region.

The veins in Oregon are not new, and while one person panning could get that kind of profit (2 oz of flakes for a week's work in the rivers isn't that out of line, especially not in the the coastal mountains, it is limited now to just panning on known government owned lands. Mechanical dredgers are banned in those areas completely, even highbankers are banned there.

You ain't going to see a millionaire from those regions. At most, you might see an unemployed person camping and earning $120,000/year with *very* hard labor. And that would even get cut into with the harsh weather we get yearly- many weeks you'd get nothing.

"However your assessment of gold price is wrong. Gold price was artificially fixed until at just over $20 oz. until 1933. After the FDR gold confiscation he revauled gold (devalued the currency) to a fixed $35 oz. The price remained there until 1971."

Thanks for the correction. Pre-1971, then, the reason these mines closed was because inefficient mining methods meant production cost was far higher than either of those fixed prices. Post-1971 (the era of CONSERVative Republican Governor Tom McCall, who started the environmentalist land use laws in Oregon) we haven't seen a return to large scale production because of the damage it does.

I'm still thinking about taking a weekend or two to go gold panning, as time allows- and if I end up unemployed again, a weekly trip to Shady Cove Campground may be in order, as it's my closest proven vein where panning is allowed.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Report Back

Please report back should you go panning. I would like to hear what your efforts gain.

This reminds me of an Atlantic article.

If anyone has a chance, please take a gander at this article from the Atlantic magazine. It's basically how deBeers sold America diamonds. But what's interesting is the part about when the Soviets got into the act and how deBeers had reacted. Here you had the emergence of a rival source of diamonds, smaller than the ones coming out of Africa, but in much larger quantities. The famed diamond monopoly rushed to make a deal with the Kremlin, thinking they could get things under control. Problem was, deBeers underestimated the supply that could come out of Siberia.

Its a really interesting piece. You see how they had to essentially put into conflict everything they said about regular sized diamonds to push the smaller gems. This campaign would also have some unintended consequences. Your talk about price drops and supply reminded me of that article.

--------------------------------------------

www.venomopolis.com

Peak Gold

Despite the fact that the price of gold has increased nearly 4 fold since 2001, gold production has slowly fallen .

click image to enlarge

[edit: RO, format your links and images ya all! the tools are here, use 'em, pls]