Eventually the unsustainable will end. It's an immutable law of both physics and economics. For the American dollar, it appears that this day of reckoning is approaching quickly.

Merrill Lynch has warned that the United States could face a foreign "financing crisis" within months as the full consequences of the Fannie Mae and Freddie Mac mortgage debacle spread through the world.The country depends on Asian, Russian and Middle Eastern investors to fund much of its $700bn (£350bn) current account deficit, leaving it far more vulnerable to a collapse of confidence than Japan in the early 1990s after the Nikkei bubble burst. Britain and other Anglo-Saxon deficit states could face a similar retreat by foreign investors.

America has a savings rate of zero and must borrow about $2 Billion a day, 365 days a year, to maintain its standard of living.

America has been living far beyond its means for most of the Bush Administration, so why start worrying now?

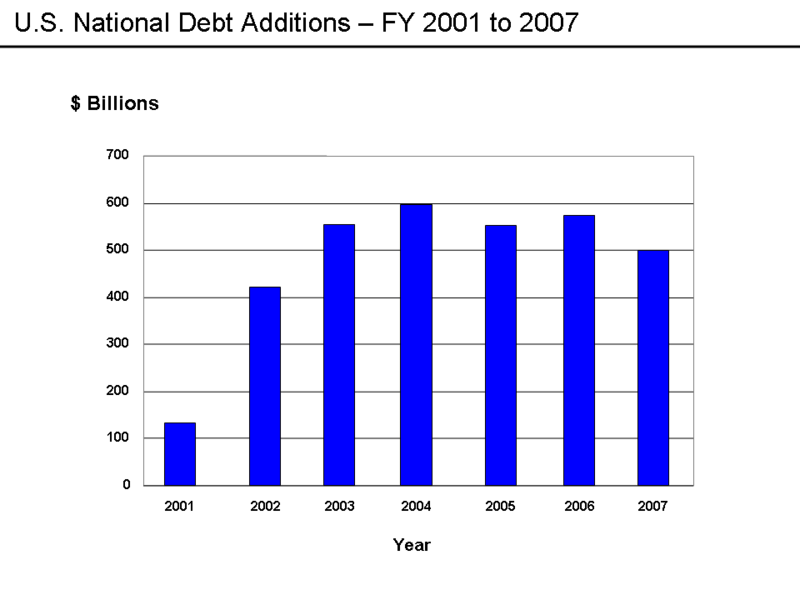

I went to the Treasury Direct web site and did some quick math.

From January 2007 to July 14, 2007 the national debt increased by $197,542,190,350

From January 2008 to July 14, 2008, the national debt has increased by $303,565,163,100

If you were a lender, and your primary borrower who was already living beyond his/her means suddenly had to increase borrowing by more than 50%, would you be concerned?

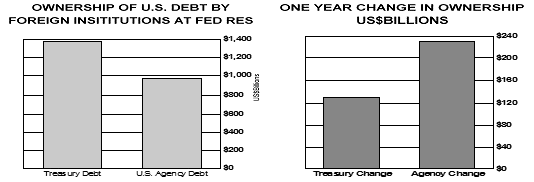

Roughly $1.5 trillion of Fannie and Freddie AAA-rated debt - as well as other US "government-sponsored enterprises" - is now in foreign hands. The great unknown is whether foreign patience will snap as losses mount and the dollar slides.

Hiroshi Watanabe, Japan's chief regulator, rattled the markets yesterday when he urged Japanese banks and life insurance companies to treat US agency debt with caution.

In a sign that our foreign creditors are taking this seriously, sovereign wealth funds are cutting back on their exposure to dollar assets.

Behind the scenes, fund officials are questioning the credibility of the Federal Reserve and US Treasury in defending the dollar and maintaining financial stability. Reacting to last year’s collapse of structured investment vehicles, the head of one Middle East fund said: “I thought the problem of off-balance sheet had gone away with Enron.”

Probably the most disturbing thing that our foreign creditors must be worried about is that Washington has completely abandoned all pretense of fiscal sanity. For instance, the Democrats are planning yet another tax rebate. Meanwhile, in another display of cluelessness, Bush said that the Fannie Mae/Freddie Mac bailout wasn't a bailout.

CNN called it the trillion-dollar mortgage time bomb.

In fact, a bailout of Fannie and Freddie will be so large that it will cost America its AAA debt rating. Losing the AAA rating would mean foreigners would fly from our Treasuries, thus bringing to an end the dollar's status as world's reserve currency.

The important point to note here is that the GSE's didn't get themselves in trouble all by themselves. They didn't become the dominant force in the housing market, even while the market implodes, all by themselves.

They were instructed to bail out the housing market by the Bush Administration.

By reducing the extra cushion of capital the two companies have been required to hold since 2004, the regulator, the Office of Federal Housing Enterprise Oversight, is enabling the companies to invest $200 billion more in home loans. In essence, the companies are being allowed to take billions of dollars that had been used as a reserve against possible further losses and invest that money now in the housing market.

This bailout that isn't a bailout, when you look beyond the simplistic rhetoric, has almost unimaginably negative implications for the dollar and the American economy in general. To give you an idea of the size and magnitude we are talking about, let me list a few facts for you:

1) As part of the bailout, the Bush Administration has "called on Congress to raise the national debt limit."

2) The markets detected an increased risk of the Treasury Department going bankrupt and defaulting on the national debt.

3) Treasury Secretary Henry Paulson has asked Congress for "authority to buy unlimited stakes in the companies and lend to them".

I don't know about you, but when the government starts using the term "unlimited" I get nervous. But the real kicker here is - who is going to be bailed out? Would it surprise you to know that, in true third-world government fashion, it will largely be rich foreigners?

As politicians call for taxpayer bailouts and a government takeover of troubled mortgage lenders Freddie Mac and Fannie Mae, FreedomWorks would like to point out that a bailout is a transfer of possibly hundreds of billions of U.S. tax dollars to sophisticated investors and governments overseas.

The top five foreign holders of Freddie and Fannie long-term debt are China, Japan, the Cayman Islands, Luxembourg, and Belgium. In total foreign investors hold over $1.3 trillion in these agency bonds, according to the U.S. Treasury's most recent "Report on Foreign Portfolio Holdings of U.S. Securities."

FreedomWorks President Matt Kibbe commented, "The prospectus for every GSE bond clearly states that it is not backed by the United States government. That's why investors holding agency bonds already receive a significant risk premium over Treasuries."

"A bailout at this stage would be the worst possible outcome for American taxpayers and mortgage holders, who have been paying a risk premium to these foreign investors. It would change the rules of the game retroactively and would directly subsidize the risks taken by sophisticated foreign investors."

"A bailout of GSE bondholders would be perhaps the greatest taxpayer rip-off in American history. It is bad economics and you can be sure it is terrible politics."

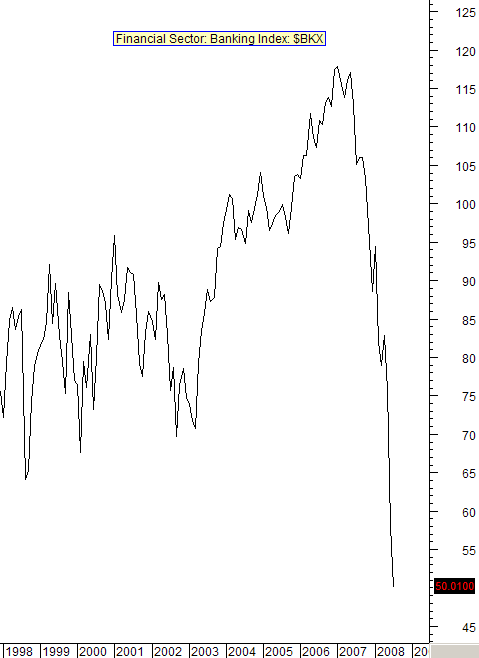

The bailouts are not over. The markets have judged the risk of more and larger bank failures is rising. Plus, there is the ever present danger of the bond insurers, such as MBIA and Ambac, imploding and forcing a revaluation of hundreds of billions of dollars in bonds. The havoc being caused on the financial markets is hard to imagine.

Bridgewater Associates has issued an apocalyptic warning to clients that bank losses from the worldwide credit crisis may reach $1,600bn (£800bn), four times official estimates and enough to pose a grave risk to the financial system.

...

If Bridgewater is anywhere near correct, governments alone have the wherewithal to rescue the system. This would mean the de facto nationalization of the banking systems in the US, Britain and Europe.

I don't know how else to say this: there is no easy solution that will enable us to avoid pain. Anyone who tells you that all we need is another bailout or a little more regulation and everything will be fine is a liar.

This country has been run by people telling you that you can have your cake and eat it to and debt doesn't matter for so long that we've run out of painless solutions. We've pushed the cost and pain into the future for so long that any amount of sacrifice has become an unacceptable scenario. Yet pain, in the form of widespread bankruptcies, is exactly what this country needs now. We need it because this country is drowning in debt, and bankruptcy is the only way we can get out from under the debt and get the country moving again.

The only other option is increasingly larger bailouts which will take their toll on the dollar until it becomes a worthless scrap of paper.

Comments

Great analysis

I put other in the poll because I would like to see them fix Fannie/Freddie once and for all, immediately freeze all foreclosures and evaluate all of them for predatory loans to restructuring to even putting some of the losses onto the bank and refinancing at a new price evaluation and so on, but that's pretty detailed. I do think bailing out Wall street and a bunch of screwed companies and not the people suffering is dead ass wrong.

Bottom line people are drowning in debt because the middle class and good jobs are being squeezed. Only so long can America be viewed as a bunch of consumers and disposable workers and the consequences don't come home to roost.

So, bottom line is a huge depends but as it's currently being presented this is @&*)$&@ and it appears they are not addressing the underlying reasons this became the mess it did.

I am very nervous about Paulson's plan

...giving the Bush administration a blank check to bail out Fannie and Freddie (not to mention whatever else the Bush administration, known for its punctilious adherence to the rule of law) for the next 6 months,

What are the odds that favored cronies of the Administration, be they wealthy individuals or connected firms, will be given an unlimited license to loot?

Well....

....it would seem that at this point we have no choice but to protect foreign investors. Without them....well, we are not going there.

What needs to happen in my mind is, in addition to Robert's call to 'fix Fannie Mae et. al. is....

Cut defense spending to the bone and raise taxes. We really don't need the V-22 and a bunch of other stuff on the boards and the folks who've been getting a heavily discounted ride, historically speaking, need to step up and cough it up.

Really like to see a post about income tax rates, upper levels, and productivity and growth in GDP going waaaaaaaaaaaay back. I have a feeling that the Clinton years are no 'exception' as the 'conservative' hack economists, yeah 'Chicago School I'm talkin ' bout you, would have you believe.

Now is the time to take a look at the underlying assumptions and data which the Republicans have been using to justify their looting of the Treasury for the uber-rich as the citizenry is sounding like they are finally ready to listen.

Let's bring in some of the newer ways of looking at things such as 'Complexity Economics' and move the 'dismal science's' theory and effect on policy into the 21st Century.

Before it's too damn late.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Is it time yet for local currencies divorced from the dollar?

This is what the US Dollar seems to have turned into: A way for big con games on the East Coast to rape the economies of the rest of the nation.

This leads me to believe it's time for local governments who care about keeping jobs in their cities and keeping food on the tables of their citizens to consider starting to print their own currency.

Such currency could be used in a return to small centralized market places, where those who don't want to trust people 3000 miles away can trade goods and services without having to bother with federal taxes or the ultimately corrupt central banking system.

We don't need to "avoid the pain" of having the centralized banking system collapse- we need to go through the pain to decentralize the economy.

-------------------------------------

Maximum jobs, not maximum profits.

Those currencies already exist

They've always existed. They're called gold and silver. Also, an effort has already been made in this country to monetize these coins. It was called Liberty Dollars.

The FBI and Secret Service raided the offices and seized all the assets under questionable legal justification.

I'd Like to See...

Income tax paid only to the states -- and not to the Feds at all.

(Greetings everyone. First-time poster, here.)

Then let the States pay taxes to the Feds to underwrite perimeter infrastructure and defense, national museums and archives, foreign aid and international affairs, National Guard, certain emergency services, intrastate issues, enforcing the constitution, and shepherding the nation. That way we get rid of earmarks, the IRS, block grants and bullshit legislation, and most government crap.

And the states can start to take care of the people and the region at the local level -- where it is most cost effective and contextual.

All Social Security and Medicare-related revenues should be kept in a blind trust in Switzerland -- and may not be used for any other purpose.

While it sounds far-fetched and a little Ron Paulish, I'm pretty sure this is inevitable.

The European Union quite recently invented itself into nation states -- and the states continue adding themselves.

Below is a link to a really cool animated map of how quickly that happened and how Europe is now poised to become the biggest single market in the world.

http://news.bbc.co.uk/2/shared/spl/hi/europe/02/euro_borders/html/1.stm

Bottomline -- the U.S. does not scale. It's too large and its infrastructure is way too primitive for the 21st century -- unlike all other nations created before the automobile.

I don't see a reason to change the currency, in this scenario.

Hey, Pluto, welcome aboard!

You can find many of your favorite issues here without having to dig through loads of non-economic stuff. And more and more fellow commentors you know from Big Orange are stopping by too.

no "quotas"

(see if I can capture a conservative with the subject title ;))

Ditto Pluto and just to remind everybody, we can make up our own rules as we go along...so if someone gets into a writing jag and wants to post 3 writings in a day, no problemo as long as it's good juju.

Also, the forums are for those little "did you see this" type things where you want to grab attention to something. almost glorified mini open threads if you will.

I've been putting little quick news links in them for the most part.

Given the Abysmal Stupidity of the Folks setting 'Policy' in the

....Federal government today and their willingness to use ideology instead of science to 'solve' the problems we face I can understand you perspective here.

But....

Really large scale infrastructure, that which I assert we will need to avoid the Road to Olduvai Gorge such as the Solar Grand Plan will require a national effort not only because of cost but such truly large projects require that intrastate commerce laws be revised or, in some cases, new legislation written.

We still have tremendous advantages over many other countries, no not coal..coal bad, bad, bad, as you can easily see if you contrast what we are up against with the Solar Grand Plan and the challenges the Japanese are struggling with in 'Rope the Sun!'

America's failures today are of leadership and learning. Leaders no longer lead and the citizenry has spent the last generation getting dumb enough to love American Idol.

The tidal wave of foreclosure notices are sorting that out quite nicely however.

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Solar makes more sense small scale than large

Hate to say it- but centralization and large scale thinking is exactly the problem. What we need is small scale thinking- every building generating its own energy and then some (from ambient sources, be they solar, wind, wave, deep water thermal transfer, geothermal, or something I'm not even aware of), every vehicle self-contained in some way.

Economics, also, makes much more sense on the small scale than the large: take the simple example of the parasite criminal con artist. If your economics is small scale, you're going to see him in social settings his entire life, and somebody, someday, will take revenge upon him for his crimes. But if you're in a large scale economy, he can rob your 401k account without you ever knowing who he was or why he did it, and revenge becomes impossible.

This is the reason why globalization has failed. This is the reason why federalization is failing. Anonymous economics yeilds bad neighbors.

-------------------------------------

Maximum jobs, not maximum profits.

Solar makes more sense small scale than large

Very good observations.

A coworker of mine who had an all electric home a couple years back and was seeing his electric bills getting upwards of 800 bucks a month in the winter

He installed a windmill, and has been adding solar panels on his southern roofline. He is using a modular system that you can add panels as time and budget permit.

He is completely off grid now and electric self sufficient

Investment since he did most of the work himself was around 20k. If his energy bills averaged 5k a year thats only a 4 year payback

You are absolutely right about micro economics we really need to be rediriecting from globalization to localization. It puts people somewhat back in control of their own destinies, saves energy and reduced environmental impact

Hey!

I'm using the rating system! Yay for me!

'When you see a rattlesnake poised to strike, you do not wait until he has struck to crush him.'

Yippie

I don't know if anyone but myself knows there is currently a code bug plus I need to add to it! Let's see if it ever gets used so the code bug shows up! ;)

the systems are there in case we get a sudden well, "funky" blog post because they do automatically start on the front page and if enough demotions occur a post will be removed from the front page or vice versa, a forum can be put up to the front page or an especially funky "comment" so you can hide it.

I can make the user controlled content voting system more advanced but nobody was really using it, but as we grow, I'll bet money we get that "funky" front page post and I might not be connected to catch it.

People have mentioned and I heartily agree to not turn it into a popularity contest method or a retaliation method (say you disagree with the poster, but their post is reasonably financially cited/sound), which to me is a good sign we all think the "ratings" of certain "sites" is out of control....

Anybody can show up here and write something so it's also a method to keep the site "on topic" (a hem).

The Greatest Taxpayer

Let freddie and fannie fail. Let housing prices collapse, and then create a new entity to get mortgages at the new price. When the loans become underwater, force the lenders to eat differential between home equity and oustanding mortgage equity. If the big banks can't handle it, let the government take over the banking business and/or relegate it to the states.

I think the best way to relegate it to the states, would be to allow the states to run the banks with say a 10/1 leverage ratio, and have the banks overseen and audited by the fed. These banks could lend to local officials and/or local banks. Bank secrecy laws should be changed to make a public account of all loans, and prevent fraud.

I don't think the financial system should be dominated by big money center banks. Credit creation should be more distributed throughout the country with oversight. Sufficient leverage ratios should be maintained, and diverse types of loans should offered. If the leverage ratio goes out of bounds, liquidation should be forced. However, the individuals should be aware of what they are financing with their bank account.

The Greatest Taxpayer

Just some of the many reasons why most of our founding fathers abhorred the idea of central banks, and why we used to have regulations that prevented these mega merger financial institutions as well as the seperation of commercial banking from investment banking, insurance and other fianancial firms - to prevent the sort of excesses we are seeing today

We need to return some regulatory power back to a more local level as well as the federal level, break up the mega banks and return to seperation of the various fiancial institutions.