Last September, during the debate over the federal bailout of Wall Street, politicians that supported the bailout used a certain phrase.

"Our time has run out," said Rep. Spencer Bachus, R-Ala., the ranking Republican on the House Financial Services Committee. "We're going make a decision. There are no other choices, no other alternatives."

Recently I saw the same argument made on DKos concerning the deficit spending and bailouts. It seems like common knowledge at this point. If we hadn't bailed out Wall Street then we would headed into a Depression.

The fact of the matter is that this idea, that we had no choice, is wrong on three different levels.

Reason #1

The most obvious reason why the "no other alternative to avoid a Depression" premise is wrong is that we haven't avoided anything.

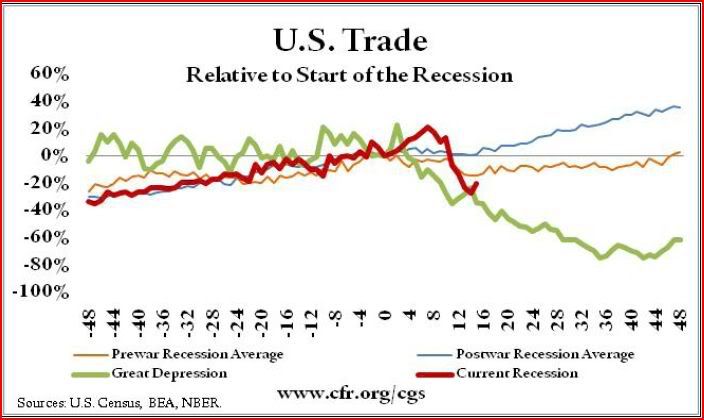

If you look at the actual numbers, rather than listen to the rhetoric of the politicians and news media, the economy is tracking the descent that marked the economy of 1929-1930. If the objective was to avoid following in the footsteps of our experience of the early Great Depression, then we've totally and completely failed.

U.S. Industrial Output

Reason #2

The second reason why the "no other choice" premise is wrong is blatantly obvious to the 95% of the world's population that doesn't live in America. To them it is nothing more than a double standard.

Among critics of American-style capitalism in the Third World, the way that America has responded to the current economic crisis has been the last straw. During the East Asia crisis, just a decade ago, America and the I.M.F. demanded that the affected countries cut their deficits by cutting back expenditures—even if, as in Thailand, this contributed to a resurgence of the aids epidemic, or even if, as in Indonesia, this meant curtailing food subsidies for the starving. America and the I.M.F. forced countries to raise interest rates, in some cases to more than 50 percent. They lectured Indonesia about being tough on its banks—and demanded that the government not bail them out. What a terrible precedent this would set, they said, and what a terrible intervention in the Swiss-clock mechanisms of the free market.The contrast between the handling of the East Asia crisis and the American crisis is stark and has not gone unnoticed. To pull America out of the hole, we are now witnessing massive increases in spending and massive deficits, even as interest rates have been brought down to zero. Banks are being bailed out right and left. Some of the same officials in Washington who dealt with the East Asia crisis are now managing the response to the American crisis. Why, people in the Third World ask, is the United States administering different medicine to itself?

America's solution for 3rd world nations for the last 50 years when their banks get into trouble and their trade deficits get too high is to "suck it up", the exact opposite "solution" that we have reserved for ourselves.

How big of hypocrites do we look like?

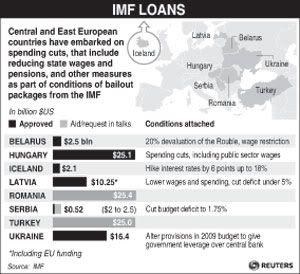

And it isn't just 10 years ago, or 30 years ago. Even right now, during this very crisis, we continue to impose this double standard on smaller nations.

Forced into the arms of the International Monetary Fund, the Latvian government is now slashing its budget and the wages of state employees in a bid to rebalance a society that had run badly out of whack.

Latvia's deficit is supposed to hit 11.6% of GDP this year, significantly less than America's federal deficit of 12.9% of GDP.

Latvia isn't alone. Hungary is being forced by the IMF to reign in spending and cut payrolls despite having a much more modest deficit problem.

For three years Hungary has been struggling to reduce its wide budget gap, but in view of a deeper-than-expected recession that is ahead it managed to broker a deal with the IMF and Brussels to let the deficit run up to 3.9% of GDP this year and be cut only to 3.8% in 2010.

All of the conditions that currently plague America where the same conditions that got so many nations in Asia, Africa, and Latin America in trouble: too much debt, too large of trade deficits, too much deficit spending, and not enough savings.

Does that mean our foreign policy is wrong, or that our domestic policy is wrong, or that we are somehow special and the rules don't apply to us? I'm not sure if it is our foreign or domestic policy that is wrong, but surely one of them is.

One thing I can say for certain is that we are NOT special, despite our reserve currency status.

We are hypocrites.

If you think we can abuse our reserve currency status forever and it will never effect us negatively, think again.

Reason #3

The final reason why the "no other choice" premise is wrong is because this road has been walked down before, and it didn't work that time either. The people that walked down this road were the Japanese, and they are still stuck on this road.

“I thought America had studied Japan’s failures,” said Hirofumi Gomi, a top official at Japan’s Financial Services Agency during the crisis. “Why is it making the same mistakes?”

...

“I think they know how big it is, but they don’t want to say how big it is. It’s so big they can’t acknowledge it,” said John H. Makin, an economist at the American Enterprise Institute, referring to administration officials. “The lesson from Japan in the 1990s was that they should have stepped up and nationalized the banks.”

Supposedly the only lesson to be learned from Japan was to move quicker and more forcefully. Japan waited until 1998 to start recapitalizing their banks, just like our Treasury Department did last year.

However, here it is 10 years later and Japan's economy is still stuck in neutral despite immense deficit spending and multiple stimulus packages. It calls into question the idea that only thing we needed to learn from Japan was timing.

The Japanese crisis of the 1990s and early 2000s had roots similar to the American crisis: a real estate bubble that collapsed, leaving banks holding trillions of yen in loans that were virtually worthless.Many in Japan thought that low interest rates and economic stimulus measures would help banks recover on their own. In late 1997, however, a string of bank failures set off a crippling credit crisis.

Prodded into action, the government injected 1.8 trillion yen into Japan’s main banks....

Fearing more bad news if banks were forced to disclose their real losses, Japan’s leaders allowed banks to keep loans to “zombie” companies on their balance sheets.

Japan, instead, experimented with a series of funds, in part privately financed, to relieve banks of their bad assets.

The funds brought limited results at best, says Takeo Hoshi, economics professor at the University of California, San Diego.

All of these steps we have either tried, or are currently trying now. Why do our politicians, economists and media pundits think that we will succeed where Japan failed?

It appears that the real lesson to be learned here is that if you want to avoid a painful depression that you shouldn't let the economy get saturated in debt. In order to do that, you must not let credit and money get cheap beforehand.

Yet it appears that our present "solution" is to cheapen money further, and the people most responsible for the bubble, the Federal Reserve, are to be given even more power, while the same bankers remain in charge of the banks.

Like France's Bourbon Kings of old, we have "learned nothing and forgotten nothing".

Comments

We never tamed the financial oligarchy.

The financial oligarchy has essentially gotten off scott free. Nothing has changed. In fact many underlying factors that make financial conglomerates balance sheets still toxic remain. Unemployment exceeding "worse case" scenario on "stress test" is just an example that things may actually get worse. Fed and Treasury is hoping the zombie banks can earn their way out of this mess. That will extremely difficult thing to do with unemployment over 11%.

The time for dramatic action has long past. Now, we sit and wait and hope for the best. Just like the "Lost Decade".

RebelCapitalist.com - Financial Information for the Rest of Us.

How about this for "learn nothing":

Goldman Sachs on pace for Record Bonuses

Nothing changed. The sad thing is that it is working class people who are hurt the most by these economic crises. I do believe we have established a "new" normal for economic growth. We can adjust to that but it is the financial oligarchy and financial conglomerates that can't afford to adjust so they, with the help of Fed and Summer/Geithner, will try to re-inflate the asset and credit bubbles. That is the only way that they can survive.

RebelCapitalist.com - Financial Information for the Rest of Us.

GAO report on TARP

The GAO just implied while there are some indicators they really cannot for certain assess the effectiveness of TARP.

See the this Instapopulist, GAO - June 2009 TARP Report.

So, I have to agree, now it's just being spun that the TARP and all of the bail outs saved the day, but where is the definitive proof?

Now Congress is talking about a $15k tax credit to buy a home (let's re-inflate the bubble and fraud shall we?) and Dean Baker called out the obvious manipulations and housing flips this could cause.

Relevant quote

I just found this.

"Jobless" recovery

Nice quote. I'm thinking some history on "jobless" recoveries vs. wage repression and how that affects the other EIs, the macro economic data is in order.

It is real pain but I also have a hypothesis that it's the "tipping point" to bring the entire economy down.

I think there is only so much squeezing the bone dry of the middle class and it's exceeded, yet unemployment is still categorized as "just a lagging indicator" and not weighted or the implications of this debacle not realized on the overall economic health.

In other words, my hypothesis is: when you screw the middle class you screw the country.

We don' need no stinkin' bailouts

Bonddad presented a simple graphic a year or so ago that showed the relationships of business, consumers and financial institutions. All must function for a stabile economy. When the major institutions that provide the financial services required for a functioning economy were faced with imminent collapse (due entirely to their own malfeasance) most of our political establishment panicked and bailed them out.

What was not brought forth at that time or since was that what had to be saved were not the institutions themselves but the functions they provided to the economy as a whole. The Federal Reserve did step in to facilitate the commercial paper market which reinforces the contention that the institutions were unnecessary. Thus AIG should have failed and have been broken into its solvent regulated insurance side and its insolvent unregulated CDS side. Federal monies would not have gone to Goldman or other institutions and had these failed their functions would have been broken up, sold to solvent institutions or taken over by the Government. Their toxic assets would have been sold in an orderly fashion for their market prices or maintained and backed by the Government if they were held behind deposits (money market funds for example). The stockholders, bondholders and executives would have eaten the losses. Fannie and Freddy had to be nationalized and, at some cost, could have continued facilitating the mortgage markets. Thus functions would be maintained and the bad apples culled just as when the FDIC closes a bank.