Before us we have the proposal to expand the powers of the Federal Reserve as the systemic risk regulator.

Consider this:

Thus within 18 months of taking office, Obama will likely have appointed five of the seven Fed governors . The central bank is designed to be independent from politics, so a president's best chance of influencing how the Fed will regulate banks or respond to economic changes is through these appointments.

The Federal Reserve acts independently of government, with pretty much only these appointments, each a 14 year term, and confirmation of each governor by the Senate.

Considering we cannot find out which institutions received Federal money or where the $12.82 trillion dollars of Federal Reserve financial commitments are, isn't this making the Democratic aspects of financial regulation even worse?

During the Bush administration we had then Treasury Secretary Hank Paulson, acting as CEO in Chief, strong arming banks and even Congress into passage and use of the TARP. No other ideas were seriously considered and Congress simply handed over the cash with a lot of scare tactic rhetoric.

Some of this occurred due to the assumption if Merrill Lynch was allowed to go bankrupt, the entire global financial system would collapse.

But is this assumption even true? The GAO has admitted in their latest report, they cannot ascertain the effectivness of TARP.

Now, again, building on the assumptions of contagion and system risk, proposals are developing to create a super czar of regulatory powers, assigned to the Federal Reserve.

Was the TARP even really necessary?

Something bad Lurking Under TARP:

Geithner's care-free attitude about banks repaying the government early defies a truth about the program: many banks were forced to take bailout cash to cover for troubled banks that truly needed it. The government, which never gave detailed criteria about what institutions would qualify for TARP cash, intentionally tried to create confusion around the program.

What about simply reinstating Glass-Seagall? (Alternatively repeal Gramm Leach Bliley) What about simply repealing the Commodity Futures Modernization Act?

What about that commission to even determine specifically how this all happened in the first place? Since this bill passed I have not heard a word on finance forensics. Instead hear we will have yet another major policy reform, perhaps the biggest reform in 50 years, ramrodded through Congress.

What bothers me most on financial regulatory reform is the lack of examining the regulatory system as a whole. While the focus is on systemic risk and contagion within the financial system, how about systemic risk by one regulatory agency running amok due to too much power, no oversight, corruption, poor leadership and/or no transparency?

Last information I have is contagion is not understood and assuredly the specifics of systemic risk are not either. Wouldn't it be better to actually comprehend these issues and carefully craft regulatory reform accordingly?

Creating a bureaucracy is a non-trivial event, yet finding even a flow chart for checks and balances in these proposals has been deemed a hunt in the Google outback.

While Congress is holding massive hearings, the actual legislative text is being written by the Obama administration.

Since we already know their game plan, this is not good. What's the point of having so many hearings if one is not going to craft legislation from the results?

The SEC, CFTC will now share regulation on derivatives, but what about the structure of those derivatives themselves? Many of these models, or financial innovation (which seemingly should be retitled financial obfuscation) are based on bad math, so what good is regulation when the actual thing being regulated is a work of fiction?

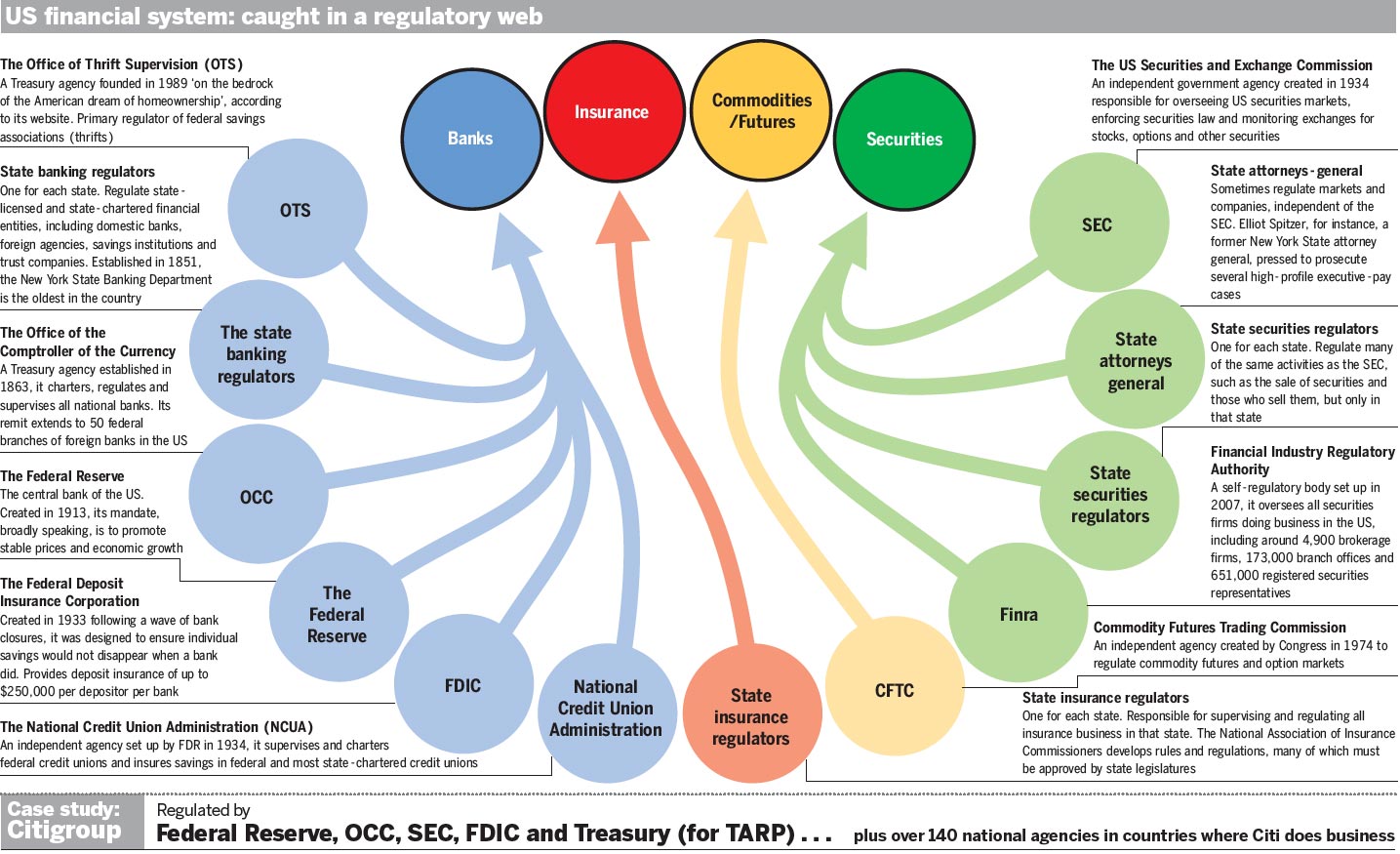

Here is the current regulatory flow chart Medusa:

Source: Financial Times, click image to enlarge

Believe this or not, there is no organizational flow chart on overall regulatory reform. It appears that the above chart will remain intact, with an additional layer of council of advisers to (cough) oversee the new powers of the Federal Reserve, the death for the Office for Thrift Supervision, and a creation of a new agency, the Consumer Financial Protection Agency.

But how all of these various regulatory bodies interact into a cohesive system is muddled as mystery meat pot roast.

How this does not pass even more power to the Federal Reserve, the Treasury and the executive branch is very unclear. Maybe that's the point of the design?

Comments

The Obama Administration is sacrificing

effectiveness for speed. This are half-ass measures, whether financial regulation or health care reform, I know that politics are driving this. I agree, we need to slow down and do this right the first time.

The regulatory regime needs a complete overhaul. There are too many overlapping jurisdictions then to add two new bureaucracies on top of that is crazy.

If we had the return of Glass-Steagall and reform the regulatory structure, we won't need a systemic risk regulator.

RebelCapitalist.com - Financial Information for the Rest of Us.

Consumer Financial Protection Agency

One thing that is under attack, which is a no brainer to add (a very good thing to do), is the Comsumer Financial Protection Agency.

I almost feel it is a deflection by corporate lobbyists in order to avoid the real regulation needed on the shadow banking system.

I would rather see a period of economic experimentation

The one thing that seems to me to prevent soft sciences from becoming hard sciences is an utter lack of experimentation. What little is done, is done on such a huge scale that you can't compare one experiment to another because there are simply not enough resources to support more than one experimental regulatory system at a time.

But in state's rights, we can fix this somewhat. Regulation of insurance companies is done at a state level- why not the rest of the economy as well? Make it *harder* to do interstate fraud by simply putting up some firewalls between the economies of the states; and make it a state, not a federal, job to regulate financials within the state.

THEN maybe we could get some real data to play with.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Can I get my $10 million grant

Will the Feds ever stop their spending spree?

Document Type: Grants Notice

Funding Opportunity Number: USAID-CAMBODIA-442-09-003-RFA

Opportunity Category: Discretionary

Posted Date: Jun 23, 2009

Creation Date: Jun 22, 2009

Original Closing Date for Applications: Jul 10, 2009

Current Closing Date for Applications: Jul 10, 2009

Archive Date: Aug 09, 2009

Funding Instrument Type: Cooperative Agreement

Category of Funding Activity: Education

Category Explanation:

Expected Number of Awards: 1

Estimated Total Program Funding: $10,000,000

Award Ceiling: $10,000,000

Award Floor: $10,000,000

CFDA Number(s): 98.001 -- USAID Foreign Assistance for Programs Overseas

Cost Sharing or Matching Requirement: Yes

Eligible Applicants

Unrestricted (i.e., open to any type of entity above), subject to any clarification in text field entitled "Additional Information on Eligibility"

Additional Information on Eligibility:

Agency Name

Cambodia USAID-Phnom Penh

WT#? is this?

They are giving $10 million dollars to ? educate Cambodians on ?

Seriously. But I would not be surprised in the least to see a host of grants/projects that are either special interest payback or make no sense.

Did you see over on noslaves.com that Washington just gave instate tuition to all foreign guest workers with less qualifying time than out of state U.S. citizens? Unreal, absolutely unreal

Here is th dot gov link - forgot it yesterday

Cambodia Basic Education

And the beat goes on..and on...

Seriously, there is no "Financial Regulatory Reform" - simply the consolidation of the banksters official and overt control. Both Prof. Michael Hudson and Nomi Prins have done outstanding critiques of President Obama's reform --- and to anyone who has read the paper presented thus far, it reads as if the American Securitization Forum had written it.

Ever since I heard that the ultimate offshoring evangelist, Diana Farrell (McKinsey Global Institute, author of phony study purporting the great profitability in offshoring jobs, and editor of: "OFFSHORING" - evangelizing offshoring to the max) had been appointed Deputy Director of the National Economic Council, it is abundantly obvious that this administration is not only continuing on the previous administration's policies, but has appointed EVEN MORE anti-worker, anti-union types.

The end game is the destruction of the American economy - for the way the derivatives markets are structured (that is, the way the largest insurance/banking/investment fraud in history is structured), the highest yield is only realized then.

Sorry to sound so pessimistic, but that's the reality.

McKinsey - conflict of interest

I note few fail to mention that McKinsey's other division makes there money by offshore outsourcing jobs...

Obama also put in place those who have promoted offshore outsourcing the government jobs in as "CIO/CTO" in chief.