By now we've all seen reports about the amazing stock market rally of 2009.

The widely followed stock market measure broke above 1,000 on Monday for the first time in nine months as reports on manufacturing, construction and banking sent investors more signals that the economy is gathering strength.

...

The day's reports were the latest indications that the recession that began in December 2007 could be retreating. Better corporate earnings reports and economic data propelled the Dow Jones industrial average 725 points in July to its best month in nearly seven years and restarted spring rally that had stalled in June.

If you listen to the financial news long enough you would know that the all-seeing, all-knowing stock market has declared the Great Recession to be over.

A 50% stock market rally is indeed impressive and unusual. In fact, it's been 80 years since the last time the stock market has moved so far, so fast.

It’s an amazing run-up throughout the last five months, but one that is also very similar to the five-month rally of 48% from November 1929 to April 1930, notes Miller Tabak equity strategist Peter Boockvar.That rally almost 80 years ago followed the initial crash, and was then followed by a deteriorating stock market and economy.

That's not to say that history will repeat itself, but it is a good example of a stock market rule-of-thumb: the sharpest and most violent stock market rallies always occur during a bear market.

So is this the start of a new bull market, or a bear market sucker's rally? To determine that we need to decide whether stocks are cheap or expensive.

If stocks are expensive then the amount of "upside" is limited. If they are cheap then the amount of "downside" is limited. Let's start by looking at the earnings reports that the financial media mentioned above.

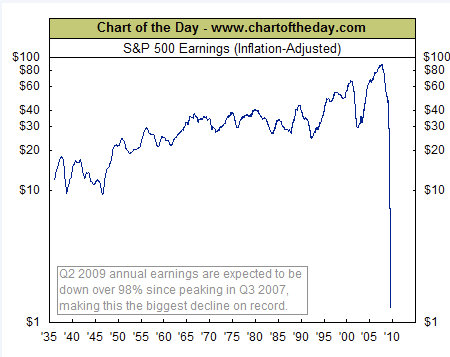

Looking at the earnings reports it is obvious that they've been a disaster. The reason why the financial media is bragging them up is because the earnings are "only" down about 30% when they were expected to be down 36%.

That's a reason for a relief rally, but not for the near euphoria you are seeing these days.

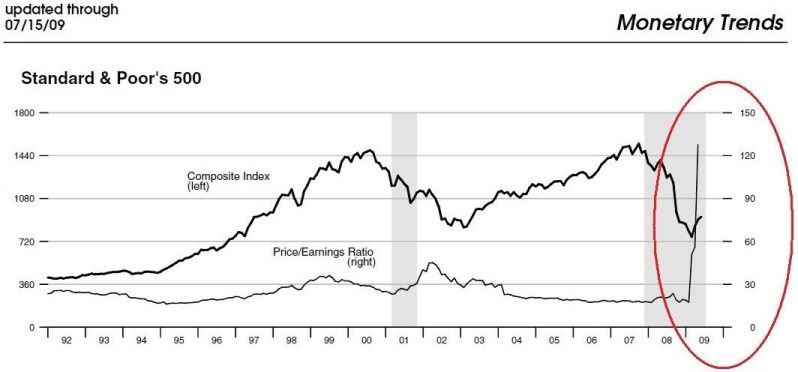

The ultimate way of determining whether a stock is cheap or expensive is comparing their earnings to their price, also called a P/E ratio (price/earnings).

The trailing P/E ratio has shot up to levels that I've never seen in my lifetime. To say that stocks are pricey is an understatement.

And it isn't just the S&P 500 stocks. Nasdaq 100 stock P/E's are also hitting the stratosphere.

The only way that prices like these can be justified is if the economy is about to roar back in the next 3 months in a way that the country hasn't seen in 26 years.

Is that likely to happen?

Personal income is falling. Home prices have fallen at a rate not seen since the Great Depression.

The commercial paper market is still frozen. The FDIC expects 500 banks to fail in coming months, mostly because the commercial real estate market is imploding.

The Federal Reserve predicts that high unemployment will cause the eventual economic recovery to be drawn out and weak for years to come.

Given that almost no one outside of the financial media believes the economy is about to bounce back, what does all the happy-talk about Green Shoots and recovery mean?

It means that the smart money, needs someone to sell to.

Wall Street insiders can't get rich off of each other. That would require talent and skill.

What Wall Street insiders need is what is affectionately known as "dumb money". They need money from 401k's, outsiders, and amateurs. In other words, they need your money to buy their stocks that have been bid up beyond all reason. They need money from people foolish enough to believe what the financial media is telling them.

Wall Street needs suckers.

Comments

But the stock market is "forward looking"

Whatever! S&P earnings is key. If you look at the composition of the earnings reports many companies met or exceeded targets based on cost cutting not earnings growth. Cost cutting only goes so far. Unless there is a huge reversal in the economic fortunes of Americans - earning growth will be non-existent for a while and any bull market will be just bullsh*t.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

these 1930 correlations are uncanny

as noted earlier to a dow jones post...

so another question for me asks what fueled the original 1930 suckers rally?

Today I saw even on pathetic corporate press kit hype machine CNBC discussion that the market will correct down again, based on PI, unemployment rate, consumer spending.

Question for the G man.

Robert just added "salted and barren" to the "???Shoots Poll". I guess his eyeballs started spinning in their sockets like mine did after reading this article. This Elliott Wave stuff is fascinating to me, but way over my head. Would you have a look at it please, and hopefully contradict it. I mean, how probable is a DOW approaching ZERO!?!

I agree that the fundamentals are woeful and I truly believe this is the sucker of all sucker rallies. I also read this article which is in total agreement with you and also explains why extreme volatility supports that conclusion.

Your further comments are much appreciated.

E-Wave

I'm not an Elliot Wave kind of guy. From what I can tell there are so many different ways of interpreting the data that its predictive ability is largely useless.

As for going to near zero, that isn't going to happen either, if only because the Fed and Treasury won't let it happen. I think inflation will keep the nominal prices up, even if the real prices decline.

But only in comparison to a dollar

Which, if the Fed and the Treasury were foolish enough to force that level of inflation, wouldn't be worth a Zimbabwean baked bean.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Super Safe Haven article & E-Wave stuff

Excellent article mention.

With the dramatically falling federal tax revenues - for the obvious reasons - and indicators that over the past ten years the majority of what little actual job creation took place was in the public sector - and with the contraction of service sector - again for the obvious reasons - and what actual private sector job creation takes place overseas (and that's not counting current jobs offshoring) - the consequences can only be dire!

Evidently none of the present crop of pseudo-economists (sorry, Mr. Oak) aren't familiar with Jean-Baptiste Say, or Henry Ford's wife's and accountant's philosophy on economics. (It's a loop - not a one-way pipeline.)

eh? I will pseudo respond

I think one topic I pound on, continually, is how global labor arbitrage is not only destroying the U.S. middle class but will eventually destroy the U.S. economy on a macro economic level.

Working hard to make that statement go from a general comment to actual proof from the statistics as well as economic theory itself.

Robert, the evidence is right in front of you.

Look no further than Dr. Thomas Palley's report:

America’s Exhausted Paradigm: Macroeconomic Causes of the Financial Crisis and Great Recession. I have read the report several times now and Dr. Palley makes a very compelling case for the destruction of the middle class or at least the dismantling of the mechanisms that allowed for the growth of the middle class.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

uh

you realize I Put up Palley in a FNV along with this report right?

What makes you guys think I'm not promoting those types of analysis? Are people not reading my actual posts, remembering every link, every summary, every policy push, every silly opinion?

;)

Shift that Paradigm baby!

From Palley's paper.

I'm thinking if EPers aren't realizing just how many posts and papers and so on I've spent hours typing up pushing for major trade, labor, immigration, offshore outsourcing, corporate governance, taxes and so on policy shifts....

maybe I'm doing something wrong here and we're not getting the spotlight on these major policy recommendations to promote them. I'm wondering what else to do (beyond try to go to some townhall, lobby the Congress critter and get nowhere) to highlight these needed changes.

Got to keep plugging away

Eventually people will hear. Besides, I believe that "the meek shall inherit the earth." I want to be on the side of the meek when they do.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Lack of oxygen, stovepiping, someone else's fault

Lack of oxygen -- I'm guessing a lot EPers are politically active and in Washington health care is sucking up all of the oxygen. Let's hope we're not all flat knackered when that's done, because this is even more difficult. Health care at least has a "known good" solution (that also happens to be off the table). And after this there are the even bigger problems of climate and energy.

Stovepiping. It's easy to get channeled. Recently Goldman Sachs has been catching a lot of ire (deservedly so). But as huge as they are they're a not that big a part of the problem. The Fed has been catching even more flak; they're a bigger part, but nowhere near the whole of it. Other big parts -- such as too flat a tax rate or too great a dependence on the stock market -- get hardly any discussion. There's a lot of anger, a lot of wallowing in righteous indignation, not so much seeing straight.

Someone else's fault: the big bad bankers, the bondholders, Goldman and Merrill and AIG; gov't regulation, ACORN, irresponsible poor people; China, India, illegal Mexicans. But the flaws are structural and will require the kind of change that comes once in a generation or two, and we find it really really hard not just to change but to acknowledge the necessity.

Credit markets frozen?

If credit markets (esp.commercial paper) are hungry, why is it so hard to get a decent return on money market funds? At this point, somebody will say "The Fed." But what does the Fed want us to do -- buy AIG shares? Oh, if Ben would only tell us!

Your choice of words suggests another mechanism

If this is a "sucker's rally", then who is being suckered?

Having gone through a forced liquidation of my stock market positions consequent to a divorce in 2004-2005 (Yes, it took that long. No, it was not initiated by me.) I have not been in the market in years. I suspect that many others were forced out by the crash and that the market is controlled by the institutions and market makers.

In that scenario, making money from betting on stock values becomes problematic without fresh, naive blood. The traditional approach of making money from dividends is not only long-despised by current market participants, but not an option given the weak economy and the continuing business credit crisis. So those who are controlling the stock market need to sucker in new investors ("suckers") by driving up prices to produce a rally.

The History

It would seem that more people need to pay more attention to history. Those who ignore it are doomed to repeat it. There could very well be trouble ahead. casino en ligne

If it's a suckers rally...

It's still a rally. I do not like to watch the tape, but it is working. Yes, the structure is rotten and Goldman Sachs is able to front-run, but it's not my orders they care about. Back when I was an investor, the green turned to red overnight and sucked the value out ever so quickly, but trading can work if you stay with the trend. What does this say about American capitalism? You can't trust those who run out "insitutions" -- they have deep conflicts of interest, but so what? It says the system does not give a crap about my trading account and my IRA, and that is why I don't mind being with the "dumb money" as long as it is working. Let GS exaggerate the volatility and kill the goose. Long term? Mr. Siegel can write about the long term till he's blue in the face, he can't extend my life expectancy and I want to do well in the short run. A rally is a rally is a rally, sucker or not.

What is your definition of WORKING?

With 11% of the country on food stamps and people unable to bury the dead, I'd rather have feudalism or communism than this definition of capitalism "working".

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Working...

My defintion of "working" is it increases my portfolio value. Do you really want feudalism? Or life under Uncle Joe and his KGB, or Kim Jong-Il? My original point is that the "institutions" have screwed investors so badly that you have to protect your assets -- that means you are in during a rally (even a fake one) and out during a decline. I don't view hedge-funds that are Fed-protected as "capitalism." It is state-sanctioned banditry -- they view you as a serf, and themselves as Masters of the Universe. In God we trust, all others cash.

Good luck with that one

Great for the few who are successful investors. Horrible for those of us who have been going into debt to finance the growth in your portfolio, which is the rest of the country. Many investors, also, are quite upside down on debt at this point, if you take into account their share of the governmental and trade deficits. Globalization will NEVER actually increase your portfolio value.

At least then we could use the guillotine for change. How do you change a government run by the banks, for the banks? Kill all the bank managers you want, the corporation will still go on. Even a peasant under communism has the chance, even though only a very small chance, to use assassination as the last resort- and the ruling class knows this and will do whatever it takes to keep the people happy/controlled enough not to end at that last resort.

But that fake rally- is being taken not from production, but rather, directly from exploitation of the lower classes, paid for with credit cards.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Fake rally is still a rally, just keep your swim suit on

Of course. I never meant to imply that I was a successful investor -- but I have to try and make back my losses. I wish we could all be prosperous, but all we can do is fight in the environment we have. I will turn bear as soon as I see this one start to crumble. Don't mistake trader talk for economics or politics.

Yes, the system perpetuates itself -- Michels told us that, and it's still true. Geithner is not placed where he is to accommodate us, nor is Uncle Ben.

Now I have seen communism up close, and it ain't pretty. Uncle Joe did not need the guillotine, he simply used mass starvation and labor camps. But it's amazing how fast those states can turn capitalist. Statues of Lenin near private businesses and global banks.

But here in the US, we have problems. It will get uglier before it gets better. But it will get better. Meanwhile,I ain't rich but I try not to get poorer -- as Sophie Tucker would say, "It's my duty."

Frank T.

Frank T.

I'd just rather have the openness

To try something else. But then again, I'm beginning to realize that I'm really an anti-progressive in many ways- that I represent the form of populism that says "Go ahead and write the rules, but then NEVER change them. Give us a foundation to adapt to on which we can build our lives."

That to me is a working economy- one that builds a status quo and then never changes. We've got enough bad things happening from nature and life- we don't need to add economic problems to it.

Sure, nobody will get rich that way- you need bubbles and busts to build wealth- but find some way for the rest of us who just don't care to "stop the pendulum, we want to get off".

I think my Asperger's affects a lot more of my opinions than I realize.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Living by the Rules

That may be too much to expect. No sooner do we get consensus on what's the "right thing to do" than we elect a crowd that wipes out usury laws and declares "Now everyone can have credit," but it's going to cost more. Inflation rears its head and the bankers suddenly want ARMs and resets. We elect a president who promises change, and we get more of the same with minor tweaks and the same crowd making decisions for us. AIG makes Uncle Ben angry, but he goes ahead and lets them pay 100 cents on the dollar to German banks and Goldman Sachs. Hey, at least somebody plays by the rules -- no "managed bankruptcy" for the Golden Boys, and no "Sorry fella, but you seem to be a victim of massive financial fraud -- be more careful who you deal with next time."

Well, what are friends for? If Bernie Madoff had only been in the insurance business, he might still be a free man.

Frank T.

Frank T.

More on corporate earnings

Would you believe the piss-poor earnings reports so far this year are actually fictional?

The article gives several examples. For example:

You would think that after all the Wall Street scandals, they would be a little more sensitive to BS accounting. But you would be wrong. The game continues.

this is the issue I have with "green shoots vs. brown weeds"

Honestly I don't really care who calls the recession bottom and when it happens...

precisely because the entire nation is defocusing on such the types of things like above.

Remember all of the fraud, scandals, ripoffs of the dot con era? Corporations got a slap on the wrist and then they all went and moved onto the real estate sector.

If there was ever evidence the U.S. needs dramatic regulatory and policy changes I'd say handing over $800 Billion of U.S. taxpayer dollars to Zombie banks and an "verge of Economic Armageddon" would be it.

But instead it's like they are trying to erase these events from memory....and want to continue with business as usual.

At least Bloomberg wrote about it, abet after the fact...I'll bet you won't see such a report on CNBC.

VIX futures predicting Sept. correction

VIX Signals S&P 500 Swoon as September Approaches .

I think more people should read EP. People here are writing posts and it's like two weeks later, we start seeing similar headlines in the MSM.