Remember that cash for clunkers success? Guess what? It looks like it added to the trade deficit, which in turn detracts from overall U.S. GDP.

That means we stimulated other national economies, not our own.

The trade figures for July 2009 have been released. The trade deficit jumped it's highest one month change since 1999 to $32 Billion.

The June to July increase in exports of goods reflected increases in automotive vehicles, parts, and engines ($1.3 billion); capital goods ($0.7 billion); industrial supplies and materials ($0.4 billion); consumer goods ($0.4 billion); and other goods ($0.2 billion). A decrease occurred in foods, feeds, and beverages ($0.4 billion).

The June to July increase in imports of goods reflected increases in automotive vehicles, parts, and engines ($2.4 billion); consumer goods ($1.7 billion); industrial supplies and materials ($1.4 billion); capital goods ($1.3 billion); and other goods ($0.2 billion). A decrease occurred in foods, feeds, and beverages ($0.1 billion).

Of all of the components on the trade deficit (see tables) autos was by far the largest jump. We also know that Toyota sold the most in the cash for clunkers program while overall sales for GM and Chrysler were down.

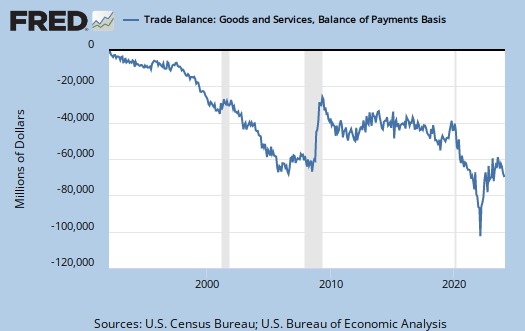

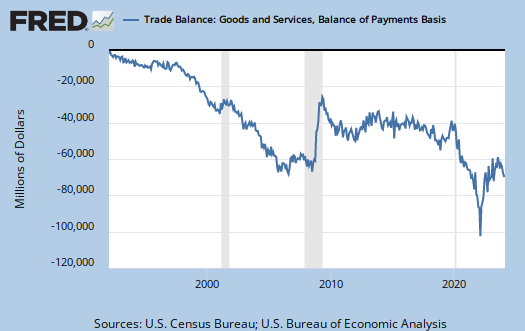

Below are some graphs of the trade deficit.

So, firstly you can see the ballooning trade with this deficit graph of goods and services over the last 17 years. Note the zero BN (before NAFTA) and also recall 83% of the non-petroleum deficit is with China.

Now you can see from the above balance, zeroing in on this recession, global trade really curtailed, which actually helped U.S. Q2 2009 GDP figures.

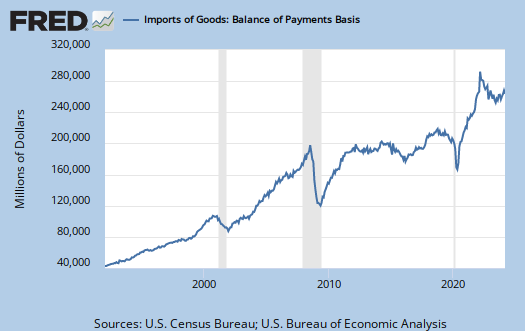

But here is just imports of goods:

and exports of goods:

While both have dropped off dramatically in this recession, you can see, until now, an increase in import drop off relative to exports.

So, somehow I don't think returning to a ballooning trade deficit is really good news for the U.S. economy. A ballooning trade deficit doesn't means jobs for Americans, a revitalized U.S. manufacturing sector and sustainable long term growth.

Forum Categories:

| Attachment | Size |

|---|---|

| 390.65 KB |

Well...

You can't just take exports - imports to get GDP growth; Cash for clunkers increased local demand increasing GDP as well. The trade deficit can't be avoided. The American dollar being the de fact world currency and the American people being the defacto world consumers makes it cheaper to import goods. It will hurt us down the line, but not now.

A booming trade deficit means a rise in retail jobs, services, economic confidence, and consumption. All are beneficial things.