The March 2013 S&P Case Shiller home price index shows a 10.9% price increase from a year ago for over 20 metropolitan housing markets and a 10.3% change for the top 10 housing markets from March 2012. This is the highest yearly gain since April 2006. Prices are soaring at the same pace as the housing bubble return. Not seasonally adjusted home prices are now comparable to October 2003 levels for the composite-20 and December 2003 for the composite-10. Below is the yearly percent change in the composite-10 and composite-20 Case-Shiller Indices, not seasonally adjusted.

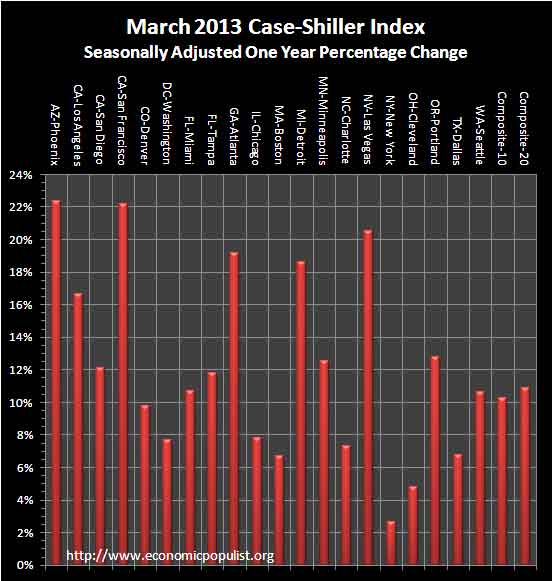

Below are all of the composite-20 index cities yearly price percentage change, using the seasonally adjusted data. All city home prices have had positive gains for three months in a row. Phoenix prices just keep soaring, up 22.4% from a year ago and Las Vegas, ground zero for the housing bubble, is up 20.6%. San Francisco is now up 22.3%, back to it's have and have not housing market where one needs to be a millionaire to own a home. Twelve of the 20 cities saw double digit annual home price increases in their respective areas. Double digit gains imply the housing bubble has been re-established as home prices are clearly out of reach again for most.

S&P also produces a third national index. S&P is using the not seasonally adjusted national index when they report Q1 2013 home values are up 10.2% from Q1 2012, although the seasonally adjusted change is the same. Below is the national index, not seasonally adjusted (blue), which are used as the headline numbers, against the seasonally adjusted one (maroon).

Below is the quarterly national index percent change from a year ago. The seasonally adjusted change was 7.3% from Q4 2011 to Q4 2012. From Q3 2011 to Q3 2012 the change was 3.6%. The national index also shows soaring prices and a return to not affordable housing.

S&P reports the not seasonally adjusted data for their headlines. Housing is highly cyclical. Spring and early Summer are when most sales occur. See the bottom of this article for their reasoning. For the month, the not seasonally adjusted composite-20 percentage change was 1.4% whereas the seasonally adjusted change for the composite-20 was 1.1%. The monthly not seasonally adjusted composite-10 percentage change was 1.4%, whereas the seasonally adjusted composite-10 showed a 1.4% increase as well. This is still winter really, so the not seasonally adjusted increase being higher than the seasonally adjusted composite-20 implies even more market bubbling. The below graph shows the composite-10 and composite-20 city home prices indexes, seasonally adjusted. Prices are normalized to the year 2000. The index value of 150 means single family housing prices have appreciated, or increased 50% since 2000 in that particular region. Case-Shiller indices are not adjusted for inflation.

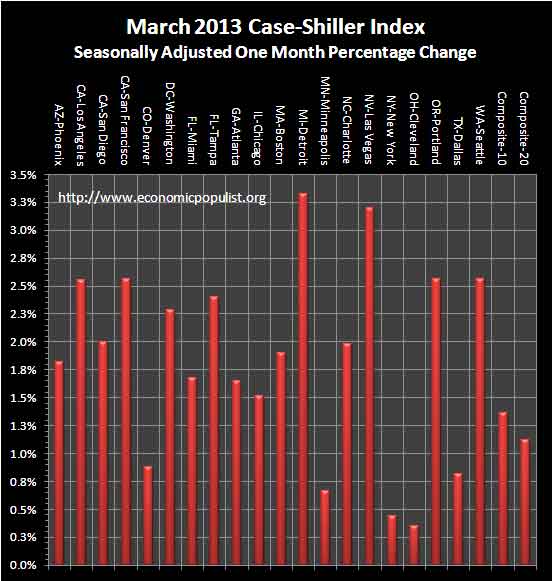

Some in the press use the seasonally adjusted data, and others do not. Some report the monthly change, others the annual change. S&P themselves use the not seasonally adjusted housing price data. To make matters worse, some in the press do not specify which statistic they are quoting from S&P. Below are the seasonally adjusted monthly home price percentage changes for each City reported by S&P. According to S&P, five areas had the highest monthly gains in seven years using the not seasonally adjusted indices: Charlotte, Los Angeles, Portland, Seattle and Tampa.

Below are the seasonally adjusted indices for this month. The index itself tells you what has happened to home prices, per city, from the year 2000. Only Detroit is below their 2000 home price values with Atlanta just barely at 2000 price levels.

S&P estimates home prices are down approximately 28-29% from the height of the housing bubble's June and July 2006 price peaks. These statistics use the not seasonally adjusted home price indices. The question now is who is buying up all of these homes? Somehow we do not believe institutional investors making fast profits means the housing market has returned to healthy levels. To wit, the Census released homeownership rates and for Q1, they are down to Q4 1995 levels. Rents are also increasing. Both of these metrics do not support your average person buying a home and instead to institutional investors and potentially inventory being kept off the market, such as bank owned foreclosures.

To Season or Not to Season, That is the Question:

The S&P/Case-Shiller Home Price Indices are calculated monthly using a three-month moving average and published with a two month lag. Their seasonal adjustment calculation is the standard used for all seasonal adjustments, the X-12 ARIMA, maintained by the Census.

So, why would S&P report the not seasonally adjusted data? According to their paper on seasonal adjustments, they claim the not seasonally adjusted indices are more accurate. It appears the housing bubble burst screwed up the cyclical seasonal pattern. What a surprise, although those steep cliff dives are now going back to 2009, one would think the seasonally adjusted data would now start to converge back to it's cyclical, seasonal pattern.

The turmoil in the housing market in the last few years has generated unusual movements that are easily mistaken for shifts in the normal seasonal patterns, resulting in larger seasonal adjustments and misleading results.

To see S&P's argument in action, look at the below graph. The maroon line is the seasonally adjusted national index, reported quarterly. The blue line is the not seasonally adjusted national index. As we can see before the housing bubble burst, we see a typical cyclical pattern difference between the seasonally adjusted and not seasonally adjusted data points. Yet after the bubble burst we see large swings, which would throw off a seasonal adjustment adaptive algorithm. This is going to become a major question among statisticians, how does one adjust for seasonality in the face of tsunami like economic events?

Not seasonally adjusted data can create more headline buzz on a month by month basis due to the seasonality of the housing market. S&P does make it clear that data should be compared to a year ago, to remove seasonal patterns, yet claims monthly percentage changes should use not seasonally adjusted indices and data. This seems more invalid than dealing with the statistical anomalies the massive housing bubble burst caused. Below is the seasonally adjusted and not seasonally adjusted Composite-20 Case-Shiller monthly index, for comparison's sake.

For more Information:

S&P does a great job of making the Case-Shiller data and details available for further information and analysis on their website.

Here is our Case-Shiller past overviews as well as the overviews of residential real estate statistics.

Recent comments