Canadian and Australian Pension Funds Formalize the Cap Invest Initiative

Bryan McGovern of Benefits Canada reports Canada’s largest pension funds joining Australian peers to increase investments in both countries:

Bryan McGovern of Benefits Canada reports Canada’s largest pension funds joining Australian peers to increase investments in both countries:Canada’s largest pension funds are joining an initiative that aims to boost pension investments between Canada and Australia.

The Canadian-Australian Pension Funds Investment Initiative, announced Wednesday during Prime Minister Mark Carney’s visit to Australia, will create a framework for pension funds in the two countries to discuss policy barriers and associated solutions to improve the current business environment.

The agreement includes participation from the Alberta Investment Management Corp., the British Columbia Investment Management Corp., the Caisse de dépôt et placement du Québec, CPP Investments, the Healthcare of Ontario Pension Plan, the Investment Management Corp. of Ontario, the Ontario Municipal Employees’ Retirement System, the Ontario Teachers’ Pension Plan and the Public Sector Pension Investment Board.

The participating Australian pension funds include the Australian Retirement Trust, AustralianSuper, Aware Super, CareSuper, the Construction and Building Unions Superannuation, HESTA, Hostplus and the Retail Employees Superannuation.

“We seek to contribute our experience, knowledge and relationships to the mutual benefit of CAP Invest Initiative participants, as this initiative upholds constructive engagement that will help support stable, investable markets over the long run,” John Graham, president and chief executive officer at CPP Investments, said in a press release.

The deal, which was facilitated by IFM Investors, will also require building awareness of investment models that leverage the expertise of long-term and reliable pension capital investors, according to a press release.

“I’m proud of the strong relationships our team has built in Australia and excited about the role we can continue to play through this initiative,” Deborah Orida, president and CEO at PSP Investments, said in a statement. “For more than a decade, Australia has been an important market for us.”This agreement will build the natural partnership between the two countries and putting long-term pension capital to work in both countries, said Ken Luce, executive director Canada at IFM Investors, in an emailed statement to Benefits Canada.

“Both countries have world-leading pension systems and stable, open economies. There’s a real opportunity to deepen collaboration, address barriers where they exist and make it even easier to invest long term in opportunities that benefit working and retired Canadians and Australians alike.”

Freschia Gonzalez of Benefits and Pensions Monitor also reports Canada and Australia pensions strike first-of-its-kind cross-border investment pact:

Canada and Australia are tying together two of the world’s largest retirement systems through a new investment pact that aims to push more pension capital into both markets.

More than a dozen Canadian and Australian pension giants have entered a first-of-its-kind memorandum of understanding (MOU) under the Canadian-Australian Pension Funds Investment Initiative (CAP Invest Initiative).

CPP Investments said the initiative asks leading pension investors to make a voluntary commitment “to facilitate dialogue on investment environments and policy barriers to generate solutions that unlock greater opportunities for value creation.”

Bloomberg reports that the MOU was announced in Sydney during Canadian Prime Minister Mark Carney’s visit to Australia and is the first agreement between the two pension systems.

Under the arrangement, funds will cooperate to channel more pension capital into opportunities in both markets, according to a statement from eight of Australia’s largest pension funds cited by Bloomberg.

Signatories include AustralianSuper, which manages A$410bn (US$289bn), and the Canada Pension Plan Investment Board, with $781bn (US$571bn) in assets, along with eight other major Canadian funds.

Canada operates the world’s second-largest pension system, while Australia’s A$4.5tn pool is No. 4, and Canada’s system is forecast to reach $8tn while Australia’s is projected to swell to A$11tn by 2040, according to the same statement cited by Bloomberg.

CPP Investments said the CAP Invest Initiative “fosters collaboration among participating pension and investment funds in Canada and Australia, with millions of contributors and beneficiaries in both countries.”

While tailored to these markets, the underlying practices “such as structured engagement, identification of opportunities and shared learnings, are the same disciplines that support success across other regions where CPP Investments operates.”

The organisation added that continuing to build strategic relationships between participants aligns with its commercial activities internationally.

CPP Investments president and CEO John Graham said the fund will use its experience, knowledge and relationships to contribute to the CAP Invest Initiative.

He described CPP Investments as “an established global investor” and said the initiative aims to support stable, investable markets over the long term.

Bloomberg reports that Carney’s government is seeking funding for large-scale infrastructure projects — including ports, rail and pipelines — as Canada looks to cushion its economy against US President Donald Trump’s protectionist policies, and that the Canadian leader has toured the globe in recent months searching for capital to help fund those ambitions.

The new agreement is “underscoring support for ongoing cooperation between Canada and Australia in the interest of mutual value creation,” CPP Investments said in a separate statement, as cited by Bloomberg.

Australian funds, supported by mandatory retirement contributions set at the equivalent of 12 percent of wages, are steadily increasing offshore investments, with roughly half of the country’s pension assets invested abroad and that share expected to rise as managers pursue larger deals.

The Australian funds’ statement said there is “fertile ground” for investment between Canada and Australia and that the agreement will facilitate dialogue with governments on policy barriers to improve the business environment for investment.

The MOU will “unlock greater long term capital for private investment on behalf of millions of working and retired people,” the statement added, according to Bloomberg.

Through its participation in the CAP Invest Initiative, CPP Investments said it supports a collaborative framework for information-sharing among partners that “enhances collective learning and contributes to the prudent deployment of patient capital, in the ultimate service of delivering strong returns for CPP contributors and beneficiaries.”

Darcy Song of Top1000Funds also reports infrastructure at the heart of Canada-Australia pension fund pact:

A group of major Canadian pension funds, including the Maple 8, has entered a high-powered memorandum of understanding with top Australian superannuation funds to lobby for policy changes that would help fast-track investments in both countries.

The deal, brokered by industry super fund-owned asset manager IFM Investors and known as the Canadian-Australian Pension Funds Investment Initiative (CAP Invest Initiative), is a first-of-its-kind deal between two of the world’s largest pension markets which are expected to manage $13.9 trillion in fiduciary capital by 2040 collectively.

The announcement came as Canadian Prime Minister Mark Carney began his four-day diplomatic visit to Australia in Sydney this Tuesday with the aim of bolstering the connection between the two so-called ‘middle power’ countries.

He attended a breakfast event hosted by IFM Investors in Sydney on Wednesday morning alongside Canadian Finance Minister François-Philippe Champagne, Australian Minister for Financial Services Daniel Mulino, as well as a slew of Australian and Canadian pension fund executives who have signed the MoU.

While the agreement does not commit to a specific dollar amount to be deployed by the pension funds in both nations, with IFM Investors chair Cath Bowtell characterising it as a “MoU for partnership”, enabling infrastructure investments in both nations will be a significant focus of the deal.

“Our job through this partnership is to really look at the frictions that are prohibiting us from making those deployments, and see whether we can work with governments at the national and sub-national level to eliminate those frictions,” Bowtell said at a press conference in Sydney.

IFM has been speaking about the need to unlock private-public partnerships for some time, including at last year’s Top1000funds.com Fiduciary Investors Symposium at Stanford (See Public-private partnerships key to fixing US infrastructure).

Funds in both systems are major sources of capital for real assets around the world. Canadian pension funds are known for having significantly diversified private markets exposures enabled by the famous “Canadian model” which emphasises independent governance and large-scale, in-house investment management.

Australian pension funds have invested heavily in Australian infrastructure since the 1990s as the government privatised transport, utilities and telecommunications assets, making them an early mover in the asset class.

Australian and Canadian pension funds are among the largest allocators to infrastructure globally with the average fund in Australia allocating 6.8 per cent and those in Canada allocating 10.1 per cent, according to a Macquarie Asset Management report – well above investors in other countries.

“We seek to contribute our experience, knowledge and relationships to the mutual benefit of CAP Invest Initiative participants, as this initiative upholds constructive engagement that will help support stable, investable markets over the long run,” John Graham, president and chief executive of CPP Investments, said about the partnership.

Setting the policy agendaAs savings flow into Australia’s A$4.1 trillion ($2.8 trillion) defined contribution system, super funds are seeking opportunities in deeper overseas markets such as the US and the UK. This means they have both a collaborative and competitive relationship with their global peers which are often much larger in size, especially around sourcing and accessing deals.

AustralianSuper is the biggest fund in Australia with A$410 billion ($294 billion) in assets under management, and large offices in both New York and London. The fund is projected to grow to A$700 billion by 2030 and A$1 trillion not long after. It is expected that 70 per cent of new flows will be invested offshore. (See Behind AustralianSuper’s global expansion)

A delegation of super fund executives and lobbyists embarked on a soft power mission to Washington and New York last February, and are being hosted by Australian Ambassador to the US Kevin Rudd in Silicon Valley, New York and Washington next week, to foster greater relationships with US investment partners. US Treasury Secretary Scott Bessent remarked to the super funds that “the confidence you have in the growth is not what one might expect for Australia”.

IFM Investors is a crucial vehicle of super funds’ push for global influence due to its ownership structure and significant mandates with global asset owners. Most recently, NEST, the UK’s largest defined contribution fund, became a shareholder of IFM and committed to invest £5 billion through IFM Investors by 2030. (Inside Nest’s serendipitous deal for IFM stake.)

IFM Investors’ head of global external relations David Whiteley previously said Australian funds must take a collective approach to compete effectively with giant pension funds in North America, Europe, the Middle East and Asia for better access to global investment opportunities.

The infrastructure manager’s UK leaders include former Labour Member of Parliament and Shadow Minister of State for Pensions Gregg McClymont.

In 2024, IFM Investors made a move to influence policymaking in a foreign country, leading a consortium of pension funds in pressuring the UK government to unclog its stagnant pipeline of infrastructure deals, especially around energy transition.

Meanwhile, former president and CEO of CPP Investments and former chair of AIMCo, Mark Wiseman, is now the Canadian Ambassador to the US.

Canadian funds that signed up to the CAP Invest Initiative include AIMCo, BCI, La Caisse, CPP Investments, HOOPP, IMCO, OMERS, OTPP and PSP Investments. On the Australian side, the signatories are Australian Retirement Trust, AustralianSuper, Aware Super, CareSuper, Cbus Super, HESTA, Hostplus and Rest, as well as IFM Investors.

On Wednesday, CPP Investments issued this press release stating it has entered the CAP Invest Initiative Memorandum of Understanding:

Toronto, ON (March 3, 2026) – Canada Pension Plan Investment Board (CPP Investments) today announced it has entered into a Memorandum of Understanding (MOU) under the Canadian-Australian Pension Funds Investment Initiative (CAP Invest Initiative), underscoring support for ongoing cooperation between Canada and Australia in the interest of mutual value creation.

The CAP Invest Initiative defines a voluntary commitment among leading pension investors to facilitate dialogue on investment environments and policy barriers to generate solutions that unlock greater opportunities for value creation.

The CAP Invest Initiative fosters collaboration among participating pension and investment funds in Canada and Australia, with millions of contributors and beneficiaries in both countries. While tailored to these two markets, the underlying practices such as structured engagement, identification of opportunities and shared learnings, are the same disciplines that support success across other regions where CPP Investments operates. Continuing to build strategic relationships between the participants of the CAP Invest Initiative aligns with CPP Investments’ commercial activities internationally.

“CPP Investments is an established global investor with a strong track record of deploying significant, patient capital into high-quality, economically productive assets. We seek to contribute our experience, knowledge and relationships to the mutual benefit of CAP Invest Initiative participants, as this initiative upholds constructive engagement that will help support stable, investable markets over the long run,” said John Graham, President & CEO, CPP Investments.

Through participation in the CAP Invest Initiative, CPP Investments supports a collaborative framework for information-sharing among partners that enhances collective learning and contributes to the prudent deployment of patient capital, in the ultimate service of delivering strong returns for CPP contributors and beneficiaries.

For its part, PSP Investments issued this press release on the CAP Invest Initiative Memorandum of Understanding:

Montréal, Canada (March 3, 2026) — The Public Sector Pension Investment Board (PSP Investments) today announced it has entered into a Memorandum of Understanding (MoU) under the Canadian–Australian Pension Funds Investment Initiative (CAP Invest Initiative), marking PSP Investments’ participation in a voluntary framework that strengthens collaboration between Canadian and Australian long-term pension investors.

The CAP Invest Initiative was launched today by leaders of some of the largest pension investors in Australia and Canada, in the presence of Prime Minister Mark Carney, the Canadian Minister of Finance and National Revenue, François-Philippe Champagne, and the Assistant Treasurer of Australia, Daniel Mulino. It aims to facilitate dialogue with governments on policy barriers and associated solutions to improve the business environment for investment in each jurisdiction. This collaboration will unlock greater long-term capital for private investment on behalf of millions of working and retired people in both countries.

The CAP Invest Initiative reflects the natural alignment between Canada and Australia. With a shared heritage, open and resource-rich economies, strong credit worthiness, and reliable and transparent legal institutions, PSP Investments believes there is fertile ground to bolster opportunities for investment between Canada and Australia.

“I’m proud of the strong relationships our team has built in Australia and excited about the role we can continue to play through this initiative,” said Deborah Orida, President and Chief Executive Officer of PSP Investments. “For more than a decade, Australia has been an important market for us. This Memorandum of Understanding strengthens cooperation among like-minded long-term investors and helps create the conditions for durable value and essential infrastructure that supports people and communities.”

Through the MoU, signatories also commit to building awareness of investment models that leverage the expertise of long-term and reliable pension capital with the objective of delivering risk-adjusted returns for working and retired people and value for investee companies.

Alright, big pension news to cap Prime Minister Mark Carney's successful visit to Australia.

So what is this Memorandum of Understanding (MoU) under the Canadian–Australian Pension Funds Investment Initiative (CAP Invest Initiative) all about?

Basically, it's a framework where Canada's largest pension funds (Maple 8 + IMCO) and Australia's largest pension funds will collaborate and exchange ideas to strengthen their pension systems and engage policymakers on what investable opportunities they are looking to invest in.

That's the broad picture. In essence, I agree with the article above that this is all about unlocking opportunities in infrastructure so Canada and Australia's largest pension funds can invest.

Keep in mind, Canada's largest pension funds already invest billions in Australia, mostly in infrastructure but also in real estate, natural resources (where PSP Investments and OTPP have a significant portfolio) and elsewhere.

In fact, Australia is way ahead of Canada in terms of creating the right opportunities for foreign investors to invest in infrastructure and other real assets and we can learn a lot from them.

Again, all of Canada's large pension funds have significant investments in Australia and even issue bonds denominated in Australian dollars, the same cannot be said of Australian pension funds investing in Canada.

Where will the CAP Invest Initiative head and who will nurture it and communicate with stakeholders?

I have no idea, it's all based on voluntary participation, there are no fixed targets, nobody "owns" it but it's clear there will be political pressure on both sides to continue the dialogue and share ideas/ build collaboration.

Alright, that's it from me, my week off turned out to be more work than I wanted (the drawback of being a one-person operation).

Below, Prime Minister Mark Carney delivers a speech to Australia's parliament in Canberra, the second Canadian prime minister to do so in the last 20 years.

Great speech, take the time to listen to it.

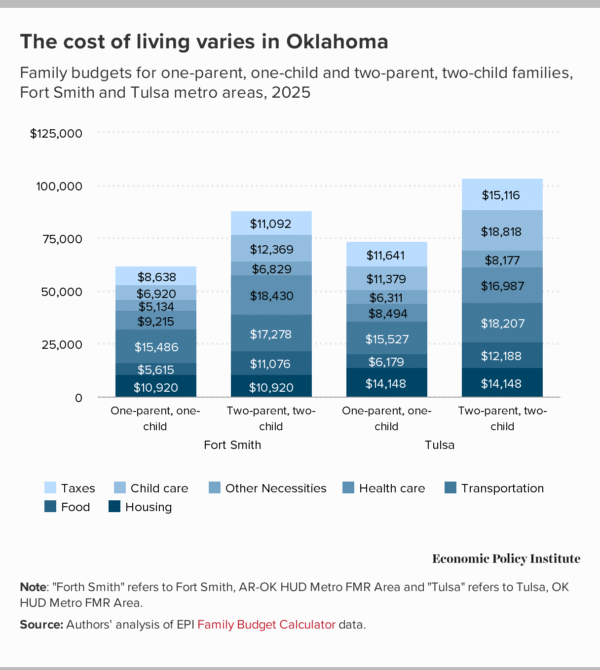

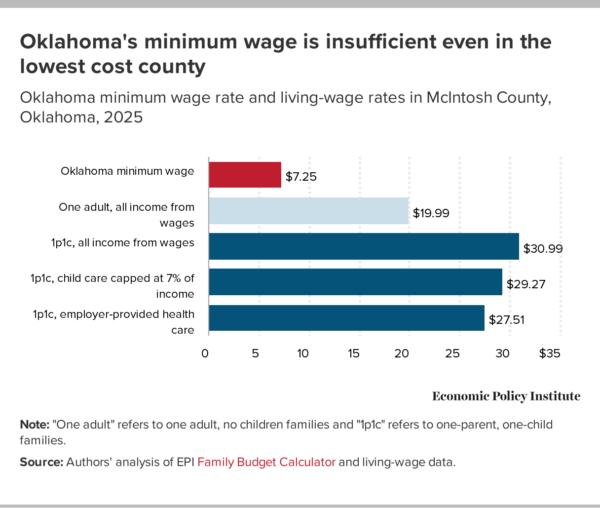

The Family Budget Calculator can be used to calculate living wages

The Family Budget Calculator can be used to calculate living wages

Oklahoma needs a higher minimum wage

Oklahoma needs a higher minimum wage

Recent comments