The Turkish people elected a new government in 2002.

Recep Tayyip Erdoğan became Prime Minister after his AK Party gained an absolute majority in the nation's unicameral legislature. Erdoğan and AK have governed continuously from 2002 through the present.

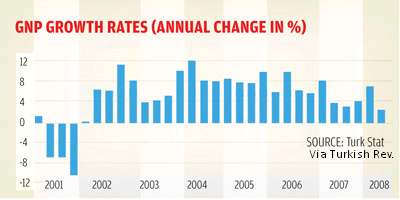

The annual change in gross national product (Graph, Turkish Review, January 2011) developed through Turkish management of the economy.

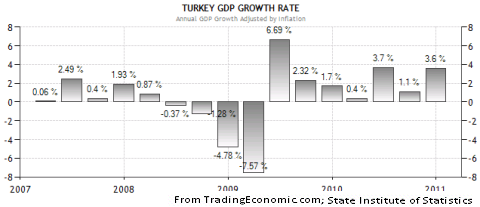

During the critical period that included the global recession, Turkey fared better than most industrial nations. (Trading Economics)

Negative growth hit Turkey in only three quarters, with a solid rebound starting in 2009. Forth quarter 2010 economic growth was 9.2%. Only China led Turkey during that time with 9.8% growth.

The International Monetary Fund (IMF) announced an end to its formal agreement with Turkey in 2010. In fact, the Turks ended IMF involvement with economic management in 2007 when they rejected IMF's "austerity" requirements for a stand by loan. Since that time, Turkey has paid off 75% of its IMF debt and managed the economy without IMF help.

Highlights - How they did it

Recent comments