The Social Security administration announced there will be a 1.5% increase in social security benefits next year. The cost of living adjustment is fairly low, but if chained CPI had passed Congress and was used, the situation for social security increases would be much worse. The 2014 low increase in benefits should be no surprise for the official inflation figures have been tame.

Monthly Social Security and Supplemental Security Income (SSI) benefits for nearly 63 million Americans will increase 1.5 percent in 2014. The 1.5 percent cost-of-living adjustment (COLA) will begin with benefits that more than 57 million Social Security beneficiaries receive in January 2014. Increased payments to more than 8 million SSI beneficiaries will begin on December 31, 2013.

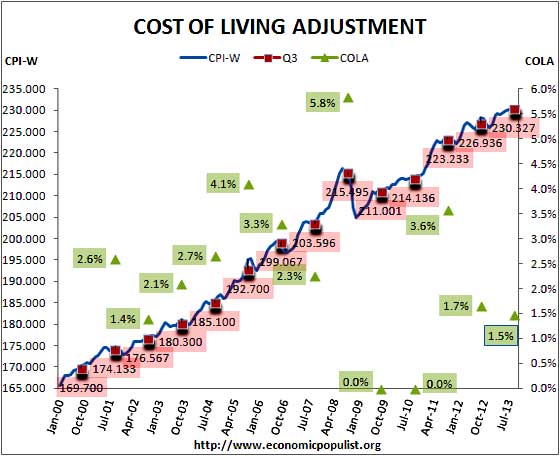

COLA stands for cost of living adjustment. The below graph shows the COLA, (cost of living adjustment) per year in green including the 2014 1.5% COLA increase. CPI-W stands for the consumer price index for wage earners and is used to calculate COLA. The CPI-W monthly figures are in blue and are not seasonally adjusted numbers. The third quarter CPI-W values, used to calculate COLA, are graphed in red.

The COLA, or Cost of Living Adjustment is a strange brew indeed in how it is calculated. The COLA is taken from not seasonally adjusted CPI-W data, using only the previous year's third quarter, i.e. the months of July, August and September, to calculate. The magic formula for how increases are calculated, upon which so many depend, is:

The average CPI-W for the third calendar quarter of the prior year is compared to the average CPI-W for the third calendar quarter of the current year, and the resulting percentage increase represents the percentage that will be used to adjust Social Security benefits beginning for December of the current year. SSI benefits are adjusted by the same percentage the following month (January).

Notice in the above graph how low a 1.5% increase is in comparison to most years. Also notice the big drop around 2008 for the consumer price index for wage earners (CPI-W), the blue line. That's when the great recession deflation hit and resulted in no increase in benefits for two years in a row. Earlier we warned on some in the press trying to second guess what the cost of living increase would be but, they got lucky on their 1.5% claim. Now here it is, COLA is finally announced after the delay due to the government shutdown and we have yet another low figure to adjust for the cost of living for over 63 million Americans. The thing is, if Congress and the Obama administration have their way, cost of living adjustments for social security could be much, much worse

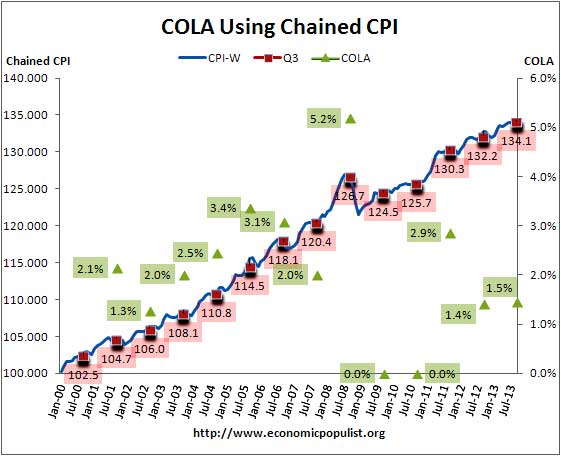

Below is a graph showing what COLA would be if chained CPI was used instead of CPI-W, as it is now. Chained CPI is the proposed bait and switch inflation measure Congress and Obama want to use to adjust for inflation on a host of government benefits. The graph is the same as above, COLA is in green the calculation is still the third quarter.

While the cost of living adjustment using chained CPI or the currently used CPI-W result in a 1.5% increase for 2014, we can see from the above graph, that typically is not the case. Over time, using chained CPI to calculation cost of living needs and the effects of inflation result in less money for beneficiaries.

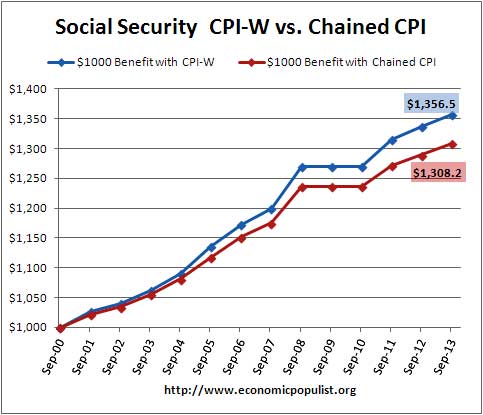

Take the below graph for example. We start out with someone receiving $1000 dollars in social security benefits every month. Look at what happens when chained CPI instead of CPI-W is used as an inflation measure to calculate COLA. Over time chained CPI has the effect of reducing social security benefits for people. Trust us, the grocery store and gas station could care less what chained CPI says inflation really is, their prices are going to increase no matter what, while people on fixed incomes are left holding the less money for them bag.

One thousand dollars a month is below average of the monthly social security check most workers have earned. The greater the monthly base amount the social security benefit is, the less money someone gets to adjust for inflation in coming years using chained CPI.

COLA isn't just used to adjust for inflation on social security benefits, but for all government transfer payments of any kind. Most people in the United States are affected by the cost of living adjustment as a result. With all of the whining on social security by the GOP, one might take a look at the maximum benefits one can get from social security. Frankly it is not enough to live on in most areas of the country as it is.

Now, why does the government just use 1 quarter out of 4 for it's annual cost of living adjustment? Good question! Obvious it doesn't make a lot of sense to use only one quarter, Q3, and not inflation measures over the entire year. If one has a deflationary third quarter in comparison to one year ago that means there will be no cost of living adjustment for the next year. This is a bad calculation for one could have all of the other quarters with high inflation and thus the entire year shows prices have dramatically increased overall. The reason the COLA calculation is so funky is Congress demanded COLA be calculated this way. Politicians have already played slight of hand games with cost of living adjustments to reduce benefits for millions unnecessarily. Expect to see more chipping away of America's earned benefits with funky math, bad formulas and misleading inflation figures. In the meantime welcome to the lowest cost of living increase since 2010!

other adjustments

there will also be a corresponding 1.7% increase in the income tax brackets, which means that the highest marginal tax rate of 39.6% wont kick in until taxable income of an individual exceeds $406,750 in 2014...and the dead will get an even greater increase than the elderly and the rich, as the individual estate-tax exclusion, which is now also pegged to inflation, will be $5.34 million in 2014, up from $5.25 million currently...

rjs

who would have thought

under Obama there would be just tax cuts for the rich. One more in the notch of Bushism.