Income Inequality + Financialization + Globalization = Destruction of the Middle Class

This equation is a work in progress for me. I have tried an econometric model but it crashed my computer. Seriously, we are losing sight of the much bigger picture that is playing out across the country. Our policy makers are distracted by this financial crisis or intentionally ignore the plight of the Middle Class in the U.S.

This equation was derived from reading a debate between Professors Branko Milanovic and Ashok Bardhan: Two Views on the Cause of Global Crisis (Here and Here). These two professors debated the causes of the global financial crisis. Milanovic argued that income inequality was the root cause of the financial crisis while Bardhan argued that globalization and financialization were the causes of the financial crisis. I argue they are both right. But they highlight a much bigger problem that is being overlooked by this financial crisis.

Most arguments about what caused the global financial crisis ignore a more insidious problem that is being overlooked in all the discussion and policy proposals: the destruction of the Middle Class. This global financial crisis has negatively impacted the Middle Class more than any other income group. A report by Bank of American/Merrill Lynch shows that (via LA Times). Tom Petruno summarizes the BofA Merrill report this way:

The report hammers home what you might already suspect: The consumer debt problem in the economy really is a debt problem for the middle class. The need to work off a chunk of that debt will sap middle-class families’ spending power for perhaps years to come.

It estimates that middle-class families’ debt as a percentage of disposable income was 205% in 2007, a function of the level of trading-up during the housing boom and of the cash people pulled from their houses via home-equity loans.

By contrast, lower-income families’ debt-to-disposable-income ratio was a much less onerous 133%. And for the wealthy the percentage was lower still, at 116%.

What’s more, on the asset side, BofA Merrill says the middle-class has suffered more than the wealthy from the housing crash because middle-class families tended to rely more on their homes to build savings through rising equity. Also, the wealthy naturally had a much larger and more diverse portfolio of assets -- stocks, bonds, etc. -- which have mostly bounced back significantly this year.

I strongly encourage people to click the LA Times link above to read Tom Petruno's story because he raises a very important policy question.

The negative impact of this financial crisis on the Middle Class is a symptom of a more larger problem or disease. As Dr. Thomas Palley points out in his report: "American's Exhausted Paradigm", our economic growth model (which he calls a neo-liberal growth model) is terrible flawed. The equation - Income Inequality + Financialization + Globalization = Destruction of Middle Class is meant to symbolize the flawed model. It is this flawed neo-liberal model that needs to be corrected if the Middle Class is to survive.

All this talk and policy proposals of re-regulating the financial sector are just treating the symptoms and not the disease.

INCOME INEQUALITY

The first part of the equation. This is no surprise that there is income inequality in the U.S: a small number of people earn a lot more money than the rest of us. What is surprising is the magnitude of the inequality. This magnitude of inequality is not a good thing.

Branko Milanovic summarized income inequality in the U.S. this way:

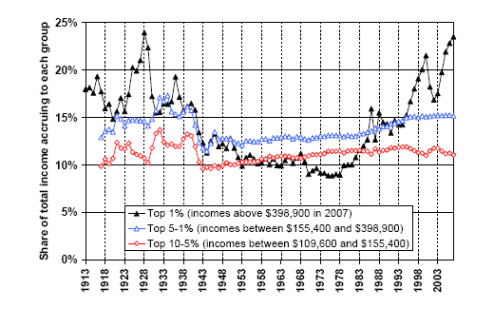

In the United States, the top 1 percent of the population doubled its share in national income from around 8 percent in the mid-1970s to almost 16 percent in the early 2000s. That eerily replicated the situation that existed just prior to the crash of 1929, when the top 1 percent share reached its previous high watermark American income inequality over the last hundred years thus basically charted a gigantic U, going down from its 1929 peak all the way to the late 1970s, and then rising again for thirty years.

Then we got this stunning graph from Professor Emmanuel Saez's updated report on income inequality in the U.S.:

Notice how income distribution really starts to change right around the early 1980's. That is the time which Dr. Palley rightfully claims that the neo-liberal economic growth model - our current growth model - began to take hold. And another thing, this graph only shows incomes as low as $109,600 which means that a very large group of Americans making less money have a very small share of total income. That is why this graph is so startling.

Some people may say that income inequality is not a big deal. Oh yeah. Well income inequality creates huge inefficiencies in the economy in terms of allocation of resources. It also creates the potential for an aristocracy (or financial oligarchy) that will do whatever it can to protect its dominate position in society. A better description would be the creation of a two-tiered economy - kind of like many Latin American countries - what our economy is starting to look like.

Professor Emmauel Saez in his report "Striking it Richer" offers this suggestion for the huge income inequality:

The labor market has been creating much more inequality over the last thirty years, with the very top earners capturing a large fraction of macroeconomic productivity gains. A number of factors may help explain this increase in inequality, not only underlying technological changes but also the retreat of institutions developed during the New Deal and World War II - such as progressive tax policies, powerful unions, corporate provision of health and retirement benefits, and changing social norms regarding pay inequality.

Emphasis is mine.

Interesting, that bold phrase is what Dr. Palley is railing about in his report regarding our flawed neo-liberal economic growth model.

FINANCIALIZATION

Financialization means the increasing position/size of financial assets and the financial sector in the economy. This financialization was facilitated by de-regulation of the financial sector. Professor Ashok Bardhan explains financialization:

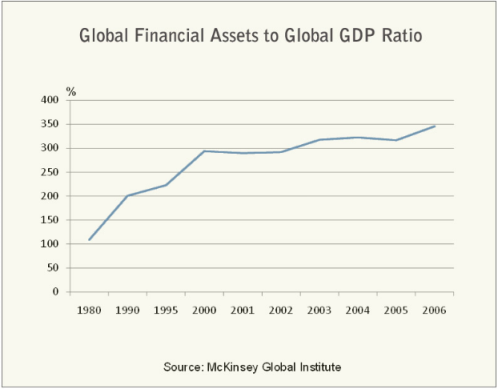

Over-financialization could be seen in rise in the size of financial assets relative to the real economy as indicated by gross domestic product. Globally, the holdings of financial assets, comprising equities, government and private bonds and bank deposits ballooned way out of proportion to global GDP, the primary underlying measure of real economic activity (see Figure 1). Similarly, the gross market value of outstanding derivative contracts more than doubled between mid-2006 and mid-2008. The share of financial services in GDP has increased dramatically in the US and UK in recent years; in the latter it has doubled in the last decade alone. In many countries, the financial sector grew to a size disproportionate to its primary raison d'etre - to efficiently bring savers and borrowers together, allocate savings to viable investments, and manage diversification of risk. Liquid and deep financial markets are necessary; indeed, they are the lifeblood of economic activity, but to extend the analogy, not if they cause high blood pressure to the economy!

This Financialization was indicative of a much larger problem. What replaced wage growth was asset price inflation and rising indebtedness. For example, as the BoA Merrill report points out above, Middle Class families relied heavily on the equity in their homes - this was an important savings vehicle. Consider this from Dr. Palley's report:

- Since 1980, each U.S. business cycle has seen successively higher debt/income ratios at end of expansions, and the economy has become increasingly dependent on asset price inflation to spur the growth of aggregate demand.

- Over the last 20 years, the economy has tended to expand when house price inflation has exceeded CPI (consumer price index) inflation. This was true for the last three years of the Reagan expansion. It was true for the Clinton expansion. And it was true for the Bush-Cheney expansion. The one period of sustained house price stagnation was 1990–95, which was a period of recession and extended jobless recovery.

Financialization is a symptom to the disease that is destroying the Middle Class.

GLOBALIZATION

Globalization can be defined by the free flow of trade and capital from country to country. The policies implemented since 1980 have precipitated globalization which has forced American workers to compete with much lower-paid foreign workers. But there is more to it. Our current, neo-liberal, incredibly flawed, economic growth model depends on CHEAP IMPORTS. The impact from wage stagnation is covered up by cheap imports - it is a way to pacify Middle Class families. What better way to make us feel like we have a lot of purchasing power by having access to incredibly cheap consumer goods from a big retailer.

Dr. Palley describes it this way:

The reality is that the structure of U.S. international engagement, with its lack of attention to the trade deficit and manufacturing, contributed to a disastrous acceleration of the contradictions inherent in the neo-liberal growth model. That model always had a problem regarding sustainable generation of demand because of its imposition of wage stagnation and high income inequality. Flawed international economic engagement aggravated this problem by creating a triple hemorrhage that drained consumer spending, manufacturing jobs, and investment and industrial capacity. This in turn compelled even deeper reliance on the unsustainable stopgaps of borrowing and asset price inflation to compensate.

THE EQUATION

Like I said, it is a work in progress but hopeful something that people, especially policy makers, will understand:

Income Inequality + Financialization + Globalization = Destruction of the Middle Class

Together these factors have contributed to the destruction of the Middle Class. Some economists, like Dr. Palley, argue that our current, neo-liberal, economic growth model is not sustainable. I would argue that it is not so much that this economic model is not sustainable, because I am sure that the financial oligarchy and corporate aristocracy would keep it going, but it will destroy the most important aspect to any stable economy - the Middle Class.

It is not too late to reverse course but based on current affairs I have little faith that it will happen soon. Time is running out.

Oh, BTW, where the hell is the President's Middle Class Task Force.

P.S. Any suggestion on improving the equation are welcomed.

Comments

Excellent blog, but slightly off on the equation

Since the root cause of poverty is unearned (and concentrated) wealth, and since Financialization + Globalization leads (and by design) to massive income inequality (capital has no barrier, but labor, and labor arbitrage is thoroughly controlled), the actual equation should be Financialization + Globalization = Income Inequality (thus leading to the destruction of the middle class, and the inevitble destruction of any existing global middle class eventually). [I know, I'm dealing with trifling points here, but....]

All three profs are right, of course (Saez, Milanovic and Bardhan), but the BofA study in the LA Times is a classic case of misdirection. While superficially true, it diverts one's focus from the reality that the primary (if not only) product of Wall Street is debt, and the peddling of said debt product is the primary purpose for the meltdown and the further super-concentration of wealth.

Again, we return to that magical process of debt pyramiding, securitization (or, securitization gone wild, if you prefer). A process which began, using slightly different financial instruments back in 1909, and took off around 15 years or so prior to the Great Depression.

By design, I refer to Reagan's Executive Order No. 12615, establishing the Office of Privatization. (Step 1) The deregulation (which began with the Carter Administration) began to really take off in the next administration (Reagan's administration with the Monetary Control Act of 1980 and the Depository Institutions Act -- which acted to deregulate monetary controls) and really took off in the Clinton (Financial Services Modernization Act & Commodity Futures Modernization Act) and Bush Administrations.

Various exemptions along the way, granted to Goldman Sachs, the banking industry (especially JP Morgan, later JP Morgan Chase) essentially sealed the deal.

Another excellent equation I've noticed on the Web:

50,000 Foundations + 35,000 D.C. Lobbyists + 5 Media-controlling Corporations = Engineered Consent

(Trivia Question: What do bacon & eggs, women smoking cigarettes and shaving their underarms, and the public sanitizing of American overthrowing of democratically-elected foreign governments have in common?)

Again, a super blog!

Globalization

ok, now the common argument to "no borders" capital is to claim "no borders" labor will counterprevail that influence...but nothing could be further from the truth....

that is the ultimate race to the bottom on labor arbitrage.

So, I would go further with the term globalization and say global labor arbitrage. This is MNCs hunting the globe for the ultimate cheap labor markets...in fact they are so obsessed with labor costs....many have been burned by huge costs after the fact, say on shipping or turn over or lack of training, list goes on and on....

Believe this or not, IBM literally tried to patent an algorithm to determine where to move to next for the ultimate cheap labor pool and where they could rip off the local government the most for various incentives, as well as manipulate different nation-states for the ultimate tax savings.

This is where globalization just plain needs to be stopped, dead in it's tracks.

The entire theory rests on labor being a static element, i.e. a domestic labor force that is not mobile....i.e. it is finished goods that are looked at in Ricardo, the minute one starts moving around the means of production, i.e. labor, plants and so on...

the equations start to show a "lose-lose" or "win-lose", esp. for that nation with the higher PPP (i.e. first world nation, rich one, with higher standard of living and thus labor costs).

Agreed the globalization part needs to be beefed up

We I was writing this I was amazed at the relationship of the variables. It was very circular - like a continuous cycle that was only halted by the crisis but can definitely start up again if status quo is maintained.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

watch out for the black and white hole

multi-lateral trade is vastly complex and can be a very good thing (as we see from China!) if done right. The problem is the U.S. has done it wrong....they basically just gave away the farm and one suspicion is not only it is foreign national lobbyists but also those very financial institutions so they can make profits by investing in these EEs with guaranteed returns (guaranteed in that it's guaranteed the U.S., esp. the middle class will lose) are the ones who wrote up those agreements. (supposedly Citigroup was heavily involved).

But the argument so presented is false...i.e. either you are for free trade or against it. Trade in and of itself is usually a good thing, but these aren't even trade agreements, they are more glorified labor arbitrage agreements in so many words.

Want an exercise is "good f#@king God" reaction? Scan through the actual China PNTR agreement. I became convinced Clinton had been taken over by the pod people for signing it after reading through it.

Yes, and that is what we need to change.

this notion that even mentioning globalization - you are against trade. NO. The problem is one of engagement as you point out - we don't have to give away the entire store.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Bad Samaritans

Ha-Joon Chang quite thoroughly disassembles the neoliberal argument in Bad Samaritans. He does use a lot of data, so that likely disqualifies him among true believers. Somehow we as a nation bought into the neoliberal line, and we need to change that mindset if we're going to get out of this mess and stay out.

Ha-Joon Chang - talk

Friday Night Video

This is really worth watching, not only is it in depth but he is just hysterical. I mean funny as hell!

Great talk!

Only listened to half of it -- the book is just as breezy and comes at you from some unexpected angles. Definitely worth a read.

My phraseology slightly off, too

Oh no, I completely agree with you about the fallacy of "mobile labor" --- didn't mean that would be a countervailing measure, simply that a controlled labor situation was another factor and was adding to the present economic debacle.

What would be a definite improvement would be management arbitrage, as American management has only three strategies for economic aggrandizement: (1) offshoring American jobs (or importing foreign scab labor), (2) peddling junk bonds, and (3) leveraged buyouts -- with their usual resultant devastation to the workplace and business environments.

(I'm being slightly facetious here as my experience with foreign CEOs is somewhat limited.)

not a problem

I just point it out because that seems to be a good answer, until one looks at what happens when 1 billion people show up in one locality because there are jobs there.

;)

no kidding

It's pretty clear all of the major structural changes, such as modification of trade policies, banning outsourcing of federal, state contracts, revamping corporate tax structures to curtail incentives to offshore outsource....how about stop giving tax incentives to corporations who promise to create jobs locally....but take those incentives and offshore outsource jobs instead?

What about some sort of massive subsidy to start-up advanced manufacturing?

The list goes on and on and on and on...

I don't know about your equation because myself, I like mathematical formula details, very specific policy consequences, policy recommendations, implications thereof.

I'd say start with this paper, Where Ricardo and Mill Rebut and

Confirm Arguments of Mainstream Economists Supporting Globalization, Paul A. Samuelson.

My findings are one does not need a new equation, unless one is looking for phraseology to re-coin a concept....

the answers are in existing equations and it ain't all "win-win" as claimed, not by a long shot.

I think you're missing a political side of the equation

In any given democracy- fair government is inversely proportional to concentrated wealth.

-------------------------------------

Maximum jobs, not maximum profits.

-------------------------------------

Maximum jobs, not maximum profits.

Political side is recognized

Neo-liberal model really took off in 1980s with the Reagan Administration. It is built in the equation.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Points well taken ...

.. and for the most part I believe well understood. It's no surprise to most of us that concentration of debt within the middle class is purely by design, as the middle class, or working class, has historically strived to emulate the lifestyle of the elite non-working class and only does so by virtue of the easy money debt trap from which to borrow that illusion from the money changers (with interest). They are distinct from the working class moreso in that they do not work at all, but rather put their wealth to work for them in the world's rigged speculation casino (in other words, what you refer to as financialization).

If you mean to point out that the destruction of the middle class is tantamount to killing the golden goose, then in fact I submit that it IS the point to milk the golden goose to death, for as unrepayable debt becomes a nations problem vs. the problem of a certain class then the real spoils of monetarism are reaped - that nation's sovereignty.

But again, I think that plan is well known. It's been used successfully so many times before.

Answer to trivia question

And since nobody bothered to answer my favorite trivia question:

What do bacon & eggs, women smoking cigarettes and shaving their underarms, and the public sanitizing of American overthrowing of democratically-elected foreign governments have in common?

Answer: Edward Bernays, nephew of Sigmund Freud, and the PR and advertising maven who gave us all of the above, once upon a time known as United Fruit's best friend (and employed by the CIA -- today United Fruit is known as Chiquita, with present Attorney General Eric Holder having formerly represented them in that lawsuit involving mercenaries, and assassins of union organizers in South America).

I skim & WHERE is definition of 'middle' ??

this is seriously annoying.

how many f'ing links do I need to click through to find the definition of 'middle'?

furthermore, how many households are in that middle?

by statistical abstract of the us, 2006 data, table 670, money income of households - there are about 35 million outta 116 million households with money income over 75,000...

I'm 49, I grew up on welfare, I'm in career #3, I've made 51,000 a year ONCE in my life and less every other year

and I can PROMISE you that there is NO chance at retirement security, health security, transportation security, retraining security, unemployment security, housing security on LESS than 75 grand.

WHO THE F'K IS THE MIDDLE? if (116-35)/116 is on the edge?

rmm.

screw it. I don't have time to do dig this up -

rmm.

Yond Cassius has a lean and hungry look;

He thinks too much: such men are dangerous

Yond Cassius has a lean and hungry look;

He thinks too much: such men are dangerous

Roughly,

Based on income distribution, I would argue that middle class is: $30,000 to $100,000.

The income distribution graph above has the high end $109,000.

Poverty line for a family of 4 is $21,200

Median Income (2007): $50,233

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Center of Budget and Policy Priorities

has some new graphs and report based on Prof. Saez's work that are eye popping (ht: Chris Bowers @ Openleft ):

This is our country on 'neo-liberal' economic policies.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.