Has housing hit a bottom? Fox News declared that the bottom is in, as had many other talking heads.

In fact, the reality of the situation is a "good news, bad news" scenario.

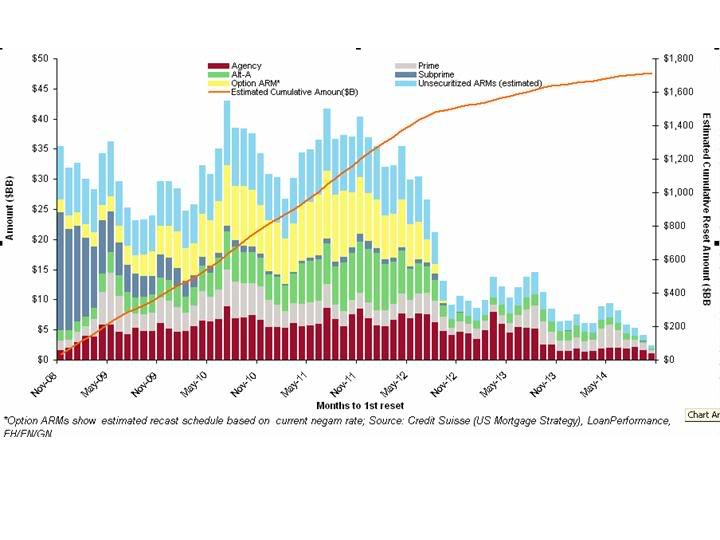

(Bloomberg) -- The wave of “option” adjustable-rate mortgages recasting to higher payments, projected by some economists to represent a looming source of foreclosures that will hurt housing markets over the next few years, will be smaller than “feared” because many borrowers will default before their bills change, Barclays Capital analysts said.

So you see, the coming tsunami of foreclosures will be much small than expected because people are going to go broke beforehand. That's the good news.

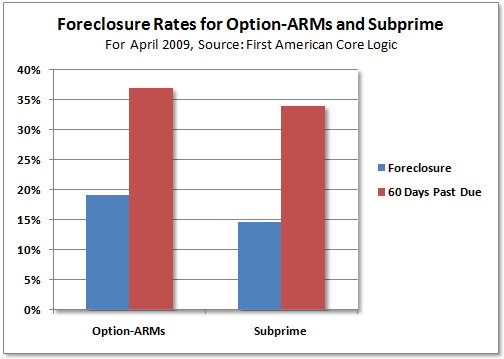

The subprime crash is largely over, but the Option-ARM bubble was supposed to be spread out over many years.

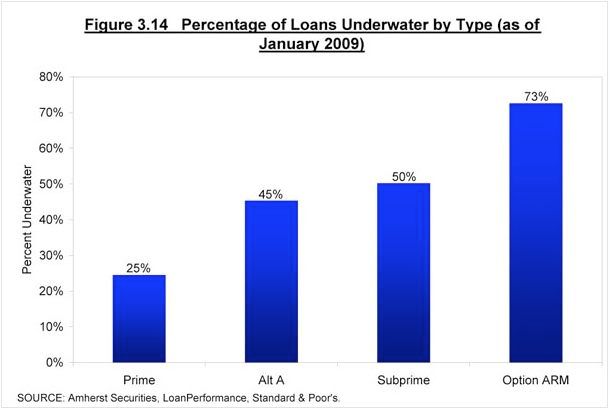

Instead the Option-ARM mortgages are blowing up ahead of time. Why are they blowing up early? Because they are already underwater, and "negative equity is a necessary condition for foreclosure" according to the Boston Federal Reserve.

Option-ARM holders are the worst of the worst. While 32% of all mortgage holders are currently underwater, and that number expected to rise to 48%, Option-ARM borrowers are expected to peak at a number closer to 90%.

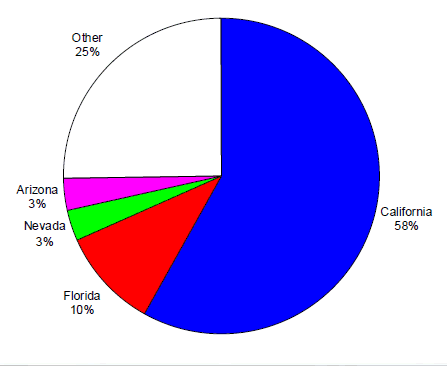

40% of Option-ARM borrowers are already delinquent. This is especially bad news for California, where an overwhelming percentage of Option-ARMs originated.

“The additional risk really will only be for borrowers who manage to stay current over the next couple of years and might default due to a payment shock,” the New York-based analysts including Sandeep Bordia and Jasraj Vaidya wrote.

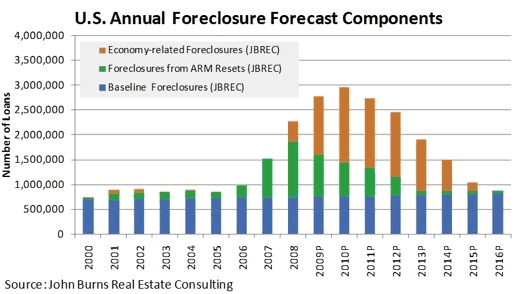

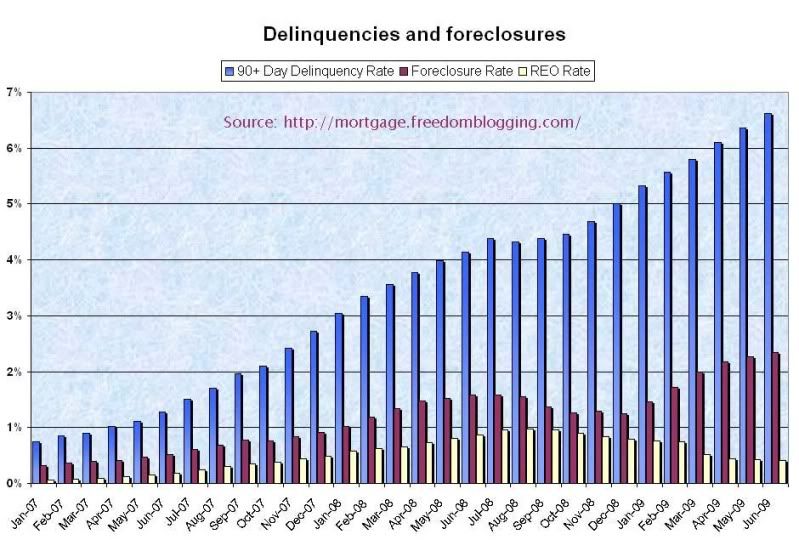

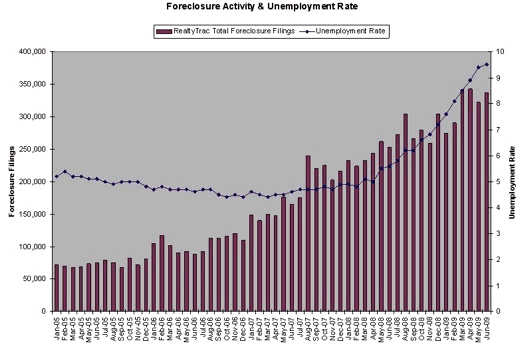

So what does the coming foreclosure wave look like and when will it hit? After all, foreclosures and foreclosure inventory is already at all-time highs.

Click on this graph to get a more visual idea.

“To say there is a second wave implies the (current) wave has receded. I don’t see that the wave has receded.”

- Sam Khater, senior economist, First American CoreLogic

Another factor you must take into the coming wave of foreclosures is the high unemployment rate.

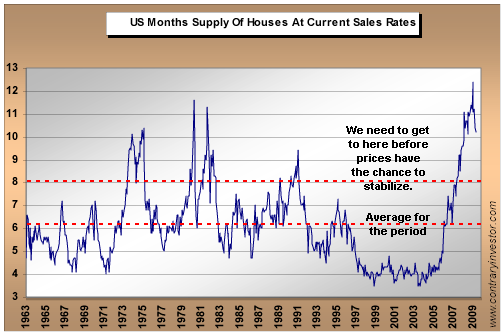

Another factor weighing on the housing sector is the near record level of inventory.

And that's only the official housing supply. The Shadow Inventory is far, far larger.

"The number of homes listed officially on the market, while still at historically high levels, might be only the tip of the iceberg," said Stan Humphries, chief economist at real estate website Zillow.com in Seattle, Washington.According to Zillow's latest Homeowner Confidence Survey, 12 percent of homeowners said they would be "very likely" to put their home on the market in the next 12 months if they saw signs of a real estate market turnaround, 8 percent said "likely," while 12 percent said "somewhat likely."

Survey results could translate into around 20 million homeowners trying to sell their homes, a startling number given that the Census bureau indicates there are 93 million U.S. houses, condos and co-ops, Humphries said.

According to the National Association of Realtors, the market is currently on track to sell 4.89 million homes annually.

"At this pace, it would take about four years to run through this amount of backlogged inventory," he said.

And if that wasn't enough, the banking sector has its own "shadow inventory" that it refuses to sell at this time because it can't afford to book the losses. Estimates are somewhere north of 600,000 homes.

Speaking of the banks, what effect will all these foreclosures have on them?

The Barclays analysts, who wrote that about 88 percent of option ARMs packaged into securities in 2007 will eventually default, said that after a rally in prices they no longer suggest owning related bonds, “a trade we have been recommending for months.”

...

More than $750 billion of option ARMs were originated between 2004 and 2008 as borrowers used their low initial payments to afford higher-priced homes, according to newsletter Inside Mortgage Finance.

All those losses that banks will eventually have to book one way or another, will take their toll on balance sheets. The Congressional Oversight Panel created to oversee the U.S. banking bailout, had this to say about the state of the banking system.

In its latest assessment of the $700 billion financial system bailout, the Congressional Oversight Panel warns that banks still hold many risky loans of uncertain value. If unemployment rises sharply or the commercial real estate market collapses -- as many economists fear -- the banking system could again lose its footing, the panel says in a report to be released Tuesday.

No mention of Option-ARMs, but then maybe no one wants to talk about it.

Comments

FHA

I saw they were continuing to do subprime, 3.5% down and were hitting a 7.5% default rate. I didn't verify those stats but the "let's re-inflate the housing bubble" seems to be active.

Supposedly the taxpayer will never see any of the money back given to Freddie/Fannie and their recent profit was due to some sort of accounting technical issue.

a couple of remarks: - that

a couple of remarks:

- that 20m homes that could end up on the market is a highly exaggerated number. all those families do not intend to become renters or move abroad, but to trade up or down, more likely down.

- the loss rate on the option-arm morgages is not even touched upon. most reset at 125% ltv, which combined with a depreciation of 30-40% in ca/nv/fl means about 50% recovery rate for banks before any additional foreclosure and resale expenses. it is realistic to say that banks would barely recover 30% of the loan value, so they better become rentiers.

Proposal:

Change current mortgage model to one similar to Danish mortgage model. Fannie/Freddie can be consolidated and used as the entity to start lending under the new model or as a guarantor.

Here is a little info. on Danish Mortgage model: Link

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Report: China's Sovereign Wealth Fund buying Mortgages

China's CIC to buy U.S. mortgages: sources

It is investing in the smaller PPIP. It is investing in the "safer" toxic mortgages - the ones guaranteed by FDIC.

RebelCapitalist.com - Financial Information for the Rest of Us.

RebelCapitalist.com - Financial Information for the Rest of Us.

Extent of the problems

I think one can look at the extent of the problems in the housing market to get a further sense of just how much taxpayer money is going to be wasted propping up failed institutions like Fannie and Freddie and trying to help the banks "earn" their way out of this mess. This unfortunately though is going to take a large toll on our currency and cause interest rates to rise in the long term, which will make the chance of a sustainable recovery based on sound economic principles very unlikely. So I would again state that one of the few ways for investors to profit from this trend will be to invest in gold and gold mining companies, which will benefit from the weaker dollar. in particular, is levered to the gold price and trades at one of the cheapest cash flow per share valuations in the industry. If the company can continue to bring down its cost structure, then this current valuation gap should shrink considerably.

And with regard to the amount of Option Arms that are or will soon be delinquent, I think it is very important that this was discussed in the post. A very large sum of money is most likely going to be printed by the government to further offset the damaging effects of this in 2010 and 2011.

Article updated

I just spotted new information about the underwater situation.

It turns out that it's not 24% of all U.S. mortgages are underwater.

It's 32%.

If you count another 2.5 million properties that are nearly underwater, it comes out to 38%.

Suddenly that 48% projection doesn't look unrealistic.

And another comment

This has some interesting observations on the coming foreclosure wave.

negative equity

What are they going to do in Nevada and California? This is where the negative equity is the worse?

The actual prices were so unaffordable in comparison to wages they cannot return, yet both areas look like a nuclear bomb is going on and who can pay for 2x for something what it is really worth?

What is this disconnect, homebuilders confident!

Homebuilder Confidence in U.S. Rises to One-Year High:

Tell me they are not trying to rebuild the housing bubble. Someone tell me that with projected 3.2M foreclosures this year.

Delinquency rates surge

Calculated Risk notes a new Fed report.

Meanwhile, banks continue to tighten credit standards.

Tighter credit and less demand for it. Does this really sound like Green Shoots to you?

not on the neutron bomb called financial crisis it doesn't!

Looks like grass killer is being sprayed all over the green shoots lawn!

Good God, this needs it's own blog post. That's an incredible rate of delinquencies.

I should note that in 1986, Tax Reform Act of 1986, removed a lot of CRE tax shelters.

This hit, hard...many upper middle class, but not super rich, investors and is one of the contributing factors to the S&L crisis.....

So, considering the above numbers vs. a major tax shelter change that caught hundreds of thousands of CRE investors with their pants down in the 1980's....

I think this news deserves it's own historical analysis blog post.

No Skin in the Game

A lot of the credit that never should have been created is being extinguished. Not sure how big the number is, but this is demand that is not coming back. Credit limits lowered -- and wage garnishment for some unsecured debtors. Not a good outlook.

Frank T.

Frank T.

Welcome Naked Capitalism Readers!

Thank you Naked Capitalism for the link.

We love NC, esp. the bail out, Fed, derivatives coverage.

Yes, isn't this post a huge disconnect from what we are hearing on the housing market in the MSM?

Charts don't lie!

Seeking Alpha picked up your post, Welcome Seeking Alpha readers

Ah, what a series of references put together in a coherent post will do. Thank you again midtowng...

Seeking Alpha article recommending this post, markets taking a breather or change in direction?

They should read your market is for suckers post, Ultimate Stock Market Sucker's Rally.