I think what many people fail to see is that the fed was likely under pressure from the administration to be seen to doing something shortly before mid-term elections. $600 billion sounds like a lot, but it is likely the smallest amount the Fed could put out there and still appear that they are taking efforts to "do something". From the response of the market, this and things like leaking the bit about wanting to push the market higher has obviously had the effect they intended and after the crash there will be 2(ish) more years for the administration to "fix" things again before the next election.

What no one in America wants to talk about is the fact that there is going to be a restandardization of how Americans are living, and not for the better. Instead of focusing on the root causes of these financial problems and working to improve peoples' situations long-term, we're just patching things and hoping that things get better. Keeping the train moving as fast as possible even though the bridge is out up ahead. That's likely because politicians are focused on giving Americans what they want (immediate, visible, short-term gains) rather than what they need (increased competitiveness in the global market; primarily education) so they can be reelected. For example, if China was to let their currency float at a faster pace as many American politicians have been screaming about, it would be disastrous for the majority of Americans. It would immediately prompt massive inflation as most consumer goods are produced or have components from China. And despite many peoples' belief that it would help bring jobs back from China, it would just send those jobs to other countries like Thailand and Vietnam faster than they are currently moving to those countries. The vast majority of those jobs are NEVER coming back.

What can we do about it? I have no idea. Americans have lost their will to improve their own situations blaming their problems on everyone else: The government, the Chinese, illegal immigrants, etc. Apparently we're just getting what's coming to us. People tend to get the government they deserve.

I'll try to find out exactly what deals were made in India but that trip cost figure is just not validated and frankly it doesn't add up, make sense.

Right now Obama is claiming India creates American jobs, which assuredly will put the nail in his re-election coffin. That said, I am trying to find out specifics and will post if I can...

in the interim, don't believe everything you read out on the Internets.

No one talks about Obama's $9fig clan trip to

Asia when we the people r unemployed & can't make ends meet, he went to sell USA products to Asia? r u kidding me? they work for $2 a day, no unions, long hours, better products,what the hell can we sell them? A GM car? they just beat the US market with the TATA NANO. Why is this admin think we're stupid?

What I think, from the results of QE1, is that this will not spark inflation. I predict it will spark another massive carry trade. A carry trade is when institutions, investors, banks borrow in the U.S. and lend to other nations. i.e. cheap money here, but instead of investing it in the U.S., they invest it in say...China. NOT GOOD!

But in terms of looking at PPI, CPI, our inflation measures, it's more to stem a potential deflationary event, QE2. I don't think people realize that we had a major deflationary event before QE1 and the Great Depression accompanied deflation.

That's actually not too great of a good thing, case in point farmers in the Great Depression poured out their milk because it cost more to bring it to market than what they could get for it.

On the other hand, oil is rearing it's very ugly head. We're once again heading to $100 oil and that's BAD for the economy, it hurts consumers, hurts businesses with energy costs, and oil by itself can do real damage.

Just take the oil bubble in 2008 and the consequences as an example.

Anyway, in spite of on the surface it seems like we'd head to the Weimer Republic German hyperinflation, how this really works is a little more tricky than that.

Dollar devaluation helps the trade deficit, our debt, hurts our PPP (standard of living).

Western Commercial Bank a Findley project was doomed from the beginning because the founder had not been an experienced banker. He was a mortgage processor who somehow got approved and then jumped in the Southern California mortgage whirlwind. Never having heard of or grasp the concept of "over concentration" in any one product group. This is reminiscent to the days of the S&L crisis when developers realized the Holly Grail was to own one then run all your projects through them, aka give the pimp the key to the barracks. Then we have First Vietnamese American Bank which began with a lot of hoopla about having raised some $30 million in capital all in $500 dollar increments in brown paper bags. (first sign of concern a cash based ethnic group they come from a place that you don't trust governments or banks) While the concept was sound to provide a Bank for those who lived in Little Saigon of Southern Cal, it was launched with inadequate management and tight enough policy to assure safety and soundness. This bank operated under a regulatory order for most of its short life. Surprisingly the Bank had as a Board member David Scott who was the most senior member of the Ca DFI when he retired after a long career of raking havoc on Banks Bankers and Boards of Directors for almost any concern legitimate or not that he and his side kick back then Sharon Dunlavey could deliver he joined FAVB. If he was that good how did this bank open with and keep an order for the length of its existence. Add to this a second Bank in Little Saigon opening at the same time with an identical business plan. Neither Bank has done well. (this was an Ed Carpenter fiasco) In the end the Vietnamese Business Community losses as does the Banking community of California because greed and short lived fame blinded all. bankalchemist.

This is a business hostile, creativity inhibiting economy right now. How can people start a business when going dependent means you either can't get health insurance or you pay exponential amounts. The lack of credit is the big picture impediment of the business creation environment.

I used to think that it was all about money with these folks but now I'm seeing money as a by product. They're afraid that enough people will figure out the various scams and throw them in jail. It's just amazing to see the wasted potential of a great country.

Right, then they're not obligated and they can just start ignoring them again after the market trick. Good point. The varieties of Wall Street deception are endless.

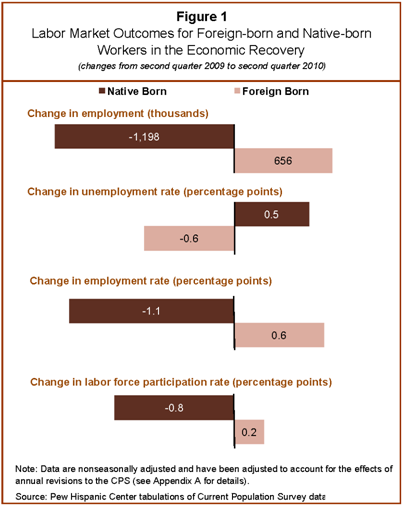

that I want to look at. Something is "wrong with this picture" with our cheap labor pals touting "immigration" as "helping the economy but the above sure looks like U.S. worker displacement.

The "foreign born" unfortunately is not divided up by immigration status or ethnicity. I can tell you the Hispanic unemployment rate, which does include illegal immigrants, is higher than the national average....so these "foreign born", do not appear to be illegals. I suspect, strongly, that foreign temporary guest workers are in that count.

Right now I'm analyzing the BLS unemployment report and there is conflicting data in it! I'm not making this up, one section seems to be quoting last month's numbers and another has different numbers. Good God.

Native U.S. population is growing 160K per month and Immigration is adding 120K per month. 280K per month is far above the best job creation numbers. The result is not just IT workers browsing garbage but younger native born workers doing Grapes of Wrath stuff picking vegies. We just do not need any more immigration. When pressed, open border crowd uses the safety valve argument: immigration eases tensions in developing countries. But 60 percent or 6.6 Billion world wide live at a standard of living below that of Mexico. Aroound 1.5 Million immigrate to the U.S, or .00025 % of the world population. No real safety valve.

The idea that we can let economies unwind gracefully is a comfort food of the Bourgoisie. There is just too much destruction and pain already, not that there will not be more. The Fed, Wall Street, Corporate America are happy to watch the rubble bounce. That moves nothing forward. The Crisis of Capitalism goes on a very long time. The money sent to the BRIC economies by the Hedge Funds is returning domestically in the form of the expanding Trade Deficit of the last 15 months.

When 'creative destruction' is trumpeted, the shouters never asks 'Whose pain and destruction?' This class war has is just a shout away.

3 Month Treasuries pay 0.01%, 10 Years pay 2 3/4%. Selling this paper is playing pusherman at the high school, so the money goes to the coffee can or the BRIC markets. The rest of the central banks denounce the Fed because ot the series of bubbles Bernanke is creating. Watch what Bernanke is also not doing.

He will not fund community banks or U.S. agencies who support commerce. Goods producing jobs fell massively in the last month.

Like all true socioppaths, the Fed, the Administration, and the rest of the corporate ruling class can look at the faces of the victims and not really be concerned about the effect of the crime.

"Canada only has five large banks, all with a nationwide presence, and all Too Big To Fail, yet the government there is not contemplating breaking them up."

To the best of my knowledge, Canadian banks operate the way banks have traditionally done. Only one bank held my mortgage until it was discharged, and when the kids were shopping for a mortgage they shopped the various banks for the best deal, and continue to deal with that same bank each five year period to renegotiate the interest rate.Several years ago the major banks applied to the regulator to allow mergers among the banks inorder to compete more effectively with the behemoths South of the border. That application was denied. It was perhaps one of the best reasons why Canadian banks were not severely affected by the financial crisis.

It never fails to amaze me how out of touch some organisations are when making fore-casts, in particular this example of Goldman Sachs unemployment "guestimate".

Their claim that unemployment will peak in 2011 at about 10.75% is way off the mark. Public sector redundancies aside, Atos Origin Healthcare who are contracted to operate the "Work Capability" assessments on the behalf of the DWP, are rejecting record numbers claiming disability allowance. At a conservative estimate, this alone will add an extra 1 million to the unemployment figures.

I just had a thought, artificially inflating the stock market might be about filling the empty public pension and other retirement fund coffers. I don't know the latest but earlier they were in huge trouble. Just sayin'.

The Carry Trade is very real, and other financial press are talking about it. It like they don't get that everything just flows out of the U.S. and gets parked in some emerging economy, such as our manufacturing base, our jobs and now our money.

Many believed the QE2 was already priced into the stock market and Gold, but aha! Fed did almost double what was expected. Most expected $500 billion.

That said, this maybe great for flash traders and such but in terms of the real economy.....uh.

If someone has some good reference for another economists or blogger, financial press who has analyzed QE2 in terms of the real economy, please put the link in a comment so we can check it out.

Everything I've read has just been for investors versus real live working people.

http://users.on.net/~jvizard/myne/qe2.jpg

Seriously though, how awesome is that iceberg's shape?

I think what many people fail to see is that the fed was likely under pressure from the administration to be seen to doing something shortly before mid-term elections. $600 billion sounds like a lot, but it is likely the smallest amount the Fed could put out there and still appear that they are taking efforts to "do something". From the response of the market, this and things like leaking the bit about wanting to push the market higher has obviously had the effect they intended and after the crash there will be 2(ish) more years for the administration to "fix" things again before the next election.

What no one in America wants to talk about is the fact that there is going to be a restandardization of how Americans are living, and not for the better. Instead of focusing on the root causes of these financial problems and working to improve peoples' situations long-term, we're just patching things and hoping that things get better. Keeping the train moving as fast as possible even though the bridge is out up ahead. That's likely because politicians are focused on giving Americans what they want (immediate, visible, short-term gains) rather than what they need (increased competitiveness in the global market; primarily education) so they can be reelected. For example, if China was to let their currency float at a faster pace as many American politicians have been screaming about, it would be disastrous for the majority of Americans. It would immediately prompt massive inflation as most consumer goods are produced or have components from China. And despite many peoples' belief that it would help bring jobs back from China, it would just send those jobs to other countries like Thailand and Vietnam faster than they are currently moving to those countries. The vast majority of those jobs are NEVER coming back.

What can we do about it? I have no idea. Americans have lost their will to improve their own situations blaming their problems on everyone else: The government, the Chinese, illegal immigrants, etc. Apparently we're just getting what's coming to us. People tend to get the government they deserve.

I'll try to find out exactly what deals were made in India but that trip cost figure is just not validated and frankly it doesn't add up, make sense.

Right now Obama is claiming India creates American jobs, which assuredly will put the nail in his re-election coffin. That said, I am trying to find out specifics and will post if I can...

in the interim, don't believe everything you read out on the Internets.

No one talks about Obama's $9fig clan trip to

Asia when we the people r unemployed & can't make ends meet, he went to sell USA products to Asia? r u kidding me? they work for $2 a day, no unions, long hours, better products,what the hell can we sell them? A GM car? they just beat the US market with the TATA NANO. Why is this admin think we're stupid?

Since this post is increasingly popular, might let Bernanke have his say on this.

not to spark inflation.

What I think, from the results of QE1, is that this will not spark inflation. I predict it will spark another massive carry trade. A carry trade is when institutions, investors, banks borrow in the U.S. and lend to other nations. i.e. cheap money here, but instead of investing it in the U.S., they invest it in say...China. NOT GOOD!

But in terms of looking at PPI, CPI, our inflation measures, it's more to stem a potential deflationary event, QE2. I don't think people realize that we had a major deflationary event before QE1 and the Great Depression accompanied deflation.

That's actually not too great of a good thing, case in point farmers in the Great Depression poured out their milk because it cost more to bring it to market than what they could get for it.

On the other hand, oil is rearing it's very ugly head. We're once again heading to $100 oil and that's BAD for the economy, it hurts consumers, hurts businesses with energy costs, and oil by itself can do real damage.

Just take the oil bubble in 2008 and the consequences as an example.

Anyway, in spite of on the surface it seems like we'd head to the Weimer Republic German hyperinflation, how this really works is a little more tricky than that.

Dollar devaluation helps the trade deficit, our debt, hurts our PPP (standard of living).

Western Commercial Bank a Findley project was doomed from the beginning because the founder had not been an experienced banker. He was a mortgage processor who somehow got approved and then jumped in the Southern California mortgage whirlwind. Never having heard of or grasp the concept of "over concentration" in any one product group. This is reminiscent to the days of the S&L crisis when developers realized the Holly Grail was to own one then run all your projects through them, aka give the pimp the key to the barracks. Then we have First Vietnamese American Bank which began with a lot of hoopla about having raised some $30 million in capital all in $500 dollar increments in brown paper bags. (first sign of concern a cash based ethnic group they come from a place that you don't trust governments or banks) While the concept was sound to provide a Bank for those who lived in Little Saigon of Southern Cal, it was launched with inadequate management and tight enough policy to assure safety and soundness. This bank operated under a regulatory order for most of its short life. Surprisingly the Bank had as a Board member David Scott who was the most senior member of the Ca DFI when he retired after a long career of raking havoc on Banks Bankers and Boards of Directors for almost any concern legitimate or not that he and his side kick back then Sharon Dunlavey could deliver he joined FAVB. If he was that good how did this bank open with and keep an order for the length of its existence. Add to this a second Bank in Little Saigon opening at the same time with an identical business plan. Neither Bank has done well. (this was an Ed Carpenter fiasco) In the end the Vietnamese Business Community losses as does the Banking community of California because greed and short lived fame blinded all. bankalchemist.

This is a business hostile, creativity inhibiting economy right now. How can people start a business when going dependent means you either can't get health insurance or you pay exponential amounts. The lack of credit is the big picture impediment of the business creation environment.

I used to think that it was all about money with these folks but now I'm seeing money as a by product. They're afraid that enough people will figure out the various scams and throw them in jail. It's just amazing to see the wasted potential of a great country.

Right, then they're not obligated and they can just start ignoring them again after the market trick. Good point. The varieties of Wall Street deception are endless.

that I want to look at. Something is "wrong with this picture" with our cheap labor pals touting "immigration" as "helping the economy but the above sure looks like U.S. worker displacement.

The "foreign born" unfortunately is not divided up by immigration status or ethnicity. I can tell you the Hispanic unemployment rate, which does include illegal immigrants, is higher than the national average....so these "foreign born", do not appear to be illegals. I suspect, strongly, that foreign temporary guest workers are in that count.

Right now I'm analyzing the BLS unemployment report and there is conflicting data in it! I'm not making this up, one section seems to be quoting last month's numbers and another has different numbers. Good God.

Native U.S. population is growing 160K per month and Immigration is adding 120K per month. 280K per month is far above the best job creation numbers. The result is not just IT workers browsing garbage but younger native born workers doing Grapes of Wrath stuff picking vegies. We just do not need any more immigration. When pressed, open border crowd uses the safety valve argument: immigration eases tensions in developing countries. But 60 percent or 6.6 Billion world wide live at a standard of living below that of Mexico. Aroound 1.5 Million immigrate to the U.S, or .00025 % of the world population. No real safety valve.

The idea that we can let economies unwind gracefully is a comfort food of the Bourgoisie. There is just too much destruction and pain already, not that there will not be more. The Fed, Wall Street, Corporate America are happy to watch the rubble bounce. That moves nothing forward. The Crisis of Capitalism goes on a very long time. The money sent to the BRIC economies by the Hedge Funds is returning domestically in the form of the expanding Trade Deficit of the last 15 months.

When 'creative destruction' is trumpeted, the shouters never asks 'Whose pain and destruction?' This class war has is just a shout away.

3 Month Treasuries pay 0.01%, 10 Years pay 2 3/4%. Selling this paper is playing pusherman at the high school, so the money goes to the coffee can or the BRIC markets. The rest of the central banks denounce the Fed because ot the series of bubbles Bernanke is creating. Watch what Bernanke is also not doing.

He will not fund community banks or U.S. agencies who support commerce. Goods producing jobs fell massively in the last month.

Like all true socioppaths, the Fed, the Administration, and the rest of the corporate ruling class can look at the faces of the victims and not really be concerned about the effect of the crime.

"Canada only has five large banks, all with a nationwide presence, and all Too Big To Fail, yet the government there is not contemplating breaking them up."

To the best of my knowledge, Canadian banks operate the way banks have traditionally done. Only one bank held my mortgage until it was discharged, and when the kids were shopping for a mortgage they shopped the various banks for the best deal, and continue to deal with that same bank each five year period to renegotiate the interest rate.Several years ago the major banks applied to the regulator to allow mergers among the banks inorder to compete more effectively with the behemoths South of the border. That application was denied. It was perhaps one of the best reasons why Canadian banks were not severely affected by the financial crisis.

It never fails to amaze me how out of touch some organisations are when making fore-casts, in particular this example of Goldman Sachs unemployment "guestimate".

Their claim that unemployment will peak in 2011 at about 10.75% is way off the mark. Public sector redundancies aside, Atos Origin Healthcare who are contracted to operate the "Work Capability" assessments on the behalf of the DWP, are rejecting record numbers claiming disability allowance. At a conservative estimate, this alone will add an extra 1 million to the unemployment figures.

Melissa Bean is down 553 votes. She is the ultimate corrupt Democrat so getting her finally out would be great news for American workers!

She was the trader vote on a trade agreement in 2006 that was analyzed to cost even more American jobs. Tons of votes along those lines.

I just had a thought, artificially inflating the stock market might be about filling the empty public pension and other retirement fund coffers. I don't know the latest but earlier they were in huge trouble. Just sayin'.

The Carry Trade is very real, and other financial press are talking about it. It like they don't get that everything just flows out of the U.S. and gets parked in some emerging economy, such as our manufacturing base, our jobs and now our money.

Here are some posts on the carry trade from QE1.

On actual U.S. inflation, I'm not so sure. I mean we had a demand from the Q3 2010 GDP report of a meager 0.7%.

While none of this turned into jobs or anything for the real economy, there is one element I think is missed here.

That's the pull out of the deflationary spiral that was going on.

He needs to link to what he actually wrote.

No surprise, more "why did it take so long" when this announcement was released.

Stocks surge and Gold jumped.

Many believed the QE2 was already priced into the stock market and Gold, but aha! Fed did almost double what was expected. Most expected $500 billion.

That said, this maybe great for flash traders and such but in terms of the real economy.....uh.

If someone has some good reference for another economists or blogger, financial press who has analyzed QE2 in terms of the real economy, please put the link in a comment so we can check it out.

Everything I've read has just been for investors versus real live working people.

Pages