The Spell Of Woke Is Broke: Let's Keep It That Way

Authored by Thomas F. Powers via American Greatness,

It is too early to know with any precision what the long-term effects of the Trump administration’s anti-DEI efforts will be. We might take our bearings on that score by considering the fate of essays written by prominent law professors in the 1950s and 1960s touting this or that discrete step in the unfolding of the civil rights revolution—the latest Supreme Court decision, and so on—as if each were an all-or-nothing earth-shattering decision.

What we can now say with certainty is that what the Trump administration has done on the DEI front represents the beginning of a general reorientation of our politics away from wokeness. One need only survey what prominent leaders of the Left are saying about the political price the Democratic Party has paid on that score. What they are saying indicates a large political change, even if the Dems prove incapable of unmooring themselves from woke politics for the near future.

The first sign of this reorientation is a general shift in the popular mindset: the spell of woke politics has broken. This matters because it was always the way in which woke politics commanded assent in the citizens’ hearts and minds that was crucial. That assent has been questioned or denied now in a broad way, with the backing of public authority (Supreme Court decisions, executive orders, agency directives), and with widespread public support. Wokeness’s public hectoring, punitiveness, and censoriousness, and the extremism of many of its positions on the issues, is unpopular at the level of 70–30 or 80–20 opinion poll divides.

We ought to be confident, therefore, that the broken spell of wokeness augurs a permanent shift in our public life. What that means precisely, however, depends very much on how we understand wokeness and what is done going forward to ensure that woke excess does not return. Now, if, as many say, wokeness was the product of cultural Marxism (Christopher Rufo and a host of followers) or postmodernism (Jordan Peterson and another host of followers), then all that needs to be done is to combat bad ideas. On these interpretations, our universities in particular, and other cultural institutions where the influence of such ideas holds sway, need our attention. Certainly, cultural Marxism and postmodernism represent bad ideas, and the world would be a better place without their influence.

But if what wokeness represents above all is the explosive power of the civil rights revolution and the influence of an aggressive leftist interpretation of anti-discrimination politics, as another band of interpreters claims (I among them), then the task ahead is much bigger and much more difficult.

Trump’s anti-DEI measures, on this view, would represent only the first step in a broader campaign of civil rights reform. One could look long and hard without seeing much in the way of evidence for any such thing so far. Are these current efforts against DEI an illusion, a brief moment of political opportunism that will recede as public hatred of wokeness recedes—only to return in a few years when the next wave of anti-discriminatory passion rises up?

I don’t think that worry is justified. The anti-DEI campaign to date will have enduring consequences because even if it is not yet clear that what is at stake in DEI is civil rights politics, the current reorientation can only have the effect of raising our awareness of the role of anti-discrimination in our public life. This has begun on the all-important moral plane of civil rights politics. Precisely by breaking the spell of its puritanical commands, our anti-woke moment is reworking something essential to civil rights politics. Because public morality is the crucial filter of the human mind, a shift at this level will change what we see, what we think, and what we think we can say. Anti-woke sentiment, backed by changes in the law, is providing a moment of political, cultural, and mental freedom that will necessarily lead, after many decades during which this was not possible, to a general reappraisal of the moral power and the meaning of the civil rights revolution.

Morality, the Problematic Core of Anti-Discrimination Politics

The civil rights regime was always a collection of disparate, crucial elements. anti-discrimination politics began with the discrete groups who claim its protections (by now an overwhelming majority of the population), but it has been bolstered by laws and institutions and by a set of supporting “ideas” (critical race theory, postmodernist “difference” theory, critiques of “prejudice” by sociologists and anthropologists in the early twentieth century, e.g.). Its modes and orders have been advanced further in a hundred independent corollary efforts of cultural change throughout modern life (in the professions and in the domains of art, literature, and the like).

But central to the whole has always been the moral claim of the fight against discrimination. That moral claim has always been essential to civil rights politics and explains its great power in modern life.

Morality is crucial to anti-discrimination for a very simple reason: our perception of “discrimination” is a perception of an injustice. Indeed, what we mean politically by “discrimination” is always “unjust discrimination.” All human beings discriminate among classes of things, conceiving of better and worse, all the time; whenever we say “that’s discrimination” in a political sense, however, what we always have in mind is some kind of unfair or unmerited discrimination or negative judgment.

At the very beginning of anti-discrimination, we of course confront a form of unfair or unjust discrimination against blacks in America that any fair-minded person can very easily see was outrageous. Any decent person will say that an individual ought to be judged by the content of his character, not by the color of his skin. Anti-black discrimination in America was also extremely harsh and harmful, entailing a wide array of harms, ranging from minor indignities all the way up to violence and homicide. Americans were powerfully reminded of the profound injustice of American racism at the moment of their great moral triumph over Hitler and Nazism, which revealed the full scale of the horror of the Holocaust.

The moral power of civil rights politics played a decisive role in the 1950s and 1960s when the anti-discrimination regime was launched. It is true that the American liberal democratic tradition had long expressed a certain wariness of moral crusades (like Prohibition or, before that, religious puritanism). Only a moral force of immense power, of the sort the civil rights revolution was, could overcome our hesitations along those lines. The only real parallel to the civil rights effort was the attempt a century earlier to deal with American race discrimination’s father, or grandfather, slavery, in the Civil War, the bloodiest war in American history.

Victims of discrimination now carried a moral claim that could be used to demand attention from others. This moral starting point was supercharged and made hyper-spirited because, not entirely by conscious design, anti-discrimination enforcement came to institutionalize a hybrid of the civil law and criminal law. Policing harassment and discrimination borrows from the spirit of the criminal law at crucial points (naming offenders and victims, enlisting government prosecutors, paying close attention to intent and “motive”) but with the legal instrumentalities of tort law (looser procedures with lower standards of protection for the accused).

One consequence of this hybrid quasi-public, quasi-private legal structure was that enforcement of the machine could be handed over to employers, educational establishments, and other large (private or public) institutional entities acting in their capacity as “employers.” Enforcement was then implemented by our fellow citizens, acting under a sanction that was rooted in the law but not evidently or obviously “official” or governmental. The overall result was that anti-discrimination enforcement became a way of policing in an effective and relatively intimate way a significant portion of our social interactions, interpersonal behavior, and private speech—and policing how people treat one another is very much a matter of basic morality.

It was into this social domain that civil rights law, invited in by all-too-willing fellow citizens (bosses, deans, HR managers), imported the punitive and blame-casting spirit of the criminal law. At least as important, these individuals wielded the crucial coercive “corrective measure” of this privatized enforcement regime, above all, the firing of individuals. Punishment thus completes the picture for anything in the ballpark of “harassment”—and also for actions like demonstrating recalcitrance to the demands of the new order.

A New Morality?

As important as the victim/perpetrator injustice claims have been to the moral hold of civil rights politics, the morality of the anti-discrimination revolution is more complicated than that; moreover, its various claims are stated in much more precise terms. Indeed, a whole new system of public morality emerged out of the civil rights revolution.

To elaborate on this in detail would take more space than I have here, but in brief, a new terminology has emerged to clarify the harm of discrimination and to articulate the steps that must be taken to eradicate it. “Identity” is a vitally important term today because it names with some precision what it is in the individual that is threatened by group-on-group discrimination. “Respect” must replace mere “toleration” as a standard of interpersonal treatment because toleration is consistent with some kinds of discrimination (especially discrimination in the private sector). Claims from both identity and respect show that civil rights politics is thus necessarily a politics of “recognition.” New schemes of representation come into view as necessary as well—new, more “inclusive” schemes that reflect the “voices” of those previously excluded by discrimination. And, last but certainly not least, a host of new equality claims—systemic, structural, societal—call into question noticeable inequalities affecting the groups protected under anti-discrimination law. Such claims are now advanced under the heading of “equity.”

A whole new civic morality has thus emerged out of the political upheaval of the civil rights revolution; shamefully, our political scientists have nothing to say about this massive and astonishing fact of our public life.

It is the morality of civil rights as interpreted by the Left that supplies the key “ideas” that are at the core of the woke outlook—and not, I would insist, cultural Marxism or postmodernism or cultural relativism, and so on. To be sure, “ideas” there are here aplenty—identity, inclusion, recognition, respect, equity, etc.—but they are all ideas with a very simple and clear political origin. The lesson for us here ought to be this: political history as the cause of ideas, not intellectual history as the cause of politics.

One additional step remains: it is above all the moral logic of civil rights politics that must be “taught,” as a semi-official catechism, by way of the public and private enforcers of the regime, through things like diversity training, Title IX training, anti-bullying training, and the like—and with punitive sanctions for those who do not want to go along.

The moral power of the anti-discrimination revolution helps to explain how it could grow and grow, more or less unchecked, to the point where it became the monstrous woke regime against which the people have finally rebelled. This explains, too, why the American Left thought for so long that the Democratic Party could ride an anti-discrimination coalition to enduring political victory. Because of its moral content, the anti-discrimination regime—its groups, its laws, its ideas, its institutions, public and private—all seemed unquestionable, simply above criticism.

Our Doubts About the New Morality

What is crucial about the current moment is that anti-DEI sentiment extends to a new wariness concerning precisely the moralism of wokeness. Americans are heirs of the Enlightenment and heirs of liberal democratic constitutional government, and they have not entirely forgotten the suspicion of any politics that claims too much in the name of high and lofty ideals, religious or secular.

It’s true that almost no one is saying publicly that anti-wokeness is really at bottom opposition to civil rights moralism. But one need only consider in rough outline what it is that public anti-woke ire expresses in order to see why that is the case.

We don’t see this, however, and that is because the great moral power of civil rights still does its work to halt us from facing the enormous consequences of the social-political revolution that has taken place in its name. This is something that we see today, even in the Trump administration’s very effective anti-DEI measures. This is a huge effort of civil rights reform, in fact, unprecedented in its sweep. But does anyone call it by that name?

What is needed is a fuller and franker facing of the hold the civil rights revolution has on us. The greatest obstacle to that is its moral hold. How, then, to start to challenge—or at least to begin to think clearly about—something as important to American life as the morality of anti-discrimination without going off the deep end into a world that would welcome back discrimination of the kind American blacks endured before the 1960s. That is a price we cannot pay.

One answer is to begin to look at, to see, the civil rights revolution in its many conflicts with another morality that has great power in America—namely, the morality of the liberal democratic constitutional tradition. And when one begins to look on that level, there are indeed many, many conflicts between the logic of anti-discrimination and that older moral-political outlook.

Looking at anti-discrimination (as a whole) from the perspective of liberalism (as a whole), we will perhaps be able to begin, finally, to see the anti-discrimination regime as a distinct entity. We will, at the same time, be unable not to notice the many lines of tension between these twin poles of our moral-political order. That ought to free us up to start thinking more clearly about the relationship between them. Questioning one’s civic morality is not something to be embraced lightly, but fortunately for us in this situation, questioning one set of our moral categories may be done with a view to another, healthier, set.

* * *

Thomas F. Powers is Visiting Lecturer at The Center for Civics, Culture, and Society at Cleveland State University and author of American Multiculturalism and the Anti-Discrimination Regime (St. Augustine’s Press).

Tyler Durden

Thu, 03/05/2026 - 12:35

Karlsruhe: The Second Senate of the Federal Constitutional Court gathers. Photo: Uli Deck/dpa (Photo by Uli Deck/picture alliance via Getty Images)

Karlsruhe: The Second Senate of the Federal Constitutional Court gathers. Photo: Uli Deck/dpa (Photo by Uli Deck/picture alliance via Getty Images) U.S. Marine Corps. Lt. Gen. Francis Donovan looks on during a Senate Armed Services Committee Confirmation Hearing on Capitol Hill on Jan. 15, 2026. Tom Brenner/Getty Images

U.S. Marine Corps. Lt. Gen. Francis Donovan looks on during a Senate Armed Services Committee Confirmation Hearing on Capitol Hill on Jan. 15, 2026. Tom Brenner/Getty Images Military personnel patrol a market as they carry out weapons and drug checks in Quito, Ecuador, on Feb. 10, 2026. Rodrigo Buendia/AFP via Getty Images

Military personnel patrol a market as they carry out weapons and drug checks in Quito, Ecuador, on Feb. 10, 2026. Rodrigo Buendia/AFP via Getty Images

Illustration by The Epoch Times, Public Domain, Shutterstock

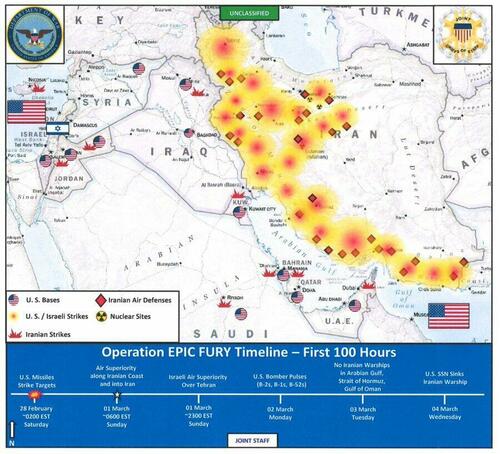

Illustration by The Epoch Times, Public Domain, Shutterstock Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters

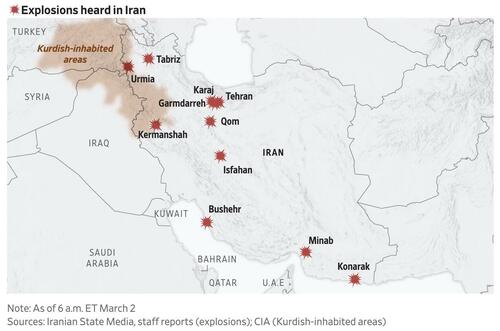

Joint Chiefs of Staff Chair Gen. Dan Caine holds a briefing about the U.S.–Israeli conflict with Iran, at the Pentagon in Washington on March 2, 2026. Elizabeth Frantz/Reuters Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images

Plumes of smoke rise over the skyline following explosions in Tehran, Iran, on March 1, 2026. Majid Saeedi/Getty Images Illustration by The Epoch Times, Public Domain

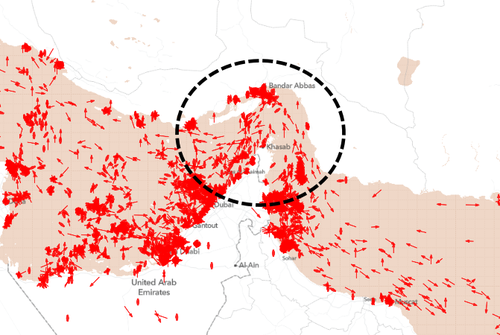

Illustration by The Epoch Times, Public Domain (Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images

(Top) Nimitz-class aircraft carrier USS Abraham Lincoln (CVN 72), Arleigh Burke-class guided-missile destroyers USS Michael Murphy (DDG 112), USS Frank E. Petersen Jr. (DDG 121), Henry J. Kaiser-class fleet replenishment oiler USNS Henry J. Kaiser (T-AO-187), Lewis and Clark-class dry cargo ship USNS Carl Brashear (T-AKE 7), and U.S. Coast Guard Sentinel-class fast-response cutters USCG Robert Goldman (WPC-1142) and USCGC Clarence Sutphin. Jr. (WPC-1147) sail in formation in the Arabian Sea, on Feb. 6, 2026. (Bottom Left) An F/A-18E Super Hornet, attached to Strike Fighter Squadron (VFA) 14, prepares to land on the flight deck of aircraft carrier USS Abraham Lincoln (CVN 72) during Operation Epic Fury at Sea on March 1, 2026. (Bottom Right) U.S. sailors prepare to stage ordnance on the flight deck of the USS Abraham Lincoln on Feb. 28, 2026. Mass Communication Specialist 1st Class Jesse Monford/U.S. Navy via Getty Images, U.S. Navy via Getty Images (Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

(Top Left) A U.S. F-15 fighter plane prepares for landing in Mildenhall, England, on Jan. 7, 2026. (Top Right) B-2 Spirit Bombers fly over the White House on July 4, 2025. (Bottom Left) A U.S. F-35 fighter plane takes off in Mildenhall, England, on Jan. 7, 2026. (Bottom Right) A U.S. Air Force F22-Raptor takes off in Ceiba, Puerto Rico, on Jan. 4, 2026. Dan Kitwood/Getty Images, Eric Lee/Getty Images, Miguel J. Rodriguez Carrillo / AFP via Getty Images

Recent comments