Stocks Drop As Oil Rebounds Over $90 On Escalating War, Ignoring Looming SPR Release

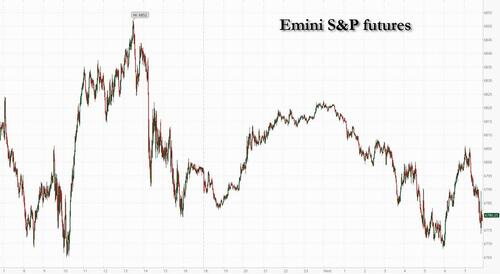

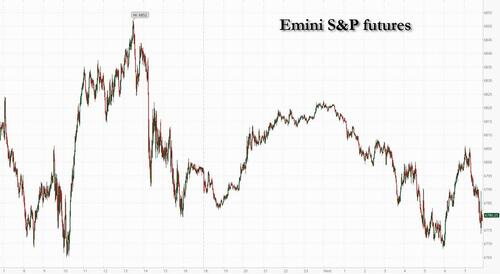

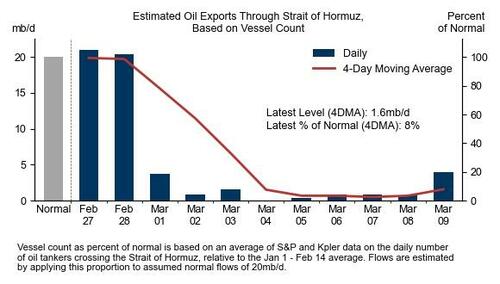

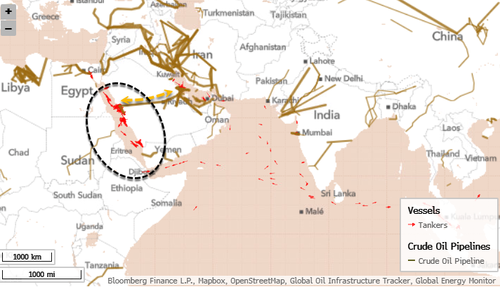

US equity futures remain extremely illiquid, jittery and volatile, and are down 10bps near the morning lows, erasing a 0.5% gain after earlier rebounding on hopes the upcoming SPR release will keep oil lower (it has so far failed to do that). Global equities saw a leg lower during APAC hours following an FT report that JPMorgan is marking down private credit portfolios. Mixed messaging from the Trump administration has helped fuel sharp swings in volatility gauges, with the VVIX jumping 10 points on Tuesday. As of 8:10am ET, S&P and Nasdaq futures are down 0.1%, as Oracle’s 10% climb in the pre-market offers support to the AI trade, while inflation is back in focus with today’s CPI print. The ORCL print supports optimism across the secular AI data center trade with focus on raised FY27 rev guidance on management's expectations for continued expansion in AI and advanced compute demand. Asia is leading overseas with TWSE up 410bps, NKY up 143bps, Europe flat to lower led on the downside by Germany down 67bps. In commodities, crude up 300bps feels like a non-event vs. intra day swings over the last seven trading days. Oil does, however, remain in focus as strikes continued across the Middle East overnight, with the UK Navy noting three vessels were hit in the Strait of Hormuz and the Persian Gulf. The IEA is proposing a record release of up to 400 million barrels of emergency oil reserves — more than double the amount deployed after Russia’s invasion of Ukraine. However, as explained here, it is unlikely the release will do much for a sustained drop in prices. Moves elsewhere in commodities benign. Yields elevated ahead of CPI with 10-year at 4.17%, dollar bid back with DXY at $99 and Bitcoin lower down 1% just below $70k. German CPI in line at +1.9%. We’ll get US CPI at 8:30am ET this morning.

In premarket trading, Magnificent Seven stocks are mixed (Alphabet -0.1%, Amazon +0.1%, Meta -0.01%, Nvidia +0.2%, Apple +0.1%, Microsoft +0.1%). Tesla rises 0.2% after Business Insider reported that the company is ramping up an AI agent project

- AeroVironment (AVAV) falls 10% after the drone maker cut its revenue guidance for the full year. Analysts trim their price targets, while Citizens noted that some of the weakness stems from defense deals getting delayed.

- Campbell’s Co. (CPB) falls 5% after the food company cut its adjusted earnings per share guidance for the full year.

- Domo (DOMO) rises 38% after the enterprise software company’s fourth-quarter results beat expectations.

- Nike (NKE) gains 2% after Barclays upgraded the sportswear retailer to overweight, citing recent operational progress, financial inflections and management’s disciplined actions.

- Oracle (ORCL) rises 9% after the company posted strong results and gave an outlook that suggested there is little letup in demand for AI computing.

- Serve Robotics Inc. (SERV) climbs 12% after the developer of AI-powered delivery robots posted fourth quarter results. Also, the company and White Castle launched a delivery pact via Uber Eats.

- UniFirst Corp. (UNF) rises 8% after Cintas Corp. agreed to buy the uniform maker in a cash-and-stock deal valued at $5.5 billion

- Upstart (UPST) rises 2% as the firm plans to apply for a US national bank charter, aiming to reduce costs and streamline its AI-based lending platform

In other AI news, the Chinese government moved to curb the usage of OpenClaw for banks and state agencies amid a user rush to adopt the AI agent. Amazon is making its debut in the euro bond market with a record eight-part sale, with maturities ranging from two to 38 years, following the 11-part dollar sale on Tuesday to fund AI investments. Elsewhere, Nintendo surged due to the surprise success of its new Pokémon game.

US futures are struggling for direction and Brent climbed back above $90 a barrel as an expected record release of crude stockpiles failed to lift sentiment amid attacks on vessels in the Middle East, simply because it will do little to offset the daily supply taken out by the Strait blockade. Volatility continued to grip equities, with S&P 500 contracts erasing a 0.5% advance, and it's nowhere near over: equities are “set for days of upcoming volatility, as the conflict in the Middle East is far from being resolved,” according to Roland Kaloyan, head of European equity strategy at Societe Generale adding that “Moving forward, there are high chances of seeing alternating risk‑on and risk‑off days.” The “markets’ starting point from when the conflict began was quite high so it’s also some excess optimism being cut to risk premiums which appears closer to what we perceive as the fundamentals.”

Sentiment was also dented as JPMorgan restricted some lending to private credit funds after marking down the value of certain loans in their portfolios, the latest sign of stress in the $1.8 trillion industry.

As the Iranian conflict rages on with no sign of de-escalation, the UK Navy said three ships were attacked in the Strait of Hormuz and the Persian Gulf. Governments are seeking to contain the spike in energy prices, with the International Energy Agency proposing a release of emergency oil reserves of as much as 400 million barrels, according to a person familiar.

“It’s helpful, but it’s more a short-term fix,” said Richard Saldanha, global equity fund manager at Aviva Investors. “The reality is, the way we’re going to avoid any kind of long-term shock is the Strait of Hormuz re-opening again.”

In the latest oil news, the IEA will propose the biggest-ever release of oil reserves. The potential 400 million barrels would cover days of global demand. OPEC’s monthly deep-dive analysis on the global crude market will likely draw more attention than usual.

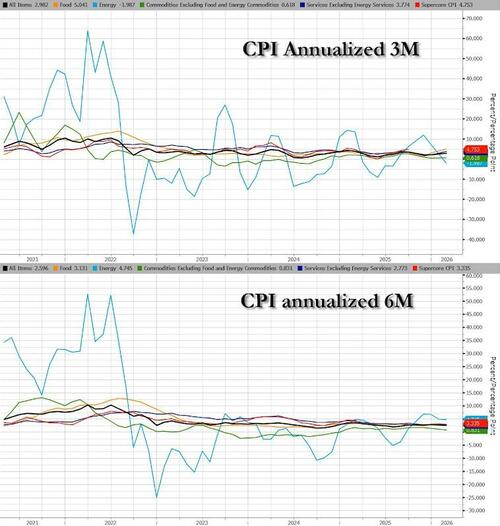

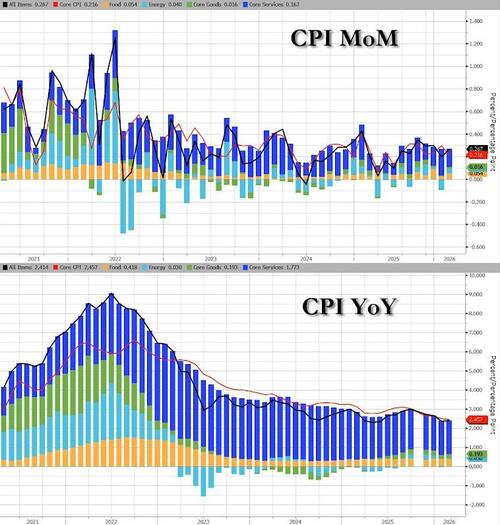

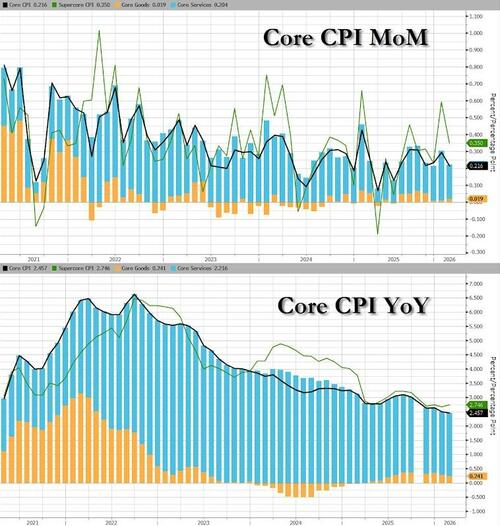

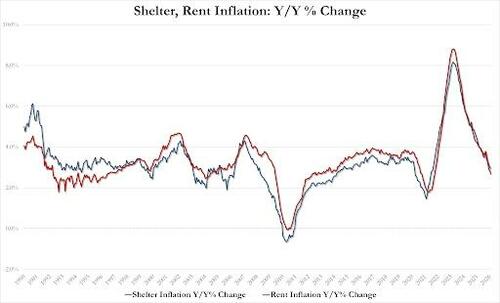

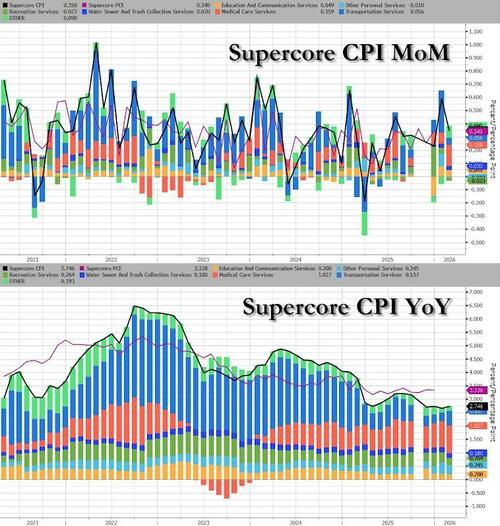

The US CPI print will be closely watched as stagflation concerns resurface. Bloomberg Chief US Economist Anna Wong expects the reading to be “unseasonally tame,” citing disinflationary effects from several heavily weighted components, while two new supply shocks - in metals and memory chips - were building pre-Iran. Derivatives strategists at Barclays say the S&P 500’s implied move for Wednesday is materially higher than recent history with the forward volatility term structure having shifted higher amid market stress.

The consumer price index report is projected to show a core inflation measure, which strips out volatile food and energy costs, rising 0.2% last month. That would suggest some easing in price pressures before the outbreak of the war. Money markets are leaning toward a Federal Reserve rate cut in July and the possibility of a second move in December.

“Even with geopolitics in the foreground, investors still want CPI to validate the ‘disinflation-with-room-for-cuts’ narrative rather than re‑ignite a sticky‑inflation scare,” said Ulrich Urbahn, head of multi-asset strategy and research at Berenberg.

Inflation expectations are building in international markets with European assets facing challenges because cost pressures concerns have soared rapidly, and an ECB rate hike is potentially closer than thought, according to Governing Council member Peter Kazimir.

The Stoxx 600 fell 0.4% to 603.44 with 417 members down, 171 up. The upside in energy prices and mounting bets that the ECB will hike rates have knocked European stocks lower with the Stoxx 600 down 0.8%, although off the lows of the day as oil trimmed gains; retail and automotive stocks outperforming, while industrial goods and real estate underperforming. Here are the biggest movers Wednesday:

- Balfour Beatty shares surge as much 13% to a record high after the construction group announced better profits and a larger buyback than expected

- Inditex shares gain 5.2%, outperforming European peers, after the Zara parent reported strong results for 2025 and gave a trading update for 1Q that analysts called “reassuring.” Shares are 2.8% lower YTD

- Orlen gains as much as 4.2% to the highest since Nov. 2017 after PKO and Santander both raised the Polish energy group to buy, expecting higher refining and gas margins from disruptions in the Middle East

- Avolta shares climb as much as 4.6% after the travel retailer reported solid results, announced a buyback and confirmed its 2026 outlook, despite uncertainty caused by conflict in the Middle East

- Wacker Chemie shares rise as much as 10% after the German chemicals firm posted better-than-expected guidance for 2026 on the back of its semiconductor polysilicon unit and cost savings

- Elis shares rise as much as 7.7%, the biggest jump in 11 months, after the workwear specialist delivered in-line results and outlined a bigger buyback for this year than expected

- CVC Capital shares fall as much as 7.4% to a new low as the private equity and investment advisory company cuts guidance for performance-related earnings again

- Legal & General shares fall as much as 6.2%, the most in 11 months, as the insurer and asset manager’s solvency ratio, an indication of financial strength, proves lower than expected

- Rheinmetall shares fall as much as 6.3% after the German defense company’s sales outlook fell short of analyst expectations. Oddo BHF says the print is slightly disappointing when it comes both to results and 2026 guidance

- Canal+ shares drop as much as 21%, the sharpest fall on record, as challenges at newly-acquired MultiChoice Group weigh on sentiment and detract from positive trends in the rest of the business

- Galenica shares fall as much as 5.3% after UBS lowers earnings per share expectations for the Swiss pharmacy operator through 2028, citing a weak flu season and the strong franc

- BW LPG falls as much as 10%, the most in almost nine months, after DNB Carnegie gives the maritime gas transportation company its only sell rating and sets a new Street-low PT to reflect an uncertain near-term outlook

Earlier, Asian stocks - which are now due for a painful catch down - rose as oil prices cooled, easing concerns about a major inflation shock for the region’s energy-import-dependent economies. The MSCI Asia Pacific Index gained as much as 2%, adding to Tuesday’s 3.2% advance. Shares of chip giants such as TSMC, Samsung and SK Hynix were among the biggest contributors to the rally after better-than-expected earnings from Oracle Corp., which pushed the cloud infrastructure company’s stock up nearly 10% in extended US trading. Oil climbed back near $90 a barrel after the close of trading in several Asian markets, paring the previous session’s 11% plunge, as vessels in the Middle East came under fire amid ongoing military strikes. Volatility across financial markets continued to be high as mixed messages from the Trump administration over the war in Iran kept investors on edge.

In FX, the Bloomberg Dollar Spot index faded losses as the risk tone deteriorated and is now flat. Aussie dollar is the clear outperformer across the majors as traders expect the RBA to deliver another rate hike next week.

In rates, treasury yields nudged higher ahead of the February inflation print; long-end yields are about 2bps higher as oil advance weighs globally. US front-end yields are little changed, slightly extending Tuesday’s curve-steepening move; 10-year near 4.17% is higher by less than 2bps with German and UK counterparts cheaper by 5bp and 7bp. European bonds plunged as a central bank official warned the Iranian war could force an earlier-than-expected interest-rate hike. Front-end bonds in Europe remain under pressure with German and UK two-year yields adding 8bps and 10bps respectively. Focal points of US session include February CPI report and $39 billion 10-year auction. Corporate new-issue slate may include Salesforce with a jumbo offering following Tuesday’s single-day volume record.

In commodities, brent crude futures are up 3.4% and largely shrugging off news that the IEA has proposed a 300-400 million barrel reserve release. Spot gold is flat, while silver declines 1.8%. Bitcoin is down 1%.

US economic data slate includes February CPI (8:30am) and federal budget balance (2pm)

Market Snapshot

- S&P 500 mini -0.1%,

- Nasdaq 100 mini -0.1%,

- Russell 2000 mini -0.5%

- Stoxx Europe 600 -1%,

- DAX -1.6%,

- CAC 40 -1%

- 10-year Treasury yield +1 basis point at 4.17%

- VIX +0.8 points at 25.73

- Bloomberg Dollar Index little changed at 1200.97,

- euro -0.1% at $1.1596

- WTI crude +5.2% at $87.79/barrel

Top Overnight News

- Iran has begun laying mines in the Strait of Hormuz, the world’s most important energy chokepoint that carries about one-fifth of all crude oil, according to two people familiar with US intelligence reporting on the issue. The mining is not extensive yet, with a few dozen having been laid in recent days. CNN

- The IEA is proposing a record release of up to 400 million barrels of emergency oil reserves — more than double the amount deployed after Russia’s invasion of Ukraine, a person familiar said. Japan is set to release oil reserves by itself as early as Monday, NHK reported, citing PM Sanae Takaichi. BBG

- The Trump administration believes it can withstand a brief spike in oil prices — for as many as four weeks, as one person close to the White House suggested — before the political hit does lasting damage. Politico

- JPMorgan Chase has clamped down on its lending to private credit groups, with bankers looking to cut risks as concerns mount over the credit quality of companies in their stables.

- Global bonds face more declines as traders bet inflation fallout from the Iran war will push central banks to raise rates. Markets are pricing two hikes in Australia and see the BOJ and ECB among candidates to also tighten. BBG

- Lebanon's Hezbollah is applying lessons from its last war with Israel as it braces for a possible full-scale Israeli invasion and protracted conflict, returning to its roots in guerrilla warfare in south Lebanon, four Lebanese sources said. RTRS

- The UK Navy said three vessels were hit in the Strait of Hormuz and the Persian Gulf. BBG

- China moved to restrict government agencies and state firms from running OpenClaw AI apps on office computers. BBG

- ECB’s Christine Lagarde said policy makers will ensure the Iran war doesn’t cause the same inflation surge as Russia’s Ukraine invasion did. BBG

- Senators Warner (D) and Rounds (R) are to introduce new legislation focused on AI and the workforce: Axios

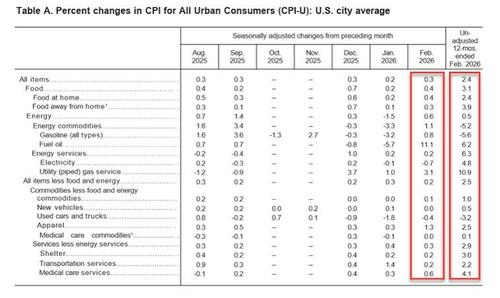

- CPI Preview from Goldman: Expect a 0.17% increase in February core CPI (vs. +0.2% consensus), corresponding to a year-over-year rate of 2.42% (vs. +2.5% consensus). Expect a 0.18% increase in headline CPI (vs. +0.3% consensus), reflecting higher food (+0.1%) and energy (+0.5%) prices. GS forecast is consistent with a 0.24% increase in core PCE in February.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks traded higher as the recent easing of oil prices helped the region shrug off the lacklustre lead from Wall Street and reports of Iran beginning to lay mines in the Strait of Hormuz. ASX 200 gained with strength in mining, resources, materials and financials, front-running the advances, but with upside capped amid increased bets for the RBA to hike rates at next week's meeting following recent central bank rhetoric and calls by some of Australia's largest banks for consecutive rate increases in March and May. Nikkei 225 rallied following the recent easing of oil price pressures and as softer-than-expected PPI data, which showed a surprise monthly deflation, supports the case for a delay in BoJ policy normalisation. Hang Seng and Shanghai Comp lagged amid quiet catalysts and with Chinese officials said to be frustrated by what they see as insufficient US preparation for the Trump-Xi summit later this month, while China also moved to curb the use of OpenClaw AI by banks and state agencies.

Top Asian News

- Japan's government is considering measures amid Middle East tensions and will announce gas and utility price measures at an appropriate time, according to Nikkei.

European bourses (STOXX 600 -1.0%) are entirely in the red, as the Iran conflict intensifies. Losses in the IBEX 35 (-0.4%) have been limited after positive Inditex (+0.8%) earnings, which beat Q4 EBIT estimates and boosted capex following a strong start to 2026. The DAX 40 (-1.2%) underperforms after Rheinmetall (-6.2%) missed FY net income and guided softer 2026 revenue than analysts expected. European sectors are broadly weaker across the board, as Energy (+0.3%) continues to gain. Real Estate (-1.3%) and Financial Services (-1.3%), alongside Industrial Goods and Services (-1.8%), sit at the bottom of the pile, with higher yields and risk tone weighing on the sectors.

Top European News

- European Commission draft Citizens' Energy Package recommends concrete measures to lower household energy prices, Handelsblatt reported; aim is to lower electricity taxes to a minimum.

Central Banks

- ECB's de Guindos said risks are tilted to the downside, macroeconomic projections will be much more complicated now.

- ECB's Kazaks said the ECB could act if war raises inflation expectations.

- ECB's Kazimir said a rate hike on Iran may be closer than thought; no reason to act at next week's meeting.

- ECB’s Villeroy said he does not expect a rate hike at next week's ECB meeting, said energy costs are a minor part of consumer spending, said banks should stay calm amid the Iran crisis.

- ECB's Nagel said the ECB will act decisively if an energy spike feeds into durably higher inflation; the risk of higher inflation has risen, economic outlook has deteriorated; the latest US statements on Iran war offer cause for hope.

- Westpac and National Australia Bank now expect the RBA to hike rates in March and May.

FX

- DXY is choppy this morning; currently trading around the unchanged mark, within a narrow 96.69-99.07 range. Little fresh from a European perspective, as focus remains on newsflow out of Iran. As it stands, the current conflict is showing few signs of ending, with reports now suggesting that Iran is taking steps to lay mines in the Strait of Hormuz. On the energy front, the IEA Governing Board is meeting today, whilst a separate G7 discussion on energy coordination is also scheduled for 14:00 GMT today. It was recently reported that the IEA proposed a 300-400mln barrel release of stockpiles – sources suggest that, should there be no objections, it could be announced as soon as today. Focus later will also be on US CPI, though it may lack signalling capacity given the current geopolitical situation.

- The Aussie extends on recent outperformance, as more banks now expect the RBA to hike rates at next week’s meeting. NAB and Westpac are the latest banks seen supporting a hike, joining the likes of Goldman Sachs and Bank of America. Delving into Westpac briefly, the bank previously forecast a hike in May, but the analysts now believe that the RBA will be “compelled to react” to the recent strength in oil prices. AUD/USD currently trades towards the upper end of a 0.71154 to 0.7185 range.

- Other G10s are trading modestly on either side of the unchanged mark vs the USD. The Loonie posts mild gains, given today’s strength in oil prices, whilst the JPY is the slight laggard, joined by the EUR. USD/JPY is venturing back into the touted “intervention zone”, beyond the 158.00 mark - though desks question the efficacy of intervening as the Iran war continues. GBP is essentially flat, awaiting cues from the Treasury Committee, which will question the Chancellor Reeves on the Spring Statement. BoE’s Breeden is also set to speak.

- For the EUR, currently trades just above the 1.1600 mark, within a 1.15904-1.1645 range. Today, there was a slew of ECB speakers, with particular focus on Kazimir who suggested that a rate hike on Iran may be closer than thought. This spurred some very modest upside in the EUR at the time, but was ultimately short-lived, given that he stated there is no reason to move rates at the next meeting.

Fixed Income

- APAC trade for fixed income was for the most part rangebound, with USTs and Bunds holding a handful of ticks in the red. JGBs also opened under pressure, with downside of 20 ticks at most. However, the move proved short lived as strong demand at the 5yr JGB tap underpinned the benchmark and lifted it to a 131.98 high, just shy of yesterday's 132.01 best.

- While relatively contained at first, EGBs came under renewed pressure early doors following ECB speak and a further uptick in energy benchmarks. Sending Bunds to a 126.55 trough over the course of the morning. On the former, Kazimir said an Iran-related rate hike could be closer than thought, though clarified that there is no reason to act in March. Near term market pricing has seen a very slight hawkish move this morning, but more pertinently end-2026 pricing implies around 25bps of tightening.

- In geopols, the UKMTO update seemingly spurred another leg higher in the crude space, with additional impetus potentially coming from the ongoing reporting around but lack of action on a reserve release.

- Moving to Gilts, the benchmark opened lower by over 50 ticks and has since slipped another 30 or so to a 90.27 base. Currently lagging, posting downside of 78 ticks vs 63 for Bunds. Action is very much occurring in tandem with the EGB move. Additionally, the UK has a packed agenda with Chancellor Reeves discussing her Spring Statement with the TSC, the release of Mandelson-related files by the government (around 12:30GMT) and then an appearance from BoE's Breeden, however this is scheduled to be on stablecoins.

- Vnet (VNET) , China's largest data centre operator, is considering a dollar bond sale to fund expansion, Bloomberg reported citing sources.

- Amazon (AMZN) opens books on eight-part EUR denominated bond offering.

- Japan sold JPY 1.9tln 5yr JGBs; b/c 3.69x (prev. 3.10x), average yield 1.633% (prev. 1.640%).

- Australia sold AUD 1bln 4.25% October 2036 bonds, b/c 3.87, avg. yield 4.9002%.

Commodities

- WTI and Brent front-month futures have been grinding higher since early European hours following a choppy APAC session and the declines seen during the prior session. Yesterday, there was a bout of selling pressure after US Energy Secretary Wright mistakenly posted that the US Navy escorted an oil tanker through the Strait of Hormuz, although oil then pared some of the losses as the post was deleted shortly after, and the White House confirmed that this was false.

- Note, the IEA Governing Board is meeting today, whilst a separate G7 discussion on energy coordination is also scheduled for 14:00 GMT today. It was recently reported that the IEA proposed a 300-400mln barrel release of stockpiles – sources suggest that, should there be no objections, it could be announced as soon as later today.

- Spot gold holds an upward bias on either side of the USD 5,200/oz level, with the precious metal kept afloat alongside the recent easing in oil price pressures, although DXY has clambered off worst levels as eyes remain on flows in the Strait of Hormuz. A deterioration in sentiment in early European hours cushions downside for the yellow metal for now, which resides in a narrow USD 5,175.35-5,223.38/oz at the time of writing.

- Copper futures traded rangebound overnight but then slipped in early European hours amid a broader deterioration of sentiment as the Iranian war shows no signs of ending despite recent commentary from US President Trump. 3M LME copper is back under USD 13,000/t and resides towards the bottom end of a USD 12,993.00-13,151.53/t at the time of writing.

- G7 statement said the group is vigilantly monitoring the energy market, and G7 supports in principle the use of strategic oil reserve.

- IEA to recommend the release of strategic reserves, according to sources; volume in the first month would reportedly exceed 100mln barrels.

- IEA reportedly proposed oil stockpile release of around 300-400mln barrels, according to Bloomberg; decision is possible later on Wednesday, said a source.

- IEA has proposed the largest ever release of oil from strategic reserves to bring down the price of crude, according to WSJ. "Countries would decide Wednesday whether to release oil stocks in an attempt to tame crude prices". "The release would exceed the 182 million barrels of oil that IEA member countries put onto the market in two releases in 2022 when Russia launched its full-scale invasion of Ukraine".

- As part of a potential 400mln barrel IEA crude release, Germany would release around 19.5mln barrels, Handelsblatt reports citing sources; equating to around 20% of Germany's reserves

- Black Sea CPC blend oil exports were reportedly revised down to around 1.4-1.5mln BPD for March (prev. 1.7mln BPD)

- White House reportedly believes it can "withstand a brief spike in oil prices — for as many as four weeks... before the political hit does lasting damage", according to Politico citing sources.

- Iraq's oil ministry has sent a letter to the Kurdistan regional government for the export of at least 100k BPD via the Kurdistan pipeline to Turkey's Ceyhan, according to oil officials.

- EU Commission President von der Leyen said Europe's dependency on fossil fuels have cost it EUR 3bln in extra costs in the first 10 days of the Iran war, returning to Russian fossil fuels in the current crisis would be a strategic blunder. EU is preparing options to lower energy prices, which include better use of purchase power agreements and CFDs, state aid measures, gas price subsidies or caps.

- Maersk (MAERSKB DC) CEO tells the WSJ that 10 ships are trapped in the Persian Gulf and would need at least 10 days to resume normal operations if a ceasefire was to occur.

- Glencore (GLEN LN) workers reportedly set to conduct a strike at Australian copper refinery, according to Bloomberg.

Geopolitics

- Iran's Joint Command Spox said US and Israeli banks will be hit after an attack on an Iranian bank, via IRNA.

- Iran’s IRGC said it carried out its heaviest and most intense attacks since the start of the war, targeting US and Israeli assets across the region, according to WSJ.

- IRGC said it launched missiles carrying 2-ton warheads in a new wave of heavy, multi-warhead strikes targeting US bases in Iraq and Bahrain as well as Israel.

- Iran's police chief said anyone taking to the streets at the enemy's request will be confronted as an enemy and not a protester, adds security forces are prepared to respond and have their fingers on the trigger.

- Iran launches new wave of missiles on occupied territories.

- Iranian armed forces spokesperson vows retaliation for Israeli and US strikes on residential areas.

- US officials said Iran has laid less than 10 mines in the Strait of Hormuz and it is unclear if it intends to lay more in the near term, according to WSJ.

- Drone reportedly hits a US diplomatic facility in Iraq, according to Washington Post.

- US Central Command said US forces eliminated multiple Iranian naval vessels on March 10th, including 16 mine layers near the Strait of Hormuz.

- Air defenses shoot down a drone targeting a US military base near Erbil Airport in Iraqi Kurdistan.

- Israeli army announces massive wave of raids on Tehran, targeting Iranian regime infrastructure.

- UAE Defence Ministry reported air defences are currently intercepting missiles and drones from Iran.

- Israel rejects Lebanon's request for a halt in fighting to allow for talks, according to FT.

- UKMTO said it has received a report of an incident 50NM north-west of Dubai, with a bulk carrier hit by an unknown projectile.

- Russia's Kremlin said Istanbul is an possible location for talks next week but there is no specific clarity yet.

- North Korea conducted strategic cruise missile tests on Tuesday for a naval destroyer, while Leader Kim said destroyers must be equipped with supersonic weapons, according to KCNA.

US event calendar

- 7:00 am: United States Mar 6 MBA Mortgage Applications, prior 11%

- 8:30 am: United States Feb CPI MoM, est. 0.29%, prior 0.2%

- 8:30 am: United States Feb Core CPI MoM, est. 0.23%, prior 0.3%

- 8:30 am: United States Feb CPI YoY, est. 2.4%, prior 2.4%

- 8:30 am: United States Feb Core CPI YoY, est. 2.5%, prior 2.5%

- 2:00 pm: United States Feb Federal Budget Balance, est. -310b, prior -94.62b

DB's Jim Reid concludes the overnight wrap

After an extraordinary start to 2026, a small – and possibly brief – pocket of relative calm has returned to markets. I'd stress the emphasis on the word relative. The year has already delivered Venezuela, Greenland, an early year JGB slump, a surge and subsequent slump in gold and silver, IEEPA tariffs being overturned, sharp falls in software and other AI sensitive stocks, private credit fears, major breakthroughs from Claude and Anthropic, and viral, vibe-driven commentary from Matt Shumer and Citrini Research that wiped more than a trillion dollars off global equity markets amid fears of disruption and millions of imminent job losses. We have also seen the KOSPI rise more than 50% in the first handful of weeks of the year, only to fall into a bear market before rebounding. And now we find ourselves in the middle of the Iranian conflict. Have I missed anything? In nearly 31 years of doing this job, I’ve experienced many years dominated by huge headlines and crises, but I don’t think I’ve ever seen the narrative shift so rapidly over such a short period. What is equally impressive is that most asset markets remain healthily positive for the year.

Until we move onto the next big event, markets continue to be driven by volatile news flow around Iran and the outlook for oil flows. Overall, the narrative has shifted towards a cautiously more optimistic tone, even as there’s little sign of an imminent end to the conflict. The improved optimism helped drive a dramatic fall in oil prices, with Brent crude down -11.28% from Monday’s European close to $87.80/bbl, marking its largest one-day decline since March 2022. The 12-month Brent future also fell by -1.93% to $72.05/bbl. After some volatility late yesterday, Brent is slightly lower again this morning and is around -27% below Monday’s intra-day highs but still about +20% above where it was before the US and Israeli strikes against Iran.

While much of the oil decline had come after Trump comments late on Monday, the move extended on Tuesday, notably after Saudi Aramco said it will ramp up crude flows via its pipeline to the Red Sea to 7mb/day within a few days, which would allow it to resume 70% of its usual oil shipments. While redirection of crude via this route was expected, it was still seen as good news as questions remained over its exact capacity. And while reporting over potential mining of the Strait of Hormuz saw oil prices bounce late in the US session, they moved lower again overnight after the Wall Street Journal reported that the IEA (International Energy Agency) has proposed the largest release of oil reserves in history to combat rising prices. IEA member countries are expected to decide on the proposal today, while G7 leaders will also today discuss the response to the crisis, according to Canada’s Mark Carney.

Brent even moved as low as $81/bbl shortly after the European close yesterday as US Energy Secretary Chris Wright posted that the US had successfully escorted an oil tanker through the Strait of Hormuz. However, this post was soon deleted and the White House confirmed that no such operation took place. And not long after, President Trump posted that Iran would face consequences “at a level never seen before” if it placed any mines in the Strait of Hormuz. That came as CNN reported that Iran was beginning to lay mines in the straits. Those headlines saw Brent move back towards $92/bbl, before declining again following the WSJ report on the planned oil reserve release.

Easing oil market stress sparked a strong rally in risk assets yesterday, with the STOXX 600 (+1.88%) recording its best day since last April. And while more concerning headlines late in the US session saw the S&P 500 (-0.21%) erase its gains, futures on the S&P 500 are +0.32% higher overnight. As I started typing this, they were +0.5% higher but an FT story has just been released suggesting JP Morgan have "clamped down on its lending to private credit groups" and have "marked down the value of certain loans in their portfolios". Asian markets are also off their highs but still up strongly with the Nikkei (+1.99%) and Kospi (+2.52%) leading the gains in Asia this morning.

The volatility late in the US session did mean that the S&P 500 (-0.21%) closed nearly a percentage point off intra-day highs, with the equal-weight S&P 500 seeing a larger -0.82% decline. And the VIX index closed at 24.93, a modest -0.57pts lower on the day and notably above its intra-day low of 22.19. Still, while there remains plenty of caution, financial stress has eased materially since the start of the week when the VIX reached 35 at Monday’s open. And despite the recent volatility, the S&P 500 is still less than 3% from its record high on January 27. Some of the risk premium was also stripped out of other assets, with US high yield spreads tightening by -9bps while the dollar index (-0.35%) recorded its largest daily fall in the past month.

The Mag-7 have played a big role in supporting the relative resilience of US equities, with the index now +1.15% above its levels before the strikes after a +0.38% gain yesterday. The tech mood was also helped by Oracle’s results after the US close last night, with a strong sales forecast sending its stock +8% higher in after-hours trading.

Although developments in the Middle East remained the dominant driver, the latest US economic data also reinforced the picture of resilience. ADP’s weekly private payrolls report showed a four-week average of 15.5k for the period up to February 21, equivalent to around 62k on a monthly basis. Meanwhile, US existing home sales surprised to the upside in February, rising to an annualised pace of 4.09mn (vs 3.88mn expected). These releases helped mitigate concerns following the weakness in last Friday’s jobs report and pushed yields higher. A surge in corporate bonds sales added some upward pressure on yields, with a soft 3yr auction and volatile oil headlines leaving 10yr yields (+6.0bps to 4.16%) at the session’s highs by the close. Treasuries are reversing some of this move overnight, with the 10yr yield down -1.6bps.

US data remains firmly in focus today with the release of the February CPI report. This is a key print, as the recent oil shock has pushed back market expectations for the next Fed rate cut. While the Fed is widely expected to hold rates steady at next week’s meeting, today’s data will help shape expectations for subsequent decisions. Our US economists are watching for tariff related strength in core goods, particularly apparel, alongside recent gains in wholesale used car prices. Overall, they expect headline CPI to rise by +0.27%, boosted by a +1.0% increase in energy prices, keeping the year-on-year rate at +2.4%. Core CPI is forecast at +0.24% month on month, leaving the annual rate unchanged at +2.5%. For more detail, see their full preview here.

In Europe, markets rallied sharply as investors finally had the chance to react to Trump’s comments made after the previous day’s close. All major equity indices surged, including the DAX (+2.39%), FTSE 100 (+1.59%) and CAC 40 (+1.79%). Fixed income markets also saw large moves, as the fall in oil prices prompted investors to rapidly scale back expectations for rate hikes this year. Overnight index swaps are now pricing just 17bps of ECB tightening in 2026, down from 30bps at Monday’s close, while BoE pricing for December moved from pricing 1-2bps of hikes to 16bps of cuts by the close. As a result, 10 year gilt yields dropped by -9.3bps, their biggest daily fall since the reaction to the 90 day tariff delay after Liberation Day last year, while 2 year gilt yields fell -12.3bps. Moves in German bunds were more muted, with the 10 year yield down only -2.0bps to 2.83%, although the 2 year yield declined by a larger -6.4bps. Overall, the backdrop now looks much closer to the scenario outlined by our European economists here, which envisages a moderate and transitory shock rather than one that would prompt ECB tightening.

Early morning data showed that Japan’s wholesale inflation (PPI) slowed for a third consecutive month in February (+2.0% y/y) down from +2.3% in January and coming in slightly below the 2.2% forecast. This moderation was largely facilitated by government fuel subsidies, providing a temporary buffer against rising commodity costs. Nevertheless, economists warn that the benefits may be short-lived due to the escalating oil prices.

Looking ahead, today brings the US February CPI and the federal budget balance. Central bank speakers include the Fed’s Bowman and the ECB’s Guindos and Schnabel. Notable earnings include Telecom Italia, and there is also a 10-year US Treasury auction.

Tyler Durden

Wed, 03/11/2026 - 08:28

Illustration by Lumi Liu

Illustration by Lumi Liu

AFP via Getty Images/People

AFP via Getty Images/People Pictured: President Donald Trump holds up an executive order on the rapid development, deployment and use of advanced nuclear technologies, on May 23, 2025, in the White House. (Photo by Win McNamee/Getty Images)

Pictured: President Donald Trump holds up an executive order on the rapid development, deployment and use of advanced nuclear technologies, on May 23, 2025, in the White House. (Photo by Win McNamee/Getty Images)

Recent comments