Futures Tumble As Oil Jumps Above $100 On Iran War Chaos

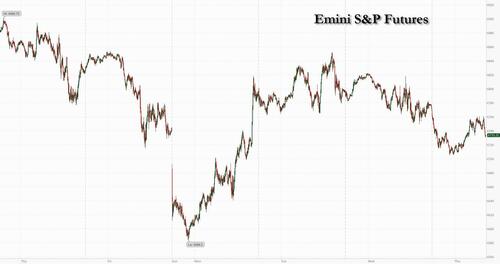

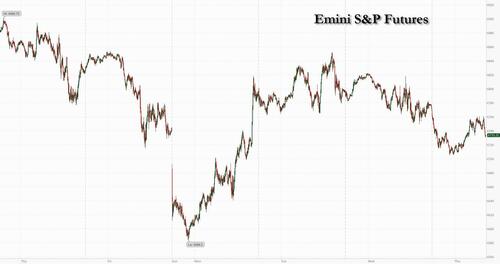

US futures are sharply lower, as oil briefly surges back over $100 while markets start to accept the view that the Iran war will not end this week, and possibly any time soon. As of 8:15am ET, S&P and Nasdaq futures are down 0.7% and R2K futures slide more than 1%. Futures dropped more than 1% overnight as Iraq suspended oil terminal activity following an attack on two tankers; they recovered some losses after the resumption of normal operations at Oman’s Mina Al Fahal oil terminal. Global market moves overnight were relatively benign: KOSPI down 48bps the most muted day in weeks, China flattish, Europe mixed with Germany flat and France down 50bps. In premarket trading, Mag 7 names are all weaker, energy names are stronger, and defensives outperform cyclicals on the move lower. Iran offered an off-ramp (guarantee of no future attacks from US and Israel) but unclear if that will be accepted. Private credit fears continue to surface as Morgan Stanley and Cliffwater gated withdrawals from their private credit funds, pressuring both Equities and Credit. Bond yields are flat, the USD is bid, and commodities are seeing strength across all 3 complexes, led by Energy. Today’s macro data focus is on jobless claims and housing starts. The Fed remains in blackout into next week’s (Mar 18) meeting. The market wants to see if Powell echoed Trump’s view that prices increases from the conflict are transitory when other central banks are seeing expectations flip from cuts to hikes.

In premarket trading, Mag 7 stocks are all lower (Alphabet -0.7%, Meta -0.7%, Amazon -0.6%, Microsoft -0.4%, Nvidia -0.4%, Tesla and Apple little changed)

- Fertilizer, energy and chemical stocks climb as the war in Iran and disruptions to the Strait of Hormuz tighten supply, raising prices, while airlines and cruise stocks are down as higher crude prices lift costs.

- Blue Owl Capital Inc. (OWL) falls 3% after the asset manager defended its recent sale of $1.4 billion of loans from three of its funds, arguing the transaction contained no backstops or hidden incentives.

- Bumble (BMBL) rises 24% after the online dating company forecast Ebitda for the first quarter that beat expectations. Analysts noted that focus now shifts to upcoming product overhaul planned for later in the year.

- Hims & Hers Health (HIMS) rises 5% after rallying 10% on Wednesday. The stock is set to extend its advance for a fourth straight session.

- Lightwave Logic (LWLG) climbs 16% after the company announced a development agreement with Tower Semiconductor.

- Petco (WOOF) rises 10% as the pet health and wellness company’s adjusted Ebitda forecast for the first quarter beat the average analyst estimate. Jefferies upgrades its rating, noting that investors underappreciate the progress made thus far.

- UiPath (PATH) falls 6% after the software company reported fourth-quarter results. Bloomberg Intelligence writes that growth concerns persist despite a strong quarter.

In corporate news, Atlassian is the latest software firm to announce AI-linked job cuts. Abivax shares are surging after French media reported that the biotech had granted AstraZeneca exclusive access to confidential information until March 23 with a view to formalizing an offer. And the widening war has upended global travel, sending fares soaring and leaving travelers facing record prices ahead of the Easter rush.

Iran escalated attacks on parts of Dubai and shipping assets, pushing oil briefly back above $100 a barrel and intensifying concern about the length of the Middle East war and the effective closure of the Strait of Hormuz. Multiple oil tankers were attacked in Iraqi waters and Oman evacuated ships from a key terminal. The Iran war has disrupted 7.5% of global crude supply, with flows through the Strait down by more than 90%, the IEA said. It's telling that after yet another Whitehouse jawbone and the IEA’s record reserve release announcement, oil still failed to drop. Overnight Reuters reported, “Iran has laid about a dozen mines in Strait of Hormuz, sources say”.

Hostilities are fast-approaching a third week, with no sign of de-escalation. Iran escalated attacks on parts of Dubai and shipping assets, driving oil prices higher and increasing concern among traders about how much longer the conflict in the Middle East will go on for. The surge in oil prices reflects concern that the conflict could throw energy markets into turmoil for a prolonged period, with efforts to cushion the impact offering little relief. Crude is driving moves across asset classes as traders fear that higher fuel costs will rekindle inflation and hit economic growth.

“What you’re are seeing is the market pricing a long-lasting scenario of high oil prices,” said Karen Georges, an equity fund manager at Ecofi in Paris. “The security of shipping in the region is a big concern while the release of emergency oil reserves can only provide temporary relief.”

The International Energy Agency said in a monthly report that the Iran war is causing unprecedented turmoil in oil markets. Global oil supply will be slashed by 8 million barrels a day this month, or almost 250 million barrels in total, the IEA estimated. The report comes after the agency’s members agreed to release 400 million barrels from emergency reserves on Wednesday.

“While Trump’s claim that we could soon see a resolution to the conflict does provide hesitancy for the bulls, the reality of the situation will undoubtedly call for higher prices as the days roll on,” said Joshua Mahony, chief market analyst at Scope Markets.

For Francois Rimeu, senior strategist at Credit Mutuel Asset Management in Paris, the reaction in equity markets has been rather sanguine given how broad and impactful a worst-case scenario for the conflict could be. “The draw-down could really turn much lower should the conflict last longer, and the longer it lasts, the longer a return to business as usual will be,” Rimeu said. “If you ask me when is the right time to buy back, I would tend to say when one actually sees ships crossing the Strait of Hormuz again.”

In the latest hit to private credit, Morgan Stanley and Cliffwater gated withdrawals from their multibillion-dollar private credit funds after investors sought to redeem vastly more than the vehicles allow. Partners Group warned that private credit default rates could double in the next few years. Tariffs are also back in the spotlight as the US begins a probe into trade investigations that set the stage for new levies.

Back on oil, China tightened fuel export curbs, while the average retail cost for one gallon of gasoline in the US has risen to the highest level since May 2024, piling pressure onto the administration to find an off-ramp for the conflict. Trump has said that the war could end soon, but the latest rhetoric from Iran dimmed prospects for a quick resolution.

Elsewhere, JPMorgan said hedge funds are experiencing the biggest drawdown since April’s tariff turmoil, as unwinds in crowded trades punish the fast-money cohort. In a brutal trading week, Citadel’s Global Fixed Income Fund and Taula Capital Management are among the hedge funds worst hit, while D.E. Shaw’s two main vehicles were a rare bright spot in the industry.

European stocks are lower across the board but off session troughs after the resumption of normal operations at Oman’s Mina Al Fahal oil terminal provided some reprieve. Banks are the biggest underperformer, while chemicals outperform most. Here are the biggest movers Thursday:

- Accelleron Industries shares rise as much as 17%, a record jump that briefly sent the stock to an all-time high, after the maker of turbochargers posted full-year earnings that topped expectations, with a solid outlook and its first buybacks

- Abivax shares rise as much as 17% after La Lettre reported the biotech company had granted AstraZeneca exclusive access to confidential information until March 23 with a view to formalizing an offer

- K+S gains as much as 8.8%, the most since last April, after the German fertilizer group reported solid earnings, which analysts said boded well for 2026. They noted that higher sulfur prices due to tumult in the Middle East could prove a tailwind

- Zalando gains as much as 9.2%, the most since November, after the German online seller of fashion announced a new share buyback program of up to €300 million, which RBC said should soothe concerns over capital allocation

- Leonardo shares gain as much as 8.7% to a new record high after the defense technology firm outlined its targets through 2030, which Mediobanca described as “bullish.” Analysts highlight, in particular, order intake expectations

- Bachem shares jump as much as 9.7%, the most since July, after the pharmaceutical ingredients producer reported slightly better results than expected

- PolyPeptide advances as much as 11% after confirming its 2025 numbers and providing outlook commentary which Jefferies says demonstrates the biotechnology company’s strong execution

- Trainline shares slide as much as 6.7% after its annual results, with JPMorgan warning the rail ticketing platform is lacking visibility and faces a “more challenging chapter ahead” in FY27

- Bodycote drops as much as 5.5% after being downgraded at RBC Capital Markets, with analysts citing more limited upside. The cut comes a day after the provider of heat treatment and specialist thermal processing services beat expectation

- Savills shares fall as much as 8.4% to the lowest in six months, as the property services group’s in-line results are overshadowed by the war in the Middle East

- On the Beach shares drop as much as 15% to the lowest level since November 2024. The online seller of package holidays suspended its full-year guidance of £39m to £43m adjusted profit before tax due to a “significant slowdown”

Earlier in the session, Asian stocks fell on Thursday, snapping a two-day rising streak after a string of disruptions in the Iran war renewed fears of a longer-term energy supply strain in the Middle East and briefly pushed Brent crude back above $100 a barrel. The MSCI Asia Pacific Index fell as much as 2%, led by chipmakers TSMC, Samsung and SK Hynix. The jump in oil prices came as Iran suspended oil terminal activity following an assault on two tankers, and Oman temporarily evacuated its main export hub. The regional benchmark had climbed for two previous sessions when oil prices softened, underscoring investors’ focus on volatile energy markets. Bonds in the euro area trimmed early declines.

In FX, the Bloomberg Dollar Spot Index gains 0.3%, before paring the advance; the greenback is on course for a fresh 2026 high, options markets show. USD/JPY is little changed at 158.90; it rose earlier to a two-month high at 159.24 as options traders and strategists see a high threshold for intervention from Japan to defend the yen

In rates, US rates have clambered off session lows but remain weak with global bonds erasing 2026 gains. US yields are down around 1bps across the curve. US long-end yields are little changed with front-end tenors richer by 1bp-2bp, steepening 5s30s spread by around 1bp. 10-year near 4.21% is lower by about 1bp with UK counterpart up about 4bp. In IG issuance, Salesforce led eight issuers that sold a combined $41.7 billion Wednesday, taking weekly volume past $107b, the third largest on record achieved in only two sessions. Issuers paid an elevated 21bp in new issue concessions on deals that were 1.9 times covered. At least one issuer stood down Wednesday, while a couple are considering Thursday.

A Bloomberg index that tracks total returns from investment-grade government and corporate bonds is now flat for 2026. The gauge had been up as much as 2.1% this year through Feb. 27, just before the US and Israel attacked Iran.

In commodities, Brent crude futures rise 4.6% to $98 but off session highs; Iranian attacks on shipping assets and areas of Dubai alongside China tightening fuel export curbs briefly lifted prices above the $100 a barrel mark.Spot gold and silver are higher by 1.5% and 0.1% respectively. Bitcoin is down 0.4%.

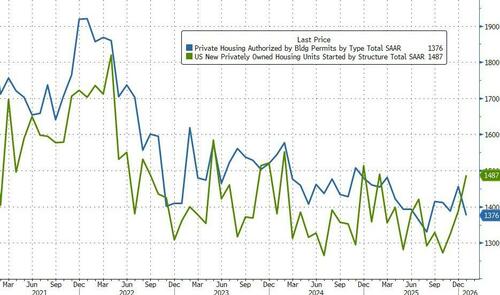

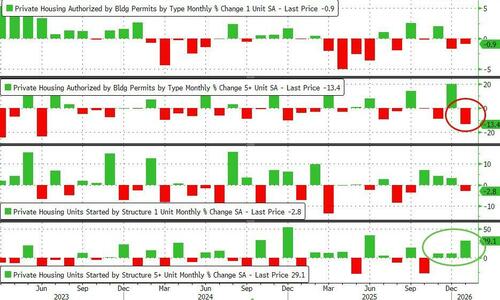

US economic data slate includes January trade balance and housing starts and weekly jobless claims (8:30am) and 4Q household change in net worth (12pm)

Market Snapshot

- S&P 500 mini -0.6%

- Nasdaq 100 mini -0.6%

- Russell 2000 mini -1.3%

- Stoxx Europe 600 -0.6%

- DAX -0.5%

- CAC 40 -0.7%

- 10-year Treasury yield little changed at 4.23%

- VIX +1.3 points at 25.53

- Bloomberg Dollar Index +0.2% at 1204.95

- euro -0.1% at $1.1551

- WTI crude +6.2% at $92.66/barrel

Top Overnight News

- Iran escalated attacks on parts of Dubai and shipping assets, pushing oil briefly back above $100 a barrel and intensifying concern about the length of the Middle East war and the effective closure of the Strait of Hormuz. Two oil tankers were attacked in Iraqi waters and Oman evacuated ships from a key terminal. The Iran war has disrupted 7.5% of global crude supply, with flows through the Strait down by more than 90%, the IEA said. BBG

- President Trump—faced with rising oil prices and pushback from his MAGA base—is signaling that he wants to wind down the war he launched against Iran less than two weeks ago. Stopping the fighting carries risks. Leaving in place Iran’s theocratic regime—angry, defiant and in possession of its nuclear stockpile and what remains of its arsenal of missiles and drones—would essentially grant Tehran control over the world’s energy markets. WSJ

- India plans to unveil a more than $10.8 billion fund aimed at bolstering domestic chipmaking, people familiar said. BBG

- German bond yields rose to their highest since October 2023 as the Iran war stoked inflation concerns. BBG

- Oracle has stepped up preparations to cut jobs over the coming months as it credits AI with driving efficiencies in its team and conserves cash to fund its costly push into data centers. FT

- President Trump—faced with rising oil prices and pushback from his MAGA base—is signaling that he wants to wind down the war he launched against Iran less than two weeks ago. Stopping the fighting carries risks. Leaving in place Iran’s theocratic regime—angry, defiant and in possession of its nuclear stockpile and what remains of its arsenal of missiles and drones—would essentially grant Tehran control over the world’s energy markets. WSJ

- U.S. officials say relentless American and Israeli aerial attacks have crippled Iran’s air defenses, navy and missile arsenal. But the regime in Tehran has so far held on to power, and it effectively shut down a crucial choke point for the world’s oil supplies. CNBC

- The White House believes it has until the end of March before rising gas prices become an “unsustainable” political five-alarm fire, one of the officials said. CNBC

- Morgan Stanley and private credit lender Cliffwater have restricted withdrawals from private credit funds, in the latest sign of investor unease about the sector. Separately, a US distressed debt investment fund told its investors that private credit lenders such as Blue Owl are obscuring weaknesses in their portfolios and a sharp correction in debt markets is approaching soon. FT

- Investors demanded significant concessions in Salesforce’s $25bn bond deal on Wed, highlighting rising worries on Wall Street about how AI technology could disrupt software companies. FT

- Trump is to signs orders on housing in the coming days, according to Punchbowl citing a White House spokesperson.

- BofA Card Spending (w/e March 7th): +4.6% Y/Y, vs 3.2% in February. Y/Y spending appears to be robust in the early part of March.

A more detailed look at global markets courtesy of Newsquawk

APAC stocks declined as rising oil prices dampened sentiment and stoked inflationary concerns, while the announcement of a record joint emergency reserves release failed to drag energy prices lower, due to likely slow deliveries and with further disruptions in the Middle East from the ongoing hostilities. ASX 200 was dragged lower by losses in nearly all sectors aside from energy, and with further calls by large banks for the RBA to deliver a back-to-back rate hike next week. Nikkei 225 briefly slumped below the 54,000 level as the higher oil prices lifted yields and weighed on manufacturer and exporter sentiment. Hang Seng and Shanghai Comp conformed to the broad downbeat mood in the region, with risk appetite also not helped by the announcement that the US is initiating a Section 301 investigation into 16 trading partners, including China, the EU, Mexico, Vietnam, India and Japan.

Top Asian News

- Japanese PM Takaichi said won't rule out using FY25 reserve funds for fuel and the existing fund has JPY 280bln remaining, adds no additional budget for fuel subsidies now and will use existing fund for fuel price measures.

European bourses (STOXX 600 -0.4%) have started the cash session on the backfoot, with higher oil prices continuing to weigh on growth prospects. Weakness in banks continues to affect the IBEX 35 (-0.9%), given its exposure. The DAX 40 (U/C) is modestly lower, but losses are limited due to gains in Zalando (+12.2%), Rheinmetall (+2.9%) and Hannover Re (+3.2%). European sectors are broadly in the red, with Banks (-2.1%) continuing to underperform. Automobiles (-0.9%) also sit near the bottom of the pile after BMW (-1.1%) missed Q4 sales estimates and forecast higher tariffs acting as a headwind on EBIT margin. Basic Resources (+0.7%) are benefiting from the rise in metals prices, while Chemicals (+0.8%) gain after K+S (+8.0%) beat Adj. EBITDA estimates.

Top European News

- Germany's IFW institute sees 2026 inflation at 2.5% (prev. 1.8%), GDP at 0.8% (prev. 1.0%), 2027 GDP at 1.4% (prev. 1.3%).

Trade/Tariffs

- USTR Greer said US is initiating Section 301 investigation into 16 trading partners, including China, EU, Mexico, Vietnam, India and Japan, adds the investigation could lead to responsive actions, including tariffs. Said the EU has done approximately 0% of what was agreed in the bilateral trade deal.

- South Korea parliament passes US investment bill, as expected.

FX

- DXY is slightly firmer this morning and trades within a 99.31-99.52 range, and now heading back to the YTD high at 99.69 (March 9th). Upside on Wednesday was facilitated by higher yields as the energy prices continue to trudge higher as the geopolitical situation in Iran is showing little signs of abating any time soon, as an overnight attack on Omani export terminals led Brent back above USD 100/bbl. The recent IEA 400mln barrel reserve release has ultimately had little impact on prices, given the lengthy timeline for the barrels to enter the market and ING rightly points out, it still works out to be “far short of the supply losses we are seeing from the Persian Gulf”. Domestically, weekly jobless claims, trade data and Fed speak via Bowman - though she will not touch on monetary policy.

- G10s are broadly flat to lower against the USD. The JPY and CAD hold afloat, though the former remains within the touted intervention zone beyond 158.00. As mentioned in previous FX pieces, intervention seems unlikely given, a) intervention would prove to be ineffective given the current geopolitical environment, b) low volume short positions on the JPY, c) the move is fundamentally driven by higher energy prices d) the recent lack of verbal intervention suggests potentially higher bar for USD/JPY to rise. Nonetheless, markets will be cognizant of any jawboning heading into the BoJ meeting and wage negations next week.

- AUD underperforms vs USD this morning, scaling back some of this week’s gains. RBA hike bets continue to be taken by sell-side banks, with ANZ the latest see a 25bps increase at next week’s meeting; money markets now assign a circa 80% chance of such a move.

Central Banks

- Bank of Japan Governor Ueda said foreign exchange is an important factor affecting the economy and prices, during parliamentary testimony. Need to be mindful that Forex has larger impacts on prices than in the past and could affect inflation expectations. Will conduct appropriate monetary policy while assessing how Forex affects the likelihood of our forecasts.

- ANZ Bank and Goldman Sachs now see the RBA hiking the Cash Rate at next week's meeting.

- NBP's Janczyk said the current base rate is at an appropriate level for the coming quarters.

- BoK member Hwang said need to make rate decision with greater caution.

Fixed Income

- Another bearish session for fixed as, despite the IEA stockpile announcement, energy benchmarks are on the front foot once again with Brent eclipsing USD 100/bbl in APAC trade and Dutch TTF as high as EUR 53.80/MWh. In brief, energy strength comes as the market digests the time it will take for the IEA flows to hit the market, the Middle East conflict showing no immediate signs of stopping, and the associated ongoing Strait of Hormuz block.

- Given this, USTs are lower by a handful of ticks and holding just off a 111-21 base. If the move continues, we look to support at 111-19+, 111-10 and 111-08+ from earlier in the year. The US docket is headlined by Fed speak and then a 30yr auction to round off the week, after a poor 3yr and a 10yr that was an improvement from the last outing, but softer than the average tap.

- Gilts lower by around 40 ticks at most, hitting a 89.36 trough, which, while notable is still some way clear of the 88.80 MTD low and the 88.52 contract base. Pressure a function of the referenced energy moves and a return towards some of the hawkish BoE pricing seen at the start of the week, with around a 20% chance of a hike by end-2026 currently implied.

- Finally, Bunds followed suit at first and hit a 125.91 base, taking the German 10yr yield to another multi-year high. Amidst this, market pricing got to around an 80% chance of two 25bps hikes by the ECB in 2026; reminder, at most we have seen two hikes fully priced in recent sessions. However, this pared across the mid-morning with the benchmark briefly, but only marginally, moving into the green. No clear or overt fundamental behind the gradual turnaround, but the action is potentially a function of energy benchmarks easing from overnight peaks.

Commodities

- WTI and Brent futures trade firmer but off best levels after Brent futures briefly rose above USD 100/bbl in APAC hours, with the former currently in a USD 88.61-95.97/bbl range and the latter in a USD 96.69-101.59/bbl parameter. The gains come amid a war that seems to be escalating rather than abating (full Newsquawk Analysis available on the headline feed).

- European natgas prices are firmer but off their best levels after rising almost 8% in sympathy with crude prices. The EU’s Dombrovskis warned that inflation could exceed 3% this year if the Middle East war keeps Brent around USD 100/bbl and gas prices elevated for a prolonged period; under that scenario, 2026 growth would be up to 0.4ppts below the 1.4% pace forecast late last year.

- Spot gold is mildly firmer this morning and largely moves in tandem with the USD, which in turn tracks oil prices. Gold retreated overnight following US CPI data, which reduced expectations for any near-term Fed rate cuts, and as the Middle East conflict lifted crude prices. XAU/USD resides in a USD 5,125.64-5,189.86/oz range within Tuesday’s USD 5,117.35-5,238.75/oz.

- 3M LME copper ekes mild gains on either side of USD 13,000/t as the red metal largely tracks the USD and oil for any impact on the growth narrative, with further upside likely capped by the US initiating a Section 301 investigation into 16 trading partners, including China, the EU. 3M LME copper currently resides in a narrow USD 12,920.60-13,055.88/t range at the time of writing.

- IEA OMR: cuts 2026 global oil supply growth forecast to 1.1mln BPD (prev. 2.4mln BPD), total 2026 supply forecast 107.2mln BPD (prev. 108.6mln BPD). Middle East conflict is the largest oil supply disruption ever. Demand Forecasts. 2026, total: 104.8mln BPD. 2026, growth: 640k BPD (prev. 850k BPD). OPEC+ production decreased by 210k BPD in February.

- US is to release 172mln barrels of crude from strategic petroleum reserve, according to Energy Department. The release will begin next week, with delivery expected to take around 120 days based on planned discharge rates, while the US will replace reserves by 20% more than what will be withdrawn. SPR release is part of the broader coordinated crude oil release from IEA member countries in response to the Iran war.

- US President Trump said IEA decision to release oil from reserves will substantially reduce oil prices.

- Oman’s Mina Al Fahal crude export terminal has resumed normal operations after a temporary halt earlier Thursday, with loading activities now proceeding as usual, according to reported.

- Iraqi official said oil ports have completely stopped operations, while commercial ports continue to operate following attack on two fuel tankers.

- India is in discussions with Iran to secure passage for 20 tankers through the Strait of Hormuz, Bloomberg reported citing sources.

- US Energy Secretary Wright said hope to see ships through the Strait of Hormuz in a few weeks.

- China reportedly expands BHP's (BHP AT) iron ore ban to new products, asking domestic steel mills not to take delivery from BHP's Portside Newman fines from next week.

Geopolitics

- A senior US administration official, on the Middle East conflict and President Trump's view, said "The Iranians fcking around with the Strait makes him more dug in". An advisor said that Trump is bullish on the success of the operation thus far and believes the American people will believe it was the right approach once it is over. Advisor adds that Trump, and others in the administration, genuinely believe that gas prices will substantially fall when the Middle East conflict concludes, and long enough before the midterms to not be a problem.

- US President Trump was reportedly "ambiguous and noncommittal" during the G7 leaders call, Axios reported; with some participants thinking POTUS wants to end the war, while other attendees left with the opposite view.

- US President Trump said we knocked out Iran's navy and mine layers, adds oil prices will come down, but we won't leave early. said the job on Iran must be finished and don't want to return every two years.

- US President Trump said we know where Iranian sleeper cells are and have eyes on all of them, adds we are going to look very closely at the Straits.

- Reports of a drone attack on a US military base in Kuwait, Tasnim reported.

- According to Lebanese newspaper citing diplomatic sources, Iran clarified that they defend itself against American and Israeli aggression and that it will not agree to a ceasefire that is not accompanied by clear guarantees, via N12 News reporter Lipkin.

- Officials from four nations are attempting to persuade Iran to begin talks with the US, Jerusalem Post reported citing sources; however, thus far, Iran has refused to engage and is maintaining a hardline position.

- Reports suggests that Iran says it struck a US oil tanker in the Strait of Hormuz.

- Iran said it gives permission for Indian oil tankers to pass through the Strait of Hormuz. This was later denied by an Iranian source.

- "The campaign against Hezbollah will not be short and will not adhere to a specific timetable", according to Sky News Arabia citing Israeli officials.

- Iranian explosive-laden boats hit two fuel tankers in Iraqi waters.

- Iran military-affiliated outlet Defa press cites informed sources that note Yemeni resistance and some other resistance groups are fully prepared to join the battle in the coming days. According to predictions, with the entry of these groups, there is a risk of closing the strategic Bab-al-Mandab Strait which would disrupt transit in the Suez Canal.

- UKMTO received a report of an incident 35 nautical miles north of Jebel Ali in United Arab Emirates, in which a container ship was struck by an unknown projectile causing a small fire, while all crew are safe.

- Saudi Ministry of Defence said they are intercepting a drone heading to the Shaybah oil field, Sky News Arabia reported; reported suggest the interception was successful.

- Qatar residents reportedly receive mobile alert for missile threat.

US Event Calendar

- 8:30 am: United States Jan Trade Balance, est. -66b, prior -70.3b

- 8:30 am: United States Mar 7 Initial Jobless Claims, est. 215k, prior 213k

- 8:30 am: United States Feb 28 Continuing Claims, est. 1849k, prior 1868k

- 8:30 am: United States Jan Housing Starts, est. 1340.5k, prior 1404k

- 8:30 am: United States Jan P Building Permits, est. 1410k, prior 1455k

- 11:00 am: United States Fed’s Bowman Speaks on Basel III

DB's Jim Reid concludes the overnight wrap

As we go to press this morning, the market volatility has shown no sign of easing, with Brent crude surging back +8.95% overnight to $100.21/bbl. The main catalyst for that has been further attacks on shipping, with two tankers and a container vessel struck in the Gulf this morning. Moreover, Bloomberg have also reported overnight that Oman has evacuated ships from the export terminal of Mina Al Fahal, which exports around 1mn barrels per day. So that’s driven a fresh surge in oil prices, and there’s been a clear risk-off move as a result. Indeed, futures on the S&P 500 (-0.86%) and the German DAX (-1.06%) have seen further declines this morning, and the major indices in Asia have all lost ground as well.

From a market perspective, the problem is that investors are increasingly pricing in a more protracted conflict that causes extensive economic damage. After all, with no concrete signs of de-escalation yet, that’s keeping oil prices elevated, and raising the risk of a broader stagflationary shock. Indeed, we know that investors are pricing in the longer scenarios, because the 6-month Brent future is also up +3.06% this morning to $82.97/bbl, and with each passing day it gets harder to argue that the disruption to shipping and energy infrastructure will only prove temporary.

With the latest move back above $100/bbl, we’re also getting closer to the territory that’s historically led to bigger risk-off moves. I explored this in a note on Monday (link here), looking at the scenarios where previous oil shocks have led to sizeable market selloffs. So far at least we’ve not been in that territory, because of the assumption that oil prices aren’t going to be elevated for a sustained period, which we can see in the futures curve. In other words, markets aren’t yet pricing in a 2022-style scenario, where oil prices spent around 5 months above $100/bbl. In addition, fears of a hawkish response aren’t as prominent today relative to 2022 because inflation was running well above target to start with back then, even before the oil price spike. But clearly the longer that oil remains at these levels, expectations of a sustained shock will only grow.

Those fears of a longer conflict have been reflected in the latest newsflow as well, with few signs that either side are moving towards a ceasefire. Indeed, Iran’s Fars News agency cited a military spokesman yesterday who said that they were moving from reciprocal to continuous strikes, while Bloomberg reported later in the day that Iran had told regional intermediaries that to achieve a ceasefire the US must guarantee that neither it nor Israel will strike Iran in the future. Meanwhile, President Trump separately said that the US could strike even more targets if they wanted. So comments like that added to the concern that both sides were preparing for an extended operation, with no obvious sign of either backing down.

For investors, a big focus is whether the Strait of Hormuz can reopen, but traffic there is still largely suspended in practice. For instance, the German foreign minister said yesterday that it was “definitely not navigable at the moment”. And even though there was more discussion about escorting ships through the Strait of Hormuz, President Macron said it would take a few weeks to coordinate. However, there was some brief relief from the International Energy Agency’s announcement, as they agreed to release 400mn barrels from emergency reserves, with the US confirming later on that this would include 172mn barrels from its Strategic Petroleum Reserve to be released over 120 days.

The latest oil spike overnight comes on the back of another tough session yesterday, with Brent crude (+4.76%) already posting a decent increase back up to $91.98/bbl, even before the latest attacks. And there was little respite elsewhere, as hawkish ECB commentary led to a major selloff for European sovereign bonds, with 10yr bund yields (+9.7bps) closing at their highest level since late-2023, at 2.93%. So it was a tough day across the board, and concern about the wider economic damage meant equities struggled, even before the latest falls overnight. Indeed, we know that the longer-term scenarios are being priced in, because the 12-month Brent future (+2.94%) was up to $74.17/bbl, posting its biggest daily gain yesterday since the strikes began.

As all that was happening, there were huge moves for European sovereigns yesterday as speculation grew about an ECB rate hike this year. That was driven by comments from Slovakia’s central bank governor Kazimir, who said “a reaction by the ECB is potentially closer than many people think”. Meanwhile, Bundesbank President Nagel said the ECB “will act decisively” if the energy shock translates into higher medium-term inflation. So those comments and yesterday’s oil price moves saw investors fully price in an ECB rate hike as soon as the July meeting. And in turn, yields on 10yr bunds (+9.7bps), OATs (+12.6bps) and BTPs (+14.3bps) all saw their biggest rise since March last year, back when the German debt brake reform was announced. So these were significant moves, even in the context of the volatility of recent days. Indeed, there were even larger yield moves at the front end of the curve, with 2yr German yields (+12.4bps) jumping up to 2.37%, their highest since September 2024.

That pattern was echoed in the US, where investors also moved to dial back the pace of cuts this year. So by the close, there was just a 35% probability of a cut by the June meeting, which spoke to growing doubt about how quickly a new Fed Chair could start easing policy. And looking further out, just 30bps of cuts were priced in by the December meeting, which is the fewest so far this year, and overnight that’s fallen back to 28bps. So Treasury yields rose across the curve, with the 2yr yield (+6.1bps) at a 5-month high of 3.65%, whilst the 10yr yield (+7.4bps) was up to 4.23%. And overnight, the 10yr yield (+1.0bps) is up again to 4.24%.

Amidst all that, we did get the latest US CPI print for February. However, markets were paying a lot less attention to that than usual, given we know there’s going to be a fresh price shock from the Middle East conflict. So to some extent, the print was already seen as backward-looking. Even so, there was little reaction anyway, as the numbers were broadly in line with expectations beforehand. So headline CPI was at a monthly +0.3% as expected, keeping the year-on-year rate at +2.4%. And core CPI was at a monthly +0.2%, leaving the year-on-year rate at +2.5%.

Given the mounting fears about an extended economic shock, with potentially hawkish implications, global equities have lost ground across the world. In Asia overnight, the major indices have fallen back across the region, with declines for the Nikkei (-1.34%), the Hang Seng (-1.32%), the CSI 300 (-0.98%), the KOSPI (-0.91%) and the Shanghai Comp (-0.65%). Then in Europe, the STOXX 600, the DAX (-1.37%) and the CAC 40 (-0.19%) all fell back. And in the US, the S&P 500 (-0.08%) was down for a second day running despite paring back its losses later in the session. That was another broad-based decline, with two-thirds of the S&P 500’s constituents down on the day, though a third consecutive gain for the Mag 7 (+0.37%) helped counteract the deeper losses elsewhere.

In other news, US Trade Representative Greer announced that they would begin Section 301 investigations into over a dozen major economies, including China, the EU, India and Japan, focusing on alleged excess manufacturing capacity. The investigations are required for the President to be able to set tariffs against countries deemed to rely on unfair trading practices, which the administration could use to replace the stopgap 150-day Section 122 duties that it imposed after the Supreme Court struck down the IEEPA tariffs last month.

Looking at the day ahead, data releases include the US weekly initial jobless claims, along with housing starts and building permits for January. Otherwise, central bank speakers include BoE Governor Bailey, the Fed’s Bowman, and the ECB’s Villeroy.

Tyler Durden

Thu, 03/12/2026 - 08:33

via India Today

via India Today

Blocks with symbols and atomic numbers of Rare Earth Elements (REE) are placed on a Chinese flag in this illustration taken January 21, 2026. REUTERS/Dado Ruvic/Illustration/File Photo

Blocks with symbols and atomic numbers of Rare Earth Elements (REE) are placed on a Chinese flag in this illustration taken January 21, 2026. REUTERS/Dado Ruvic/Illustration/File Photo

LeBlanc prepares to hand a shotgun to a PhantomMattia Balsamini for TIME. Source: TIME

LeBlanc prepares to hand a shotgun to a PhantomMattia Balsamini for TIME. Source: TIME

suwijaknook6644689/Shutterstock

suwijaknook6644689/Shutterstock

Recent comments