The Iran War Exposes The Farce Of American "Representative Democracy"

Authored by Ryan McMaken via MisesInstitute,

The Trump administration has unilaterally—without any Congressional debate or vote, of course—forced Americans into yet another war. This time, the war is a large-scale military campaign against Iran. Was there any groundswell of public support for this war? Did the Congress vote to spend more American tax dollars on another war? Apparently not. According to a March 1 poll from Reuters, only 27 percent of Americans polled said they support the US’s new war on Iran. Needless to say, few Americans have been calling their representatives in Congress asking for yet another Middle Eastern war.

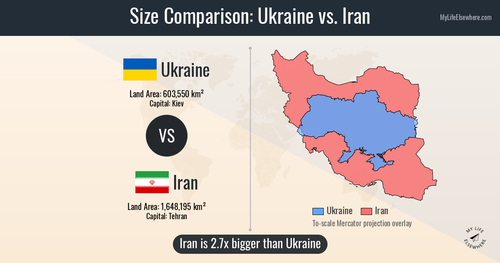

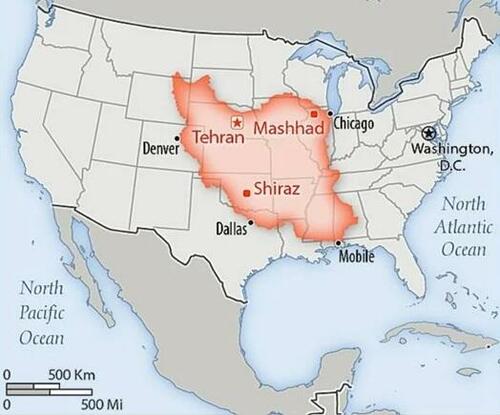

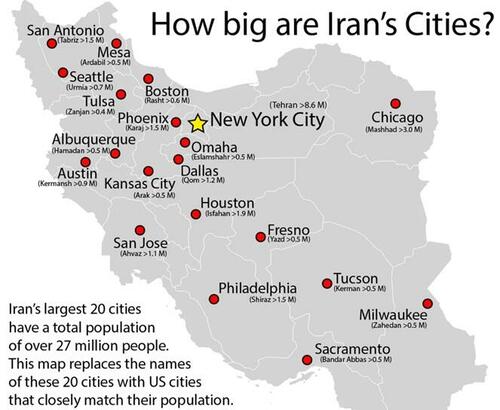

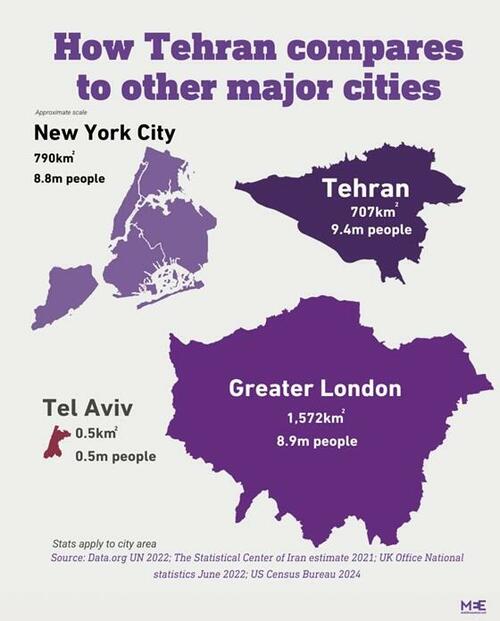

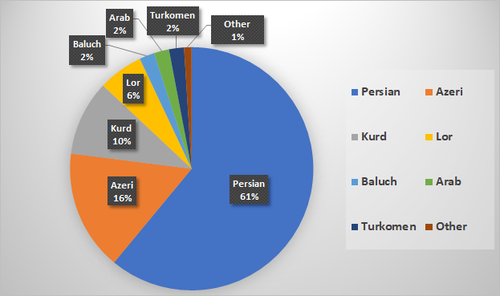

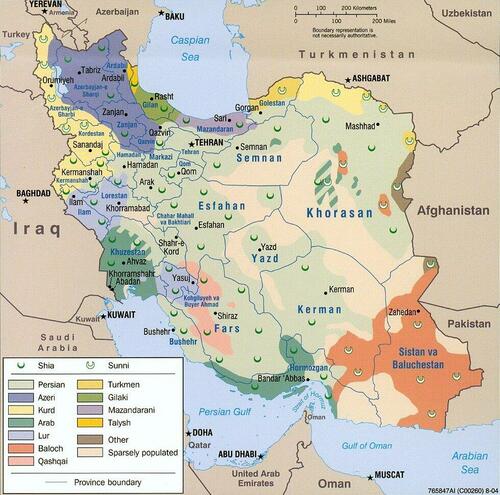

So, why is the US now at war with Iran? Not even the administration appears to know for sure. After the war had already begun, the White House repeatedly changed its stated rationale for opening hostilities against Iran. At the beginning the US regime had been claiming it wanted regime change in Iran to “liberate” Iranians. Yet, by Monday, when Trump listed his reasons for starting the war, he didn’t mention regime change at all. Rather, the administration now seems to have settled on claims that the Iran regime was creating a missile program that, somehow, endangers the United States. Yet, virtually no one believes that the Iranian regime has ever had long-range missiles capable of getting anywhere near US territory. Rather, the only “threat” to the United States is a threat to US bases which the US government has insisted on building 10,000 miles from US territory, and which have nothing to do with the safety of Americans in the United States.

On Monday, Rubio said that the United States began the war because the State of Israel planned to attack Iran, and that this would lead to Iranian reprisals against US bases. Rubio was essentially stating that Tel Aviv forced the US into the war. Trump today directly contradicted his Secretary of State—as well as the GOP Speaker of the House and GOP Senator Tom Cotton—and claimed “I might’ve forced their hand.”

Completely absent from all these confused and retroactive attempts to justify the war is any mention of the American people, their tax dollars, their freedoms, or even their alleged representatives in Congress. Nor is this surprising. The current war is a timely reminder that the US ruling elites regard the US taxpayers and ordinary Americans as little more than inconvenient afterthoughts in the formation of US foreign policy. At the same time, the US regime also claims to have the moral high ground precisely because the American regime is supposedly “democratic” with the support of “the people.”

Indeed, the Trump administration overall has helped make it abundantly clear that US elections and public opinion are almost completely irrelevant to the foreign policy. Throughout his campaigns, Donald Trump repeatedly claimed to be the peace candidate, announcing in his speeches that he would end wars, rather than start them. In the days before the 2024 election, the GOP posted this image in social media, clearly presenting the Trump administration as “the pro-peace ticket”:

Yet, less than a year into his second term, Donald Trump’s foreign policy looks largely indistinguishable from that of the foreign policy of Barack Obama or Joe Biden. Indeed, if the current war drags on, we’ll be able to say Trump’s foreign policy is reminiscent of the George W. Bush administration.

It was clear during the campaign that the Trump ticket was trying to take advantage of public sentiment which favored less US involvement in foreign wars. With American foreign policy, however, elections don’t matter. This was recently emphasized by the bumbling US ambassador to Israel, Mike Huckabee, in a recent interview with Tucker Carlson. Carlson began with a simple question for Huckabee:

Carlson: How much does it matter what Americans think?

Huckabee: Well, it matters every bit what Americans think.

Carlson then points out that about 21% of Americans support war with Iran. He asks Huckabee if that’s enough for the US regime to start a war with Iran. Huckabee states “We don’t live in a world where you have a poll taken to find out whether our policy should be in a particular direction...”

Carlson then points out that Huckabee had just said public opinion matters a lot and Huckabee says “we care deeply about it...”

Carlson: “If we’re ignoring it, in what sense to we ‘care deeply about it?’”

Huckabee then offers a non sequitur: “I think we care deeply when we see there’s a threat.” Huckabee then continued with more word salad in a desperate attempt to make a connection between public opinion and his preferred policy of repeatedly starting elective wars with Middle Eastern regimes that are no threat to the US population.

The reality, of course, is closer to Rubio’s explanation for the US’s involvement in the war: following the lead of the State of Israel.

This is apparently fine with Ambassador Huckabee, of course, who in his Carlson interview, was asked if Huckabee thinks the State of Israel has a “right” to take over most of the Middle East. Carslon stated: ”Does Israel have the right to that land?” Huckabee responded ”It would be fine if they took it all.”

And what if most Americans don’t share this opinion? Clearly, the US regime doesn’t care, and neither does Huckabee, or Donald Trump.

Meanwhile, Donald Trump says he doesn’t care about polling so he won’t rule out deploying American troops on the ground in Iran.

In spite of all the US regime’s posturing about “the will of the people” and “representation” in Congress, what really matters in Washington is serving powerful interest groups. The taxpaying public simply exists as a resource to be bled dry in favor of wars, protectionism, and federal spending which serves the ruling elite’s complex system of patrons and clients that keeps the elite in power.

When it comes to US foreign policy in the middle east, the dominant interest group is the State of Israel. This is executed through the American-Israeli Political Action Committee (AIPAC) and other elements of what foreign-policy scholars John Mearsheimer and Stephen walt call “the Israel lobby.” When Mearsheimer and Walt released their book The Israel Lobby in 2007, they were predictably accused of anti-semitism. Yet, the book was ahead of its time in describing how pro-Israel interest groups have been extremely successful in gaining financial, military, and strategic favors for Israel from US policymakers. It has all been done at the expense of American taxpayers. The result has been an American foreign policy elite that overwhelmingly favors incessant foreign intervention to favor a foreign state—the State of Israel—regardless of any concern for the cost borne by Americans or the potential for drawing the US into broader conflicts that do not in any way increase the security of the United States.

In 2007, The Israel Lobby seemed controversial to many. In 2026, it is merely a statement of the obvious—that US foreign policy is tailored to favor certain interest group, rather than the interests of ordinary voters. This, however, is how all interest group politics works. The voting public doesn’t matter, and it hasn’t mattered for a long time.

This is shown in empirical studies that have tried to find a connection between public opinion and actual policies favored in Washington. The connection is tenuous at best.

For example, in a 2014 study by Martin Gilens and Benajmin Page, the authors note that when it comes to “impacts on U.S. government policy ... average citizens and mass-based interest groups have little or no independent influence.” Gilens and page note that “the preferences of economic elites ... have far more independent impact upon policy change than the preferences of average citizens do.”

This can be seen in Trump’s own fundraising given how one of his biggest donors, billionaire Miriam Adelson, is notable for an extreme pro-Israel position. This is, not surprisingly, reflected in Trump’s foreign policy.

The final conclusions of Gilens and Page are clear:

In the United States, our findings indicate, the majority does not rule—at least not in the causal sense of actually determining policy outcomes. When a majority of citizens disagrees with economic elites or with organized interests, they generally lose. Moreover, because of the strong status quo bias built into the U.S. political system, even when fairly large majorities of Americans favor policy change, they generally do not get it.

Perhaps no group of “economic elites” is more influential in foreign policy than those who control campaign funds distributed through pro-Israel interest groups like AIPAC, or through the spending of wealthy individuals like Adelson.

Other studies have come to similar conclusions. For example, in a 2017 paper on voter preferences, John Matsusake concluded that legislator preferences don’t correlate with voter preferences:

[W]hen legislator preferences differed from district opinion on an issue, legislators voted congruent with district opinion only 29 percent of the time. The data do not show a reliable connection between congruence and competitive election, term limits, campaign contributions, or media attention. The evidence is most consistent with the assumption of a citizen-candidate model that legislators vote their own preferences.

There is, of course, no such thing as a “district opinion,” but the general idea is clear enough: if a legislator’s campaign war chest depends on pleasing a specific interest group, then the preferences of the voters don’t really matter.

Similarly, in a 2016 study from Michael Barber, he writes on how votes in the US Senate bear little relation to public opinion: “[S]enators’ preferences diverge dramatically from the preference of the average voter in their state. The degree of divergence is nearly as large as if voters were randomly assigned to a senator.”

So, if policymakers are largely independent of the voters who the policymakers ostensibly “represent,” then what determines federal policy?

The current war is just the latest reminder that pluralism is wrong and elite theory is right. There is no “we the people.” There is no “representative democracy.” And, when it comes to the big stuff like war, federal spending, and the central bank, elections don’t matter. It’s why, no matter who gets elected, US foreign policy proceeds more or less as usual, year after year after year.

This is why it doesn’t matter that only about one in four Americans is interested in being on the hook for yet another Middle Eastern war with no apparent benefits for any average American. This is why the administration continues to engage in shifting claims about the origins of this conflict. The administration knows that claims about Iran being a threat to the American people are not tenable, and are on the same level as claims about Iraqi WMDs. Nor can the regime just come right out at say “our pro-Israel funders told us to fight Iran.” So, we have Rubio telling us the war was a “preemptive strike” against the potential blowback from US-funded Israeli strikes on Iran. This explanation is already falling apart, which is why Trump now denies it.

In the end, the regime doesn’t even really need to come up with a plausible explanation. The political fallout will settle largely on the current administration, and this will have little effect on the real governing elite which remains in control regardless which party is ostensibly “in power.”

Tyler Durden Wed, 03/04/2026 - 21:20

Adobe Stock image

Adobe Stock image Source: CIA World Factbook (2016)

Source: CIA World Factbook (2016)

The Epoch Times/Shutterstock

The Epoch Times/Shutterstock

Open source file image: Launcher for Iranian Zolfaghar ballistic missiles

Open source file image: Launcher for Iranian Zolfaghar ballistic missiles A view of houses in a neighborhood in Los Angeles on July 5, 2022. Frederic Brown/AFP via Getty Images

A view of houses in a neighborhood in Los Angeles on July 5, 2022. Frederic Brown/AFP via Getty Images The Google logo is projected onto a man, in this photo illustration. Leon Neal/Getty Images

The Google logo is projected onto a man, in this photo illustration. Leon Neal/Getty Images

Rep. Dan Crenshaw, R-Texas, was unseated in Tuesday's primary. Tom Williams / CQ-Roll Call via Getty Images file

Rep. Dan Crenshaw, R-Texas, was unseated in Tuesday's primary. Tom Williams / CQ-Roll Call via Getty Images file

Treasury Secretary Scott Bessent testifies before the Senate Committee on Banking, Housing, and Urban Affairs on Capitol Hill in Washington on Feb. 5, 2026. Madalina Kilroy/The Epoch Times

Treasury Secretary Scott Bessent testifies before the Senate Committee on Banking, Housing, and Urban Affairs on Capitol Hill in Washington on Feb. 5, 2026. Madalina Kilroy/The Epoch Times

Recent comments