Socialism Is A Noun - A Synonym For Socialism Is Theft

Submitted by Mitchell Vexler,

socialism is defined as a political system advocating that the means of production and distribution are owned or regulated by the community as a whole.

Words that you may have heard of being representative of socialism are collectivism, communalism, communism, leftism, progressivism, Marxism, Bolshevism, Leninism, Trotskyism, welfarism, Maoism, neo-Marxism, social democracy, consumer socialism, utopian socialism, classless society, collective ownership, public ownership, state ownership, Stalinism, Sovietism Marxism-Leninism, Eurocommunism, totalitarianism, radical socialism, state ownership, rule of the proletariat, and state socialism.

All of these synonyms can be replaced with 1 word, and that word is THEFT.

Theft of your money or theft of any person / victim who earns money and pays taxes, where those taxes go into pet projects which the victims did not vote for and or to cover the compound cumulative interest on the non-stop production of fraud created by the fraudsters (socialists).

It is no coincidence that the 2 largest purveyors of fraud in the U.S. are the Federal Reserve and the School Districts, which own the Central Appraisal Districts, both of which utilize the mantra of printing money. One, the Federal Reserve via its right hand, the U.S. Treasury, prints money, not backed by assets, at will. The other being the School Districts which print their money by committing accounting fraud and bond fraud, demanding continuous bond raises, delivering pre-determined budgets for their owned CAD to contrive additional property valuation fraud and thus over taxation for you the victim to pay for in perpetuity, and as a result the median household income (MHI) shrinks at an alarming rate. In other words, the FED, School Districts, and CADs are socialist organizations that execute the plan socialism while simultaneously paying themselves which is again, transferring your money via fraud into their pockets.

This Article is now part of a series of recent important articles all of which should be read by every citizen in the U.S. & Canada, and any country across the world, to help people understand that socialism is the scourge of any society.

The reason why these articles are so important is that our goal is to expose the fraud that touches the lives of every property owner and also, directly or indirectly, every single Citizen.

It has become clear in recent years that many people paid for an education that did not create a return on their investment. It is also clear that many so-called bastions of education have now been exposed as incubators for socialists. Isn’t it interesting, and not at all coincidental, that on average, across the U.S., property taxes account for 83% of local revenues for public schools, allocated in two components: operations and maintenance (O&M) and interest and sinking fund (I&S), both of which are now proven to be counterproductive to the education of students. We have shown conclusively how the theft of your money by the school districts occurs. See School Districts and Accounting Fraud - Presentation to President Trump and Elon Musk and article, For the Kids.

The psychology of a socialist is detailed in “Chain the Doors of the Federal Reserve” linked above and further expanded below.

In this Article, an extension of Chain the Doors article and the writing of Thomas Pain presented in Thomas Paine - Quotes on Taxes & The Necessity of Taxation, I would like to dig deeper to show why socialism is the antithesis of capitalism and the U.S. Constitution and why socialism should be codified as illegal.

Without exception and without question, stealing private property is immoral and illegal. socialists via taxation, and as you are seeing play out in Minnesota, want to make this acceptable.

To crystalize the thought, money is property. Physical assets are property. Businesses are property. Your mortgage is property from which over time the amortization on your mortgage being the principal reduction is property. Bank accounts are property. In all 5 instances, which in totality are your life, the socialists want to steal your money.

Therefore, as socialists promote socialism (A) and socialism is theft (B) then socialists are thieves (C).

If A = B and B = C then A = C.

Not just theft of property, but theft of Constitutional Rights, and theft of the fabric of civilized society, being morals and respect for individual rights.

Could it be that the warped moral view of socialists is a direct result of an education system that does not teach how to survive and prosper in the real world thus making / brainwashing people to be dependent on the handouts from the government rather than participating in the only system that has worked for 5,000 years which is capitalism?

Are the students to blame, or are the teachers and politicians who are the preachers and screechers that create the fraud from which to take your tax dollars to support the fraud they created? Our goal is to explain to those who have been misled to at least consider the truth of socialism which is that it leads to death and destruction and no rational person would want that upon themselves or their families.

The legal view of a socialist, which is not legal under Constitutional law, is that preventing others from stealing your private property is somehow tyrannical. This is beyond rational thought and can only be the ramification of intentional brainwashing from which those in positions of power, regardless of political party affiliation, including the press, receive the benefit of profit and or perceived power.

Organized retail theft rampant in the most socialist US cities like San Francisco, Los Angeles, Portland, and Minneapolis is a ramification of socialist policies. The socialists make the argument that they are just the poor working class needing to prevent starvation and homelessness so stealing $5000 Louis Vuitton Bags is perfectly acceptable. This is beyond rational thought.

The need for socialists to support theft and immigration for votes (which costs the taxpayers roughly $1 Trillion per year - $64K per illegal immigrant), also conveys that socialists are not capable of building an economy, or products and services, from scratch. Socialism has never, in the history of the planet, worked because it terminates when it runs out of other people’s money to steal.

The socialist mantra: "The capitalist is stealing from the worker under wage labor slavery and the worker is not receiving the full value of their labor by pocketing what worker created".

Proof of the idiocy of the socialist cult mantra:

-

In truth, the worker and the capitalist employer voluntarily agree beforehand to wages and the work to be done, so it is not stealing.

-

The Worker would not be able to produce any goods or service of value if they are not working for their employer.

-

The worker can quit and engage in self-employment.

-

Setting up a business, making agreements with suppliers, arranging financing, and setting up a pipeline for customers, which is often what capitalists do, is labor and is much harder than a worker being involved in just one component of the company.

-

The worker can quit and join or start a coop if they believe that that type of work arrangement works better.

Society can’t fix what it can’t define and that is the main emphasis of these articles. In the furtherance of defining the issue, what was in the 1980’s and 1990’s a “democratic party” no longer exists. This is not to say there are not reasonable Democrats who would like to participate in a legitimate political party to voice their opinion. This is to say that reasonable Democrats have been cast aside and overshadowed by pure socialism and that means pure theft. The truth is laid bare in the finances of the DNC which are now negative.

Gustave Le Bon, in his work "The Psychology of Socialism," argues that socialism and radicalism function similarly to religious movements. He suggests that political controversies often stem from contrived emotional responses rather than rational deliberation. This perspective highlights the role of psychology in shaping political ideologies and movements.

socialism as a cult involves extreme devotion to a leader or ideology, often characterized by manipulation and control over members' thoughts and behaviors. This can lead to a lack of critical thinking and a strong group identity, which may be reinforced through propaganda and social pressure.

Socialism cults often revolve around a charismatic leader who promotes a vision of a collective society. These groups may exhibit extreme devotion to their ideology and leader, which can lead to a strong sense of community among members. Key characteristics include beliefs that diverge significantly from mainstream society, use of manipulative techniques to maintain loyalty and control over members, and the focus is on communal ownership and the idea of working towards a common goal.

The psychology behind socialism cults can involve several factors including that members often find a sense of identity and purpose within the group, which can be appealing, especially in times of social uncertainty. A clear pattern of cognitive dissonance emerges as its members may experience discomfort when their beliefs are challenged, leading them to reinforce their commitment to the group via emotional outbursts, or violence. It is a combination of emotional outburst, violence, and non-willingness to participate in conversation which attempts to strip the rest of society from their first amendment rights of free speech. It goes one step deeper in that there are socialists working among government entities that undermine the purpose of the entities and knowingly, with intent, break the law to support the socialist cult. This is the prime example of the wolf in sheep’s clothing.

Charismatic leaders play a crucial role in socialism cults. They often create an idealized image where the Leaders are portrayed as heroic figures, which can enhance loyalty. Propaganda is used to manipulate and maintain a positive image of the leader and the ideology. The leaders may invoke nationalistic sentiments to strengthen group cohesion while simultaneously failing to provide one stitch of evidence against the simple fact that socialism dies when it runs out of other people’s money to steal, including the theft of money from its own members.

See if you can figure out where this brilliant quote came from…."They'd come on a fishing boat and gorged themselves on coconut. So how do you get rats off an island, hmm? My grandmother showed me. We buried an oil drum and hinged the lid. Then we wired coconut to the lid as bait. The rats would come for the coconut and they would fall into the drum. And after a month, you've trapped all the rats. But what did you do then? Throw the drum into the ocean? Burn it? No. You just leave it. And they begin to get hungry. Then one by one, they start eating each other, until there are only two left, the two survivors. And then what? Do you kill them? No. You take them and release them into the trees. Only now, they don't eat coconut anymore. Now they only eat rat. You have changed their nature." This is the back story to Last Rat Standing and exactly what happens with socialism and socialists.

We are proving the truth with irrefutable evidence, on just a few inter-linked issues with property tax at the nucleus, so that society, being rational thinking people, can deal with the fraud of the socialists and insist that the Republic of the United States stand strong under its Constitution.

What we have discovered is very much applicable in Canada, and any other Country that claims to use Uniform Standards of Professional Appraisal Practice, in which USPAP has been rendered meaningless by intent to defraud, which proves the policy is that of socialism executed by socialists.

The Constitution of the United States of America or socialism???

Over 100 million people have died due to socialist, Marxist, and communist regimes—not from war, but from their own governments' brutal policies.

Socialism is cloaked in promises of equality, justice, and “free” service including free education, healthcare, housing, and jobs. Its appeal is emotional, targeting the hopes of the marginalized and the frustrations of the working class. Beneath the promises, lies the historical reality of oppression, economic collapse, and human suffering.

With Cuba and many others listed herein, socialism has consistently failed not just economically, but leaving behind a legacy of destroyed economies, starved populations, and crushed freedoms.

The False Promise of Equality

socialism is all promise and no deliver because it is a con. It centralizes power into the hands of the few, creating the very hierarchy and inequality it claims to abolish. The result is not a classless society, but a society where the government becomes the new elite, often ruled by a dictator, while the people suffer under authoritarian control and economic misery. socialism demands a revolution to tear everything down first, in order to create its new communist infrastructure and you can see this playing out live in Minnesota, Germany, European Union, the UK, and played out in our hemisphere, in Cuba. You can see a portion of my story in Cuba in an above linked Article.

After Castro took over in 1959, he nationalized 70 percent of farmland. The result? Between 1957-58, the period before Castro, and 1963-64, by which time the nationalization had been done, the production of beef, pork, poultry, eggs, milk, corn, rice, root vegetables malanga and yucca, and potatoes all fell by a double digit, and typically a high double-digit, percentage. Output of their biggest crop, sugar, fell by 35 percent. Why didn’t Cubans starve? The Soviet Union bailed them out. The CEA report notes that Puerto Rico and Cuba had relative equal national incomes in 1950 but, by 2000, Cuba’s national income relative to Puerto Rico’s had fallen by almost two thirds. I saw stores in Cuba where the locals go, and even basic toiletries were not available.

The Soviet Union: Death by Utopia

The USSR was the first major experiment in socialism after the 1917 Bolshevik Revolution. Under Stalin, the state controlled all means of production, abolished private property, and forced collectivization of farms. The result was beyond catastrophic:

-

The Holodomor (1932–1933) – A man-made famine in Ukraine caused by forced collectivization. An estimated 3.9 million people starved to death.

-

Stalin's purges, gulags, and mass arrests led to millions of deaths and imprisonments, often without trial.

-

Shortages became the norm. Citizens stood in long lines for bread and toiletries. Just like

By the time it collapsed in 1991, the Soviet socialist system had claimed over 20 million lives through executions, famines, and forced labor.

Mao’s China: The Socialist Engine of Death

Under Chairman Mao Zedong, the Chinese Communist Party unleashed two of the deadliest campaigns in human history:

-

The Great Leap Forward (1958–1962) – Mao's forced collectivization and industrialization effort caused the deadliest famine in world history, killing an estimated 30–45 million people.

-

The Cultural Revolution (1966–1976) – A purge of perceived “capitalist” elements, during which millions were tortured, killed, or driven to suicide, and priceless cultural heritage was destroyed.

All of this was carried out in the name of socialist ideology. The people were promised prosperity. What they received was death and devastation.

Venezuela: The Collapse in Real Time

Venezuela, once one of Latin America’s richest countries, embraced socialism under Hugo Chávez and continued under Nicolás Maduro. Promising to redistribute oil wealth and end poverty, the regime nationalized industries, restricted private property, and eliminated market competition.

The result?

-

Inflation surpassed 1,000,000% in 2018, making its currency practically worthless.

-

Food shortages became widespread.

-

90% of the population fell below the poverty line.

-

Hospitals lacked basic medicine.

-

Children died of malnutrition.

-

Millions of Venezuelans fled the country, creating one of the largest refugee crises in the Western Hemisphere.

Far from bringing justice, socialism in Venezuela robbed an entire generation of hope.

Cuba and North Korea: Islands of Oppression

Both Cuba and North Korea remain socialist examples of totalitarian control:

-

Cuba, under Fidel Castro, jailed dissidents, eliminated press freedom, and kept the population under tight surveillance. To this day, internet access is restricted, dissent is punished, and scarcity remains the norm.

-

North Korea represents perhaps the most extreme example. Ruled by dictatorship, its citizens face starvation, public executions, and complete isolation. Meanwhile, the regime invests in nuclear weapons and luxury for the ruling class.

Why socialism Always Fails

socialism destroys the incentive to innovate, produce, and excel by removing profit and competition. It replaces market decisions with bureaucratic ones, often by force. Worse, it concentrates immense power in the hands of the state and as we have seen that power that is almost always abused.

My Father taught me that “absolute power corrupts absolutely”.

socialism is a con, and in every case, without exception, it led to:

-

Authoritarian control

-

Economic collapse

-

Suppression of dissent

-

Loss of personal freedom

-

Mass death

The Human Toll: Over 100 Million Dead

According to The Black Book of Communism, a publication by European scholars, the death toll from socialist regimes in the 20th century exceeds 100 million. These are not deaths from war, but from starvation, executions, prison camps, and purges and all were committed in peacetime by governments against their own people.

To the socialists, it is ok if you disagree with your position in life or even this Article. However, if you are a rational thinking person, then ask yourself if there is anything in this Article that is not true. As it is true, then what does that say about you as a person wanting to put yourself, your family, and alleged friends in harms way of a horrific con that has ended in death?

To the alleged Republicans, it is time to look at the policies you created and if they were for socialist reasons and ended in socialist non-stop compound cumulative interest on fraudulent bond debt, then you either move immediately to destroy those polices (all property tax) or the only thing that separates you from the socialists in Minnesota is the violence. If any new policy is a socialist policy, that is, for the benefit of the government and not the citizens, then that attempted policy should never see the light of day or be approved.

We are now at the Supreme Court of Texas with the published statement that either the black letter of the law exists or it does not. See The Importance of the Vexler Case to Texas. The reason for this case is the refusal of the courts to deal with the legal dead zone they created and that is exactly for what the Supreme Courts exists. Either the law exists or it doesn’t. We are about to find out.

Conclusion:

socialism delivers control, coercion, and collapse.

socialism promises free, but the truth is... the world can’t afford free.

socialism must be codified into law as illegal. It is a cult. Call it what it is, and let’s deal with it.

Society, regardless of political affiliation (if any) should realize that a social policy is not socialism. A social policy could and should be a policy to eliminate hunger in the U.S. or a policy to eliminate cancer. These social policies are set forth and defined by the government but financially executed without government involvement. The market must do the lifting, not the government.

Tyler Durden

Mon, 01/19/2026 - 21:30

According to Gilbert's complaint, Swalwell's property was listed as the couple's 'principal residence' when they took out a mortgage in April 2022

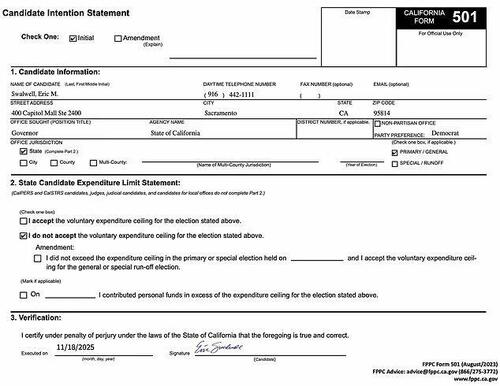

According to Gilbert's complaint, Swalwell's property was listed as the couple's 'principal residence' when they took out a mortgage in April 2022 Swalwell's Candidate Intention Statement on December 4 lists his address as a business suite in a Sacramento high-rise

Swalwell's Candidate Intention Statement on December 4 lists his address as a business suite in a Sacramento high-rise Swalwell and Fang

Swalwell and Fang The Boring Company's Prufrock 5 tunneler (via X)

The Boring Company's Prufrock 5 tunneler (via X)

Canada's armed forces file image

Canada's armed forces file image

Recent comments